Efficient Market Hypothesis (EMH) is not merely a theoretical construct; it’s a dynamic framework that shapes the very essence of how financial markets operate.

The importance of EMH extends far beyond academic circles and has profound implications in the real world. For investors, it challenges the practices of picking individual stocks or attempting to time the market.

It leads them to shift towards investing passively through constructs like index funds and exchange-traded funds (ETFs).

Economists and policymakers depend on the EMH to formulate regulations and monitor financial markets to ensure fairness, transparency, and efficiency.

In this article, we will delve deep into the Efficient Market Hypothesis, exploring its three forms—weak, semi-strong, and strong—and their real-world implications.

What is the Efficient Market Hypothesis?

This theory was developed by Eugene Fama in the 1960s and was derived from the then-popular Fair Game Model and the Random Walk Theory.

The theory posits that in an efficient market setup, stocks always trade at their fair value on exchanges, which effectively makes it impossible for anyone to buy any stock as a ‘value’ purchase.

You may also like: A guide to value investing in India

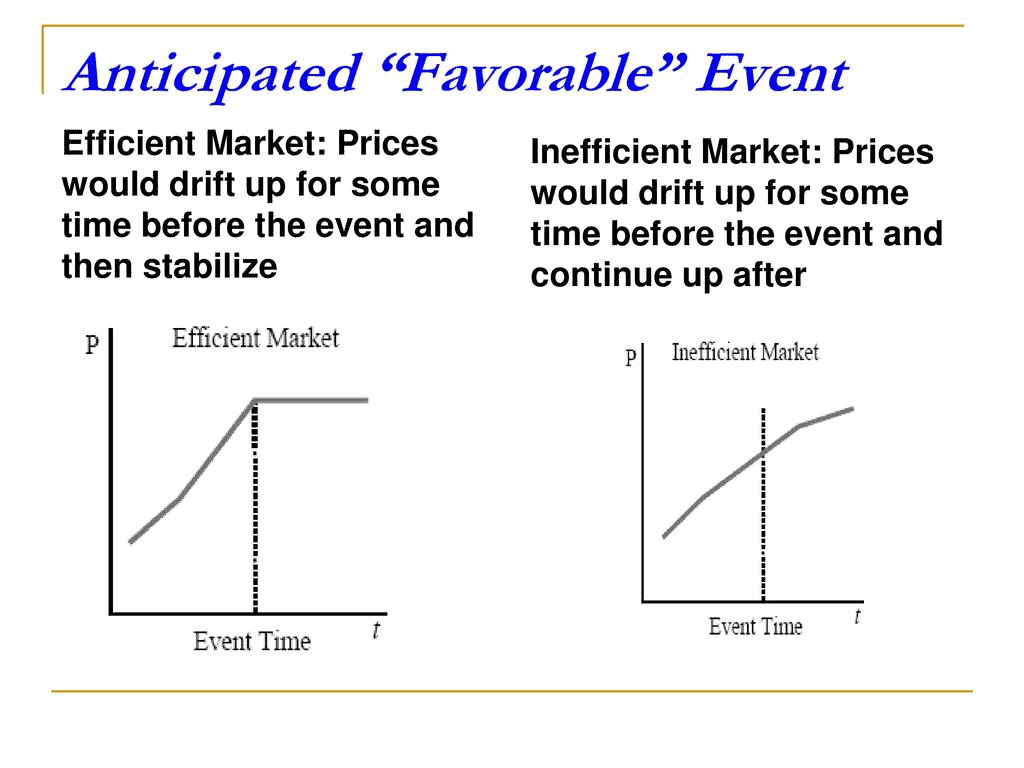

In an efficient market, every piece of information that’s out there has already been incorporated into the security’s price – which means that a ‘favourable’ upcoming event will have little to no effect on the stock’s price in an efficient market setup.

On the flip side, however, news and ‘favourable events’ influence investor sentiment, which makes the stock price rise – both due to the actual news and its anticipation.

According to the EMH, this also means that it is impossible for anyone to time the market and outperform the overall market through specialised stock selection or portfolio management. The EMH posits that the only way this can be done is by gambling with riskier investments that offer higher returns.

Here are some assumptions that the EMH makes:

- Stocks are traded on exchanges at their fair market values.

- The market value of stocks represents all relevant information required by investors for trading.

- That investors are not capable of outperforming the market since everyone’s operating on the same information.

Types of Efficient Market Hypothesis

The theory is offered in three different versions – weak, semi-strong and strong. These versions are varying degrees of the same basic theory.

The weak form

Although one of the most important assumptions of the EMH is that share prices reflect all the available information about a stock at any given time, investors who believe in the weak form of the efficient market believe that prices may not reflect new information that hasn’t yet been made available to the public.

Since new information has not yet been incorporated into the share price, these investors also believe that past prices do not influence future prices and that every movement is derived from new information that gets released to the investors.

Also Read: Do all technical analysis tools work equally well?

Hence, technical analysis is essentially a fruitless endeavour.

The weak form of the efficient market leaves room for an exceptional fundamental analyst or a particularly skilled trader to pick stocks that might outperform the overall market. This could theoretically be done by predicting what new information might affect prices and how.

The semi-strong form

This form takes inspiration from the weak form and makes most of the same assertions. However, it also posits that the market takes quick cognizance of new information that’s disclosed to the public or to the pool of major investors.

Hence, this form concludes that there’s no scope for either fundamental or technical analysis to generate market-beating returns.

The strong form

This is the purest form of the original Efficient Market Hypothesis. The followers of the strong form believe that all information, both public and private, is incorporated into the share’s current price.

Everything that can impact the security’s price and is available out there has already been incorporated into the current price. In this scenario, there is practically nothing that investors can do to beat the market.

Significance of the Efficient Market Hypothesis

Even though this theory is considered to be a cornerstone of modern financial theory, the EMH has constantly been enveloped in controversy in the past. Although believers firmly assert that it is pointless to look for or invest in undervalued stocks through either fundamental or technical analysis, many understandably disagree.

Theoretically, according to the EMH, it is impossible to beat the market consistently unless exceptionally risky investments are made with the help of inside information.

However, there’s a large amount of evidence to the contrary from investors like Warren Buffett who have consistently beaten the market over long periods – something that should’ve been impossible according to the EMH.

Asset bubbles that inflate over time and crash, just like in 1987 and with the dot com bubble, also prove that asset prices can be ballooned and can seriously deviate from their fair prices due to misinformation or market euphoria. This, too, according to the EMH, should’ve already been priced into the market.

Is the Efficient Market Hypothesis valid?

Proponents of the EMH believe that due to the randomness of the market and similar availability of information throughout, investors would do better by investing passively in index funds that mimic the market rather than pick their own stocks.

The research supports this argument somewhat. In a study conducted by Morningstar Inc., only a quarter of all portfolio managers were able to outperform their passively-investing peers.

In general, they agreed that the common retail investor would be better off investing in a low-cost index or bond fund rather than identifying individual stocks in the long term.

The validity of the theory, however, which claims that beating the market is essentially ‘impossible’ has been hotly debated in the past. There are investors like Warren Buffett, whose investment strategies relied completely on value investing, who have made billions and set an example for many.

Also Read: Teachers’ Day – Investing lessons from successful investors

While there are better portfolio managers than others, EMH followers argue that those who outperform the market do so out of luck, not skill. They say that in a given market mean value, there are always going to be people who outperform the market to balance out those who underperform.

Conclusion

Economists say that the higher number of participants that are engaged in the functions of the market, the more efficient the market will be.

However, whether market efficiency relates to stock prices and investing as cleanly as EMH proponents posit is still debatable.