Each company has to cover several day-to-day expenses like utility bills, employee salaries, purchase of office essentials, etc. Imagine, what if a company suddenly ran out of cash to make these payments?

Not only will it disrupt regular business operations, it will reflect poorly on the ability of a company to survive. This is where the concept of working capital comes into play – understanding & managing it well is a fundamental requirement for business continuity.

What is working capital?

The heartbeat of any business is its working capital. It is the money that a company has on hand to cover day-to-day operational expenses.

Imagine you run a lemonade stand. You need money to buy lemons, sugar, and cups today, but you’ll earn back that money (and hopefully more) when you sell lemonade. The money you initially spent is your working capital.

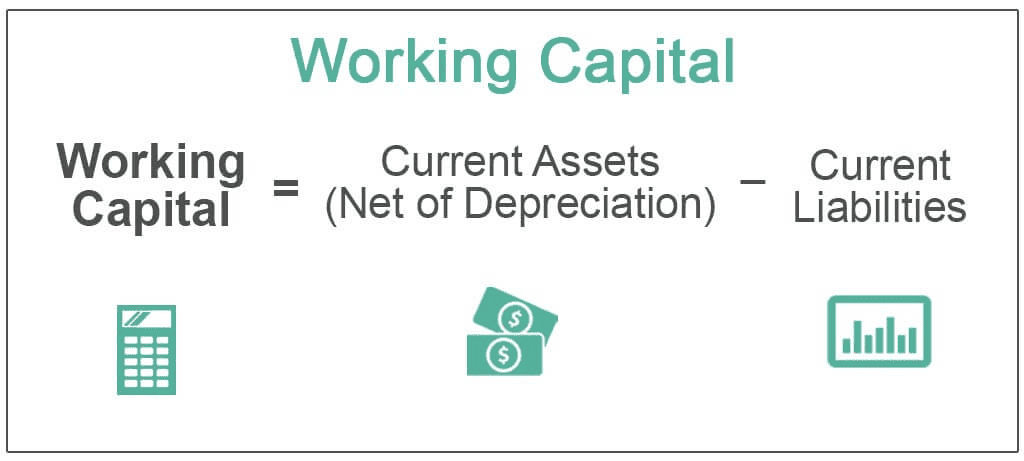

In more formal terms, the working capital definition can be framed as the difference between a company’s current assets and its current liabilities.

Working capital example

Let’s take our lemonade stand as an example to depict the importance of working capital in a business.

Your assets

You start with ₹100 worth of lemons, sugar, and cups. These materials are your “current assets.” They are called current because you plan to sell them in the form of lemonade within a short period, say a week or a month.

Your liabilities

Now, you owe ₹30 to your supplier who provided you with the raw materials on credit. This ₹30 is your “current liability” because it’s an obligation you have to fulfill in the near future.

You may also like: Mastering revenue expenditure – Categories, impacts and management

Calculating your working capital

So how much working capital do you have? You take your current assets (₹100) and subtract your current liabilities (₹30). The calculation would be:

Working Capital = ₹100 − ₹30 = ₹70

This means you have ₹70 of free cash that you can use to run your business smoothly – i.e. pay off your remaining bills & keep all the resources required handy. .

Components of working capital

These are the building blocks that help you grasp the bigger picture.

Current assets

When we talk about current assets, we’re looking at things that can be easily converted into cash within a year. This liquidity makes them “current.”

- Cash: The money you have in your business bank account or as physical currency.

- Accounts receivable: This is money that customers owe you. For example, if you’ve sold lemonade to a local event and they will pay you at the end of the event, that expected payment is your account receivable.

- Inventory: These are the goods or materials you have that will soon be sold or used to produce items for sale. In our lemonade stand, the lemons, sugar, and cups constitute your inventory.

Current liabilities

Liabilities are the opposite of assets; they’re the obligations you have to meet, again, within a short period.

- Bills: These can include utility bills for the place where you operate your lemonade stand, or the gas expense for the vehicle you use to go to the market to buy supplies.

- Loan repayments: If you borrowed some money to start your lemonade business, you would have to make regular payments to pay it back. These are your loan obligations.

- Accounts payable: This is money that you owe to suppliers. Just like accounts receivable is money owed to you, accounts payable is money you owe to others.

Understanding your assets and liabilities allows you to better manage your working capital, ensuring the smooth operation of your enterprise.

Also Read: Insurance 101: How to protect yourself and your assets!

Methods of managing working capital

There are different ways companies manage their working capital:

Aggressive method

When a company adopts an aggressive working capital strategy, it’s a bit like living on the edge. The focus here is on investing more money in long-term investments and keeping less as current assets for daily operations.

For example, a company may decide to invest in advanced machinery that could potentially bring higher returns in the long term but might also require substantial maintenance costs.

Pros:

- Higher returns are possible.

- More funds are invested in avenues that are expected to grow over time.

Cons:

- It’s risky! An unexpected expense could throw things off balance.

- Less liquidity, making it harder to cover daily expenses or unexpected costs.

Conservative method

On the other end of the spectrum is the conservative approach. Companies that opt for this strategy choose safety over high returns.

They keep more funds as current assets, ready to cover day-to-day operations and any surprises that may come their way.

Pros:

- It’s safer and more stable.

- Higher liquidity means you’re better prepared for emergencies or unexpected costs.

Cons:

- Lower returns since less money is invested in long-term growth projects.

- Money kept as current assets is often not generating returns, leading to potential opportunity costs.

Moderate method

The moderate approach aims to balance the best (and worst) of both worlds. Companies adopting this strategy keep a fair amount of funds as both current assets and long-term investments.

Pros:

- Balanced approach offers some level of safety while still aiming for growth.

- Liquidity is maintained, but there is also an attempt to grow the funds through longer-term investments.

Cons:

- While it’s balanced, it’s not specialized. This method may not maximize returns or offer the highest level of security.

- Requires diligent monitoring to ensure that the balance is maintained.

Also Read: What is equity share capital? [Explained]

How to calculate working capital?

Calculating working capital is a straightforward process. Take your current assets—this could include cash, inventories, and accounts receivables—and subtract your current liabilities, which could include short-term debts, accounts payable, and other financial obligations due within a year.

You can find these numbers in a company’s balance sheet.

The significance of the working capital ratio formula

The working capital ratio is a quick and simple tool that tells you a lot about a company’s financial health. Specifically, it helps you understand how well-prepared a company is to meet its short-term liabilities. The formula to calculate it is quite simple:

Working Capital Ratio=Current Assets/Current Liabilities

What you’re looking for is a ratio that is above 1. This indicates that the company has more assets than liabilities, giving it the financial breathing room to cover its short-term debts. A ratio under 1 could be a red flag and merits further investigation.

By understanding these various methods, calculations, and ratios, you’re well on your way to grasping the full picture of working capital and what it means for a business.

Working capital requirement

Understanding the working capital requirement is like knowing how much fuel your car needs for different kinds of journeys. It varies from vehicle to vehicle, just as it varies from business to business. Several factors influence the amount of working capital a company requires.

- Nature of the business

Different industries have different working capital needs. For instance, a manufacturing company usually has to invest in raw materials, labor, and inventory.

These companies often require higher working capital compared to service-based businesses, where the primary costs might be human resources and utility bills.

- Size of the business

The scale of your business operations can significantly influence your working capital requirement. Larger corporations often have bigger operational costs and thus need more working capital.

Smaller businesses might need less working capital as their operations are not as extensive.

- Operational costs

Your daily, monthly, and yearly operational costs directly determine your working capital needs. If you have high electricity bills, employee salaries, and rent, you’ll need a more considerable working capital to keep things running smoothly.

- Specific examples

Retail businesses generally need more working capital because they have to maintain sufficient inventory levels.

In contrast, a service-based business like a consulting firm may not need as much working capital because they don’t have to stock products.

In summary, working capital requirements are tailored to each business’s unique needs and operating conditions. Being aware of these can help in better financial planning.

Conclusion

Armed with a clear understanding of working capital’s components, calculations, and types, you are now better prepared to assess a company’s financial health or manage your own business more effectively.

This newfound knowledge empowers you to engage in informed decision-making, be it in investment, business operations, or strategic planning. Your journey toward financial acumen has only just begun; perform well!