Are you wondering how to diversify your portfolio? Do the stocks on foreign exchanges seem attractive to you? If yes, this is the article you’re looking for.

Continue reading to discover more about foreign investments, available alternatives, and the benefits and drawbacks of making these investments.

What is FPI?

FPI full form – Foreign Portfolio Investments.

As the term suggests, FPI refers to the process of purchasing securities and other financial assets in foreign countries. A common way for investors to get involved in the economy of a foreign nation, FPI’s popularity is increasingly popular today.

Various kinds of financial assets are at the disposal of investors interested in foreign investments.

Types of assets available for FPI

While investors have multiple options for foreign investments, below are some examples of Foreign portfolio investments:

- Stocks – Investing in stocks and shares of foreign corporations.

- Bonds – Investing in debt financing instruments issued by foreign entities.

- American Depository Receipts (ADRs) – ADRs are certificates held by banks in the United States, representing a certain number of shares of a foreign corporation’s stock.

- Global Depository Receipts (GDRs) – GDRs are similar to ADRs. While ADRs specifically hold shares issued in the United States, GDRs hold shares issued in multiple countries.

You may also like: Diving into FDI: What it means for investors and countries

Benefits of FPI

- Foreign portfolio investments opens international markets for stocks and boosts the demand for a company’s share, making it easy for them to raise capital.

- From the investor’s perspective, Foreign portfolio investments allows diversification of portfolios.

- Foreign portfolio investments widens the access of international credits to investors.

- With access to different markets having different features, investors can benefit from the varied risk-return ratios each market offers.

Risks involved with FPI

- The country’s economy may impact FPIs negatively during times of economic lows and political instability.

- Every market is volatile, and the fluctuations are rapid. If investors do not act quickly on their foreign investments, they are prone to incur high losses.

- Since foreign investments are subject to higher volatility, these investments are not very reliable and predictable. Large dependence on FPIs may be unfavourable to companies, at times.

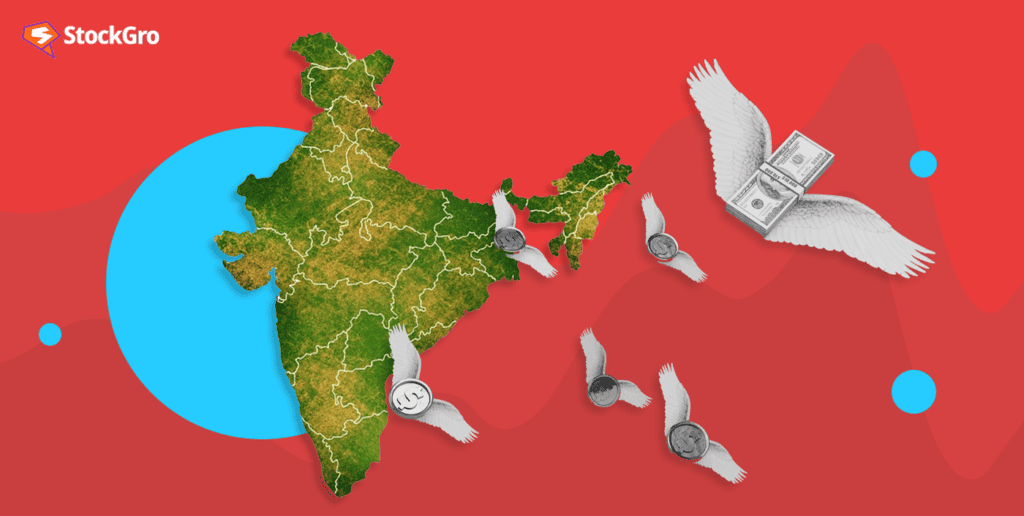

FPI in India

In recent years, Foreign Portfolio Investments (FPI) have significantly impacted the Indian economy. Foreign capital inflows have helped to finance the country’s current account deficit, increase liquidity in financial markets, and support business and infrastructure growth.

The combined Foreign portfolio investments Investments of January and February 2023 in India were negative ₹ 34,146 crores. However, the situation improved from March, and FPIs pumped in ₹ 47,148 crores in June 2023, marking June as the best month in the last ten months.

Foreign nationals must fall under one of these categories to be part of Foreign portfolio investments in India:

- Category 1: Includes investments from the government sector of foreign countries.

- Category 2: Regulated funds not within the government sector fall under this category – mutual funds, exchange-traded funds, insurance companies, etc.

- Category 3: Eligible investors not falling under the above categories, like charitable trusts and individuals, come under this category.

The Securities and Exchange Board of India (SEBI) regulates Foreign portfolio investments transactions in India.

Also Read: A comparative study of FIIs and DIIs in financial markets

Eligibility criteria for investors to be a part of FPI in India:

- Should not be an Indian resident.

- Should not be a resident of any country restricted by the FATF (Financial Action Task Force) or the Indian government.

- Should have legal permission to invest in foreign countries.

- If the investor is a foreign bank, the central bank of that foreign country should be a member of the Bank of International Settlements (BIS).

- In the case of trusts or corporations, a valid Memorandum of Association (MoA) or Articles of Association (AoA) or any equivalent document should be signed.

The inflow of Foreign portfolio investments has been a crucial driver of the Indian stock market, accounting for a significant portion of the trading volume. However, they are prone to market risks and volatility causing a shaky financial system in the country.

To address these risks, the Reserve Bank of India (RBI) has formulated various measures to regulate Foreign portfolio investments and ensure financial market stability. These measures include investment restrictions in specific sectors, debt investment restrictions, and periodic reviews of FPI legislation.

Despite these obstacles, Foreign portfolio investments play an essential role in the Indian economy, serving as a significant source of foreign capital and promoting growth and development across multiple sectors.

FPI VS FDI: Key Differences

While investing in a foreign entity’s securities is called FPI, Foreign Direct Investment (FDI) refers to investing in businesses of foreign countries. Read here in detail: Difference between FDI and FPI.

It is done through various ways – establishing subsidiaries, merging with an existing company, or starting a joint venture with a foreign company.

Also Read: Over $3 billion in the month of May! FII dollars pouring non-stop on Dalal Street

Differences based on the features of these investments:

| Foreign direct investments | Foreign portfolio investments |

| FDI investors are active owners and have a say in business decisions. | FPI investors are passive owners without strong powers to influence decision-making. |

| FDI is a form of direct and long-term investment. | FPI is an indirect investment and is generally for a short term. |

| The procedures for entering and exiting FDIs are complex. | Investment in FPI is relatively easy. |

| FDI investors invest in the physical business and have a high control over it. | FPI investors invest in financial assets and do not have control over the business. |

| FDI investments are stable and involve less risk. | FPI investments are riskier and more volatile. |

Bottomline

Individuals or institutional investors interested in diversifying their portfolios try their chances at foreign portfolio investments.

Developing economies expected to grow bigger generally attract huge numbers of investors through Foreign portfolio investments.

Foreign portfolio investments is also one of the significant ways for countries to expand their horizons and have cross-border transactions, thereby positively impacting the country’s international relations. Explore the different ways of attracting foreign investments. Analyse the differences between foreign portfolio and foreign institutional investors.