Foreign Institutional Investors (FIIs) have unleashed a buying spree like no other, showering the Indian stock market with a whopping Rs 24,740 crore ($3.2 billion) in just a fortnight. Taiwan follows closely behind with $1.4 billion in FII investments.

However, Thailand and Indonesia seem to have fallen out of favour, with FIIs pulling out $427 million and $199 million, respectively. India is the place to be!

While European markets are taking a tumble and the S&P 500 is crawling along with a measly 1% return, our beloved Indian stock market is dancing to the tune of a 2.8% rally in Nifty.

But why are these FIIs so smitten with Indian equities? Let’s dive into the details and unravel the mysteries behind this fascinating trend.

FII Rebirth

After a slump in the first three months of the year, FIIs staged a powerful comeback, propelled by multiple factors.

You may also like: Margin trading: Exploring the risks and rewards

Paused rate hikes

The Reserve Bank of India’s decision to pause rate hikes played a significant role in attracting FIIs. This decision, coupled with the positive consumer inflation print, led to hopes that the central bank would maintain a long pause, making Indian equities an attractive investment option.

Strong earnings and a rising rupee

April brought joy to investors as corporate earnings met expectations, with a few positive surprises in the financial sector and some disappointments among IT companies. This solid earnings season added fuel to the FII fire, driving their buying spree.

But that’s not all! The Indian rupee’s strengthening against the dollar has also played a part in enticing FIIs. A strong rupee means higher returns for foreign investors, making Indian equities even more attractive.

Record-breaking numbers:

The sheer scale of FII buying is mind-boggling. FIIs have pumped a staggering Rs 44,000 crore ($5.7 billion) into Indian equities so far this financial year. Within the first 14 days of May, a staggering $2.7 billion flowed into Indian equities, marking the longest buying streak in three years.

The average daily buying surpassed Rs 3,000 crore, leading to a total of over Rs 31,000 crore invested so far in the new financial year.

Reasons behind the FII buying

Strong economic recovery:

- Amid global challenges, India’s economy has showcased remarkable resilience. Effective policies and successful efforts to combat the COVID-19 pandemic have paved the way for a robust economic recovery.

- The consistent positive growth trajectory and encouraging GDP expansion have sparked optimism among foreign investors, attracting their attention to the Indian stock market.

Sectoral opportunities:

Certain sectors within the Indian economy have emerged as attractive investment hotspots, offering lucrative opportunities for FIIs. From technology and healthcare to renewable energy and e-commerce, these sectors have experienced rapid growth and hold immense potential for future returns.

FIIs are strategically positioning themselves to capitalise on these upward trends, further fueling the buying spree.

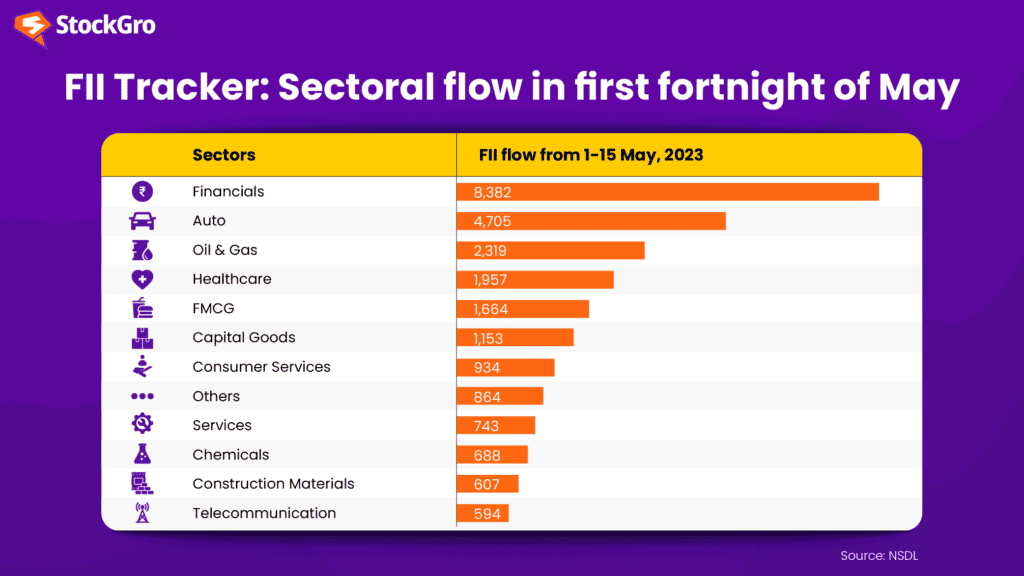

Sectors that stole the major FII inflow

Imagine going on a shopping spree with Rs 20,000 crore! Well, that’s exactly what foreign investors did in the first fortnight of May. They splurged their FII money in six sectors, and it’s worth noting where they went wild:

- Banks and Financial Stocks: These were on top of their shopping list, with foreign investors buying shares worth a whopping Rs 8,382 crore. It seems money loves money!

- Auto: Foreign investors revved up their engines and invested Rs 4,705 crore in the automobile sector. Vroom-vroom!

- Oil and Gas: The energy sector attracted Rs 2,319 crore in FII investments. Time to fuel up!

- Healthcare: Keeping well-being in mind, foreign investors injected Rs 1,957 crore into the healthcare sector.

- FMCG: Our everyday essentials saw a boost too, with Rs 1,664 crore flowing in.

- Capital Goods: The capital goods sector bagged Rs 1,153 crore.

Let’s crunch some numbers and see the impact of foreign direct investment (FDI) in India:

Also Read: What is the role of FIIs in the Indian stock market?

FDI Inflows

In fiscal year 2023, FDI into India dropped by a staggering 21.67% from the previous year, settling at $46.03 billion. That’s a significant dip!

The January-March quarter saw inflows of $9.28 billion, a whopping 41% lower than the same period last year. Ouch, that’s a tough hit.

Total FDI inflows, including fresh equity, reinvested earnings, and other capital, contracted by 29.6% in the fiscal fourth quarter, reaching $15.49 billion.

| Years | FDI equity inflows ($bln) |

| FY19 | 44.36 |

| FY20 | 49.97 |

| FY21 | 59.63 |

| FY22 | 58.77 |

| FY23 | 46.03 |

The players in the FDI game

Who are the big players when it comes to investing in India? Let’s find out:

Singapore took the crown as the top investor, pumping in a whopping $17.2 billion in FDI during the fiscal year. Impressive, isn’t it?

Mauritius secured the second spot with $6.1 billion, followed closely by the United States at $6.04 billion. These investors mean business!

Sectoral spotlight: Where the money flows

Let’s shine a light on the sectors that caught FDI inflows:

| Sectors | FDI Inflows 2022-23 (in USD billion) |

| Computer Software | 9.4 |

| Automobiles | 1.9 |

| Services | 8.7 |

| Trading | 4.8 |

| Telecommunications | 0.713 |

| Pharma | 8.7 |

| Chemicals | 1.85 |

| States/UTs | FDI Inflows 2022-23 (in USD billion) | FDI Inflows 2021-22 (in USD billion) |

| Maharashtra | 14.8 | 15.44 |

| Karnataka | 10.42 | 22 |

| Gujarat | 4.71 | 2.7 |

Despite the challenges, India remains an attractive destination for foreign direct investment. In fact, it ranked as the seventh-highest recipient of FDI in 2021, despite a 30% drop in inflows.

In 2021, despite a 30% drop in FDI inflows from $64 billion in 2020 to $45 billion, India managed to climb one spot and secure the seventh position among the world’s top FDI recipients.

Promising outlook

Guess what? India has finally bid adieu to its long-standing economic woes, commonly known as the “twin deficit” problem (stressed banking system and highly leveraged corporate sector).

The banking system is back in action, flexing record profits and boasting low non-performing assets (NPAs). On top of that, the corporate sector has reduced its debt burden, allowing businesses to borrow and invest more freely.

Banks have enough moolah to lend, and the revival of capital expenditure (capex) is on the horizon. The tides are turning!

Also Read: Jio Financial Services: Disrupting the insurance and AMC markets

Implications for local investors, the economy, and global market trends

- Liquidity Boost: The influx of FII investments injects liquidity into the Indian stock market. This increased liquidity provides more opportunities for local investors to buy and sell shares. Additionally, it enhances the market depth and stability.

- Economic Growth: FII investments play a crucial role in driving economic growth. They provide capital to domestic companies, allowing them to expand operations. The capital inflows from FIIs contribute to overall economic development and can positively impact GDP growth.

- Stock Price Movement: FII buying can influence stock prices. When FIIs purchase a significant number of shares in a particular company or sector, it often leads to increased demand and upward pressure on stock prices.

With the Indian stock market witnessing this remarkable FII buying spree, it’s an exciting time for investors and a positive sign for Dalal Street’s future prospects. The inflow of foreign investments not only bolsters the market but also reinforces India’s position as an attractive destination for global capital.