In the dynamic landscape of India’s financial markets, Angel One Ltd. has emerged as a formidable player, leveraging technology to democratise investing for the masses. As retail participation in equities surges, Angel One’s digital-first approach positions it at the forefront of this financial revolution.

But does Angel One offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ANGELONE |

| Industry/Sector | Financial Services (Stock Broking) |

| Market Cap (₹ Cr.) | 20,968 |

| Free Float (% of Market Cap) | 64.11% |

| 52 W High/Low | 3,503.15 / 1,941.00 |

| P/E | 17.82 (Vs Industry P/E of 16.81) |

| EPS (TTM) | 129.81 |

About Angel One

Founded in 1996 by Dinesh Thakkar, Angel One Ltd. (formerly Angel Broking Ltd.) has evolved into one of India’s leading retail brokerage firms. Headquartered in Mumbai, the company offers a comprehensive suite of financial services, including broking, advisory, margin funding, loans against shares, and distribution of financial products.

With a strong emphasis on technology, Angel One provides seamless trading experiences through its mobile app and web platforms, catering to a vast and growing client base across the country.

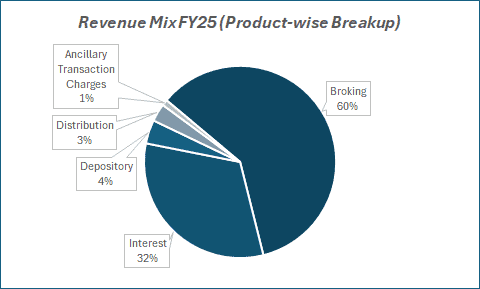

Key business segments

Angel One operates primarily in the following key business segments:

- Equity Broking and Trading: Angel One offers low-cost equity, commodity, and derivatives trading with a focus on zero brokerage for delivery trades.

- Mutual Fund Distribution: The company distributes mutual funds, earning commissions from top AMCs.

- Wealth Management & Advisory: Provides tailored wealth management services and financial planning for high-net-worth individuals (HNIs).

- Loans Against Securities: Offers loans to customers by pledging their equity holdings as collateral.

Primary growth factors for Angel One

Angel One key growth drivers:

- Surge in Retail Investors: Growing participation from retail investors, especially among tech-savvy millennials.

- Technological Advancements: Heavy investment in a seamless, mobile-first platform with AI-based tools.

- Zero-Brokerage Offering: Low-cost model, including zero brokerage on delivery trades, attracts cost-conscious investors.

- Strong Brand and Trust: Over 20 years of experience, offering a trusted platform for new and seasoned investors.

- Partnerships and Expanding Portfolio: Diversified offerings like mutual funds, insurance, and loans attract a broader customer base.

Detailed competition analysis for Angel One

Key financial metrics – trailing twelve months (TTM);

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT(₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Angel One Ltd | 5238.38 | 1980.88 | 37.81% | 1172.08 | 22.37% | 17.82 |

| MO Financial Services | 8339.05 | 4545.31 | 54.51% | 2508.18 | 30.08% | 15.25 |

| MCX India | 1112.66 | 665.31 | 59.79% | 557.95 | 50.15% | 62.35 |

| ICICI Securities | 6476.48 | 4550.80 | 70.27% | 2096.94 | 32.38% | 15.01 |

| IIFL Capital Services | 10210.90 | 5625.43 | 55.09% | 578.16 | 5.66% | 9.96 |

Key insights on Angel One

- Median sales growth of 22.6% over the last 10 years, reflecting consistent revenue expansion.

- Profit CAGR of 66.9% over the past 5 years, demonstrating strong earnings growth.

- 3-year average ROE of 36.1%, highlighting excellent return on equity and capital efficiency.

- Dividend payout ratio of 30.6% indicates a balanced approach to shareholder returns and reinvestment.

- Debtor days reduced from 36.0 to 20.9, showing improved working capital management and quicker collections.

- 3.1 crore total client base in FY25, signalling strong customer acquisition and market reach.

- Digital-first strategy driving efficient customer acquisition through targeted digital marketing and referral programs.

Recent financial performance of Angel One for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1357.28 | 1262.21 | 1056.01 | -16.34% | -22.20% |

| EBITDA (₹ Cr.) | 529.85 | 495.93 | 342.72 | -30.89% | -35.32% |

| EBITDA Margin (%) | 39.04% | 39.29% | 32.45% | -684 bps | -659 bps |

| PAT (₹. Cr.) | 339.94 | 281.47 | 174.52 | -38.00% | -48.66% |

| PAT Margin (%) | 25.05% | 22.30% | 16.53% | -577 bps | -852 bps |

| Adjusted EPS (₹) | 40.47 | 31.19 | 19.33 | -38.03% | -52.24% |

Angel One financial update (Q4 FY25)

Financial performance

- Consolidated gross revenue for Q4 FY24 decreased by 16.3% QoQ to ₹1,058 crore.

- Operating margin contracted by 1,019 bps QoQ, primarily due to continued investments in client acquisition amidst softer market conditions.

Business highlights

- In Q4 FY24, the company acquired 16 lakh clients, with 88% from tier-2 and tier-3 cities.

- Cumulative disbursements in the credit distribution segment stood at approximately ₹700 crore as of 31st March 2025.

- Mutual Fund AUM reached approximately ₹74 crore.

Outlook

- The initial impact from the new F&O regulations has subsided, but client activity may remain subdued until the end of H1 FY26.

- The wealth management business is expected to see significant potential growth, particularly among individuals with a net worth between ₹1 crore and ₹25 crore.

- With improving macroeconomic conditions, reduced Central Bank rates, and declining inflation, the management anticipates a gradual improvement in margins, with normalized margins expected to reach 40%-45% by Q4 FY26.

Company valuation insights – Angel One

Angel One trades at a TTM P/E of 17.82, slightly above the industry average of 16.81, with a -16.39% 1Yr return vs Nifty 50’s +7.50%.

Q4 FY25 was impacted by F&O regulation changes, weak market sentiment, and elevated costs, including IPL spends. While growth was muted, levers like pricing tweaks and market recovery could help regain margins.

New verticals – loans, FDs, wealth management, and AMC – offer medium-term growth. Risks include slower MTF growth and high client acquisition costs.

At 20x FY27E EPS of ₹140, the 12M target price is ₹2,800 (21% upside); 3M target is ₹2,520 (9% upside).

Major risk factors affecting Angel One

- Regulatory Changes: SEBI or RBI rules on commissions or leverage can impact revenue.

- Market Volatility: A slowdown in trading volumes during bearish phases may hurt earnings.

- Intense Competition: Rising pressure from discount brokers and new fintech entrants.

- Tech-Dependence: System outages or cybersecurity issues can damage user trust and operations.

Technical analysis of Angel One share

Angel One is forming an inverted head and shoulders pattern on the daily chart and is consolidating near the neckline. A breakout could signal an uptrend and trigger bullish momentum.

The stock is trading near its 50-day EMA but remains below the 100- and 200-day EMAs, with the 200-day EMA aligning with the neckline. MACD is positive at 33.55, though still below the signal line – an upward crossover could confirm bullish strength. RSI at 48.70 indicates neutral momentum, while Relative RSI remains slightly negative over both 21-day and 55-day periods (-0.04), hinting at mild underperformance.

ADX at 13.22 reflects a range-bound phase. A breakout above ₹2520, a key resistance level, may open the path to a target price of ₹2800. ₹2170 remains a key support.

- RSI: 48.70 (Neutral)

- ADX: 13.22 (Range Bound)

- MACD: 33.55 (Positive)

- Resistance: ₹2520

- Support: ₹2170

Angel One stock recommendation

Current Stance: Buy with a target price of ₹2,520 over a 3-month horizon and ₹2,800 over a 12-month horizon. Angel One's expanding fintech ecosystem, digital-first model, and new business verticals position it well to benefit from India’s evolving financial landscape.

Why buy now?

Digital leadership: Among the top players in digital broking with a strong presence in Tier 2/3 cities; over 3.1 crore client base.

Business expansion: Diversifying into loan distribution, MF, FD, and wealth management to unlock new revenue streams.

Margin normalisation: Management expects margins to return to ~40–45% as operating leverage improves and the market stabilises.

Portfolio fit

Angel One offers exposure to India’s rising retail financialisation and digitisation of investments. With scalable tech, sticky clients, and optionality from new verticals, it suits portfolios targeting long-term compounding in fintech, especially for investors seeking growth from financial inclusion and capital markets expansion.

If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebAngel One: Budget 2025-26 opportunities

- Financial Inclusion Drive: Focus on Tier 2/3 cities aligns with Angel One’s digital model and deepens market penetration.

- Digital Infrastructure Push: Investments in UPI, Aadhaar, and e-KYC will simplify client onboarding and reduce friction.

- Capital Market Reforms: Policies to widen retail participation can support growth in broking, MF distribution, and AMC business

- Tax & Savings Incentives: Encouragement of long-term investing through tax benefits may boost inflows into wealth management products

- Support for MSMEs & Start-ups: Opens new opportunities in loan distribution and cross-selling of financial services.

Final thoughts

Angel One Ltd. is well-positioned to capitalise on India’s burgeoning retail trading market. With its technology-driven approach, customer-first strategy, and strong brand recognition, Angel One is primed to continue its growth trajectory.

Angel One has become a one-stop platform for millions of Indians seeking low-cost trading, robust research, and seamless investment management. As the retail investor grows in prominence, companies like Angel One will continue to shape the future of the Indian capital market.

However, investors should remain cautious of potential regulatory risks and the highly competitive environment.