When you think of tyres, you think of reliability, grip, and endurance, the very traits that define Apollo Tyres’ journey over the last five decades. From its humble beginnings in Kerala to becoming a global tyre major across 120+ countries, Apollo’s story isn’t just about rubber meeting the road, it’s about Indian manufacturing meeting global ambition.

As the Indian auto cycle turns up again, and global markets begin to stabilize, Apollo Tyres finds itself at an inflection point, leaner, more premium, and more globally diversified than ever before.

But does Apollo Tyres offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | APOLLOTYRE |

| Industry/Sector | Tyres & Allied |

| CMP | 488.25 |

| Market Cap (₹ Cr.) | 30,942 |

| P/E | 36.98 (Vs Industry P/E of 30.92) |

| 52 W High/Low | 557.00 / 370.90 |

| EPS (TTM) | 13.10 |

| Dividend Yield | 1.03% |

About Apollo Tyres Ltd.

Founded in 1972, Apollo Tyres Ltd is one of India’s leading tyre manufacturers with a strong presence across passenger vehicles (PV), commercial vehicles (CV), and two-wheeler segments. The company operates through two key brands, Apollo and Vredestein, serving both domestic and international markets.

With manufacturing facilities in India (Chennai, Gujarat, Kerala, Andhra Pradesh) and Europe (Netherlands and Hungary), Apollo has built a balanced global footprint. The company’s strategic focus has shifted from volume to value, increasing its share in premium tyres and high-margin radial categories.

Key business segments

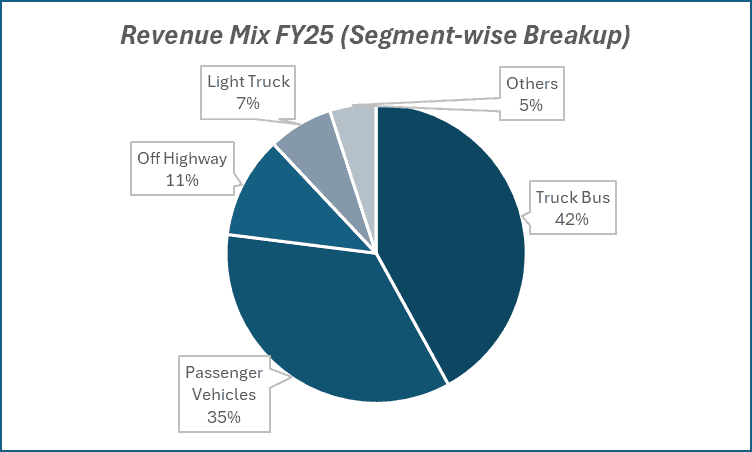

Apollo Tyres Ltd. operates primarily in the following key business segments:

- Passenger Vehicle Tyres (PV): About 45% of revenue; strong growth in India and Europe driven by premiumisation and rising radialisation, aided by the Vredestein brand.

- Truck & Bus Radial (TBR): About 40% of revenue; supported by infrastructure spending, logistics expansion, and a resilient replacement market.

- Off-Highway & Two-Wheeler Tyres: A smaller but fast-growing niche catering to farm and industrial equipment; export-led growth through Apollo and Vredestein brands.

- Replacement vs OEM Mix: About 65% of revenue from replacement ensures steady cash flows, while OEM exposure provides cyclical upside during auto upturns.

Primary growth factors for Apollo Tyres Ltd.

Apollo Tyres Ltd. key growth drivers:

- Auto Demand Revival: Strong recovery in PV and CV sales boosting tyre volumes.

- Premiumisation Focus: Shift toward high-margin TBR and premium radial tyres driving profitability.

- European Turnaround: Hungary plant at optimal utilisation improving margins and efficiency.

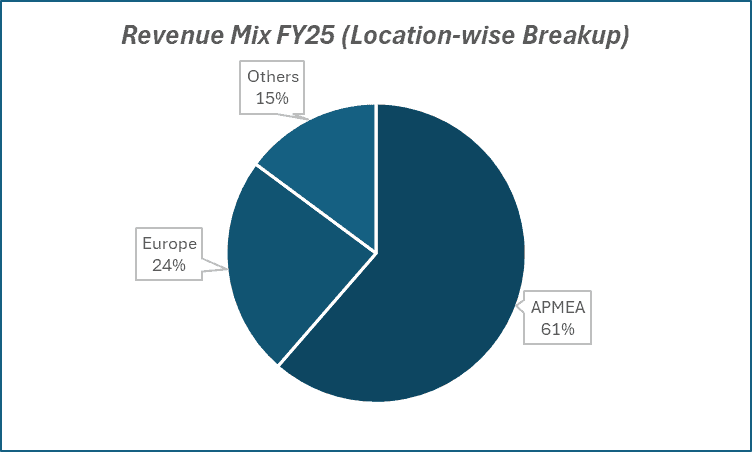

- Export Momentum: Exports form ~30% of revenue, aided by a weak euro and stable logistics.

- Raw Material Relief: Softer rubber and crude prices supporting margin expansion.

Detailed competition analysis for Apollo Tyres Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Apollo Tyres Ltd. | 26349.33 | 3530.02 | 13.40% | 831.49 | 3.16% | 36.98 |

| MRF Ltd. | 28632.42 | 3996.09 | 13.96% | 1798.74 | 6.28% | 36.86 |

| Balkrishna Industries | 10492.47 | 2300.19 | 21.92% | 1453.27 | 13.85% | 30.28 |

| Ceat Ltd. | 13554.46 | 1478.99 | 10.91% | 414.51 | 3.06% | 32.97 |

| JK Tyre & Industries | 14922.78 | 1500.70 | 10.06% | 458.88 | 3.08% | 22.97 |

Key insights on Apollo Tyres Ltd.

- Margins back on track: With rubber and crude prices stabilizing, operating margins have rebounded to ~12–14%.

- Europe turns profitable: Premium mix and Vredestein brand drive margin recovery overseas.

- Deleveraging phase: Net debt-to-EBITDA down to ~1.3–1.5x post major capex cycle.

- ROCE focus: Management targets 15%+ returns over the next few years.

Recent financial performance of Apollo Tyres Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 6334.85 | 6423.59 | 6560.76 | 2.14% | 3.57% |

| EBITDA (₹ Cr.) | 909.26 | 837.38 | 867.75 | 3.63% | -4.57% |

| EBITDA Margin (%) | 14.35% | 13.04% | 13.23% | 19 bps | -112 bps |

| PAT (₹ Cr.) | 301.98 | 184.32 | 12.82 | -93.04% | -95.75% |

| PAT Margin (%) | 4.77% | 2.87% | 0.20% | -267 bps | -457 bps |

| Adjusted EPS (₹) | 4.76 | 2.91 | 0.20 | -93.13% | -95.80% |

Apollo Tyres Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹6,560 crore (+3.6% YoY), supported by steady India growth and stable Europe performance.

- EBITDA: ₹868 crore (13.2% margin), slightly up QoQ but lower YoY due to inflationary pressures in Europe.

- India Business: Revenue ₹4,730 crore (+3% YoY), margin improved to 13.6% led by OEM demand and cost discipline.

- Europe Business: €146 mn (flat YoY), lower sequentially on weak demand; margin at 10.8%.

- Net Debt: ₹2,100 crore (↓15% QoQ), Net Debt/EBITDA 0.7x — reflecting strong balance sheet health.

Business highlights

- India: OEM demand steady (pre-buying in heavy commercial due to AC norms); replacement modest, exports weak. Market share ~20% in PCR & ~30% in TBR.

- Europe: Weak demand; focus on premium mix, cost control & new launches. Enschede plant restructuring to save costs from FY27 (₹370 cr provisioned).

- Raw Materials: Basket cost ₹166/kg (–2% QoQ); natural rubber up 3%, synthetics down, margin support continues.

- R&D & Product: Approved supplies to top German OEMs; launched Apollo Aspire 5 for premium cars/SUVs; Vredestein volumes at record high.

- Sustainability: Scope 1 emissions down 35%, Scope 2 down 39%; Gold-rated by EcoVadis; Hungary plant ISCC-certified.

- Capex & Leverage: FY26 capex unchanged; strong FCF, ROCE focus; net debt down ₹390 cr in Q1.

Outlook

- Short term: Margins to hold firm; Europe restructuring and input stability to aid profitability.

- Medium to long term: Growth visibility improving with OEM traction, rural network expansion, and premium mix gains.

- Investor sentiment: Positive, supported by deleveraging, operational focus, and long-term brand strength.

Recent Updates on Apollo Tyres Ltd.

- New Product Launches: Apollo recently expanded its “EnduRace” and “EnduMile” series for commercial vehicles, aimed at long-haul trucks and buses, improving durability and fuel efficiency.

- Sustainability Push: The company announced its goal to achieve carbon neutrality at key facilities by 2040, using renewable energy and circular material sourcing.

- Partnerships & Branding: Apollo extended its long-standing sports sponsorship deals, including the Premier League’s Crystal Palace FC and Indian Super League to enhance its global recall.

- Digitization: A growing focus on predictive maintenance, fleet analytics, and direct-to-consumer digital sales channels is part of its “Apollo Tyres 2.0” transformation strategy.

Company valuation insights – Apollo Tyres Ltd.

Apollo Tyres is currently trading at an EV/EBITDA of 8.5x, with a 1-year return of -3.8% versus the Nifty 50’s +1.2%.

The investment case lies in its improving fundamentals, aided by GST 2.0 reforms reducing tax rates across the auto value chain, benign raw material costs supporting margin recovery, and continued deleveraging.

With net debt-to-EBITDA down to 0.7x and margins rebounding on the back of lower rubber and crude derivatives, Apollo is well placed to deliver a strong earnings CAGR of over 30% over FY25–27E.

We value Apollo Tyres at 8x FY27E EV/EBITDA, arriving at a 12-month target price of ₹600 (22% upside from current levels). For the short term, we assign a 3-month target of ₹520 (~7% upside). Key upside triggers include sustained margin recovery, stronger demand post-GST reform, and continued balance sheet improvement.

Major risk factors affecting Apollo Tyres Ltd.

- Raw Material Inflation: A spike in natural rubber or crude-linked input costs could squeeze margins again.

- Slowdown in Europe: Weak macro conditions or currency volatility could impact the profitability of its European operations.

- Competition: Aggressive capacity addition by peers (Ceat, JK Tyre) could pressure market share in the domestic TBR and PCR segments.

- Capex Execution: Delays in ramping up the Andhra Pradesh plant or slower demand could hurt utilization and return ratios.

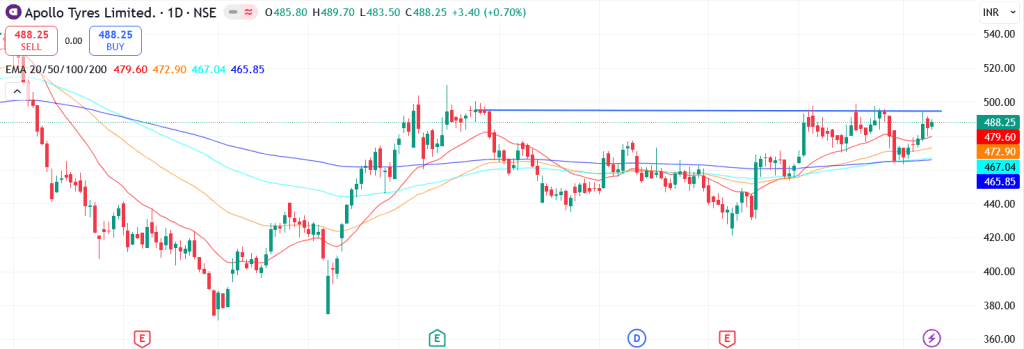

Technical analysis of Apollo Tyres Ltd. share

Apollo Tyres is currently forming a cup and handle pattern, with prices nearing a breakout above the neckline, a move that could signal the start of strong upward momentum and offer a fresh entry opportunity.

The stock is trading above its 50-day, 100-day, and 200-day EMAs, reinforcing that the broader trend remains firmly positive. A sustained move above these levels would strengthen the medium- to long-term bullish outlook.

Momentum indicators support this setup. The MACD at 2.83 is positive, with the line close to crossing above the signal line, indicating a potential momentum build-up. The RSI at 57.94 reflects healthy buying interest, while relative RSI scores of 0.01 (21-day) and 0.08 (55-day) highlight steady outperformance versus the market. The ADX at 17.71 suggests the trend is gradually gaining strength.

A breakout above ₹520 could open the door for a rally toward ₹600 (12-month fundamental target). On the downside, ₹460 remains a key support; holding above this level will be critical to maintain the bullish structure.

- RSI: 57.94 (Strong Buying Interest)

- ADX: 17.71 (Trend Gaining Strength)

- MACD: 2.83 (Positive)

- Resistance: ₹520

- Support: ₹460

Apollo Tyres Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹520 (~7% upside) and a 12-month target of ₹600 (~22% upside).

Why buy now?

GST 2.0 boost: Lower tax rates to spur OEM and replacement tyre demand.

Margin recovery: Stable rubber and crude prices support 14–15% EBITDA margins.

Stronger balance sheet: Net debt/EBITDA down to 0.7x post major deleveraging.

Earnings traction: ~31% PAT CAGR expected over FY25–27E with Europe back to profit.

Portfolio fit

Apollo Tyres offers a cyclical recovery with structural tailwinds, demand revival, cost stability, and balance-sheet strength. At current valuations, it’s a value-re-rating opportunity in the auto ancillary space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebApollo Tyres Ltd.: Budget 2025-26 opportunities

- Auto & Manufacturing Boost: Higher infrastructure and vehicle spending under the Union Budget is expected to lift tyre demand across commercial and passenger vehicle segments.

- GST 2.0 Reforms: Reduction in GST rates for automobiles and tyres (from 28% to 18%) enhances affordability, supports replacement demand, and improves industry cost competitiveness.

- PLI for Auto Components: Continued focus on localization and value-added manufacturing benefits Apollo’s radial tyre and premium segment expansion plans.

- Export Incentives: Extended export benefits and logistics infra push (ports, highways) strengthen Apollo’s position in Europe and other overseas markets.

- Sustainability Drive: Government incentives for green manufacturing and renewable adoption align with Apollo’s carbon-neutrality roadmap and eco-tyre product line.

Final thoughts

Apollo Tyres represents a story of Indian manufacturing maturity, a company that went from selling bias tyres in the 1980s to engineering radials for luxury cars in Europe.

It’s not just about tyres anymore; it’s about brand evolution, sustainability, and global competitiveness all built on Indian soil.

As India’s mobility story accelerates, from rising truck fleet utilization to growing premium car sales, Apollo seems well-positioned to roll ahead, one rotation at a time.