India’s banking landscape is undergoing a notable shift, driven by rising credit demand, improving balance sheets, and strong economic fundamentals. Among leading public sector banks, Bank of Baroda (BoB) stands out for its consistent operational improvement post-merger, better capital buffers, and technology-led retail expansion. Supported by strong asset quality trends, healthy credit growth, and improving profitability, BoB represents a compelling growth-in-value banking opportunity.

But does Bank of Baroda offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BANKBARODA |

| Industry/Sector | Financial Services (Banking) |

| CMP | 284.15 |

| Market Cap (₹ Cr.) | 1,46,944 |

| P/E | 7.58 (Vs Industry P/E of 14.26) |

| 52 W High/Low | 294.95 / 190.70 |

| EPS (TTM) | 37.50 |

| Dividend Yield | 2.94% |

About Bank of Baroda

Founded in 1908 and headquartered in Vadodara, Bank of Baroda is the third-largest public sector bank in India. With an extensive branch network across India and a strong international presence in more than 15 countries, the bank serves retail, MSME, corporate, and institutional clients. The bank is known for its strong overseas book, digital innovation through bob World, and a balanced loan portfolio.

The merger with Vijaya Bank and Dena Bank has strengthened scale, operational efficiency, and distribution capabilities.

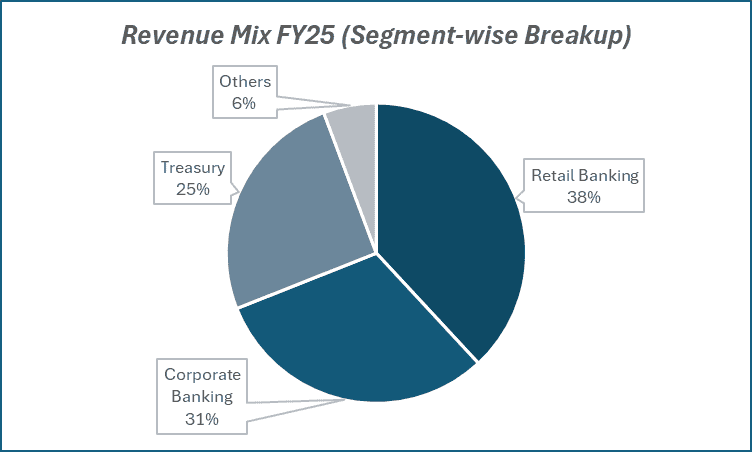

Key business segments

Bank of Baroda operates primarily in the following key business segments:

- Retail Banking: Housing loans, auto loans, gold loans, personal loans, credit cards, and small business lending, driving granular growth and improved risk-adjusted returns.

- Corporate & Institutional Banking: Working capital, term loans, treasury services, trade finance, and forex solutions for large corporates, PSUs, and government entities.

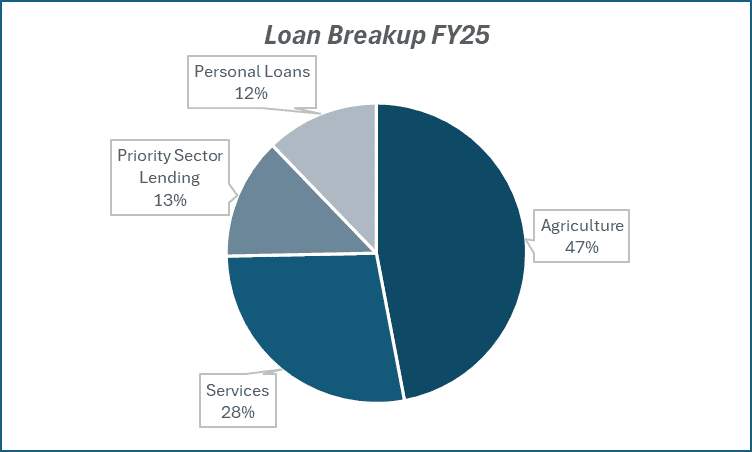

- MSME & Agriculture: Financing to small and medium enterprises, agribusiness loans, Kisan credit programs, and rural financial inclusion products.

- International Banking: Overseas branches contributing meaningful fee income and treasury operations, supporting diversified growth.

Primary growth factors for Bank of Baroda

Bank of Baroda key growth drivers:

- Strong retail & MSME momentum supported by digital penetration and economic expansion.

- Improving asset quality leading to lower provisioning requirements and healthier profitability.

- Digital transformation via bob World driving customer acquisition and operating efficiency.

- Government’s infrastructure and capex cycle boosting corporate credit growth.

- Focus on high-yield segments enhances NIM and fee income sustainability.

Detailed competition analysis for Bank of Baroda

Key financial metrics – TTM;

| Company | NII(₹ Cr.) | PAT(₹ Cr.) | PAT Margin (%) | Gross NPA (%) | Net NPA (%) | P/B (TTM) |

| Bank of Baroda Ltd. | 50185.07 | 18846.00 | 12.20% | 2.16% | 0.57% | 0.92 |

| IndusInd Bank Ltd. | 17325.61 | -759.46 | -1.40% | 3.60% | 1.04% | 0.95 |

| RBL Bank Ltd. | 6181.56 | 540.99 | 3.00% | 2.32% | 0.57% | 1.24 |

| Federal Bank Ltd. | 10744.46 | 4023.21 | 12.20% | 1.83% | 0.48% | 1.60 |

| Karur Vysya Bank Ltd. | 4508.58 | 2104.80 | 17.09% | 0.76% | 0.19% | 2.00 |

Key insights on Bank of Baroda

- Balanced credit growth across retail, MSME, and corporate segments with better yield profile.

- GNPA and NNPA consistently trending lower due to disciplined underwriting and recoveries.

- Rising fee income from cards, cross-selling, and trade finance improving non-interest contribution.

- Operating leverage improving due to digital efficiencies and cost control.

- Strong domestic CASA franchise providing funding stability and lower cost of capital.

Recent financial performance of Bank of Baroda for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| NII (₹ Cr.) | 12636.04 | 12559.77 | 13126.89 | 4.52% | 3.88% |

| PAT (₹ Cr.) | 5455.04 | 3351.88 | 5070.30 | 51.27% | -7.05% |

| PAT Margin (%) | 13.83% | 8.73% | 13.19% | 446 bps | -64 bps |

| Gross NPA (%) | 2.50% | 2.28% | 2.16% | -12 bps | -34 bps |

| Net NPA (%) | 0.60% | 0.60% | 0.57% | -3 bps | -3 bps |

| Adjusted EPS (₹) | 10.34 | 6.70 | 9.91 | 47.91% | -4.16% |

Bank of Baroda financial update (Q2 FY26)

Financial performance

- Net profit ₹5070 crore, +51% QoQ, despite ₹400 crore floating provision for ECL transition.

- Operating profit ₹7,576 crore (normalized), supported by treasury improvement and controlled costs.

- NIM improved 5 bps QoQ to 2.96%; cost of deposits declined to 4.91%, enabling positive NII growth (+2.7% QoQ).

- CASA at 38.4% remains among the best in the system; deposit growth 9.3% YoY.

- Management reiterated full-year guidance: advances 11–13%, retail 18–20%, corporate 10–11%; maintains 2.85–3% NIM guidance for FY26.

Asset quality

- Gross NPA 2.16% (improved 34 bps YoY); Net NPA 0.57%.

- Slippage ratio 0.91%, credit cost 0.29%, best performance in recent quarters.

- Fresh slippages ₹2,669 crore, lower vs prior quarters; cash recovery & upgrades improved.

- SMA 1 & 2 at 0.39%, collection efficiency 98.6% (ex-agri).

- ₹1,000 crore floating provision created ahead of ECL FY27 transition; no watchlist stress identified.

Business highlights

- RAM share 62% (+300 bps YoY); growth led by Retail +17.6%, Agri +17.4%, MSME +13.9%.

- Gold loan portfolio strong (agri +35–40%, retail +20–25%) with NPA <0.1%.

- Corporate loan growth muted at 3% YoY, but +8% QoQ with ₹40,000 crore sanction pipeline for Q3–Q4.

- Auto +17.7%, Home +16.5%, Personal +18.6%, Mortgage +19.8%; festive disbursements supportive.

- CD ratio 85.26%, comfortable within target range.

Outlook

- Q3–Q4 expected to be stronger, driven by corporate pickup and festive demand.

- Margin stability in Q3; improvement expected in Q4.

- Medium-term focus with higher RAM mix target 65%, liability optimization, treasury upside.

- In the long-term, ROA >1%, ROE >15%, strong capital buffer (CRAR 16.54%) with no near-term capital raise needed.

- Management cautiously optimistic, balancing growth execution with macro/geopolitical risks.

Recent Updates on Bank of Baroda

- Expansion in retail digital lending and rollout of high-penetration bob World platform features.

- Partnership expansions across co-lending, insurance distribution, and wealth tech.

- Increased focus on overseas expansion targeting trade corridors in UAE and UK.

- Strengthened ESG commitments including green financing initiatives and sustainable lending framework.

Company valuation insights – Bank of Baroda

Bank of Baroda is currently trading at a TTM P/B of 0.92x, delivering a 15% return over the past year, outperforming the Nifty 50’s 7.6% over the same period.

The investment argument is supported by the bank’s strong retail-led growth trajectory, high-quality liability franchise (CASA 38.4%), and continued improvement in asset quality, with Gross/Net NPA at 2.16% / 0.57% and credit cost at 0.29%, one of the strongest in the PSU banking space.

BoB’s strategic pivot toward RAM segments, expansion of the digital ecosystem, and strengthening of co-lending partnerships and international operations underpin visibility in earnings sustainability and business growth.

The bank’s robust capital position (CRAR 16.54%) provides ample headroom to support growth without near-term dilution risk. Despite muted treasury performance and near-term pressure from higher operating costs, core profitability remains resilient, supported by disciplined liability management, rising retail momentum, and improving operating efficiency.

Applying a 1.0x FY27E BV multiple, we derive a 12-month target price of ₹350 (~24% upside) and a 3-month target of ₹300 (~6% upside) from current levels.

Overall, the risk-reward remains attractive, supported by improving margin trajectory, strong recovery performance, and a clear pathway to delivering ROE of 15%+ and ROA above 1%, positioning Bank of Baroda as one of the most compelling value plays within the large-cap PSU banking space.

Major risk factors affecting Bank of Baroda

- Asset quality pressure from MSME and unsecured retail segments in a macro slowdown.

- PSU sector competitive pricing limiting rapid margin expansion.

- Global economic uncertainties impacting international book performance.

- Execution risk around digital transformation and merger integration efficiencies.

Technical analysis of Bank of Baroda share

Bank of Baroda is trading in a well-established uptrend, having recently crossed its 52-week high, indicating renewed buying momentum and strong potential for continued upside. The stock is positioned comfortably above its 50-day, 100-day, and 200-day EMAs, reaffirming the strength of its long-term bullish market structure.

Momentum indicators continue to support the positive setup. MACD is firmly positive at 6.87, with the MACD line trending above the signal line, confirming sustained upward momentum. RSI at 55.82 reflects healthy buying interest and ample room for further upside, while relative RSI values of 0.04 (21-day) and 0.13 (55-day) underscore consistent outperformance versus benchmark indices. ADX at 31.88 signals a strong underlying trend, adding conviction to the ongoing breakout structure.

A decisive breakout above ₹300 could open the path for an upside move toward ₹350, which aligns with the 12-month fundamental target. On the downside, ₹268 acts as a key support zone, and holding above this level will be critical to maintain a bullish bias.

- RSI: 55.82 (Strong Buying Interest)

- ADX: 31.88 (Strong Trend)

- MACD: 6.87 (Positive Momentum)

- Resistance: ₹300

- Support: ₹268

Bank of Baroda stock recommendation

Current Stance: BUY, with a 3-month target of ₹300 (~6% upside) and a 12-month target of ₹350 (~24% upside) based on 1.0x FY27E BVPS.

Why buy now?

Retail-Led Growth: RAM share at 62% with ~18% retail loan growth, supporting sustained credit momentum.

Margin Stabilization: NIM improved to 2.96%, aided by disciplined deposit pricing and lower cost of funds.

Superior Asset Quality: GNPA at 2.16% / NNPA at 0.57% with credit cost at 0.29%, reflecting strong underwriting controls.

Capital Strength: CRAR at 16.54% ensures comfortable growth headroom with no near-term capital-raising needs.

Improving Earnings Visibility: Recoveries, treasury normalization and festive loan momentum support profitability trajectory.

Portfolio fit

Bank of Baroda offers a compelling large-cap PSU banking exposure with a favorable risk-reward profile, driven by improving asset quality, stable margins and strong retail-led growth. The bank’s robust capital base, strong liability franchise (CASA 38%+), and disciplined credit strategy position it well for sustainable RoA (1%+) and RoE (15%+) delivery.

Given its valuation comfort, operating stability and recovery-driven earnings resilience, BoB stands as an attractive value play within the PSU banking space for medium-term compounding.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBank of Baroda: Budget 2025-26 opportunities

- RAM Credit Tailwind: Budget push toward MSME & agri lending aligns with BoB’s strategy to accelerate RAM share beyond 62%.

- Infra & Capex Cycle Boost: Higher infrastructure spending supports corporate loan revival and project financing growth.

- Digital Scale Advantage: Digital infrastructure incentives strengthen BoB’s phygital expansion and fintech co-lending partnerships.

- Risk Protection: Extended credit guarantee schemes enhance MSME growth visibility and protect asset quality.

- Global & Trade Leverage: Export and trade support initiatives enable BoB to utilize its strong international network for cross-border lending growth.

Final thoughts

Can Bank of Baroda sustain its improved profitability and continue bridging the valuation gap versus private banks?

With balance sheet strengthening, disciplined growth, and accelerating digital presence, the bank is on a promising trajectory. Yet, sustained returns depend on asset quality consistency and fee-income scaling. Investors will now watch whether BoB can convert operational momentum into durable valuation rerating.