In an era where mutual funds have become the default choice for retail investments, one company quietly powers the backbone of the industry – CAMS (Computer Age Management Services Ltd.).

While it may not be a household name like the AMCs it serves, CAMS plays a critical, high-moat role that makes it a hidden gem in India’s fintech and financial infrastructure story.

Let’s dive deep into what makes this company worth watching – and possibly investing in.

Stock overview

| Ticker | CAMS |

| Industry/Sector | Financial Services (Depository) |

| Market Cap (₹ Cr.) | 17,597 |

| Free Float (% of Market Cap) | 96.72% |

| 52 W High/Low | 5,367.50 / 3,030.05 |

| P/E | 40.84 (Vs Industry P/E of 60.73) |

| EPS (TTM) | 89.22 |

About Computer Age Management Services

CAMS is India’s largest registrar and transfer agent (RTA) for mutual funds, handling over 70% of the industry’s assets under management (AUM). It acts as a crucial link between asset management companies (AMCs), distributors, and investors, providing end-to-end back-office and data-driven technology solutions.

Incorporated in 1988 and backed by marquee investors like NSE and Great Terrain, CAMS has grown into a platform trusted by most leading mutual fund houses in India.

Key business segments

Computer Age Management Services operates in the following segments:

- Mutual Fund Services: Core offering; includes transaction processing, KYC, record keeping, and call centre support for AMCs.

- Insurance Repository Services: CAMSRep facilitates digital insurance policies and storage through its IRDAI-licensed insurance repository.

- AIF & PMS Services: Servicing alternate investment funds and portfolio management schemes – a growing niche with affluent investors.

- KRA & Account Aggregator: Registered KYC Registration Agency and a licensed account aggregator, boosting data infrastructure relevance.

- Digital Tech & Payment Solutions: Offers fintech and regtech solutions, including onboarding and e-mandate services, deepening its ecosystem.

Primary growth factors for Computer Age Management Services

Computer Age Management Services key growth drivers:

- Mutual Fund Penetration: Rising SIP inflows and investor base in Tier 2/3 cities fuel recurring revenues.

- Platform Stickiness: High switching costs and integration complexity make CAMS’ clients highly sticky.

- Diversification: Expansion into non-MF businesses like AIFs, insurance, and account aggregation.

- Regulatory Tailwinds: Push for digitisation (e.g., e-KYC, RTA rationalisation) increases reliance on tech platforms.

- Operational Leverage: Fixed-cost nature means margin expansion as volumes scale.

Detailed competition analysis for Computer Age Management Services

Key financial metrics – FY 25;

| Company | Revenue(₹ Cr.) | EBITDA(₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E TTM |

| CAMS | 1422.48 | 652.22 | 45.85% | 464.70 | 32.67% | 40.84 |

| KFin Technologies Ltd. | 1090.75 | 479.00 | 43.91% | 332.63 | 30.50% | 55.11 |

| CDSL | 1082.21 | 624.27 | 57.69% | 523.69 | 48.39% | 49.21 |

Key insights on Computer Age Management Services

- Revenue CAGR of 15% over the past 5 years, driven by the steady growth of the Indian mutual fund industry and CAMS’ dominant market position.

- EBITDA margins consistently between 44% to 46%, reflecting strong operational efficiency and a scalable business model.

- Profit CAGR of 23% over the past 5 years, showcasing robust earnings compounding and disciplined cost control.

- Debt-free balance sheet, highlighting financial prudence and enabling flexibility for future growth opportunities.

- Strong return metrics with a 3-year average ROE of 42.4%, underscoring the company’s capital-efficient operations.

- Healthy dividend payout ratio of 72.1%, indicating a shareholder-friendly approach and consistent cash generation.

Recent financial performance of CAMS for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 310.46 | 369.74 | 356.17 | -3.67% | 14.72% |

| EBITDA (₹ Cr.) | 143.34 | 172.83 | 159.38 | -7.78% | 11.19% |

| EBITDA Margin (%) | 46.17% | 46.74% | 44.75% | -199 bps | -142 bps |

| PAT (₹. Cr.) | 102.98 | 124.11 | 112.80 | -9.11% | 9.54% |

| PAT Margin (%) | 33.17% | 33.57% | 31.67% | -190 bps | -150 bps |

| Adjusted EPS (₹) | 21.06 | 25.42 | 23.07 | -9.24% | 9.54% |

Computer Age Management Services financial update (Q4 FY25)

Financial performance

- Revenue saw strong annual growth across all streams, though Q4 FY25 witnessed a sequential decline owing to yield contraction in the mutual fund segment.

- Asset-based revenue grew 25.6% YoY, aligned with rising AUM, but dipped 5.4% QoQ.

- Non-MF revenue rose 24.7% YoY, backed by robust traction in AIF, payments, and KRA businesses, contributing 13% to overall revenue.

Business highlights

- The non-mutual fund segment continues to gain scale, supporting diversification goals and reducing dependency on mutual fund yields.

- EBITDA margin for the non-MF segment remained in the 10%–15% range, reflecting early-stage investments and scalability potential.

- CAMS remains focused on leveraging its position as a financial infrastructure platform to build revenue resilience and multi-segment leadership.

Outlook

- Management expects 24–25% YoY growth in non-MF revenue in FY26, with a guided EBITDA margin of ~20% for this segment.

- Anticipated yield contraction of 6%–7% in FY26, and 4%–4.5% YoY in Q4 FY26, pointing to headwinds in the MF segment.

- EBITDA margins for Q1 FY26 expected to soften to ~42.5%–43%, owing to annual salary hikes.

- Capex guidance of ₹170 crore for FY26, marking an aggressive investment phase to scale platform capabilities and strengthen tech infrastructure.

Company valuation insights -CAMS

CAMS trades at a TTM P/E of 40.84, below the industry average of 60.73, yet commands a premium to listed AMCs – justified by its duopoly positioning, high entry barriers, and strong customer ownership. The stock has delivered a 12.11% return over the past year, outperforming the Nifty 50’s 9.43%.

While Q4 FY25 saw some weakness due to muted market sentiment, SIP flows remain robust, and a market recovery could revive momentum. The non-mutual fund business continues to scale well, providing diversification and stability beyond the core MF segment.

At 36x FY27E EPS of ₹115, we assign a 12-month target price of ₹4,140, implying a 19% upside. For the near term, we estimate a 3-month target of ₹3,800, offering a 9% upside from current levels.

Major risk factors affecting Computer Age Management Services

- Concentration Risk: Heavy dependence on mutual fund services and the top 5 AMCs.

- Regulatory Risk: Any disruption or disintermediation by SEBI or tech shifts may impact core operations.

- Competitive Threats: Emergence of new-age fintechs or RTA consolidation can affect market share.

- Market Cyclicality: A prolonged bear phase in equities may reduce volumes and investor activity.

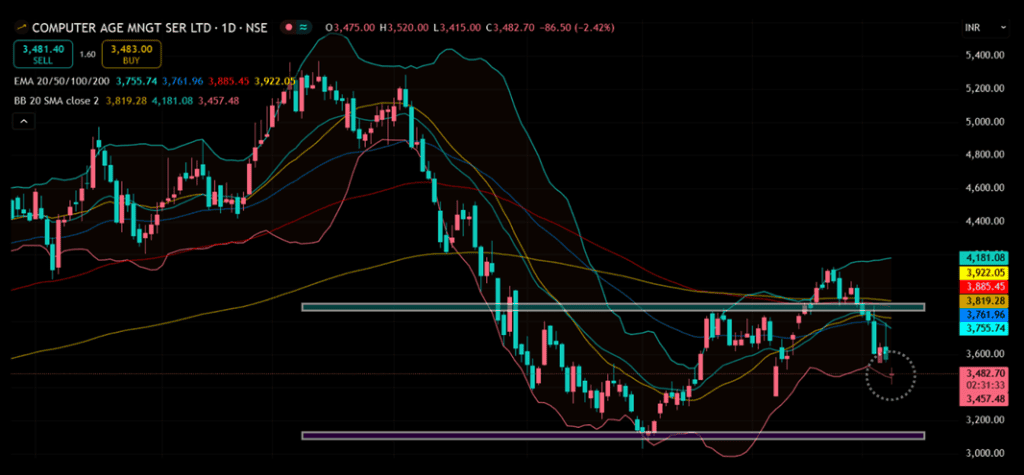

Technical analysis of Computer Age Management Services

CAMS is forming a potential head and shoulders pattern and is currently trading near the neckline, suggesting a possible entry if the price rebounds from current levels. The stock remains below all key EMAs, indicating that a sustained uptrend has yet to emerge.

MACD is positive at 3.44 but trades below the signal line with building negative histograms, signalling cautious sentiment. RSI at 39.57 reflects neutral momentum, while Relative RSI is negative over 21 days (-0.11) and neutral over 55 days (0), suggesting slight underperformance. ADX at 16.18 indicates a range-bound setup, with no clear trend dominance. The price is near the lower Bollinger Band, hinting at a potential reversal if it holds.

A sustained move above ₹3800 could trigger upside towards ₹4120, while ₹3120 remains a strong support.

- RSI: 39.57 (Neutral)

- ADX: 16.18 (Range Bound)

- MACD: 3.44 (Positive)

- Resistance: ₹3800

- Support: ₹3120

CAMS stock recommendation

Current Stance: Buy with a target price of ₹3,800 over a 3-month horizon and ₹4,140 over a 12-month horizon.

CAMS' strong positioning in the mutual fund ecosystem, duopoly market structure, and expanding non-MF verticals make it a high-quality compounder aligned with India’s financialization theme.

Why buy now?

Resilient business model: Despite near-term yield pressure in the MF segment, CAMS delivered healthy growth in FY25.

Diversified revenue base: Non-MF business grew 24.7% YoY in FY25, with robust traction in AIF, KRA, payments, and digital services.

Structural tailwinds: Sustained SIP inflows and deeper retail participation in financial markets provide long-term growth visibility.

Portfolio fit

CAMS offers high-quality exposure to India’s long-term financialization trend and digitisation of capital markets. Its asset-light model, strong operating leverage, and expanding presence in adjacencies make it ideal for portfolios seeking durable, high-ROE compounding stories in financial infrastructure.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebComputer Age Management Services: Budget 2025-26 opportunities

- Capital Market Boost: Policies to deepen retail participation can expand the mutual fund investor base.

- Digital Push: Investment in digital infrastructure to support CAMS’ platform scalability.

- Tax Incentives: Potential tax breaks on SIPs or long-term MF investments may drive inflows.

- AIF Growth: Budget support for alternative investments can accelerate non-MF revenue growth.

- KYC Simplification: Digitization and ease of compliance to enhance onboarding and efficiency.

Final thoughts

Imagine CAMS as the digital highway that mutual funds ride on to reach every Indian investor. Whether you’re starting a SIP, switching funds, or checking your KYC status, CAMS is working silently in the background.

As India’s wealth grows and financial products deepen their penetration, CAMS stands to benefit without directly taking market risk. It’s a classic picks-and-shovels play on India’s asset management boom – low-risk, high-moat, and with significant compounding potential.