Stock overview

| Ticker | CDSL |

| Sector | Financial Services – Capital Market Infrastructure |

| Market Cap | ₹ 27,700 Cr |

| CMP (Current Market Price) | ₹ 1,234 |

| 52-Week High/Low | ₹ 1,990 / 918 |

| P/E Ratio | 53x |

| Beta | 1.15 (Moderate volatility) |

About CDSL

CDSL is one of India’s two central securities depositories, providing electronic storage and settlement services for securities. Established in 1999 and promoted by BSE Ltd., it has played a pivotal role in India’s shift to a paperless securities market.

As of March 31, 2025, CDSL has registered over 15.29 crore demat accounts, marking a significant milestone in its operational history. CDSL stands as a cornerstone in India’s financial infrastructure, facilitating secure and efficient securities transactions with a vast and growing user base.

Primary growth factors for CDSL

1. Demat account expansion: The surge in retail investor participation has led to a record number of demat accounts, with over 3.73 crore new accounts opened in FY25.

2. Digital initiatives: CDSL’s focus on digital services, including e-voting and e-KYC, has streamlined processes and attracted a broader user base.

3. Regulatory support: Favourable regulations mandating dematerialisation have bolstered CDSL’s service demand. CDSL’s growth is propelled by increased retail participation, digital innovation, and supportive regulatory frameworks.

Q4 FY25 Financial Performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Operating Income | ₹ 182 cr | -2% | -18% |

| EBITDA | ₹ 114 cr | -14% | -22% |

| Net Profit | ₹ 81 cr | -16% | -23% |

| PAT Margin | 45% | -7% pts | -3% pts |

- CDSL has delivered de-growth on a YoY level, which is compounded at a QoQ level.

- This is largely because of a decline in the retail participation in Q4 when markets were seeing a correction.

- One concerning note for CDSL is that their overall PAT margin has seen a hit on a YoY level as well, due to rising costs.

Detailed competition analysis for CDSL

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| CDSL | ₹ 27,700 cr | ₹ 182 cr | 52 x | 42% |

| BSE | ₹ 85,300 cr | ₹ 830 cr | 91 x | 20% |

| MCX | ₹ 31,900 cr | ₹ 300 cr | 62 x- | 7% |

| KFin Tech | ₹ 19,400 cr | ₹ 282 cr | 58 x | 34% |

- Besides the above, CDSL faces competition from NSDL as well. NSDL is the other depository which is expected to make its public listing in the capital markets soon.

- CDSL leads in retail demat accounts, while NSDL maintains a stronghold in institutional services, highlighting distinct market focuses.

Company valuation insights: CDSL

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of CDSL shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹1450 per share

- Upside Potential: 17%

- WACC: 8.8%

- Terminal Growth Rate: 3.1%

Valuations are reasonable given that a large part of the Indian market is still underpenetrated.

Major risk factors affecting CDSL

- Market volatility: Fluctuations in market activity can impact transaction volumes and revenues.

- Technological disruptions: Cybersecurity threats and system downtimes pose operational risks.

- Regulatory changes: Alterations in financial regulations could affect business operations and revenue streams.

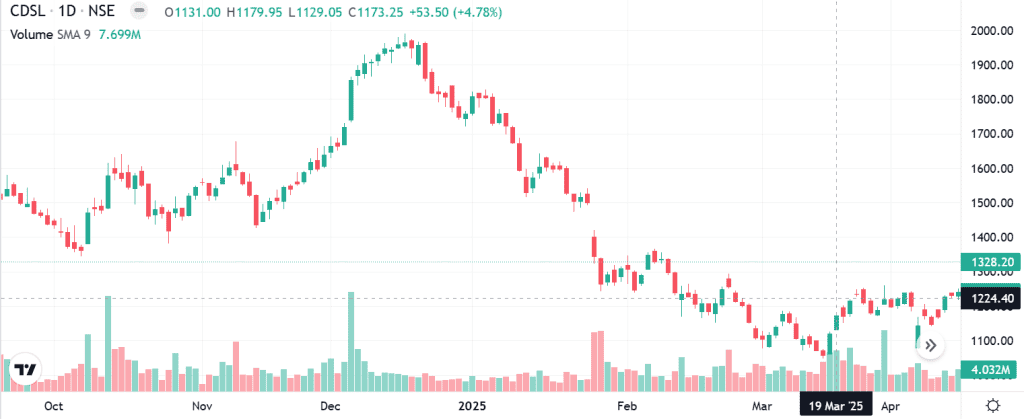

Technical analysis of CDSL

- Resistance: ₹1,380

- Support: ₹1,250

- Momentum: Neutral

- RSI (Relative Strength Index): 48 (Neutral)

- 50-Day Moving Average: ₹1,320

- 200-Day Moving Average: ₹1290

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹1380.

CDSL stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹1450 (12-month horizon); ₹1325 (6-month horizon);

Investment Horizon: 2–4 years for compounded returns

Rationale

Recommend a Buy on Dips / Accumulate approach for CDSL based on:

Market leadership in the retail segment.

Strong financials with decent margins.

Regulatory tailwinds and market expansion

Recurring revenue model

Reasonable valuationIf you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

CDSL’s pivotal role in India’s financial infrastructure, coupled with its strong financial performance and growth trajectory, positions it as a key player in the capital markets. Investors seeking exposure to the financial services sector may consider CDSL for its stability and growth potential.