Beta value in stocks is an integral part of the Capital Asset Pricing Model (CAPM), to calculate an asset’s expected returns.

It also considers the risk-free rate and the equity risk premium to calculate the expected rate of return. Essentially, beta in portfolio management is a measure of risk that’s considered when calculating the rate of return for a diversified portfolio.

What is the meaning of beta in the stock market?

Beta is used to gauge the level of volatility in the returns of investment security compared to the overall market. Beta is employed as a means to assess risk and holds a central role in the Capital Asset Pricing Model (CAPM).

The beta coefficient can be deciphered as follows:

- Beta = 1 signifies that the investment is as volatile as the market itself.

- Beta > 1 denotes that the investment is more volatile than the market.

- Beta < 1 suggests that the investment is less volatile than the market.

- Beta = 0 implies that the investment is uncorrelated with the market.

High Beta: A company with a beta exceeding 1 is much more volatile than the market. For instance, a high-risk technology firm with a beta of 1.75 would have yielded returns 175% higher than the market provided during a given period.

Low Beta: Conversely, a company with a beta lower than 1 exhibits lower volatility than the entire market. For instance, an electric utility company with a beta of 0.45 would have delivered returns equal to only 45% of the market’s returns in a given period.

Negative Beta: A company with a negative beta correlates negatively with the market’s returns. For instance, a gold company with a beta of -0.2 would have experienced a 2% decline when the market was up by 10%.

You may also like: How to compare stocks? Explore the various tools available.

How to calculate the beta of a stock?

To determine a stock’s beta, divide the covariance of the stock’s returns and the benchmark’s returns by the variance of the benchmark’s returns.

The formula for computing a stock’s beta is as follows:

Stock beta formula = COVARIANCE(Rs, Rm) / VARIANCE(Rm)

“Rs” represents the returns of the stock.

“Rm” corresponds to the returns of the entire market or the benchmark being used for comparison.

“COVARIANCE(Rs, Rm)” is the covariance between the stock returns and the market returns.

“VARIANCE(Rm)” represents the variance of the market’s returns.

Comparing high beta and low beta values: the better choice?

High-beta stocks are often considered riskier but offer higher returns. On the other side, low-beta stocks are less risky. They typically yield lower potential returns. You have to choose between high beta and low beta depending upon your investment goals.

For more conservative investors or those with near-term financial goals, low-beta stocks are typically the favoured choice. These stocks tend to exhibit minimal fluctuations in value over time. They belong to companies known for delivering consistent revenues and profits, whether the economic climate is prosperous or challenging.

In contrast, investors aiming for substantial capital gains or day traders seeking rapid profits from volatile stock prices often gravitate towards high-beta stocks. These companies historically experience considerable price swings. This category includes dynamic companies, such as tech startups looking to revolutionise industries, where investing could lead to significant gains or substantial losses.

It’s worth noting that higher beta stocks tend to outperform during bull markets marked by economic expansion and high confidence levels, while lower beta stocks tend to fare better in recessions, aligning with their stability and lower risk profile.

Also Read: Interest rate risk – Meaning and risk management strategies.

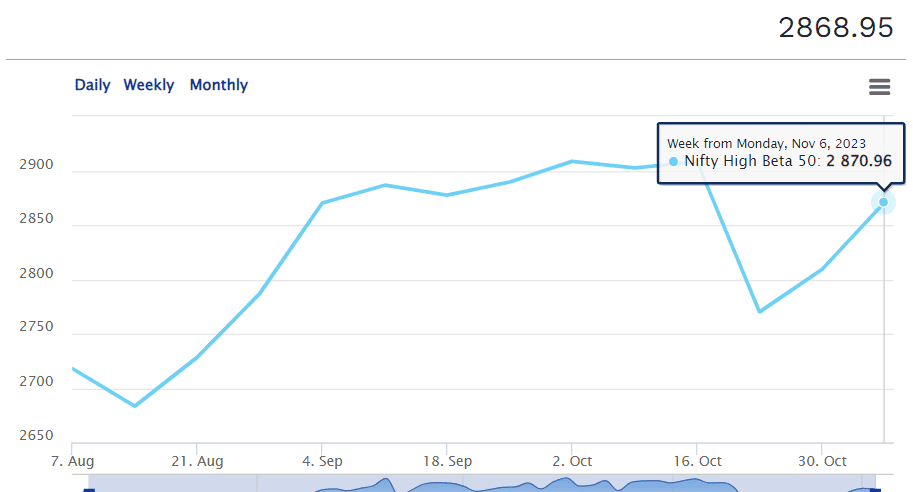

NIFTY high beta 50

It is a stock market index that shows the performance of the top 50 high-beta stocks, for the last 1 year.

Pros and cons of beta values in stock markets

Benefits:

- Beta is a crucial coefficient that aids investors in evaluating securities before making investment decisions.

- It facilitates the assessment of market-related risk associated with a company’s stock, revealing the level of correlation between these factors.

- Investors seeking substantial gains can explore stocks with a beta value exceeding one.

- Those investors looking for a stable return and a consistent cash flow through dividends can opt for stocks with a beta value of one or less.

Disadvantages:

- Beta is based on past data and doesn’t guarantee future results. Market fluctuations can cause the beta value to change, affecting a stock’s volatility.

- Beta primarily measures systematic risk, related to the market. Unsystematic risks, such as high company debt or legal issues, can impact stock price movements even when the overall market rises.

- Investing in high-beta stocks can expose a portfolio to higher risks, potentially trapping investors if other internal factors are not thoroughly analysed.

Also read: What is alpha and beta in the stock market?

Is Beta a Helpful Measure for Long-Term Investments?

Beta is a widely used measure in the stock market that quantifies the volatility of a stock in relation to the overall market. It indicates how sensitive a stock is to market movements—whether the stock moves more or less than the broader market. For long-term investors, understanding beta can be crucial, but its relevance and usefulness vary depending on the investment strategy. Here’s an in-depth look at whether beta is helpful for long-term investments.

Understanding Beta

Beta is a measure of a stock’s risk in comparison to the market. A beta of 1 means the stock’s price moves in line with the market, a beta less than 1 indicates less volatility than the market, and a beta greater than 1 means the stock is more volatile than the market.

Is Beta Useful for Long-Term Investments?

- Helps with Risk Assessment: For long-term investors, beta can provide insight into how a stock may behave relative to market swings. Stocks with higher beta are more volatile, meaning they could offer higher returns but with greater risk. On the other hand, stocks with lower beta might offer stability, making them attractive for risk-averse investors.

- Not Always a Good Predictor of Long-Term Performance: While beta helps assess a stock’s volatility, it does not predict the long-term growth potential or the intrinsic value of the company. A stock with a low beta might seem like a safer bet, but it could underperform in terms of growth compared to a more volatile stock with a higher beta.

- Relevance in Diversification: Beta is useful when constructing a diversified portfolio. For long-term investors aiming for diversification, including stocks with varying betas can help balance risk. A well-diversified portfolio, with a mix of high and low-beta stocks, can cushion the overall volatility while still aiming for growth.

- Limitations in Predicting Long-Term Returns: Beta is calculated based on historical data and past market movements, which may not always accurately reflect future stock behavior. In the long run, a stock’s performance is influenced by many factors such as company fundamentals, industry dynamics, and market conditions, which beta does not account for.

- Focus on Fundamentals for Long-Term Growth: Long-term investors typically focus more on fundamental analysis—assessing a company’s growth potential, earnings, management, and other intrinsic factors. While beta may offer insights into the stock’s volatility, it shouldn’t be the primary metric for making long-term investment decisions.

Conclusion

Many experts concur that while beta offers some insights into risk, it falls short as a standalone risk assessment tool. Beta focuses solely on a stock’s historical performance concerning the Nifty 50. Beta lacks any predictive value. It overlooks a company’s fundamentals, such as earnings and growth potential.

The beta value of stocks plays a crucial role that investors should consider before venturing into any stock market investment. While it doesn’t provide a comprehensive assessment, beta aids investors in evaluating the market risk linked to a particular investment instrument and its potential impact on the resulting returns.

FAQs

1. What is a good beta for a stock?

A beta around 1 is generally considered ideal for most investors, as it indicates that the stock moves in line with the broader market. For conservative investors, a beta below 1 (e.g., 0.5) might be preferable as it indicates lower volatility, while more aggressive investors may look for stocks with a beta above 1 for higher potential returns but at greater risk.

2. What does a 1.5 beta mean?

A beta of 1.5 means that the stock is 50% more volatile than the market. If the market goes up or down by 10%, the stock is likely to move by 15% in the same direction. This suggests the stock carries higher risk but also higher reward potential.

3. Is a 1.3 beta good?

A beta of 1.3 indicates that the stock is 30% more volatile than the market. It is suitable for investors who are willing to take on slightly more risk in exchange for the potential for higher returns, but it may not be ideal for conservative investors who prefer stability.

4. Is high beta good or bad?

A high beta (above 1) means higher volatility. While this can lead to higher returns in a rising market, it also increases the potential for significant losses in a downturn. Whether it’s good or bad depends on the investor’s risk tolerance and market outlook. High beta is more suited for risk-tolerant, aggressive investors.

5. Is 0.5 a good beta?

A beta of 0.5 indicates that the stock is less volatile than the market, moving only half as much as the market’s changes. This is considered a low-risk stock, making it attractive for conservative investors seeking stability and less exposure to market fluctuations.

6. Which stock has the highest beta?

Stocks in highly volatile sectors like technology, biotech, or startups tend to have the highest betas. For example, stocks of companies like Tesla or Netflix have exhibited higher betas due to their larger price swings compared to the overall market. However, the stock with the highest beta can change over time, depending on market conditions and industry trends.