Stock overview

| Ticker | COALINDIA |

| Sector | Mining/Energy |

| Market Cap | ₹ 1,72,100 Cr |

| CMP (Current Market Price) | ₹ 399 |

| 52-Week High/Low | ₹ 545/349 |

| Beta | 1.02 (Low volatility) |

About Coal India India Ltd.

Coal India Limited (CIL), a Maharatna PSU under the Ministry of Coal, is the largest coal producer in the world and contributes over 80% of India’s domestic coal output. It operates through 8 subsidiaries across 84 mining areas and plays a critical role in meeting India’s energy demand, particularly for thermal power generation.

Primary growth factors for Coal India India Ltd

1. Dominant Industry Position

- Commands 80%+ market share in India’s coal production.

- Backed by strong government support and policy alignment with energy security goals.

- Strategic in ensuring fuel availability to India’s power and industrial sectors.

2. Strong Financial Profile

- Low leverage and strong free cash flows.

- One of India’s most consistent dividend payers amidst strong financial performance

3. Rising Coal Demand

- Domestic coal demand expected to grow due to:

- Surge in thermal power plant capacity.

- Government’s push for import substitution.

- Expanding industrial and infrastructure projects.

4. Improving Operational Efficiency

- Mechanisation of mines and digitisation of operations.

- Higher Over Burden Removal (OBR) and improved rake availability.

- Focus on environmental sustainability and land acquisition efficiency.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | FY 2024-25 | YoY Growth |

| Revenue from operations | ₹ 37,825 cr | -1% | ₹ 1,43,369 cr | -1% |

| Net Sales | ₹ 34,156 cr | -0.3% | ₹ 1,26,957 cr | -3% |

| EBITDA | ₹ 13,291 cr | 4% | ₹ 51,640 cr | -0.3% |

| PAT | ₹ 9,593 cr | 12% | ₹ 9,593 cr | -6% |

Coal India has delivered good results in Q4 FY 25. While profitability has risen by 12% on a YoY basis, the revenue growth has largely been flat.

At a FY level, Coal India has registered de-growth in revenue and profitability which is something that the investors should look out, going forward.

Detailed competition analysis for Coal India India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Coal India | ₹ 2,45,800 cr | ₹ 37,825 cr | 7 x | 48% |

| Adani Enterprises | ₹ 2,92,500 cr | ₹ 26,965 cr | 66 x | 9% |

| Sandur Manganese | ₹ 7,524 cr | ₹ 1,321 cr | 16 x | 22% |

| Foundry Fuel | ₹ 5 cr | ₹ 0 cr | NA | NA |

Coal India is fairly valued at the moment compared to its peers. Coal India remains the single largest player in the mining sector and enjoys high investor confidence and government backing. Coal India remains an attractive bet for all investors who are looking for stock price gains and earn a good dividend yield along with it.

Company valuation insights: Coal India India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Coal India shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹460 per share

- Upside Potential: 15%

- WACC: 10.5%

- Terminal Growth Rate: 3.4%

Major risk factors affecting Coal India India

- Regulatory and Policy Risks: Pricing caps, royalty changes, environmental restrictions.

- Transition to Renewables: Long-term decline in coal usage globally due to clean energy push.

- Labour and Land Acquisition Issues: May impact project execution timelines.

- Monsoon Dependency: Seasonal impact on mining activity and dispatches.

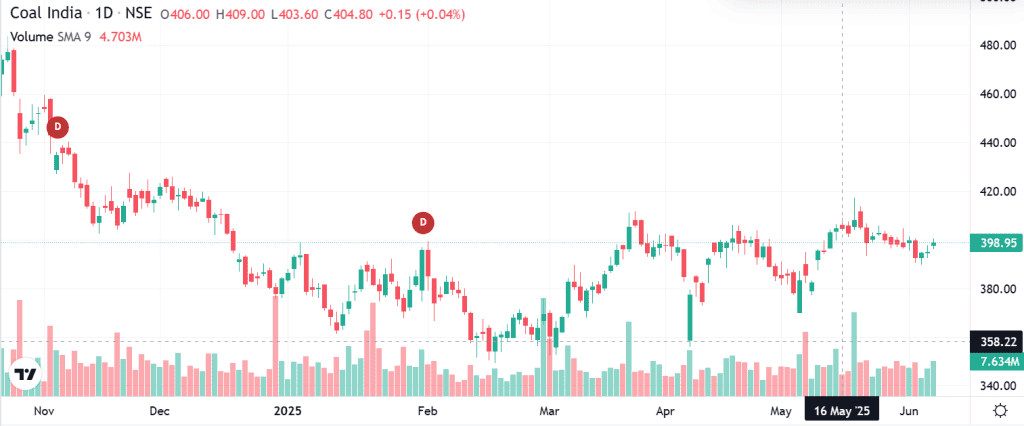

Technical analysis of Coal India India

- Resistance: ₹410

- Support: ₹ 380

- Momentum: Neutral

- RSI (Relative Strength Index): 42 (Neutral)

- 50-Day Moving Average: ₹380

- 200-Day Moving Average: ₹350

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹262

Coal India India stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹420 (6-month horizon); ₹460 (12-month horizon);

Investment Horizon: 2–4 years for stable returns

Rationale

Recommend a Buy on Dips / Accumulate approach for Coal India.

Recommendation

Accumulate / Buy on Dips

Market leadership, low valuation, high dividend yield.

Strong visibility of earnings and cash flows.

Defensive PSU play amid volatile market.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Coal India offers a rare combination of strong fundamentals, attractive dividend yield, and strategic importance to the Indian economy. With a visible earnings trajectory, operational improvements, and low valuation, it is well-positioned to deliver steady returns in the medium term. A solid bet for income-seeking and value-oriented investors.