In a rapidly evolving banking landscape dominated by aggressive private players and digital disruptors, Federal Bank has quietly built a reputation for consistency, prudence, and steady growth. It may not always grab headlines, but its disciplined execution, strong asset quality, and early digital transformation have made it one of India’s most reliable mid-sized banks. As investors search for stability in a volatile market, Federal Bank’s story stands out as a balance of growth and resilience.

But does Federal Bank offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | FEDERALBNK |

| Industry/Sector | Financial Services (Banking) |

| CMP | 236.61 |

| Market Cap (₹ Cr.) | 58,235 |

| P/E | 14.27 (Vs Industry P/E of 14.15) |

| 52 W High/Low | 237.50 / 172.66 |

| EPS (TTM) | 16.45 |

| Dividend Yield | 0.51% |

About Federal Bank

Founded in 1931 and headquartered in Aluva, Kerala, Federal Bank Ltd is one of India’s leading private sector banks with a nationwide presence and a growing international footprint. The bank offers a diversified portfolio of financial services, spanning retail banking, corporate banking, SME lending, NRI banking, and treasury operations.

With over 1,400 branches and a strong digital network, the bank has built a loyal customer base of both domestic and NRI clients. Federal Bank’s early focus on digital innovation and risk management has enabled it to maintain industry-leading asset quality while scaling its retail and MSME franchise.

Key business segments

Federal Bank operates primarily in the following key business segments:

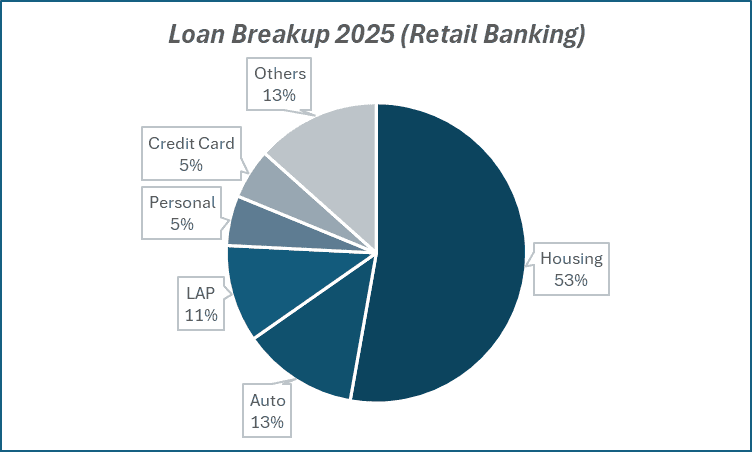

- Retail Banking: Housing loans, gold loans, vehicle finance, and personal loans form the backbone of Federal Bank’s retail portfolio, driving stable margins.

- Corporate & Institutional Banking: Offers working capital loans, term loans, and structured financing to corporates, with a focus on risk-adjusted profitability.

- SME & Agri Lending: A rapidly growing segment, contributing to diversified asset growth with lower delinquency rates.

- NRI Services: One of the strongest NRI franchises in the Indian banking sector, supported by remittance services and specialized savings/investment products.

- Treasury & Investment Operations: Focused on managing liquidity, interest rate exposure, and investments in government and corporate securities.

Primary growth factors for Federal Bank

Federal Bank key growth drivers:

- Strong Retail Momentum: Continued traction in home and gold loans ensures stable, granular growth with better spreads.

- Digital Transformation: Investments in analytics, fintech partnerships, and AI-led lending have enhanced customer experience and operational efficiency.

- NRI Business Expansion: With ~20% of deposits coming from NRIs, rising global remittance flows provide a structural growth tailwind.

- Asset Quality Discipline: GNPA and NNPA consistently among the lowest in mid-sized banks, aided by strong underwriting and risk controls.

- Deposit Franchise Strength: Healthy CASA ratio and rising term deposits enhance funding stability and lower cost of capital.

Detailed competition analysis for Federal Bank

Key financial metrics – TTM;

| Company | NII(₹ Cr.) | PAT(₹ Cr.) | PAT Margin (%) | Gross NPA (%) | Net NPA (%) | P/B (TTM) |

| Federal Bank Ltd. | 10744.46 | 4023.21 | 12.20% | 1.83% | 0.48% | 1.59 |

| Bandhan Bank Ltd. | 10931.97 | 1228.22 | 4.95% | 5.02% | 1.37% | 1.13 |

| IndusInd Bank Ltd. | 17325.61 | -759.46 | -1.40% | 3.60% | 1.04% | 0.97 |

| Karur Vysya Bank Ltd. | 4508.58 | 2104.80 | 17.09% | 0.76% | 0.19% | 1.99 |

| RBL Bank Ltd. | 6181.56 | 540.99 | 3.00% | 2.32% | 0.57% | 1.24 |

Key insights on Federal Bank

- Risk-Aware Growth: Management prioritizes steady, sustainable expansion over aggressive lending, ensuring long-term stability.

- Strong Profitability Metrics: Maintains ROA above 1.3% and ROE above 14%, comparable to larger private sector peers.

- Granular Retail Focus: Emphasis on high-quality, small-ticket retail assets has helped the bank remain resilient across credit cycles.

- Digital Lending Momentum: Over 50% of new loan disbursements are now digital, improving efficiency and customer acquisition.

- Operational Efficiency: Continuous digital adoption has driven a decline in the cost-to-income ratio, enhancing profitability.

- Subsidiary Growth Leverage: Fedbank Financial Services (Fedfina) scaling rapidly in the NBFC segment, providing additional earnings potential.

Recent financial performance of Federal Bank for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| NII (₹ Cr.) | 2612.21 | 2611.22 | 2786.71 | 6.72% | 6.68% |

| PAT (₹ Cr.) | 1104.46 | 946.77 | 1019.43 | 7.67% | -7.70% |

| PAT Margin (%) | 13.78% | 11.39% | 12.25% | 86 bps | -153 bps |

| Gross NPA (%) | 2.09% | 1.91% | 1.83% | -8 bps | -26 bps |

| Net NPA (%) | 0.57% | 0.48% | 0.48% | 0 bps | -9 bps |

| Adjusted EPS (₹) | 4.47 | 3.74 | 4.03 | 7.75% | -9.84% |

Federal Bank financial update (Q2 FY26)

Financial performance

- Net Interest Margin (NIM) improved to 3.06% from 2.94% in Q1, surpassing guidance. This was aided by a 19 bps decline in deposit cost and a 3 bps drop in borrowing cost, partially offset by a 14 bps drop in yield on advances.

- Fee income rose 13% QoQ, reflecting strong franchise growth despite muted treasury gains. The Fee-to-Average Assets ratio crossed 1% for the first time, a key milestone for the bank.

- Credit cost moderated to 50 bps (vs. 65 bps in Q1), in line with the bank’s full-year guidance of 55 bps.

- A ₹46 crore management overlay was created for standard retail accounts showing early stress in connected exposures.

- CET-1 ratio stood at 15.71% (CRAR), excluding FY26 profits, and LCR remained strong at 129%, underscoring robust liquidity.

Business highlights

- Loan growth remained moderate at 1.5% QoQ, as the bank consciously reduced exposure to low-yielding corporate and home loans (~50% of book earlier).

- Growth is now concentrated in mid-to-high-yield segments, Commercial Banking (late 20s growth), Cards (30s growth), and Retail Gold Loans (~7% QoQ growth).

- The bank expects LAP and Branch-Under-Business (BuB) units to accelerate in coming quarters, supporting FY26 guidance of 1.2x nominal GDP growth.

- CASA ratio improved by 100 bps QoQ, supported by healthy current account growth and sustained retail deposit inflows.

- NRI franchise market share in remittances rose from 18.5% to 21%, strengthening its low-cost liability base.

- Deposit growth remained moderate as wholesale and financial sector deposits were rationalized to improve deposit quality.

- MFI stress peaked in Q1 and is easing; the MFI book (BC-driven) is <1.7% of the total portfolio. Non-MFI segments continue to exhibit strong asset quality.

Outlook

- Short Term: NIM expansion expected to continue through FY26 as deposit repricing benefits flow through. Fee income to rise from wealth management (yet to launch), trade, and forex.

- Medium Term: Loan growth to accelerate from mid-yielding retail and SME segments; cards and LAP businesses to scale profitability. CASA ratio expected to inch higher from internal digital and wealth initiatives.

- Long Term: Structural reweighting of the loan book toward higher-yielding assets to lift ROA and NIM sustainably.

- Capital Plans: Decision on capital raise deferred to October 24th board meeting; proceeds likely to fund organic growth in mid-yield segments and new ventures in wealth management.

- ECL Impact: Expected to be immaterial (~0.2% of capital), with steady-state credit costs likely unchanged.

Recent Updates on Federal Bank

- Fedfina IPO Plans: The bank’s NBFC arm, Fedbank Financial Services, is preparing for its IPO, which could unlock shareholder value and provide growth capital.

- Digital Banking Tie-ups: Collaborations with fintechs and payment platforms to expand digital lending and merchant banking services.

- ESG Initiatives: Launch of green deposits and renewable project financing as part of the bank’s sustainability agenda.

- Leadership Initiatives: Strengthening mid-management and technology teams to accelerate transformation and cross-sell efficiency.

Company valuation insights – Federal Bank

Federal Bank is currently trading at a TTM P/B of 1.59x, slightly above its long-term average, and has delivered a 15.9% return over the past year, outperforming the Nifty 50’s 7.2%.

The investment case for Federal Bank rests on its consistent execution, strong asset quality, and superior return ratios. With the infusion of ‘conviction capital’ by Blackstone (₹6,197 crore at ₹227/share), the bank is well-capitalized to accelerate growth in mid-yielding retail and commercial segments, enhance CASA mix, and expand fee-based income streams through trade, wealth, and cards businesses.

Strategically, the bank’s recalibration toward profitable growth and structural improvement in NIMs (targeting 3.3–3.4%), supported by a granular deposit franchise and stable credit costs, provides visibility of ROA expansion to 1.4–1.5% by FY28.

Applying a 1.5x FY27E BV multiple, we set a 12-month target price of ₹290 (≈ 23% upside) and a 3-month target of ₹250 (≈ 6% upside) from current levels.

The risk-reward remains attractive, backed by strong capitalization, improving margins, and sustainable earnings momentum driven by mid-yield asset growth and rising CASA share.

Major risk factors affecting Federal Bank

- Margin Compression: Rising competition in retail loans and deposits could pressure NIMs.

- Credit Cycle Risk: Any slowdown in SME or retail segments could impact asset quality.

- Execution Risk in Digital Scaling: Dependence on partnerships and technology transitions requires flawless execution.

- Regulatory Headwinds: Changes in RBI’s lending or NRI deposit norms may affect growth momentum.

Technical analysis of Federal Bank share

Federal Bank has been in a strong uptrend following its Q2 results and Blackstone’s strategic stake acquisition, signaling the potential for continued upside momentum. The stock is trading well above its 50-day, 100-day, and 200-day EMAs, reaffirming the strength of its long-term bullish trend.

Momentum indicators continue to support the positive structure. The MACD stands positive at 9.96, with the line positioned above the signal line, confirming sustained buying momentum. The RSI at 82.12 indicates strong bullish sentiment, while relative RSI scores of 0.17 (21-day) and 0.15 (55-day) highlight steady outperformance versus the broader market. The ADX reading of 50.55 reflects a very strong trend, reinforcing conviction in the ongoing breakout.

A decisive move above ₹250 could open the door for an upside move toward ₹290, in line with its 12-month fundamental target. On the downside, ₹220 remains a crucial support zone, and sustaining above this level will be essential to preserve the bullish setup.

- RSI: 82.12 (Strong Buying Interest)

- ADX: 50.55 (Very Strong Trend)

- MACD: 9.96 (Positive Momentum)

- Resistance: ₹250

- Support: ₹220

Federal Bank stock recommendation

Current Stance: Buy, with a 3-month target of ₹250 (~6% upside) and a 12-month target of ₹290 (~23% upside) based on 1.5× our FY27E BVPS.

Why buy now?

Margin Expansion: NIM improved to 3.06%, up 12 bps QoQ, supported by lower deposit costs and a richer asset mix.

Strong Fee Income: Fee income grew 13% QoQ, with the Fee-to-Average Assets ratio crossing 1% for the first time, highlighting a healthy core franchise.

Controlled Credit Costs: Credit cost moderated to 50 bps, and management remains confident of maintaining full-year guidance of 55 bps, reflecting disciplined risk management.

Asset Quality Stability: Slippages in the MFI segment have peaked, while non-MFI portfolios remain robust, supported by conservative provisioning and overlays.

CASA & NRI Strength: Average CASA improved by over 100 bps QoQ; NRI market share in remittances rose from 18.5% to 21%, underscoring a strong liability franchise.

Portfolio fit

Federal Bank offers a high-quality mid-tier private banking opportunity with superior risk-adjusted returns, strong capital adequacy (CET1: 15.7%), and consistent profitability (ROA >1.3%, ROE >14%). The bank’s strategic shift toward mid-yield retail, LAP, and commercial banking, coupled with digital lending and wealth management expansion, supports sustainable growth. Backed by stable asset quality, rising margins, and digital agility, it remains a compelling long-term compounder in the private banking space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebFederal Bank: Budget 2025-26 opportunities

- Retail & MSME Credit Boost: Government initiatives to expand MSME and housing credit directly align with Federal Bank’s retail-driven loan portfolio and mid-yield focus areas.

- Digital Ecosystem Push: Increased budgetary support for fintech integration, UPI infrastructure, and AI-led banking innovation strengthens Federal Bank’s digital lending and customer acquisition capabilities.

- NRI & Remittance Advantage: Policy measures to simplify cross-border remittance norms and boost NRI deposits will benefit Federal’s strong 21% remittance market share.

- Wealth & Investment Inclusion: Incentives for financial literacy and wealth management expansion provide growth tailwinds for Federal’s upcoming wealth and investment businesses.

- Capital Market & Infra Financing: Continued policy emphasis on capital market depth and infrastructure investments opens new fee income and treasury opportunities for the bank.

Final thoughts

Federal Bank’s transformation journey mirrors the evolution of India’s financial ecosystem, from a regional lender to a tech-driven, customer-centric bank. Its story is not of explosive growth, but of consistent progress, building trust, managing risks, and adapting ahead of the curve.

For investors seeking a blend of safety, profitability, and digital agility, Federal Bank represents an underappreciated gem in India’s private banking space, steady today, and strategically positioned for the opportunities of tomorrow.