India’s rapid infrastructure growth and industrial expansion have created a massive demand for minerals and energy resources. At the heart of this transformation lies Gujarat Mineral Development Corporation (GMDC), one of India’s largest state-owned mining and mineral companies. With diversified operations across lignite, bauxite, and other minerals, GMDC plays a crucial role in powering industries, while also riding the wave of clean energy transition through its foray into renewables.

But does GMDC offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | GMDCLTD |

| Industry/Sector | Mining & Minerals |

| CMP | 613.00 |

| Market Cap (₹ Cr.) | 19,872 |

| P/E | 29.63 (Vs Industry P/E of 10.51) |

| 52 W High/Low | 642.00 / 226.59 |

| EPS (TTM) | 20.93 |

| Dividend Yield | 1.63% |

About GMDC Ltd.

Established in 1963 and headquartered in Ahmedabad, GMDC is a Government of Gujarat enterprise engaged in the exploration and development of mineral resources. It is India’s largest lignite producer, while also being a significant player in bauxite, fluorspar, manganese, and other industrial minerals. Alongside mining, GMDC has invested in captive power generation and renewable energy projects, making it a unique integrated player in the sector.

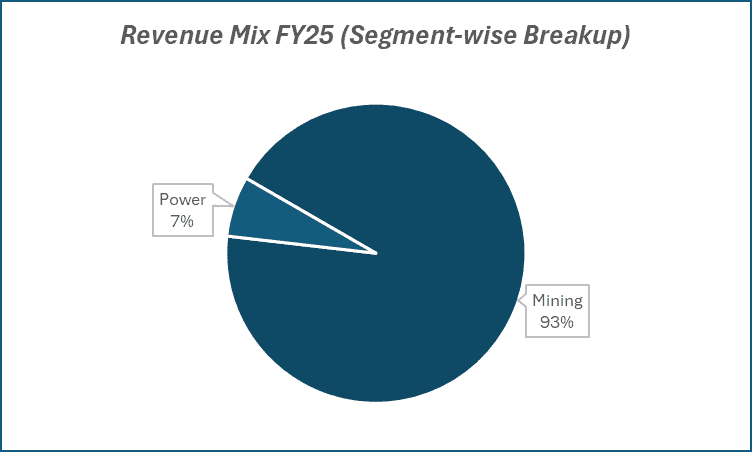

Key business segments

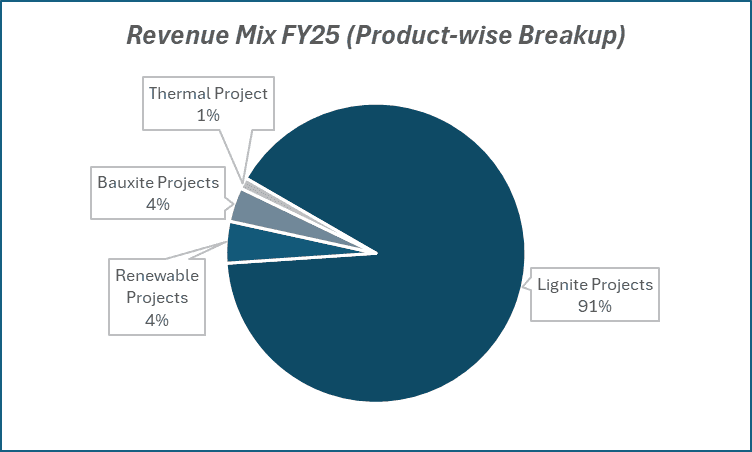

GMDC Ltd. operates primarily in the following key business segments:

- Lignite Mining: Core business, supplying power plants, textiles, chemicals, and other industries in Gujarat.

- Bauxite Mining: Used for alumina, cement, refractories, and export demand.

- Other Minerals: Includes fluorspar, manganese, silica sand, and ball clay.

- Power Business: Operates captive lignite-based thermal plants and renewable energy (wind & solar).

Primary growth factors for GMDC Ltd.

GMDC Ltd. key growth drivers:

- Rising demand for lignite as an affordable energy source for industries.

- Bauxite expansion, leveraging strong domestic alumina and aluminum demand.

- Diversification into renewable energy, reducing dependence on fossil fuels.

- Government support through mining reforms and policy push for self-reliance.

- Strong industrial base in Gujarat, ensuring consistent regional demand.

Detailed competition analysis for GMDC Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| GMDC Ltd. | 2765.31 | 596.38 | 21.57% | 666.64 | 24.11% | 29.63 |

| Coal India Ltd. | 140119.39 | 45245.90 | 32.29% | 32571.64 | 23.25% | 7.23 |

| NMDC Ltd. | 25230.19 | 8287.26 | 32.85% | 6543.70 | 25.94% | 10.23 |

| Sandur Manganese | 3668.77 | 893.13 | 24.34% | 495.14 | 13.50% | 16.64 |

| MOIL Ltd. | 1440.16 | 392.64 | 27.26% | 280.79 | 19.50% | 26.70 |

Key insights on GMDC Ltd.

- GMDC enjoys a monopoly-like position in lignite mining in Gujarat, giving it strong pricing and volume stability.

- Its diversification into renewables is strategically aligned with India’s green energy goals.

- Operational efficiency improvements in mining and better realization from bauxite exports have boosted profitability.

- As a state-owned entity, GMDC maintains a robust balance sheet and low leverage, enabling it to fund growth internally.

Recent financial performance of GMDC Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 818.13 | 786.28 | 732.60 | -6.83% | -10.45% |

| EBITDA (₹ Cr.) | 211.47 | 193.56 | 169.24 | -12.56% | -19.97% |

| EBITDA Margin (%) | 25.85% | 24.62% | 23.10% | -152 bps | -275 bps |

| PAT (₹ Cr.) | 184.14 | 226.03 | 163.87 | -27.50% | -11.01% |

| PAT Margin (%) | 22.51% | 28.75% | 22.37% | -638 bps | -14 bps |

| Adjusted EPS (₹) | 5.79 | 7.11 | 5.15 | -27.57% | -11.05% |

GMDC Ltd. financial update (Q1 FY26)

Financial performance

- Consolidated revenue declined 10.5% YoY to ₹733 crore, impacted by lower mining and power segment revenues.

- EBITDA margin slipped to ~23%, reflecting pressure from pricing and cost factors.

- Net profit fell 11% YoY to ₹164 crore, with PAT margin at ~22%.

- PBT came in at ₹225 crore, down 10% YoY.

- Mining (lignite) revenue dropped 11% YoY to ₹685 crore, while power revenue declined 31% YoY to ₹47 crore.

- Lignite sales volumes were down 14% YoY to 19.8 lakh MT; sales value also fell 14%.

Business highlights

- Weakness was broad-based across the lignite and power segments, leading to topline pressure.

- Margins moderated on account of softer pricing and cost inflation.

- GMDC continues to maintain a relatively stable cost structure with focus on operational efficiency.

- Strategic spotlight remains on diversification into rare earths and critical minerals, aimed at reducing dependence on lignite.

Outlook

- Short term: Revenue and margin pressures are expected to persist in core mining and power operations given demand and pricing headwinds.

- Medium to long term: Diversification into rare earths, critical minerals, and value-added mining solutions will be key growth drivers.

- Execution focus: Timely commissioning of new projects, disciplined capex deployment, and regulatory approvals for new mining zones remain key monitorables.

- Investor sentiment: Despite near-term softness, the stock remains in focus on expectations of long-term value creation through rare earth expansion and resource diversification.

Recent Updates on GMDC Ltd.

- Commissioning of new bauxite mining blocks to cater to domestic aluminum players.

- Expansion of wind and solar power projects in Gujarat, adding to its green portfolio.

- Partnership talks with downstream industries for value-added mineral processing.

Company valuation insights – GMDC Ltd.

GMDC is currently trading at a TTM P/E of 29.6x, well above the industry average of 10.5x, supported by a stellar 80% 1-year return versus the Nifty 50’s -1.6%.

The stock’s attractiveness lies in its strategic pivot toward rare earth elements (REEs), backed by a strong lignite and industrial minerals base. With China curbing REE exports, India’s push for self-reliance in critical minerals positions GMDC at the center of this structural shift. Through Project Shikhar, the company is targeting topline growth of ~38% CAGR by FY30, driven by a ₹13,000 crore capex pipeline across new lignite mines, coal projects, and REE beneficiation facilities.

GMDC has committed ₹3,500 crore toward developing India’s rare earth value chain, including a processing capacity of 12,000 tonnes of rare earth oxides annually by FY2028, aiming to meet up to 15% of the country’s Nd-Pr demand. This diversification, supported by its GSRC research arm, aligns with India’s clean energy and defense needs, making GMDC a strategic play on critical minerals. Meanwhile, its core lignite and power operations continue to generate steady cash flows to self-fund much of this expansion.

Using a 26x FY27E EPS of ₹30, we set a 12-month target price of ₹780 ( a 23% upside from current levels). For the short term, we assign a 3-month target of ₹680 (≈7% upside). Upside triggers include timely execution of REE projects, faster ramp-up in new lignite/coal mines, and supportive policy tailwinds in India’s rare earth ecosystem.

Major risk factors affecting GMDC Ltd.

- Commodity price volatility in lignite and bauxite impacting realizations.

- Policy and regulatory risks tied to mining licenses and environmental norms.

- Dependence on regional demand from Gujarat industries, limiting geographical diversification.

- Execution risks in scaling renewable energy and downstream mineral projects.

Technical analysis of GMDC Ltd. share

GMDC is trading in a well-established uptrend with a stellar 80% return over the last 1 year. The price has also broken above the upper trendline with a cumulative 10% move, underscoring strong upward momentum.

The stock is trading comfortably above its 50-day, 100-day, and 200-day EMAs, confirming that the broader trend remains positive. Sustained trade above these levels can establish a firm medium- to long-term uptrend.

Momentum indicators support the bullish bias. The MACD at 40.45 is positive, with the line above the signal line, affirming upward momentum. The RSI at 67.06 reflects strong buying interest, while relative RSI scores of 0.32 (21-day) and 0.63 (55-day) indicate clear outperformance versus the market. Importantly, the ADX at 40.95 signals a very strong and strengthening trend.

A breakout above ₹680 could open the gates for a rally toward ₹780 (12-month fundamental target). On the downside, ₹540 is a crucial support, and holding above it will be key to maintaining the bullish structure.

- RSI: 67.06 (Strong Buying Interest)

- ADX: 40.95 (Strong Trend)

- MACD: 40.45 (Positive)

- Resistance: ₹680

- Support: ₹540

GMDC Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹680 (~7% upside) and a 12-month target of ₹780 (~23% upside).

Why buy now?

Rare earth diversification: GMDC has committed ₹3,500 crore toward building India’s rare earth value chain, with plans to commission a 12,000 TPA REE processing facility by FY28, potentially meeting up to 15% of the country’s Nd-Pr demand.

Project Shikhar: Ambitious growth program targeting ~38% topline CAGR through FY30, supported by new lignite and coal mine ramp-ups, alongside critical mineral expansion.

Capex-led growth: Total planned capex of ₹13,000 crore by FY30, largely self-funded through cash flows, ensures scalable and sustainable expansion.

Sectoral tailwinds: China’s export restrictions on rare earths have amplified India’s focus on domestic supply security, positioning GMDC as a key beneficiary of policy support and demand from EVs, renewables, and defense.

Operational stability: Core lignite and power businesses continue to provide stable earnings and cash flow, supporting high-return investments in REEs.

Portfolio fit

GMDC offers investors a unique state-backed mining play with a dual advantage: steady cash flows from lignite/power and high-growth optionality in rare earth elements. Its scale, strategic projects, and alignment with India’s clean energy and critical minerals push make it a multi-year growth story. At current valuations, GMDC provides an attractive blend of cyclical stability and structural upside.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebGMDC Ltd.: Budget 2025-26 opportunities

- Energy Security & Rare Earth Push: Higher budgetary focus on energy transition and strategic minerals to strengthen India’s self-reliance drive, accelerating investments in rare earth mining and processing.

- Infrastructure & Power Growth: Increased allocation for coal, power, and infrastructure projects to support lignite demand, ensuring steady volumes and cash flow visibility.

- Critical Minerals Mission: Policy thrust on domestic exploration and beneficiation of critical minerals positions GMDC’s ₹3,500 crore rare earth projects as key beneficiaries of incentives and approvals.

- Capex Support & Mining Reforms: Government backing through mining reforms, faster clearances, and viability gap funding to aid GMDC’s ₹13,000 crore capex plan under Project Shikhar.

- Defense & EV Ecosystem: Strategic minerals policy aligned with defense and EV manufacturing to boost demand for Nd-Pr and other rare earths, creating long-term value opportunities for GMDC.

Final thoughts

GMDC stands at a strategic inflection point. Its lignite leadership ensures steady cash flows, while bauxite expansion and renewable investments are shaping its long-term growth story. Investors looking for a mix of stable dividends, strong balance sheet, and cyclical upside from India’s energy and mineral demand can find GMDC an attractive bet. As the company balances its traditional mining strengths with a push towards sustainability, it remains a stock to watch in India’s resource economy.