Stock overview

| Ticker | GMR Airports |

| Sector | Infrastructure / Airports |

| Market Cap | ₹ 91,650 Cr |

| CMP (Current Market Price) | ₹ 86 |

| 52-Week High/Low | ₹ 104/68 |

| Beta | 1.12 (Moderate volatility) |

About GMR Airports India Ltd.

GMR Airports Infrastructure Ltd is a leading player in India’s airport development and operations space. It operates major airports in India and overseas through a mix of public-private partnerships (PPP) and strategic investments. The company’s flagship asset is the Indira Gandhi International Airport (IGIA), Delhi , one of the busiest airports in Asia.

Key assets & operations

- Indira Gandhi International Airport, Delhi (IGIA): Flagship asset; second busiest airport in Asia.

- Rajiv Gandhi International Airport, Hyderabad: Strong performance and non-aero revenue drivers.

- Mopa Airport, Goa: Newly inaugurated, high tourism potential.

- Crete International Airport, Greece: 10% stake; long-term play on European tourism.

- Philippines (Cebu Airport): International presence through 40% JV.

GMR’s business model is built on:

- Aeronautical revenues (landing, parking, UDF, etc.)

- Non-aeronautical revenues (retail, food courts, duty-free, car parking)

- Real estate monetisation around airport zones (Airport City at Hyderabad, Delhi Aerocity)

Primary growth factors for GMR Airports India Ltd

1. India’s Aviation Boom

- India is the 3rd largest domestic aviation market globally.

- Doubling of air passengers expected over next 5–7 years.

- Government push via UDAN scheme and new airport developments.

2. Traffic Growth at Key Airports

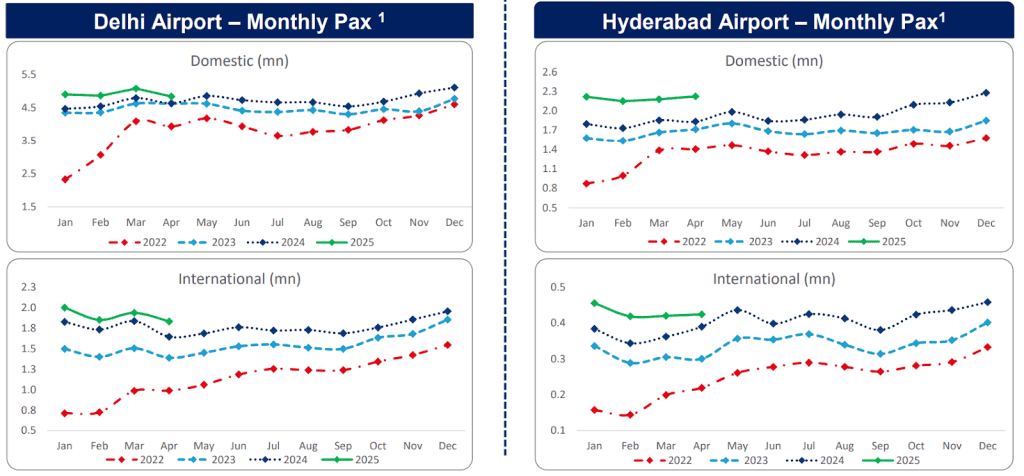

- IGIA Delhi and Hyderabad airports continue to show high double-digit growth.

- Mopa Airport is gaining strong traction from the tourism sector.

3. Non-Aero Revenue Surge

- Retail and F&B at airports are driving significant EBITDA contribution.

- Delhi Aerocity and Hyderabad Airport City developments unlocking massive real estate value.

4. Asset Monetisation

- Strategic stake sales in non-core assets.

- Potential REIT/InvIT model for monetising airport infrastructure.

5. Global Diversification

- Expansion outside India (Greece, Philippines) offers FX hedging and diversified cash flows.

6. Improving Operating Leverage

- Fixed-cost business structure benefits significantly from volume growth.

- EBITDA margins improving steadily.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Revenue | ₹ 2,863 cr | 17% | 24% |

| Expenses | ₹ 1,079 cr | 5% | 9% |

| EBITDA | ₹ 1,122 cr | 19% | 20% |

| PAT | ₹ -290 cr | 41% | 32% |

- GMR Airports has delivered a healthy growth in top line in Q4 FY 25 at a YoY and QoQ level. This is on account of a higher demand in the aviation sector and higher passenger traffic in the airports.

- While the operational expenses are under control, GMR airports have seen a 25% surge in interest, finance and depreciation costs on a YoY basis. This has put a dent on their overall profitability.

Detailed competition analysis for GMR Airports India

| Company | Market Cap | Revenue | EV/EBITDA | RoCE |

| GMR Airports | ₹ 91,600 cr | ₹ 2,863 cr | 29 x | 7% |

| IGI Ltd | ₹ 16,300 cr | ₹ 234 cr | 26 x | 43% |

| Rites | ₹ 13,100 cr | ₹ 615 cr | 26 x | 21% |

| Embassy Development | ₹ 12,900 cr | ₹ 278 cr | 16 x | -11% |

GMR Airports is valued decently at the moment compared to its peers. It remains a key player in the aviation space and the strong top line growth should continue to pave way for future growth as well.

Company valuation insights: GMR Airports India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of GMR Airports shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹105 per share

- Upside Potential: 18%

- WACC: 12.3%

- Terminal Growth Rate: 3.7%

Major risk factors affecting GMR Airports India

- High leverage; Debt reduction critical

- Regulatory risks and tariff controls

- Dependency on passenger traffic (susceptible to external shocks)

- Political risk in international markets

Technical analysis of GMR Airports India

- Resistance: ₹88

- Support: ₹82

- Momentum: Bullish

- RSI (Relative Strength Index): 48 (Neutral)

- 50-Day Moving Average: ₹82

- 200-Day Moving Average: ₹78

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹90.

GMR Airports India stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹95 (6-month horizon); ₹105 (12-month horizon);

Investment Horizon: 2–4 years for stable returns

Rationale

Recommend a Buy on Dips / Accumulate approach for GMR Airports.

GMR Airports is a company that has benefitted immensely from rising passenger traffic. With the government's plan to open up new airports and rising disposable income of consumers, we are going to see a lot of tailwinds in this sector. GMR Airports is well positioned at the moment to benefit from this situation.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

GMR Airports is at an inflection point , benefiting from India’s air traffic explosion, strong non-zero income streams, and high-quality global assets. Despite near-term losses, long-term value creation potential remains robust. With better margin visibility, traffic tailwinds, and asset monetisation plans, this could be a high-risk, high-reward infrastructure play.