India’s long-term growth story rests heavily on food security, agricultural productivity, and industrial self-reliance. Companies operating at the intersection of agriculture and chemicals play a quiet but critical role in this transition. Gujarat State Fertilizers & Chemicals Ltd (GSFC) is one such integrated player, combining a stable fertilizer backbone with a diversified chemicals portfolio. While the sector is cyclical, GSFC’s structure provides resilience and long-term strategic relevance.

But does Gujarat State Fertilizers & Chemicals Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | GSFC |

| Industry/Sector | Chemicals |

| CMP | 173 |

| Market Cap (₹ Cr.) | 6,951 |

| P/E | 10.48 (Vs Industry P/E of 26.24) |

| 52 W High/Low | 220.59 / 158.30 |

| EPS (TTM) | 16.01 |

| Dividend Yield | 2.98% |

About Gujarat State Fertilizers & Chemicals Ltd.

Gujarat State Fertilizers & Chemicals Ltd is a state-owned enterprise engaged in the manufacturing of fertilizers, industrial chemicals, and petrochemical-based products. Over the years, GSFC has evolved from being a pure fertilizer company to a diversified agri-chemical PSU, serving both the farming ecosystem and multiple industrial end markets. Its integrated operations, access to feedstock infrastructure, and PSU backing provide operational stability and scale.

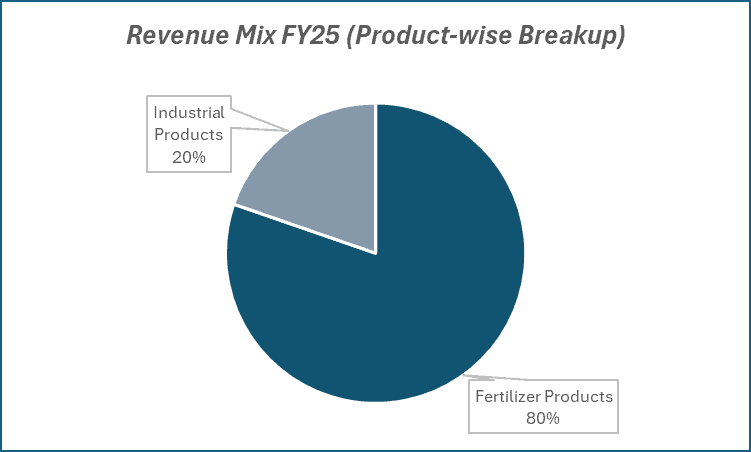

Key business segments

Gujarat State Fertilizers & Chemicals Ltd. operates primarily in the following key business segments:

- Fertilizers: Urea, ammonium sulphate, DAP, and complex fertilizers catering to Indian agriculture.

- Industrial Chemicals: Caprolactam, nylon intermediates, melamine, and other inorganic chemicals.

- Petrochemicals & Polymers: Products linked to engineering plastics and downstream industrial use.

- Utilities & Others: Power generation, utilities, and by-products supporting core operations.

Primary growth factors for Gujarat State Fertilizers & Chemicals Ltd.

Gujarat State Fertilizers & Chemicals Ltd. key growth drivers:

- Structural Fertilizer Demand: Stable long-term demand driven by food security and crop intensity.

- Chemical Portfolio Diversification: Growing contribution from non-fertilizer industrial chemicals.

- Import Substitution: Domestic manufacturing replacing imported chemical intermediates.

- Integrated Cost Structure: Better margin control through captive utilities and feedstock access.

- Policy Support: Government backing for fertilizers and domestic chemical manufacturing.

Detailed competition analysis for Gujarat State Fertilizers & Chemicals Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Gujarat State Fertilizers Ltd. | 10108.04 | 767.92 | 7.60% | 653.47 | 6.46% | 10.48 |

| Coromandel Int. Ltd. | 28620.01 | 3076.42 | 10.75% | 2406.56 | 8.41% | 28.00 |

| FACT Ltd. | 4674.77 | 179.79 | 3.85% | 103.86 | 2.22% | 490.90 |

| Chambal Fertilizers Ltd. | 19477.16 | 2543.99 | 13.06% | 1718.63 | 8.82% | 9.06 |

| Paradeep Phosphates Ltd. | 18225.20 | 1805.89 | 9.91% | 917.01 | 5.03% | 13.85 |

Key insights on Gujarat State Fertilizers & Chemicals Ltd.

- Diversified Revenue Mix: Chemicals reduce dependence on fertilizer subsidy cycles.

- PSU Stability: Government ownership provides downside protection and policy visibility.

- Cyclical Exposure: Chemical margins remain sensitive to global demand cycles.

- Cash Flow Sensitivity: Working capital impacted by fertilizer subsidy receivables.

- Optionality Ahead: Scope to benefit from specialty chemicals and cleaner manufacturing trends.

Recent financial performance of Gujarat State Fertilizers & Chemicals Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 2775.00 | 2212.00 | 3282.00 | 48.37% | 18.27% |

| EBITDA (₹ Cr.) | 289.00 | 201.00 | 333.00 | 65.67% | 15.22% |

| EBITDA Margin (%) | 10.41% | 9.09% | 10.15% | 106 bps | -26 bps |

| PAT (₹ Cr.) | 303.00 | 140.00 | 320.00 | 128.57% | 5.61% |

| PAT Margin (%) | 10.92% | 6.33% | 9.75% | 342 bps | -117 bps |

| Adjusted EPS (₹) | 7.60 | 3.51 | 8.04 | 129.06% | 5.79% |

Gujarat State Fertilizers & Chemicals Ltd. financial update (Q2 FY26)

Financial performance

- Revenue rose 18% YoY to ₹3,282 crore, with a sharp 48% QoQ jump, driven by strong fertilizer volumes and higher DAP trading during the peak season.

- EBITDA increased to ₹333 crore, up 15% YoY, though margins moderated due to a steep rise in key raw material prices (phosphoric acid, sulphur, sulphuric acid).

- PAT grew 6% YoY to ₹320 crore and surged 129% QoQ, reflecting operating leverage and seasonality benefits despite cost pressures.

- For H1 FY26, revenue grew 12% YoY to ₹5,372 crore, while PAT increased 20% YoY to ₹463 crore, highlighting healthy earnings momentum at the aggregate level.

Business highlights

- Fertilizer segment revenue rose 21% YoY, supported by higher sales volumes (5.47 LMT to 6.08 LMT), including substantial DAP trading.

- EBIT in fertilizers moderated due to sharp raw material inflation, partly offset by softer natural gas and ammonia prices and improved realizations in P&K fertilizers.

- The Industrial Products segment delivered a strong turnaround, with EBIT improving from a ₹17 crore loss to ₹54 crore profit, led by HX Crystal ramp-up, ammonia trading, and higher melamine exports.

- Caprolactam profitability remained under pressure as the Capro–Benzene spread declined to $512/MT, though cost optimization and product mix limited downside.

Outlook

- Management expects stable demand in Q3 FY26, aided by an above-normal monsoon, higher MSPs for Rabi crops, and comfortable fertilizer inventory levels.

- NBS subsidy rates for H2 FY26 include a 10% increase for phosphorus and sulphur nutrients, providing partial protection against elevated input costs.

- Industrial Products performance is likely to remain resilient, with HX Crystal running at full capacity, steady melamine exports, and ammonia trading margins sustained under long-term contracts.

- Commissioning of the Sulphuric Acid (SA-V) project (198 KTPA) in H2 FY26 is expected to improve cost efficiency and support margins. Strong balance sheet, zero long-term debt, and timely subsidy receipts position GSFC well for stable earnings and gradual margin normalization over FY26–27.

Recent Updates on Gujarat State Fertilizers & Chemicals Ltd.

- Operational Efficiency Drive: Continued focus on cost optimization and plant reliability.

- Product Mix Improvement: Efforts to improve realizations through higher-value chemical products.

- Sustainability Initiatives: Gradual steps toward energy efficiency and emission reduction.

- Agri Ecosystem Engagement: Strengthening farmer outreach and fertilizer distribution networks.

Company valuation insights – Gujarat State Fertilizers & Chemicals Ltd.

Gujarat State Fertilizers & Chemicals is currently trading at a TTM P/E of 10.5x, significantly below the industry average of 26.2x, and has delivered a -16.8% return over the past year, materially underperforming the NIFTY 50’s ~8.7% gain over the same period. This underperformance has been driven largely by concerns around raw material volatility, pressure on caprolactam spreads, and muted sentiment towards fertilizer and cyclical chemical stocks, rather than any structural weakening in GSFC’s business model, balance sheet, or competitive positioning.

The investment case for GSFC is anchored in its strong positioning across both fertilizers and industrial chemicals, supported by a debt-free balance sheet, healthy cash flows, and timely subsidy receipts. The fertilizer segment benefits from stable volumes, policy support, and improved demand visibility backed by above-normal monsoons and higher MSPs, while downside risks from raw material inflation are being partly mitigated through NBS subsidy revisions and internal cost efficiencies. Simultaneously, the industrial products segment has demonstrated a meaningful turnaround, driven by HX Crystal ramp-up, improved ammonia trading economics, and higher-margin melamine exports. Ongoing capex, including sulphuric acid and phosphoric acid expansions is expected to structurally improve cost efficiency, reduce import dependence, and support margin resilience over the medium term.

From a valuation perspective, applying a 13x multiple to FY27E EPS of ₹16.5, we arrive at a 12-month target price of ₹215, implying an upside of ~24% from current levels. On a shorter-term basis, we assign a 3-month target price of ₹185, offering a ~6% upside, supported by peak-season fertilizer volumes, stable subsidy inflows, commissioning of key capex projects, and continued momentum in the industrial products segment.

Major risk factors affecting Gujarat State Fertilizers & Chemicals Ltd.

- Subsidy Timing Risk: Delays can strain working capital and cash flows.

- Input Cost Volatility: Natural gas and feedstock price fluctuations impact profitability.

- Chemical Cycle Downturn: Weak demand for nylon and industrial intermediates.

- Regulatory Dependence: Changes in fertilizer pricing or subsidy policy.

Technical analysis of Gujarat State Fertilizers & Chemicals Ltd. share

Gujarat State Fertilizers & Chemicals has broken out above the trendline of a descending channel, signalling a potential end to the corrective phase. With momentum gradually improving, this breakout increases the probability of a fresh uptrend if follow-through buying sustains.

The stock is currently trading below its 100- and 200-day EMAs, indicating that the longer-term trend is still in the process of stabilising. However, a recent crossover above the 50-day EMA from below marks an early trend reversal signal and presents a tactical buying opportunity from a risk–reward perspective.

Momentum indicators are turning constructive. MACD at -2.14 remains negative but is on the verge of crossing above the signal line, a setup that often precedes short-term upside acceleration. RSI at 45.71 reflects improving buying interest from neutral levels, while Relative RSI (0.03 over 21 days) indicates mild outperformance versus the broader market. ADX at 18.95 suggests a developing trend, with directional strength gradually building.

A decisive move above ₹185 could open the path towards ₹215 (12-month target). On the downside, ₹165 remains a key support level; holding above this zone keeps the emerging bullish structure intact.

- RSI: 45.71 (Decent Buying Momentum)

- ADX: 18.95 (Developing Trend Strength)

- MACD: -2.14 (Negative, awaiting bullish crossover)

- Resistance: ₹185

- Support: ₹165

Gujarat State Fertilizers & Chemicals Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹185 (6% upside) and a 12-month target of ₹215 (24% upside), based on 13x FY27E EPS of ₹16.5.

Why buy now?

Earnings recovery in play: Peak-season fertilizer volumes and improving industrial products profitability support near-term earnings traction.

Policy-backed visibility: Above-normal monsoons, higher MSPs, and NBS subsidy support provide demand stability and cushion input cost volatility.

Margin improvement levers: Commissioning of the SA-V project, better product mix, and cost optimisation aid margin resilience.

Strong balance sheet: Debt-free status and steady cash flows offer downside protection and capex flexibility.

Portfolio fit

GSFC offers defensive yet value-oriented exposure to India’s agri-input and industrial chemicals ecosystem, combining stable fertilizer cash flows with cyclical upside from industrial products. With valuations well below long-term averages and peers, the stock fits well in portfolios seeking mean-reversion opportunities, PSU value plays, and earnings recovery stories, complementing core holdings in infrastructure, defence, and manufacturing.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebGujarat State Fertilizers & Chemicals Ltd.: Budget 2025-26 opportunities

- Agri & rural push: Higher MSPs, income support, and focus on food security support sustained fertilizer demand.

- Nutrient-based subsidy continuity: Stable NBS framework with periodic revisions improves visibility for P&K fertilizers amid raw material volatility.

- Domestic manufacturing thrust: Policy focus on import substitution supports local production of phosphoric acid, sulphuric acid, and downstream chemicals.

- Industrial & chemicals revival: Infrastructure, housing, and manufacturing capex lift demand for industrial chemicals, melamine, and intermediates.

- Energy & cost efficiency incentives: Emphasis on energy efficiency and cleaner production benefits integrated players with captive utilities and ongoing capex.

Final thoughts

GSFC represents a steady, policy-aligned play on India’s agricultural backbone with an added layer of chemical diversification. While not immune to cycles, its integrated model, PSU support, and exposure to both farming and industrial demand provide balance. For investors seeking stability, diversification, and alignment with India’s agri-chemical self-reliance theme, GSFC offers measured upside with controlled risk rather than high-volatility growth.