As India accelerates its infrastructure build-out, energy transition, and industrial growth, the role of base metals becomes increasingly critical. Hindustan Zinc Ltd stands at the intersection of this demand cycle, combining cost leadership, scale, and a strong balance sheet. With zinc, lead, and silver forming the backbone of multiple industrial applications, Hindustan Zinc remains a strategic asset in India’s metals ecosystem.

But does Hindustan Zinc Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | HINDZINC |

| Industry/Sector | Metals & Mining |

| CMP | 627.30 |

| Market Cap (₹ Cr.) | 2,65,054 |

| P/E | 25.14 (Vs Industry P/E of 16.83) |

| 52 W High/Low | 656.35 / 378.15 |

| EPS (TTM) | 25.00 |

| Dividend Yield | 4.61% |

About Hindustan Zinc Ltd.

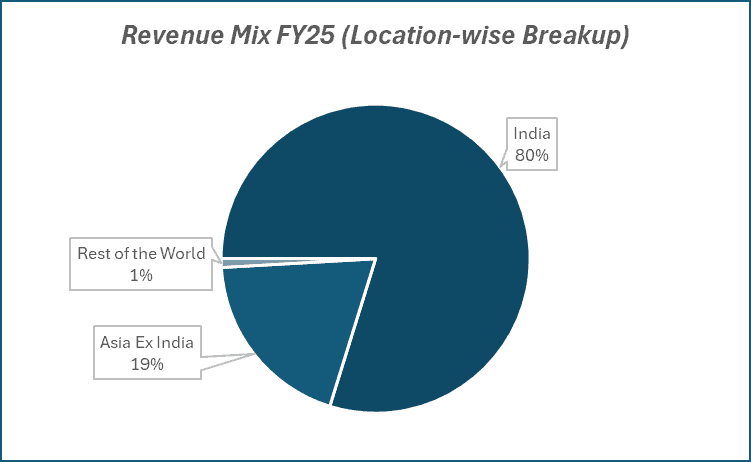

Hindustan Zinc is India’s largest and the world’s second-largest integrated zinc producer. A subsidiary of the Vedanta Group, the company operates across mining, beneficiation, smelting, and refining, making it one of the lowest-cost zinc producers globally. Its operations are primarily located in Rajasthan, supported by captive power plants and a strong logistics network, ensuring operational efficiency and cost control.

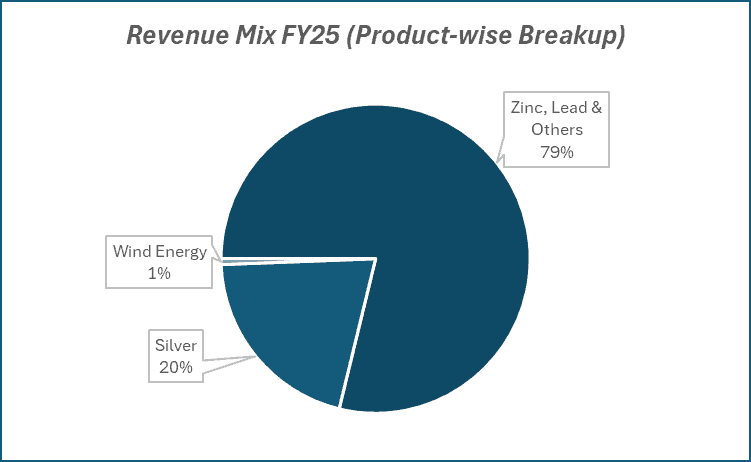

Key business segments

Hindustan Zinc Ltd. operates primarily in the following key business segments:

- Zinc & Lead: Primary revenue driver catering to galvanization, infrastructure, automobiles, and consumer durables.

- Silver: One of the world’s largest silver producers, benefiting from both industrial and investment demand.

- Alloys & Value-Added Products: Special high-grade zinc alloys for specialized industrial applications.

- Captive Power: Thermal and renewable power generation supporting mining and smelting operations.

Primary growth factors for Hindustan Zinc Ltd.

Hindustan Zinc Ltd. key growth drivers:

- Infrastructure & Construction Demand: Zinc demand driven by steel galvanization and urban infrastructure.

- Silver Upside: Growing use in electronics, solar panels, and EV-related applications.

- Cost Leadership: High-grade reserves and integrated operations keep costs among the lowest globally.

- Capacity Expansion: Debottlenecking and mine expansion initiatives to sustain volumes.

- Energy Efficiency & Renewables: Increasing renewable mix lowering long-term power costs.

Detailed competition analysis for Hindustan Zinc Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Hindustan Zinc Ltd. | 34021.00 | 17623.00 | 51.80% | 10564.00 | 31.05% | 25.14 |

| Vedanta Ltd. | 157262.00 | 43885.00 | 27.91% | 17773.00 | 11.30% | 13.57 |

| Hindalco Industries Ltd. | 253570.00 | 33291.00 | 13.13% | 17760.00 | 7.00% | 11.71 |

| Hindustan Copper Ltd. | 2293.58 | 868.40 | 37.86% | 572.65 | 24.97% | 92.34 |

| Gravita India Ltd. | 4108.93 | 375.56 | 9.14% | 362.01 | 8.81% | 37.91 |

Key insights on Hindustan Zinc Ltd.

- Global Cost Advantage: Among the lowest zinc cash-cost producers worldwide.

- Strong Cash Generation: High operating margins translate into robust free cash flows.

- High Dividend Yield: Consistent payouts supported by a strong balance sheet.

- Long Mine Life: Rich reserve base provides long-term production visibility.

- Commodity Optionality: Silver adds counter-cyclical and valuation support.

Recent financial performance of Hindustan Zinc Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 8252.00 | 7771.00 | 8549.00 | 10.01% | 3.60% |

| EBITDA (₹ Cr.) | 4123.00 | 3859.00 | 4445.00 | 15.19% | 7.81% |

| EBITDA Margin (%) | 49.96% | 49.66% | 51.99% | 233 bps | 203 bps |

| PAT (₹ Cr.) | 2327.00 | 2234.00 | 2649.00 | 18.58% | 13.84% |

| PAT Margin (%) | 28.20% | 28.75% | 30.99% | 224 bps | 279 bps |

| Adjusted EPS (₹) | 5.51 | 5.29 | 6.27 | 18.53% | 13.79% |

Hindustan Zinc Ltd. financial update (Q2 FY26)

Financial performance

- Consolidated revenue increased 4% YoY to ₹8,549 crore, driven by favourable zinc and silver prices, partly offset by lower volumes.

- EBITDA rose 8% YoY to ₹4,445 crore, with margins expanding to 52.0% (vs 50.0% YoY), supported by better pricing and lower cost of production.

- Zinc cost of production declined to USD 994/t (-7% YoY), aided by softer input costs and higher by-product credits.

- PBT grew ~14% YoY, reflecting operating leverage and cost efficiencies.

- PAT increased 14% YoY to ₹2,649 crore, beating estimates on stronger margins.

Business highlights

- Mined metal production stood at 258 kt (+1% YoY), supported by improved ore grades and recoveries.

- Saleable silver production declined 22% YoY to 144 tonnes, tracking lower lead output.

- Renewable energy accounted for 19% of total power consumption, helping structurally lower energy costs.

- EBITDA per tonne improved sequentially, reflecting sustained cost discipline.

- Refined metal output was 247 kt, with zinc production up 2% YoY, while lead output declined due to lower pyro plant availability.

Outlook

- Refined metal guidance revised to 1,075–1,000 KTPA and silver output to ~680 tonnes for FY26, factoring plant availability.

- Zinc CoP expected to decline further to USD 950–975/t by Q4FY26, driven by higher renewable usage and better grades.

- Silver output is likely to improve to 750–800 TPA by FY27 as new recovery units stabilise.

- ₹16,000 crore capex pipeline supports capacity expansion, debottlenecking, and tailings reprocessing over FY26–28.

- Strong balance sheet and industry-leading margins provide resilience amid metal price volatility.

Recent Updates on Hindustan Zinc Ltd.

- Renewable Energy Push: Increasing renewable sourcing to reduce carbon footprint.

- Exploration Activity: Ongoing exploration to extend reserve life and resource base.

- Operational Optimization: Focus on automation and digital mining for productivity gains.

- Value-Added Products: Higher focus on specialized alloys and premium zinc grades.

Company valuation insights – Hindustan Zinc Ltd.

Hindustan Zinc is currently trading at an EV/EBITDA of 11.4x and has delivered a strong 1-year return of 33.7%, significantly outperforming the NIFTY 50’s 9.7%.

This outperformance reflects a favourable commodity price environment particularly for zinc and silver along with the company’s industry-leading cost position and consistently high margins, rather than any one-off factors.

The investment case for Hindustan Zinc is anchored in its structural cost leadership, strong pricing leverage to zinc and silver, and a clear volume growth roadmap through mine expansion, smelter debottlenecking, and capacity additions. Declining zinc cost of production, driven by higher renewable energy usage and better ore grades, continues to support margin resilience. Additionally, silver production optionality, stabilization of recovery units, and a large, well-phased ₹16,000 crore capex pipeline enhance medium- to long-term earnings visibility. A strong balance sheet, high cash generation, and consistent dividends further reinforce the quality of the franchise.

From a valuation perspective, applying an 8.5x EV/EBITDA multiple to Adj. Sep’27E EBITDA, we arrive at a 12-month target price of ₹780, implying an upside of 24% from current levels. On a shorter-term basis, we assign a 3-month target of ₹665, offering 6% upside, supported by resilient metal prices, improving cost efficiencies, and steady execution on expansion projects.

Major risk factors affecting Hindustan Zinc Ltd.

- Commodity Price Volatility: Zinc and silver prices are sensitive to global economic cycles.

- Regulatory & Royalty Changes: Mining regulations and government levies can impact profitability.

- Parent-Level Overhang: Corporate actions at the promoter level may influence sentiment.

- ESG & Environmental Risks: Stricter norms may raise compliance costs over time.

Technical analysis of Hindustan Zinc Ltd. share

Hindustan Zinc had been trading in a prolonged sideways consolidation and has recently broken out above the upper trendline with a sharp ~22% up move in less than a month, signalling a potential transition into a fresh uptrend. The breakout is supported by improving volumes and a constructive price structure, indicating renewed accumulation.

The stock is now comfortably placed above its 50-, 100-, and 200-day EMAs, reinforcing strong long-term trend strength and sustained buying support across timeframes.

Momentum indicators remain supportive of the bullish setup. MACD at 33.58 is firmly positive, with the MACD line holding above the signal line, signalling strengthening underlying momentum.

RSI at 72.62 reflects strong buying momentum, while Relative RSI (0.23 over 21 days and 0.19 over 55 days) highlights continued outperformance versus the broader market. ADX at 46.52 indicates a strong and well-established trend, with rising directional conviction.

A decisive move above ₹665 could open the path toward ₹780 (12-month target). On the downside, ₹570 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 72.62 (Strong Buying Momentum)

- ADX: 46.52 (Strong Trend Strength)

- MACD: 33.58 (Positive)

- Resistance: ₹665

- Support: ₹570

Hindustan Zinc Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹665 (6% upside) and a 12-month target of ₹780 (24% upside), based on 8.5x EV/EBITDA on Adj. Sep’27E EBITDA.

Why buy now?

Structural demand tailwinds: Zinc and silver demand supported by infrastructure, galvanisation, and energy transition.

Cost leadership: Falling zinc CoP and higher renewable usage support margins across cycles.

Silver upside: Improving recovery and firm prices add earnings optionality.

Growth visibility: ₹16,000 crore capex pipeline underpins medium-term volume expansion.

Cash flow strength: Strong cash generation and steady dividends enhance downside protection.

Portfolio fit

Hindustan Zinc offers high-quality exposure to base and precious metals, combining structural cost leadership, strong cash flows, and expansion-led growth visibility. It is well suited for portfolios seeking commodity-linked earnings upside with margin resilience and capital discipline, complementing both defensive and growth-oriented allocations.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHindustan Zinc Ltd.: Budget 2025-26 opportunities

- Infra-led metal demand: Continued government push on infrastructure, housing, and manufacturing boosts zinc demand for galvanisation and construction.

- Energy transition tailwinds: Renewables, EVs, and grid expansion increase zinc and silver usage in storage, transmission, and industrial applications.

- Make in India support: Policy focus on domestic manufacturing and import substitution favours integrated, low-cost producers like Hindustan Zinc.

- Renewable energy incentives: Support for green power adoption aids cost reduction and margin sustainability through higher renewable mix.

- Critical minerals & recycling focus: Policy emphasis on resource security and recycling supports silver recovery and long-term value creation.

Final thoughts

Hindustan Zinc is a classic cash-generating metals franchise with structural cost advantages and long reserve life. While near-term performance is linked to global commodity cycles, its leadership in zinc and silver, strong balance sheet, and high dividend payouts make it a compelling choice for investors seeking steady cash flows with optional upside from silver and India’s infrastructure-led growth.