As India marches toward greater financial inclusion and rising income levels, the demand for general insurance is steadily increasing. At the forefront of this transformation is ICICI Lombard General Insurance – one of India’s leading private sector general insurers.

With a diversified product portfolio, tech-driven distribution, and strong underwriting practices, ICICI Lombard stands out as a key beneficiary of India’s underpenetrated insurance sector and the ongoing shift toward formal financial protection.

But does ICICI Lombard offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ICICIGI |

| Industry/Sector | Financial Services (Insurance) |

| Market Cap (₹ Cr.) | 92,120 |

| Free Float (% of Market Cap) | 48.13% |

| 52 W High/Low | 2,301.90 / 1,480.50 |

| P/E | 37.04 (Vs Industry P/E of 19.97) |

| EPS (TTM) | 50.59 |

About ICICI Lombard

ICICI Lombard General Insurance Company is India’s largest private non-life insurer in terms of Gross Direct Premium Income (GDPI). Founded as a joint venture between ICICI Bank and Fairfax Financial, it has since emerged as a standalone listed entity with a comprehensive suite of insurance products catering to retail, corporate, and rural clients. It operates across multiple lines – motor, health, fire, marine, engineering, and liability.

Key business segments

ICICI Lombard operates primarily in the following key business segments:

- Motor Insurance – Includes both own-damage and third-party motor vehicle coverage.

- Health Insurance – Retail and group health plans, top-up policies, and fixed benefit products.

- Commercial Lines – Fire, marine, liability, engineering, and crop insurance for corporate clients.

- Travel & Personal Accident – Niche retail offerings aimed at individual risk coverage.

Primary growth factors for ICICI Lombard

ICICI Lombard key growth drivers:

- Low Insurance Penetration – India’s general insurance penetration is still below 1%, offering ample headroom.

- Rising Healthcare Costs – Boosting health insurance demand across urban and semi-urban regions.

- Government Push – Schemes like Ayushman Bharat and crop insurance drive mass adoption.

- Digitisation & Innovation – AI-driven underwriting, paperless claims, and digital onboarding enhance customer experience.

- Regulatory Tailwinds – IRDAI reforms and increasing mandatory cover norms across sectors.

Detailed competition analysis for ICICI Lombard

Key financial metrics – Trailing Twelve Months (TTM);

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE (%) | ROCE (%) | P/E (TTM) |

| ICICI Lombard | 19800.20 | 16.77% | 12.67% | 17.17% | 22.79% | 37.04 |

| LIC India | 494625.46 | 9.09% | 7.77% | 63.13% | 63.34% | 12.60 |

| SBI Life | 84059.83 | 3.20% | 2.87% | 13.77% | 14.12% | 73.60 |

| HDFC Life | 69836.97 | 1.85% | 2.59% | 11.58% | 10.79% | 89.26 |

Key insights on ICICI Lombard

- 14% revenue CAGR and 25% profit CAGR over 3 years, reflecting consistent growth and strong bottom-line performance.

- Dividend payout of 26.5%, indicating a balanced capital allocation strategy.

- Top-3 player in motor and health insurance, backed by market leadership and strong distribution.

- Best-in-class combined ratio ensures profitability through prudent underwriting and cost control.

- Bharti AXA merger expands presence in Tier 2/3 towns and enhances reach.

- Strong balance sheet and tech-led operations support long-term growth and efficiency.

Recent financial performance of ICICI Lombard for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 4368.25 | 5045.17 | 5225.58 | 3.58% | 19.63% |

| EBITDA (₹ Cr.) | 697.79 | 960.11 | 668.20 | -30.40% | -4.24% |

| EBITDA Margin (%) | 15.97% | 19.03% | 12.79% | -624 bps | -318 bps |

| PAT (₹. Cr.) | 519.50 | 724.38 | 509.59 | -29.65% | -1.91% |

| PAT Margin (%) | 11.89% | 14.36% | 9.75% | -461 bps | -214 bps |

| Adjusted EPS (₹) | 10.54 | 14.63 | 10.28 | -29.73% | -2.47% |

ICICI Lombard financial update (Q4 FY25)

Financial performance

- Gross Direct Premium Income (GDPI) for FY25 stood at ₹26,833 crore, registering a growth of 8.3% YoY, outpacing the industry growth of 6.2%.

- Adjusted for the impact of the 1/n accounting norm, GDPI growth was 11% YoY, higher than the industry’s 8.6% growth.

- The investment book grew by 9.4% YoY, with a realised return of 8.42% for the year.

Business highlights

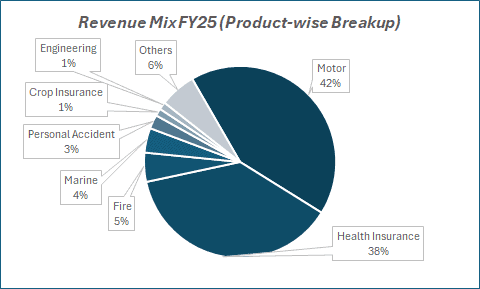

- In the motor insurance segment, GDPI stood at ₹10,740 crore, up 11.5% YoY, contributing approximately 40% to the overall GDPI mix.

- The health insurance segment reported GDPI of ₹7,673 crore, marking a 7.8% YoY growth and accounting for around 28.5% of the total mix.

- Property & casualty insurance GDPI stood at ₹6,995 crore, a modest 2.1% YoY growth, contributing 26.1% to the GDPI mix. Growth in this segment was impacted by muted government spending.

- The crop insurance segment posted a strong 21.3% YoY growth, with GDPI at ₹1,425 crore, contributing about 5% to the total GDPI.

Outlook

- Commercial lines business is expected to improve with the revival in government spending.

- The motor insurance segment remains a key focus area, with mid-single-digit industry growth expected in FY26, supported by increasing penetration in the used vehicle segment.

- The health insurance segment is set to benefit from rising demand for health protection and medical inflation, which are expected to drive double-digit growth in the coming years.

Company valuation insights – ICICI Lombard

ICICI Lombard is trading at a TTM P/E of 37.04, higher than the industry average of 19.97, reflecting its premium positioning. The stock has delivered a 1-year return of 14.62%, ahead of the Nifty 50’s 10.67%.

Despite a soft FY25 for the general insurance industry, impacted by weak infrastructure spending, regulatory changes, and slow credit growth, ICICI Lombard maintained focus on profitable growth. Motor insurance is expected to grow in double digits, supported by improved portfolio segmentation and focus on older and commercial vehicles.

Health insurance continues to gain traction, especially in the retail segment, while early signs of a recovery are visible in commercial lines post-soft fire pricing in FY25.

We expect a growth rebound in FY26 with improving profitability. At 35x FY27E EPS of ₹65.2, we assign a 12-month target price of ₹2,280, implying a 20% upside. The 3-month target stands at ₹2,020, indicating a 7% potential upside.

Major risk factors affecting ICICI Lombard

- Claims Volatility: Spikes in health or catastrophic events can skew loss ratios.

- Regulatory Uncertainty: Pricing controls or structural changes could impact profitability.

- Intense Competition: PSU insurers and newer digital players may erode market share in retail segments.

- Motor Slowdown: Weakness in auto sales directly impacts the motor insurance business.

Technical analysis of ICICI Lombard Share

ICICI Lombard is forming an inverse head and shoulders pattern on the daily chart and is currently consolidating around the neckline. A breakout above this neckline could trigger bullish momentum, making it a potential entry point for traders.

The stock is trading above its 50-, 100-, and 200-day EMAs, reflecting solid trend strength. The MACD is positive at 14.09 and has already shown a bullish crossover, reinforcing short-term momentum.

The RSI stands at 53.47, indicating moderate strength, while the Relative RSI remains slightly negative over both the 21-day (-0.05) and 55-day (-0.02) periods, suggesting mild underperformance versus the broader market.

An ADX reading of 12.57 implies a range-bound trend currently, but a breakout could change the dynamics.

A decisive move above ₹2020, which is a critical resistance, could open the upside towards ₹2280, while ₹1750 remains a strong support zone.

- RSI: 53.47 (Moderate)

- ADX: 12.57 (Range Bound)

- MACD: 14.09 (Positive, Bullish Crossover)

- Resistance: ₹2020

- Support: ₹1750

ICICI Lombard stock recommendation

Current Stance: Buy with a target price of ₹2,020 over a 3-month horizon and ₹2,280 over a 12-month horizon. ICICI Lombard’s leadership in private general insurance, strong brand equity, and consistent focus on profitability position it well to benefit from rising insurance penetration and sector recovery.

Why buy now?

Sector recovery: Growth expected to rebound in FY26 with revival in commercial lines and continued strength in motor and health.

Focused strategy: Gains in retail health and older vehicle motor segments support premium growth.

Profitability levers: Strong combined ratio and investment returns; margins set to improve by FY27.

Valuation comfort: Trading at 35x FY27E EPS with clear visibility on earnings recovery.

Portfolio fit

ICICI Lombard fits well in portfolios focused on financials, retail participation, and defensive plays with consistent cash flows. Its dominance in non-life insurance, strong underwriting discipline, and recovery potential make it a stable, long-term compounder in the essential services space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebICICI Lombard: Budget 2025-26 opportunities

- Health Insurance Push: Higher budget allocation for healthcare and Ayushman Bharat to boost retail health insurance penetration.

- Infra & Auto Capex: Increased capital outlay to support motor insurance growth through higher vehicle sales and commercial activity.

- Crop & Rural Focus: Enhanced rural spending and crop insurance subsidies to drive growth in the agri and crop segments.

- Digital Infra: Government’s push on digital health and insurance tech to improve reach, efficiency, and customer onboarding.

- MSME Support: Credit and protection schemes for MSMEs to expand demand for property and liability insurance products.

Final thoughts

Imagine an India where every household has a health cover, every car is insured digitally within minutes, and SMEs get instant fire coverage via an app. ICICI Lombard is positioning itself at the heart of this transformation. For investors, it offers exposure to a secular growth story rooted in rising awareness, regulatory support, and economic formalisation.

Its disciplined capital allocation, best-in-class claims management, and growing rural reach make it an attractive long-term compounder in the financial services space. As India insures its future, ICICI Lombard could insure your portfolio’s stability and growth.