India’s life insurance sector is undergoing a structural shift, from pure savings-oriented products to protection, annuity, and long-term wealth solutions. In this evolving landscape, ICICI Prudential Life Insurance Ltd stands out as one of the most consistent private life insurers, combining strong distribution, product innovation, and disciplined capital management. With rising financial awareness and under-penetration of life insurance in India, ICICI Prudential is well positioned to compound steadily over the next decade.

But does ICICI Prudential Life Insurance Company Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ICICIPRULI |

| Industry/Sector | Financial Services (Insurance) |

| CMP | 678 |

| Market Cap (₹ Cr.) | 98,210 |

| P/E | 70.75 (Vs Industry P/E of 13.34) |

| 52 W High/Low | 706.80 / 525.80 |

| EPS (TTM) | 9.46 |

| Dividend Yield | 0.13% |

About ICICI Prudential Life Insurance Company Ltd.

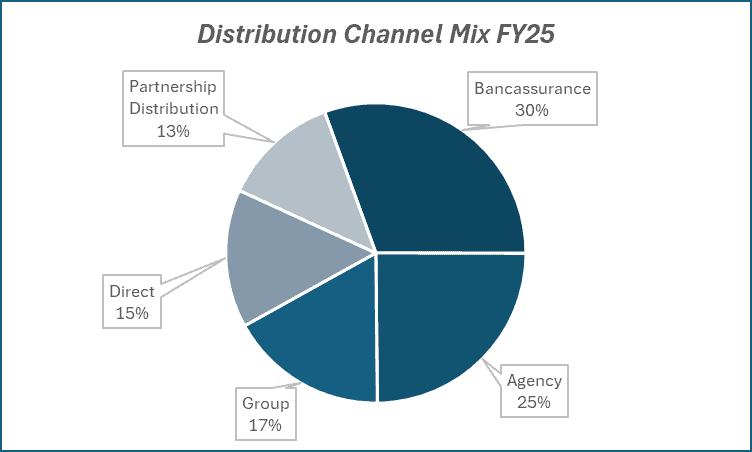

ICICI Prudential Life Insurance is among India’s leading private life insurers, promoted by ICICI Bank and Prudential Corporation Holdings (UK). The company offers a comprehensive suite of life insurance solutions spanning protection, savings, investment-linked products, retirement, and annuities. Its strategy is centred on high-quality growth, superior persistence, and a balanced product mix, supported by one of the strongest bancassurance-led distribution networks in the country.

Key business segments

ICICI Prudential Life Insurance Company Ltd. operates primarily in the following key business segments:

- Protection Plans: Term insurance and pure risk products with high margins and long-term value.

- Savings & Investment (PAR & ULIP): Participating and unit-linked plans catering to long-term wealth creation.

- Annuity & Retirement Solutions: Pension and annuity products addressing India’s growing retirement needs.

- Group Insurance: Employee benefit and credit life products through corporate partnerships.

Primary growth factors for ICICI Prudential Life Insurance Company Ltd.

ICICI Prudential Life Insurance Company Ltd. key growth drivers:

- Rising Protection Awareness: Increasing demand for term insurance and pure protection products.

- Bancassurance Strength: Deep integration with ICICI Bank provides cost-efficient customer acquisition.

- Annuity Opportunity: Structural growth in retirement planning and guaranteed income products.

- Product Mix Improvement: Shift toward protection and annuities enhances margins and VNB quality.

- Digital & Analytics: Use of data-driven underwriting and digital onboarding improves efficiency.

Detailed competition analysis for ICICI Prudential Life Insurance Company Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| ICICI Prudential LIC Ltd. | 48524.72 | 1875.65 | 3.87% | 1369.25 | 2.82% | 70.75 |

| LIC India Ltd. | 501767.94 | 55056.87 | 10.97% | 46714.51 | 9.31% | 10.23 |

| SBI Life Insurance Ltd. | 90715.06 | 2682.12 | 2.96% | 2453.29 | 2.70% | 84.55 |

| HDFC Life Insurance Ltd. | 75605.06 | 2020.91 | 2.67% | 1890.19 | 2.50% | 84.64 |

| ICICI General Insurance Ltd. | 21698.62 | 3608.93 | 16.63% | 2734.97 | 12.60% | 33.85 |

Key insights on ICICI Prudential Life Insurance Company Ltd.

- Strong VNB Margins: Focus on protection and annuity has structurally lifted profitability metrics.

- Healthy Solvency: One of the strongest solvency ratios among private life insurers, enabling growth headroom.

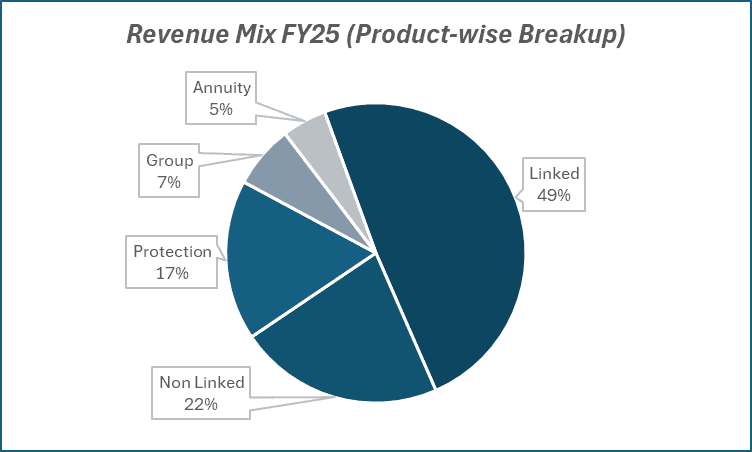

- Balanced Portfolio: Well-diversified across ULIP, non-linked, and protection products.

- Superior Persistency: Consistent improvement in renewal and long-term policy retention.

- Capital Discipline: Regular dividend payouts alongside reinvestment for growth.

Recent financial performance of ICICI Prudential Life Insurance Company Ltd. for Q3 FY26

| Metric | Q3 FY25 | Q2 FY26 | Q3 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 12261.37 | 11843.10 | 11809.26 | -0.29% | -3.69% |

| EBITDA (₹ Cr.) | 410.19 | 389.26 | 498.15 | 27.97% | 21.44% |

| EBITDA Margin (%) | 3.35% | 3.29% | 4.22% | 93 bps | 87 bps |

| PAT (₹ Cr.) | 324.91 | 295.83 | 387.15 | 30.87% | 19.16% |

| PAT Margin (%) | 2.65% | 2.50% | 3.28% | 78 bps | 63 bps |

| Adjusted EPS (₹) | 2.25 | 2.04 | 2.67 | 30.88% | 18.67% |

ICICI Prudential Life Insurance Company Ltd. financial update (Q3 FY26)

Financial performance

- New business APE increased 4% YoY to ₹25.3 crore, driven by strong protection growth, partly offset by a decline in group business.

- Value of New Business (VNB) rose 19% YoY to ₹6.2 crore, supported by favourable product mix and higher protection contribution.

- VNB margin expanded sharply by 320 bps YoY to 24.4%, beating estimates by ~90 bps, aided by higher non-linked and protection shares.

- PAT grew 19% YoY to ₹387 crore, significantly ahead of expectations, reflecting operating leverage and margin expansion.

- Cost discipline remained intact, with 9M FY26 cost ratio improving to 19.3% despite loss of input tax credit post GST changes.

Business highlights

- Protection APE grew 19% YoY, with protection contribution rising to 18.4% of total APE (vs 16.0% YoY), supported by GST exemption and higher sum assured.

- Non-linked savings contribution improved materially, driving overall margin expansion.

- Retail business continued to strengthen, with retail contributing ~84% of total APE, while group business declined 43% YoY due to a lumpy base.

- Assets under management increased 7% YoY to ₹3.3 trillion, reflecting steady inflows and market-linked growth.

- Solvency ratio improved to a healthy 214.8%, well above regulatory requirement, reinforcing balance sheet strength.

- Persistency remained a monitorable, with 13th-month persistency at 81%, though management expects recovery to 85%+ over the next year.

Outlook

- Management maintained APE growth guidance for FY26–28, supported by improving momentum in protection and non-linked products.

- VNB margin outlook upgraded, with expectations of sustained improvement driven by product mix shift, rider attachments, and yield curve tailwinds.

- Protection remains a structural growth lever, with only ~13% of India’s population currently insured.

- Cost ratios expected to remain structurally lower, with most efficiency initiatives already embedded.

- Strong solvency, rising retail protection penetration, and stable margins position ICICI Prudential well for consistent RoEV improvement amid regulatory and market volatility.

Recent Updates on ICICI Prudential Life Insurance Company Ltd.

- Product Refresh: Continued launch of simplified protection and annuity offerings.

- Digital Push: Enhancements in straight-through processing and customer self-service platforms.

- Distribution Expansion: Deeper penetration beyond metros through bank branches and digital channels.

- ESG Focus: Increasing emphasis on responsible investing within ULIP portfolios.

Company valuation insights – ICICI Prudential Life Insurance Company Ltd.

ICICI Prudential Life Insurance is currently trading at a TTM EV/Revenue multiple of 1.8x and has delivered a muted 1-year return of 4.1%, underperforming the NIFTY 50’s 10.5% over the same period. This underperformance reflects near-term moderation in APE growth, pressure on persistency metrics, and a weaker group business cycle, rather than any structural deterioration in the franchise.

The investment case for ICICI Prudential is anchored in its improving product mix, rising protection contribution, and sustained VNB margin expansion. The company continues to execute well on its strategic pivot towards high-margin non-linked savings and retail protection, with protection APE growing 19% YoY and overall protection contribution rising to 18.4% of APE. GST exemption for protection products, higher rider attachment, increasing average sum assured, and favourable yield curve movements provide structural tailwinds to margins.

Despite the loss of input tax credit, VNB margins expanded to 24.4%, highlighting strong operating discipline. A healthy solvency ratio of ~215%, diversified distribution architecture, and steady improvement in cost ratios further reinforce balance sheet strength and earnings resilience. Over the medium term, improving persistency, normalization of group business, and sustained retail traction should support a steady RoEV trajectory.

From a valuation perspective, applying a 1.7x EV/Revenue multiple to FY27E, we arrive at a 12-month target price of ₹815, implying an upside of ~20% from current levels. On a shorter-term basis, we assign a 3-month target of ₹715, offering ~5% upside, supported by stable margins, improving protection momentum, and sustained execution on product mix optimization.

Major risk factors affecting ICICI Prudential Life Insurance Company Ltd.

- Market Volatility: ULIP-linked revenues are sensitive to equity market movements.

- Regulatory Changes: Changes in product regulations or commissions can impact profitability.

- Competition: Intense competition from other private insurers in protection pricing.

- Persistency Risk: Slippage in renewal ratios can affect long-term value creation.

Technical analysis of ICICI Prudential Life Insurance Company Ltd. share

ICICI Prudential Life Insurance has formed a rounding bottom pattern, with prices currently hovering around the neckline. A sustained breakout from this zone could signal the start of fresh upside momentum, marking a transition from base formation to an emerging uptrend.

The stock is now comfortably placed above its 50-, 100-, and 200-day EMAs, reinforcing strong long-term trend strength and indicating sustained buying support across timeframes.

Momentum indicators are constructive. MACD at 12.39 remains positive, though the MACD line is just below the signal line, suggesting a potential entry opportunity on a bullish crossover. RSI at 56.13 reflects healthy buying momentum, while Relative RSI (0.05 over 21 days and 0.13 over 55 days) highlights continued outperformance versus the broader market. ADX at 37.68 points to a strong and well-established trend with improving directional conviction.

A decisive move above ₹715 could open the path toward ₹815 (12-month target). On the downside, ₹640 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 56.13 (Healthy Buying Momentum)

- ADX: 37.68 (Strong Trend Strength)

- MACD: 12.39 (Positive, crossover awaited)

- Resistance: ₹715

- Support: ₹640

ICICI Prudential Life Insurance Company Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹715 (5% upside) and a 12-month target of ₹815 (20% upside), based on 1.7x FY27E EV/Revenue.

Why buy now?

Structural protection runway: Low insurance penetration offers long-term growth visibility.

Margin expansion: Product mix shift towards protection and non-linked savings supports VNB margins.

GST tailwinds: Protection GST exemption is boosting demand and affordability.

Balance sheet strength: High solvency provides resilience and growth flexibility.

Cost discipline: Operating efficiencies support stable RoEV and earnings visibility.

Portfolio fit

ICICI Prudential Life Insurance offers high-quality exposure to India’s long-term life insurance growth story, backed by improving margins, strong solvency, and a diversified distribution platform. It is well suited for portfolios seeking structural compounding, balance sheet strength, and relatively defensive earnings visibility, complementing both growth-oriented and core financial sector allocations.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebICICI Life Insurance Prudential Company Ltd.: Budget 2025-26 opportunities

- Financial inclusion push: Higher focus on insurance penetration and social security expands the addressable life insurance market.

- Protection & savings incentives: Continued tax and regulatory support for long-term savings and protection products aids demand.

- Digital public infrastructure: Budget thrust on digital adoption improves distribution efficiency and customer onboarding.

- Household financialisation: Policy emphasis on channelising savings into financial assets supports long-term premium growth.

- Regulatory stability: Predictable policy framework strengthens margins, solvency, and long-term compounding visibility.

Final thoughts

ICICI Prudential Life Insurance offers a high-quality, structurally compounding play on India’s rising insurance penetration. Its strong protection franchise, annuity-led retirement opportunity, and bancassurance dominance provide visibility and resilience across cycles. For investors seeking long-term exposure to financialisation, demographics, and protection-led growth, ICICI Prudential remains a core life insurance compounder with a disciplined and shareholder-friendly approach.