Stock overview

| Ticker | INDHOTEL |

| Sector | Hospitality / Hotels |

| Market Cap | ₹ 1,11,900 Cr |

| CMP (Current Market Price) | ₹ 798 |

| 52-Week High/Low | ₹ 895/506 |

| P/E Ratio | 71x |

| Beta | 1.15 (Moderate volatility) |

About Indian Hotels

Indian Hotels Company Limited (IHCL), a part of the Tata Group, is India’s largest hotel company in terms of market cap and room inventory. With a portfolio of Taj, Vivanta, SeleQtions, and Ginger, IHCL has transformed over the last few years through asset-light expansion, strong profitability focus, and brand premiumisation.

This report provides a deep dive into the business fundamentals, financial trajectory, growth catalysts, valuation metrics, and investment thesis.

Primary growth factors for Indian Hotels

1. Asset-Light model driving expansion

- 50%+ of new signings are management contracts.

- Reduces capital intensity, boosts ROCE.

- 50+ hotels in pipeline under the “Aspiration 2025” strategy.

2. Premiumisation & brand strength

- Taj is consistently rated as “India’s Strongest Brand”.

- Luxury and upscale segments (₹10,000+ ADR) are outperforming budget hotels.

3. Domestic travel boom

- Surge in leisure and business travel post-COVID.

- Tier-II, III city expansion to capture the next wave of domestic demand.

- Inbound foreign travel is also seeing double-digit growth.

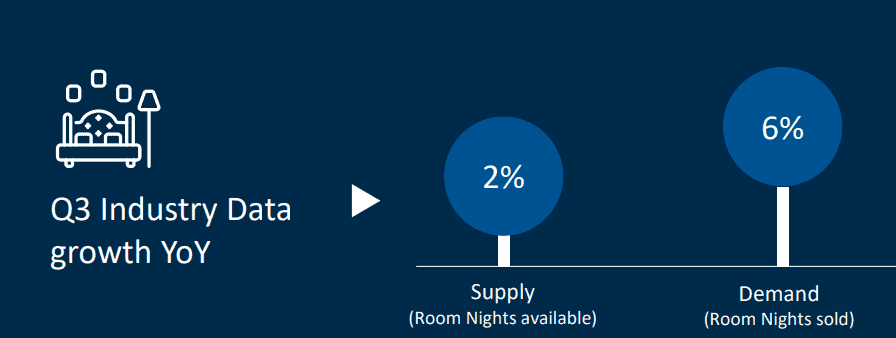

- The demand growth continues to outpace supply growth, as indicated in the chart below

4. Strong performance in ancillary businesses

- TajSATS (catering) contributing 10%+ of revenue.

- Qmin (food delivery) is scaling steadily.

- Ama Stays is tapping into the luxury homestay market.

5. Margin expansion initiatives

- Dynamic pricing tools.

- Operational efficiencies.

- Outsourcing non-core services.

6. Sustainability focus

- Taj has 80+ “EarthCheck Certified” hotels.

- Green initiatives leading to cost savings and brand equity improvement.

Q3 FY25 Financial performance

| Metric | Q3 FY 25 | YoY Growth | QoQ Growth |

| Revenue | ₹ 2,592 cr | 29% | 37% |

| EBITDA | ₹ 962 cr | 31% | 92% |

| EBITDA Margin | 38.0% | 0.7% pt | 11.5% pt |

| PAT | ₹ 614 cr | 40% | 7% |

| PAT Margin | 22.5% | -0.1% pt | -7.8% pt |

- Indian Hotels has been able to deliver exceptional Q3 FY 25 results with a healthy growth in both revenue and profitability at a YoY level.

- Indian Hotels is involved in the following strategic initiatives as well :

- Aspiration 2025 vision:

- 300 hotels portfolio.

- 33% EBITDA margin target.

- Net cash balance sheet.

- Ginger repositioning:

- Transforming Ginger hotels into “lean luxury”.

- Higher room rates, better occupancies.

- International expansion:

- Focus on the Middle East (Dubai, Saudi Arabia).

- Selective property openings in Europe & USA.

- Digital transformation:

- Enhanced direct bookings via the “Taj InnerCircle” loyalty program.

- AI/ML tools for personalised customer engagement.

Detailed competition analysis for Indian Hotels

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Indian Hotels | ₹ 1,11,900 cr | ₹ 2,592 cr | 71 x | 15% |

| EIH | ₹ 24,000 cr | ₹ 800 cr | 34 x- | 23% |

| Chalet Hotels | ₹ 18,000 cr | ₹ 457 cr | 178 x | 10% |

Indian Hotels Competitive Advantages:

- Strong brand recall (Taj = heritage + luxury).

- Pan-India presence vs metro-centric peers.

- Balanced brand portfolio across segments.

- Faster adoption of the asset-light model vs competitors.

- Backed by Tata Group’s credibility and access to capital.

Company valuation insights: Indian Hotels

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Indian Hotels shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹900 per share

- Upside Potential: 15%

- WACC: 11.7%

- Terminal Growth Rate: 5.1%

While valuations are at a premium compared to global peers (Marriott, Hilton), they are justified by:

- Strong structural demand tailwinds in India.

- Superior brand positioning.

- High-margin asset-light growth engine.

Major risk factors affecting Indian Hotels

- Economic slowdown: High correlation to discretionary spend.

- Competitive intensity: International brands are expanding rapidly.

- Cost inflation: Wage and energy inflation can impact margins.

- Geopolitical risks: Global travel can be disrupted.

- Execution risks: Slower-than-expected scaling in asset-light portfolio.

Technical analysis of Indian Hotels

- Resistance: ₹880

- Support: ₹755

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 46 (Neutral)

- 50-Day Moving Average: ₹768

- 200-Day Moving Average: ₹670

- MACD: Positive crossover; bullish divergence

The stock is likely to consolidate before the next leg up. Any dip toward the ₹700–₹725 zone may offer a buying opportunity.

Indian Hotels stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: 850 (6-month horizon); ₹920 (12-month horizon)

Investment Horizon: 2–4 years for multibagger potential

Rationale

Recommend a Buy on Dips / Accumulate approach for Indian Hotels based on:

Best-in-class brand portfolio and operational excellence.

Asset-light expansion strategy ensures sustainable growth.

Strong financial turnaround with consistent profitability.

Tailwinds from India's tourism and business travel surge.

Attractive ancillary revenue levers (TajSATS, Qmin, Ama).If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Indian Hotels is a category leader with multiple secular tailwinds, domestic travel boom, luxury premiumisation, asset-light expansion, strong ancillary business growth, and robust balance sheet strength. Its Tata Group pedigree and execution capabilities further enhance its appeal.

Despite rich valuations, IHCL offers a compelling long-term investment opportunity on the back of earnings compounding and margin expansion.