In a rapidly evolving automotive landscape shaped by electrification, lightweighting, premium vehicle features, and shifting global supply chains, Samvardhana Motherson International Ltd has emerged as one of India’s most successful auto-component giants with a strong global footprint. From a single plant in 1986, the company has grown into a diversified multinational supplying components and modules to some of the world’s largest automotive OEMs. Strong order visibility, robust global acquisitions, and a focus on non-auto diversification make it a compelling structural growth story.

But does Samvardhana Motherson International Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | MOTHERSON |

| Industry/Sector | Automobile |

| CMP | 109.80 |

| Market Cap (₹ Cr.) | 1,15,962 |

| P/E | 33.35 (Vs Industry P/E of 37.78) |

| 52 W High/Low | 116.38 / 71.50 |

| EPS (TTM) | 3.36 |

| Dividend Yield | 0.51% |

About Samvardhana Motherson International Ltd.

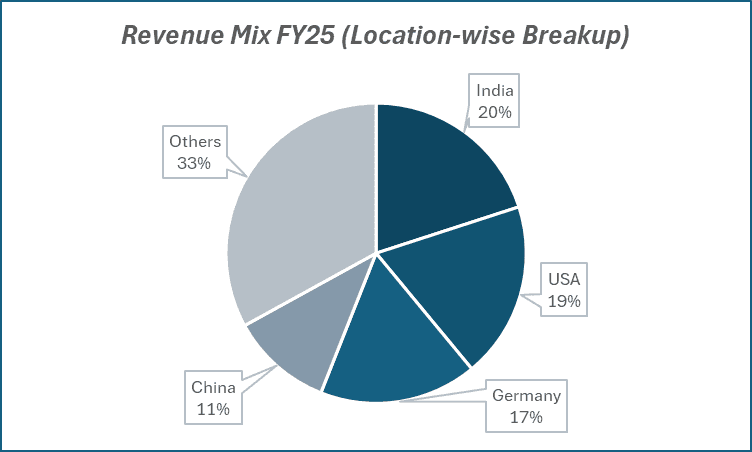

Headquartered in Noida, Samvardhana Motherson (SAMIL) is one of the world’s largest automotive component manufacturers, supplying to passenger vehicles, commercial vehicles, two-wheelers, aerospace, railways, and off-highway segments. The company operates more than 350+ facilities across 40+ countries and derives the majority of its revenue from international markets.

Over decades, SAMIL has built a strong reputation for reliability, scale, and execution through long-term partnerships with global clients including Mercedes-Benz, BMW, Volkswagen, Toyota, and Stellantis.

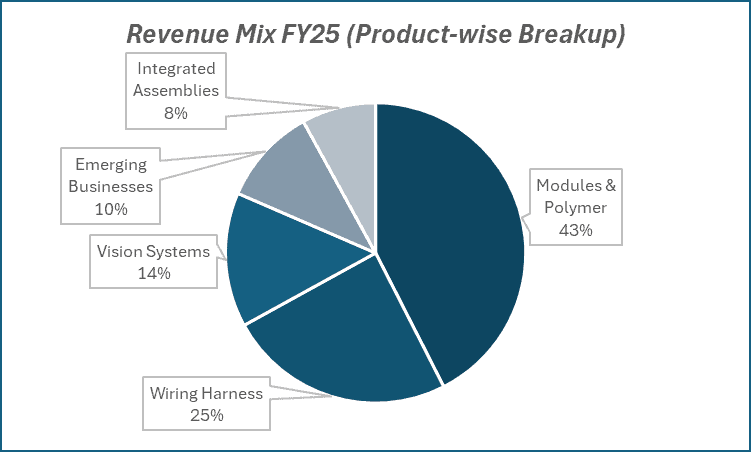

Key business segments

Samvardhana Motherson International Ltd. operates primarily in the following key business segments:

- Wiring Harness & Electrical Systems: A global leader in wiring harnesses, connectors, and modules supplying major OEMs; high entry barriers due to precision and safety requirements.

- Vision Systems: Manufactures rear-view mirrors, camera modules, ADAS-related safety systems, and smart surfaces, benefiting from rising safety regulations and premium vehicle adoption.

- Polymer & Modules: Interior and exterior components such as dashboards, bumpers, lighting, and trimming systems with an increasing shift toward lightweight materials for EVs.

- Emerging & Diversified Businesses: Aerospace & defence components, railway systems, logistics solutions, and recently expanding into medical technology and clean mobility.

Primary growth factors for Samvardhana Motherson International Ltd.

Samvardhana Motherson International Ltd. key growth drivers:

- EV & premium vehicle growth driving demand for high-content components like wiring harnesses, ADAS systems, and lightweight polymer parts.

- Strong global acquisitions pipeline supporting scale, diversification, and deeper wallet share with existing OEMs.

- Diversification beyond automotive reduces cyclicality and expands the addressable market.

- Localisation & China+1 strategy creating greater opportunities for Indian manufacturing exports.

- Increasing content per vehicle across EVs and high-end models lifting margin potential.

Detailed competition analysis for Samvardhana Motherson International Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBIT (₹ Cr.) | EBIT Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Motherson Intl. Ltd. | 117367.72 | 10200.93 | 8.69% | 3046.34 | 2.60% | 33.35 |

| Bosch Ltd. | 18959.70 | 2485.90 | 13.11% | 2681.10 | 14.14% | 40.75 |

| UNO Minda Ltd. | 18015.43 | 2078.58 | 11.54% | 969.65 | 5.38% | 63.38 |

| Tube Investments Ltd. | 20793.88 | 1918.01 | 9.22% | 1043.87 | 5.02% | 55.67 |

| Endurance Tech Ltd. | 12724.36 | 1715.70 | 13.48% | 883.14 | 6.94% | 43.83 |

Key insights on Samvardhana Motherson International Ltd.

- Deep, multi-decade customer relationships provide sticky revenue and strong visibility.

- Global manufacturing footprint provides supply chain advantage and cost competitiveness.

- Order book remains strong due to transition toward EV, hybrid, and intelligent mobility ecosystems.

- Margin improvement potential through restructuring acquired entities and operating leverage.

- Reduction in debt levels from internal cash generation strengthens financial discipline.

Recent financial performance of Samvardhana Motherson International Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 27811.86 | 30212.00 | 30172.97 | -0.13% | 8.49% |

| EBITDA (₹ Cr.) | 2447.94 | 2261.55 | 2610.72 | 15.44% | 6.65% |

| EBITDA Margin (%) | 8.80% | 7.49% | 8.65% | 116 bps | -15 bps |

| PAT (₹ Cr.) | 764.58 | 481.82 | 700.00 | 45.28% | -8.45% |

| PAT Margin (%) | 2.75% | 1.59% | 2.32% | 73 bps | -43 bps |

| EPS (₹) | 0.83 | 0.49 | 0.78 | 59.18% | -6.02% |

Samvardhana Motherson International Ltd. financial update (Q2 FY26)

Financial performance

- Revenue up 8.5% YoY to ₹30,173 crore, outperforming 3% global LV growth.

- Normalised EBITDA up double-digit to ₹2,719 crore; PAT up double-digit to ₹700 crore despite ~$10M tariff impact.

- Polymer margins improved QoQ from 6.4% to 7.4%.

- Emerging businesses margin up 110 bps QoQ to 9.5%, supported by aerospace (37% H1 growth) and consumer electronics (36% QoQ growth).

Business highlights

- Order book: Strong at $87.2B, offering 5–6 years revenue visibility.

- EV revenue: At 11%, balanced ICE–EV exposure; order book mix aligns with moderated EV adoption trends.

- European turnaround: 75–80% complete, driving sequential profitability improvement.

- Strategic acquisitions progressing: Yutaka (US$1.2B revenue) expected Q1 FY27; Atsumitec integration gaining traction.

Outlook

- Management cautiously optimistic on stronger H2 execution and improving margins.

- CAPEX guidance ₹6,000 crore +10%, focused on growth infrastructure & automation.

- Leverage stable at 1.1x, expected to improve to ~0.9x by FY26-end.

- ROCE at 14.2%, expected to rise as greenfield facilities scale.

Recent Updates on Samvardhana Motherson International Ltd.

- New acquisition activity in aerospace, medical devices, and logistics to accelerate diversification.

- New contracts secured from premium OEMs in the EV segment across Europe and the US.

- Expansion of ADAS-enabled mirrors and camera systems with increased global demand.

- Capacity additions across India, Mexico, and Eastern Europe for wiring harness production.

Company valuation insights – Samvardhana Motherson International Ltd.

Samvardhana Motherson trades at a TTM P/E of 33.35x, below the industry average of 37.78x, reflecting reasonable valuation amid temporary restructuring headwinds. The stock has delivered -0.3% 1-year return vs. Nifty 50’s 9%, but improving operational performance and margin recovery support a turnaround outlook.

A strong USD 87.2B order book provides 5–6 years of revenue visibility, while restructuring progress in Europe (75–80% complete) and scaling non-auto businesses (aerospace +37% YoY, consumer electronics +36% QoQ) are expected to accelerate profitability. Strengthening leverage (net debt/EBITDA heading to ~0.9x) and expected RoCE improvement (to ~12% by FY27E) support valuation re-rating potential.

We value SAMIL at 25x FY27E EPS of ₹5.4, implying a 12-month target price of ₹135 (23% upside) and a 3-month target of ₹116 (6% upside).

Major risk factors affecting Samvardhana Motherson International Ltd.

- Slowdown in the global auto market, particularly in Europe & China.

- Integration challenges with large-scale acquisitions.

- High dependence on global OEM production cycles.

- FX volatility due to large international revenue exposure.

- Intensifying competition in EV components and ADAS technologies.

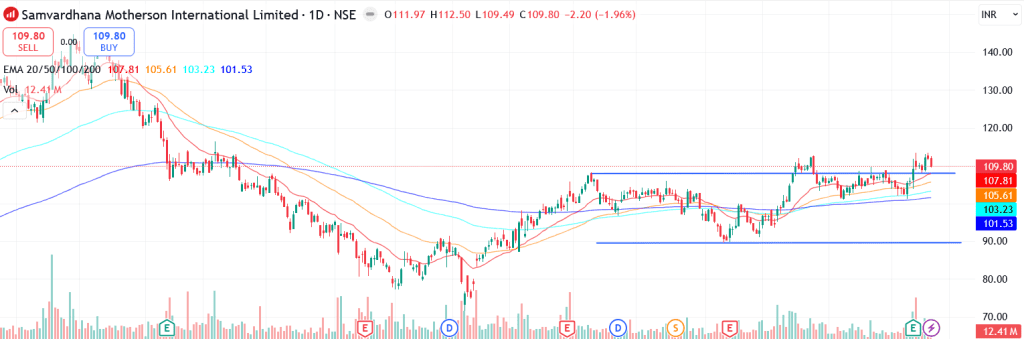

Technical analysis of Samvardhana Motherson International Ltd. share

Samvardhana Motherson is currently trading within a sideways consolidation channel, hovering near the upper trendline. A decisive breakout above this resistance could trigger a meaningful bullish continuation, signalling the start of a fresh upward leg. The stock’s ability to hold near resistance despite volatility indicates strong underlying accumulation.

The stock remains comfortably above its 50-day, 100-day, and 200-day EMAs, reinforcing the durability of its medium- to long-term bullish structure. Sustaining above these averages will be essential for maintaining positive sentiment and enabling a breakout-driven rally.

Momentum indicators support the bullish setup. The MACD at 1.51 stays firmly positive, with the MACD line well above the signal line, reflecting strengthening buying momentum.

The RSI at 57.83 indicates healthy bullish sentiment without overbought pressure, while relative RSI readings of 0.03 (21-day) and 0.07 (55-day) confirm consistent outperformance vs. the broader market.

Additionally, the ADX at 22.64 reflects a developing trend strength, suggesting that directional conviction is gradually building and could accelerate on a breakout.

A clear breakout above ₹116 could pave the way toward ₹135 (12-month target). On the downside, ₹102 remains a key support level, holding above this zone is crucial for preserving the current bullish structure and preventing deeper consolidation.

- RSI: 57.83 (Decent Buying Interest)

- ADX: 22.64 (Trend Strength Building)

- MACD: 1.51 (Positive Momentum)

- Resistance: ₹116

- Support: ₹102

Samvardhana Motherson International Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹116 (6% upside) and a 12-month target of ₹135 (23% upside) based on 25x FY27E EPS of ₹5.4.

Why buy now?

European restructuring 75–80% complete, positioning for margin and profitability recovery.

Strong $87.2B order book ensures multi-year revenue visibility.

Non-auto engines scaling fast, aerospace +37% YoY, consumer electronics +36% QoQ.

Platform launches to boost content growth as the global auto cycle improves.

Balance sheet strengthening with net debt/EBITDA improving to ~0.9x.

Margin expansion ahead driven by mix improvement, automation and operating leverage.

Portfolio fit

Ideal for investors seeking a global auto-ancillary leader with multi-year earnings recovery, diversified exposure across EV & ICE, and scaling high-margin non-auto verticals, offering both cyclical upside and structural growth potential.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSamvardhana Motherson International Ltd.: Budget 2025-26 opportunities

- Auto manufacturing boost: Higher incentives and localisation push to drive component demand.

- EV & hybrid support: Balanced policy strengthens multi-powertrain growth opportunity.

- Component localisation: Import substitution benefits wiring harness, polymer & assemblies.

- Aerospace & electronics focus: Defence & electronics capex accelerates high-margin scaling.

- R&D & automation incentives: Supports AI-led efficiency and engineering capability expansion.

Final thoughts

Can Samvardhana Motherson continue its transformation from a traditional auto component supplier into a diversified advanced mobility and technology group?

With strong global positioning, increasing EV-related content, and a clear expansion roadmap beyond automobiles, the company appears well-aligned with the future of mobility. However, consistent margin execution and post-acquisition performance remain the critical levers that will determine shareholder value creation.