India’s infrastructure and manufacturing push is once again putting steel at the center of the growth narrative. As capacity utilization improves and government-led capex accelerates, integrated steel producers stand to benefit disproportionately. Among them, Steel Authority of India Ltd (SAIL) remains a critical pillar of India’s steel ecosystem, with scale, integration, and strategic relevance working in its favor.

But does Steel Authority of India Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SAIL |

| Industry/Sector | Metals & Mining (Steel) |

| CMP | 147.00 |

| Market Cap (₹ Cr.) | 21,206 |

| P/E | 23.73 (Vs Industry P/E of 29.85) |

| 52 W High/Low | 149.19 / 99.15 |

| EPS (TTM) | 6.19 |

| Dividend Yield | 1.09% |

About Steel Authority of India Ltd.

Founded in 1954, SAIL is one of India’s largest steel producers and a Maharatna PSU. It operates five integrated steel plants and three special steel plants across the country, supported by captive iron ore and coal mines. This backward integration gives SAIL a structural cost advantage and insulates it from raw material volatility compared to non-integrated peers.

SAIL plays a strategic role in national infrastructure, defence, railways, and energy projects, making it a key beneficiary of India’s long-term industrialization and capex cycle.

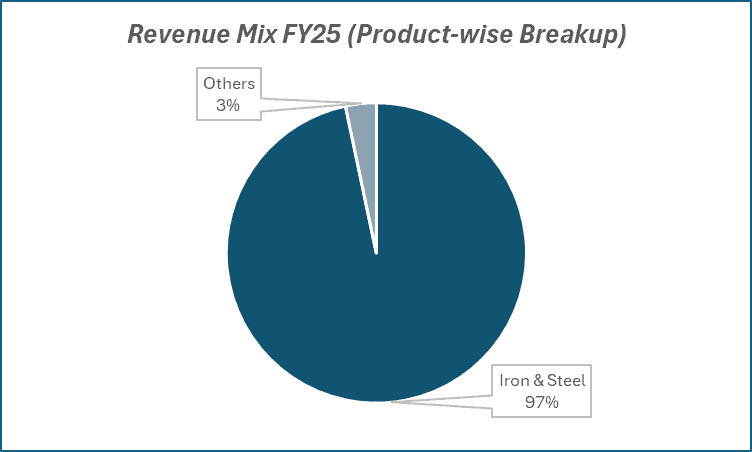

Key business segments

Steel Authority of India Ltd. operates primarily in the following key business segments:

- Steel Production (Core Business): Manufacturing of flat and long steel products used across construction, infrastructure, automotive, railways, defence, and capital goods.

- Mining Operations: Captive iron ore, coal, and flux mines provide raw material security and cost stability, enhancing margin resilience across cycles.

- Value-Added & Special Steels: Production of rails, structurals, plates, and alloy steels catering to railways, defence, and specialized industrial applications.

- Services & Others: Includes consultancy, technology services, and joint ventures, though these remain a small portion of overall revenues.

Primary growth factors for Steel Authority of India Ltd.

Steel Authority of India Ltd. key growth drivers:

- Infra-led demand visibility: Strong linkage to India’s infrastructure and manufacturing expansion ensures steady domestic steel demand.

- Government capex support: Sustained spending on roads, railways, urban infrastructure, and defence remains a key growth driver.

- Capacity expansion underway: Ongoing modernization programs are enhancing production capacity and asset efficiency.

- Cost and efficiency gains: Upgrades are helping lower operating costs and improve overall productivity.

- Shift to value-added steel: Higher focus on rails, structurals, and special steels should improve product mix and support medium-term margins.

Detailed competition analysis for Steel Authority of India Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| SAIL Ltd. | 106431.98 | 10810.48 | 10.16% | 2159.99 | 2.03% | 23.73 |

| JSW Steel Ltd. | 174496.00 | 26648.00 | 15.27% | 6500.00 | 3.73% | 46.90 |

| TATA Steel Ltd. | 221733.82 | 28786.79 | 12.98% | 6432.57 | 2.90% | 33.59 |

| Jindal Stainless Ltd. | 41205.54 | 4966.07 | 12.05% | 2836.75 | 6.88% | 24.96 |

| APL Apollo Tubes Ltd. | 21317.40 | 1578.29 | 7.40% | 1048.79 | 4.92% | 50.67 |

Key insights on Steel Authority of India Ltd.

- Integrated cost advantage: Fully integrated operations provide a natural cost cushion during commodity downcycles.

- Operating leverage in upcycles: Earnings recover sharply during steel upcycles due to high operating leverage.

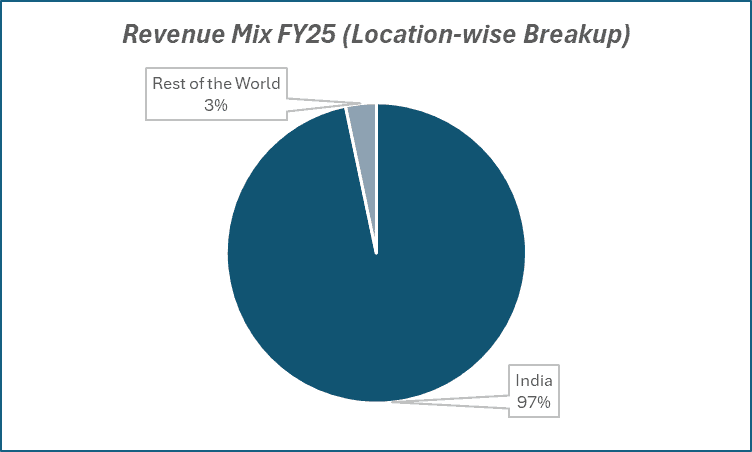

- Domestic demand focus: Strong domestic positioning limits exposure to global trade volatility and export-related uncertainties.

- Cyclical but improving profitability: While earnings remain cyclical, structural improvements are reducing downside risk.

- Stronger balance sheet discipline: Better capital allocation and improving efficiency metrics point to a more resilient earnings profile versus past cycles.

Recent financial performance of Steel Authority of India Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 24675.20 | 25921.76 | 26704.17 | 3.02% | 8.22% |

| EBITDA (₹ Cr.) | 2912.71 | 2768.66 | 2528.29 | -8.68% | -13.20% |

| EBITDA Margin (%) | 11.80% | 10.68% | 9.47% | -121 bps | -233 bps |

| PAT (₹ Cr.) | 741.92 | 671.48 | 320.54 | -52.26% | -56.80% |

| PAT Margin (%) | 3.01% | 2.59% | 1.20% | -139 bps | -181 bps |

| Adjusted EPS (₹) | 2.17 | 1.80 | 1.01 | -43.89% | -53.46% |

Steel Authority of India Ltd. financial update (Q2 FY26)

Financial performance

- Volume-led growth amid price pressure: H1 sales volumes surged 17% YoY to 9.46 MT, while revenue grew 8% YoY to ₹52,625 crore, reflecting aggressive inventory liquidation in a weak pricing environment.

- Earnings supported by operating leverage: H1 EBITDA rose 3% YoY to ₹5,754 crore, with H1 PBT up 28% and H1 PAT up 32% YoY, aided by cost controls and higher volumes.

- Balance sheet strengthening: Borrowings reduced by ₹3,384 crore YoY, improving financial flexibility ahead of the next capex cycle.

Business highlights

- Pricing headwinds, realizations cushioned: QoQ decline in steel realizations was partly offset by ₹1,140 crore of scrap and by-product sales, supporting margins.

- Operational efficiency improving: In-process inventory reduced sharply, aiding working capital efficiency; finished steel inventory stood at 1.9 MT.

- Capex and expansion on track: FY26 capex guided at ₹7,500+ crore, with the 4.5 MT IISCO expansion progressing as planned.

Outlook

- Volume momentum intact: FY26 production guidance maintained at 18.5 MT, with Q3–Q4 sales expected to exceed production to further normalize inventory.

- Margin recovery expected: Management guides 14–15% EBITDA margin by Q4 FY26 as pricing stabilizes and operational disruptions normalize.

- Deleveraging remains a priority: Continued cash generation and working capital release to support lower leverage and fund higher FY27 capex.

Recent Updates on Steel Authority of India Ltd.

- Strategic alignment with national priorities: SAIL remains closely aligned with railway expansion, defence indigenization, and large-scale infrastructure development.

- Operational efficiency focus: Continued emphasis on improving plant efficiency and productivity across key steel plants.

- Logistics cost optimization: Ongoing initiatives to reduce logistics and transportation costs, supporting margin improvement.

- Value-added steel push: Increasing share of value-added products to improve realizations and earnings stability.

- Supportive policy environment: Safeguard duties, quality controls, and domestic steel protection policies strengthen the operating backdrop for large integrated players like SAIL.

Company valuation insights – Steel Authority of India Ltd.

SAIL is currently trading at an EV/EBITDA of 7.2x, having delivered a 30.4% return over the last one year, significantly outperforming the NIFTY 50’s 10.2%.

The stock’s performance reflects improving volumes, disciplined deleveraging, and its strong alignment with India’s infrastructure-led steel demand cycle. Despite near-term pricing pressures, SAIL’s fully integrated operations, aggressive inventory liquidation, and rising contribution from scrap and by-product sales have supported earnings resilience in H1 FY26, while borrowings have declined meaningfully YoY, strengthening balance sheet flexibility.

While steel profitability remains cyclical, the investment case rests on volume-led recovery, operational efficiency improvements, and capex-driven capacity expansion. Management’s focus on value-added steel, logistics cost optimization, and de-bottlenecking across plants is expected to support margin recovery into H2 FY26, with EBITDA margins guided to improve toward mid-cycle levels. Additionally, policy support for domestic steel producers and SAIL’s dominant positioning in railways, defence, and infrastructure provide downside protection relative to global peers.

For valuation, applying a 6.9x EV/EBITDA multiple to Mar’27E EBITDA, we arrive at a 12-month target price of ₹180, implying 22% upside from current levels. On a shorter-term basis, a 3-month target of ₹155 offers 5% upside, supported by continued volume traction, inventory normalization, and incremental margin recovery as pricing stabilizes through H2 FY26.

Major risk factors affecting Steel Authority of India Ltd.

- Steel price volatility: Margins remain sensitive to global demand–supply imbalances and fluctuations in steel realizations.

- Input cost risk: Sharp increases in coking coal and other raw material prices could pressure profitability.

- Demand slowdown risk: Any slowdown in domestic infrastructure or government capex could impact volume growth.

- Global trade disruptions: Tariff actions and geopolitical developments may increase volatility in global steel markets.

- Execution and operational risks: Large-scale plant operations and delays in modernization or expansion projects could affect efficiency and returns.

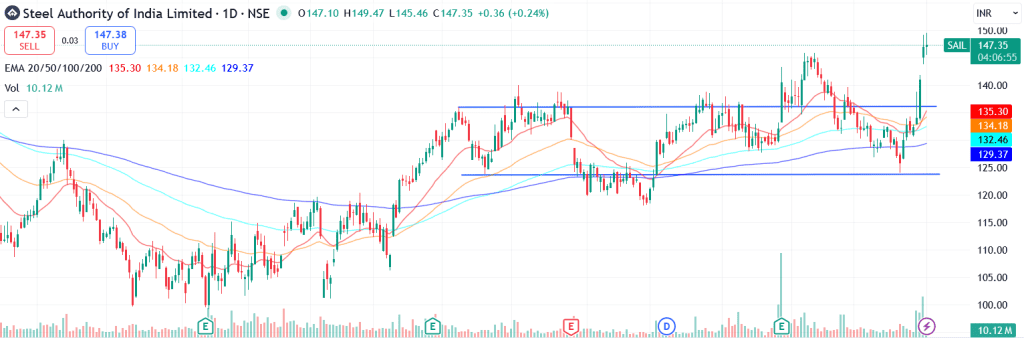

Technical analysis of Steel Authority of India Ltd. share

Steel Authority of India Limited was previously trading in a sideways consolidation range and has recently delivered a strong breakout above the upper trendline, signalling a potential shift toward a sustained upward trend.

The stock is comfortably trading above its 50-, 100-, and 200-day EMAs, reinforcing a strong long-term trend and continued buying support across timeframes.

Momentum indicators continue to support the bullish setup. MACD at 2.15 is firmly positive, with the MACD line holding above the signal line, indicating strengthening underlying momentum.

RSI at 72.01 reflects strong buying momentum, while relative RSI readings (0.09 / 0.08 over 21- and 55-day periods) highlight ongoing outperformance versus the broader market. ADX at 21.00 suggests the trend is gaining strength, indicating improving directional conviction.

A decisive move above ₹155 could open the path toward ₹180 (12-month target). On the downside, ₹135 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 72.01 (Strong Buying Momentum)

- ADX: 21.00 (Trend Gaining Strength)

- MACD: 2.15 (Positive)

- Resistance: ₹155

- Support: ₹135

Steel Authority of India Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹155 (5% upside) and a 12-month target of ₹180 (22% upside), based on 6.9x EV/EBITDA applied to Mar’27E EBITDA.

Why buy now?

Volume-led earnings recovery: Strong sales volume growth, inventory liquidation, and operating leverage are driving a recovery in profitability despite near-term pricing pressures.

Margin improvement visibility: Rising contribution from by-products and scrap sales, improving value-added steel mix, and normalization of operational issues support margin recovery into H2 FY26.

Balance sheet strengthening: Sustained deleveraging, lower borrowings, and improving net debt metrics enhance financial resilience ahead of the next capex cycle.

Structural demand alignment: Deep linkage with railways, defence indigenization, and infrastructure capex provides steady domestic demand visibility and downside protection versus global peers.

H2 tailwinds: Seasonally stronger second half, inventory normalization, and stable steel pricing environment are expected to support sequential improvement in earnings.

Portfolio fit

Steel Authority of India Limited offers domestic infra-led cyclical recovery exposure with improving balance sheet quality and operating efficiency. While steel remains a cyclical business, SAIL’s integrated cost structure, policy support, and capex-driven efficiency improvements position it well for an earnings upcycle. At current valuations, the stock offers an attractive risk–reward for portfolios seeking cyclical recovery with visibility on medium-term earnings normalization and cash-flow improvement.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSteel Authority of India Ltd.: Budget 2025-26 opportunities

- Infra capex support: Sustained spending on roads, railways, urban infra, and defence drives steel demand.

- Railways & defence tailwinds: Track expansion and indigenization boost demand for rails and special steels.

- Make in India push: Import substitution and manufacturing incentives support utilization and realizations.

- Logistics reforms: Improved freight and port infrastructure help lower costs and lift margins.

Final thoughts

SAIL offers investors a direct play on India’s infrastructure and industrial growth, backed by scale, integration, and strategic relevance. While inherently cyclical, its cost advantages, domestic focus, and improving efficiency position it well to participate in the current capex upcycle. For investors seeking exposure to India’s steel demand recovery with downside protection from integration, SAIL remains a compelling cyclical opportunity.