Stock overview

| Ticker | WIPRO |

| Sector | IT |

| Market Cap | ₹ 2,60,100 Cr |

| CMP (Current Market Price) | ₹ 248 |

| 52-Week High/Low | ₹ 325/225 |

| Beta | 1.07 (Low volatility) |

About Wipro Ltd.

Wipro is a global IT consulting and business process services company with deep capabilities in cloud, digital engineering, AI/ML, cybersecurity, and consulting. With operations in over 65 countries and a workforce exceeding 2,30,000 employees, Wipro is among the top five Indian IT exporters by revenue.

Business Segments

- IT Services (Main Contributor)

- Verticals: BFSI, Healthcare, Consumer, Energy, Manufacturing, Communications

- Geographies: North America (55%), Europe (25%), India and Others (20%)

- Strong digital and cloud transformation practice

- Verticals: BFSI, Healthcare, Consumer, Energy, Manufacturing, Communications

- IT Products

- Hardware and enterprise solutions for Indian businesses

- Hardware and enterprise solutions for Indian businesses

- India State Run Enterprise (ISRE)

- Government-led tech transformation initiatives

- Government-led tech transformation initiatives

Primary growth factors for Wipro India Ltd

1. Large-Scale Cost Optimization

Wipro has undertaken an internal restructuring, simplifying operations, reducing bench strength, and consolidating verticals for faster decision-making.

2. Deal Momentum Rebounding

Despite sectoral slowdown, Wipro reported $3.9B in TCV wins in Q4 , many in digital transformation, cloud infra, and managed services.

3. Focus on Strategic Accounts

The company has doubled down on Fortune 500 clients and is focused on mining key accounts through localized teams in the US and Europe.

4. Investments in AI and Cloud

Wipro is investing $1B over three years in GenAI, cybersecurity, and automation. Partnering closely with Microsoft, Google, and AWS.

5. Operational Stability and Leadership Reset

New CEO Srini Pallia (appointed April 2024) is focusing on simplification, margin expansion, and strengthening consulting capabilities.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Revenue | ₹ 22,504 cr | 1.4% | 0.8% |

| Operating Profit | ₹ 3,908 cr | 10.5% | 0.3% |

| Profit before tax | ₹ 4,743 cr | 22% | 6% |

| PAT | ₹ 3,588 cr | 26% | 6% |

Wipro has delivered decent results in Q4 FY 25. Both revenue and profits have risen vs LY and on a QoQ basis.

However, it is worth noting that the growth in revenue is in low single digit while profit growth has been more than the revenue growth. This indicated operational efficiency and better cost control by the management.

Detailed competition analysis for Wipro India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Wipro | ₹ 2,60,100 cr | ₹ 22,504 cr | 20 x | 20% |

| TCS | ₹ 12,22,000 cr | ₹ 64,479 cr | 25 x | 64% |

| Infosys | ₹ 6,45,500 cr | ₹ 40.925 cr | 24 x | 37% |

| HCL Technologies | ₹ 4,42,700 cr | ₹ 30,246 cr | 25 x | 32% |

Wipro is fairly valued at the moment compared to its peers, and it remains a dominant player in the IT industry

Company valuation insights: Wipro India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Wipro shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹290 per share

- Upside Potential: 17%

- WACC: 10.1%

- Terminal Growth Rate: 1.2%

Major risk factors affecting Wipro India

- Slow Revenue Growth compared to peers

- Margin Pressures from legacy contracts and pricing

- Attrition / Talent Retention post restructuring

- Macro Risks in the US and Europe (key geographies)

- Execution Risk around AI investments

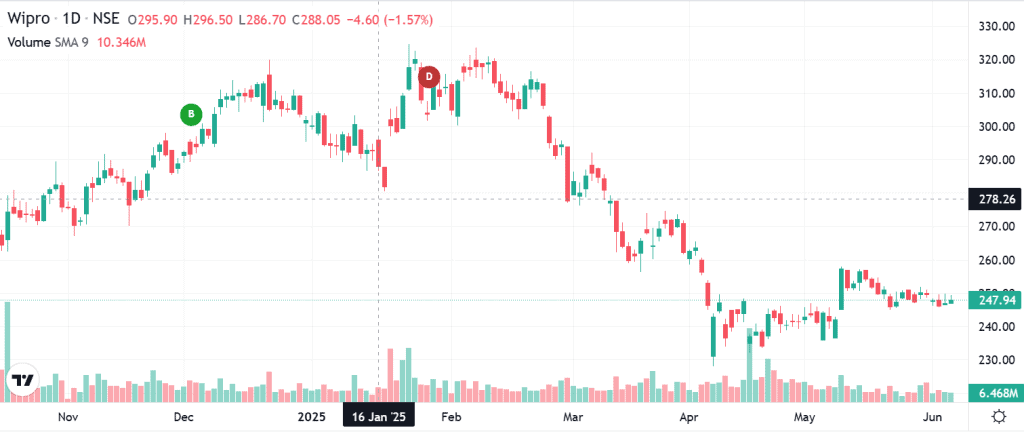

Technical analysis of Wipro India

- Resistance: ₹260

- Support: ₹235

- Momentum: Neutral

- RSI (Relative Strength Index): 47 (Neutral)

- 50-Day Moving Average: ₹237

- 200-Day Moving Average: ₹249

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹262

Wipro India stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹265 (6-month horizon); ₹290 (12-month horizon);

Investment Horizon: 2–4 years for stable returns

Rationale

Recommend a Buy on Dips / Accumulate approach for Wipro.

Recommendation

Accumulate / Buy on Dips

Wipro offers a value opportunity in the IT pack, at a discount to peers, with signs of bottoming out and a leaner, more focused structure post-realignment. A re-rating is likely if execution remains consistent and large deal wins continue.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Wipro is gradually emerging from a period of underperformance with early signs of operational improvement and strategic clarity under its new leadership. While it still lags behind peers in terms of margin profile and revenue growth, its consistent deal wins, simplification strategy, and focus on AI and cloud provide a solid foundation for revival. Trading at a discount to larger IT peers, Wipro offers a value play for long-term investors looking for a turnaround story in Indian IT. With moderate risk and improving fundamentals, it deserves a measured but optimistic allocation in a diversified tech portfolio