The financial market offers an enormous platter of varied securities to investors. There is a unique kind of security for every investor – stocks for those investors who wish to own the shares of companies, debentures and bonds for investors looking for stable income, currencies for investors who wish to be part of foreign markets, and so on.

Through this article, we intend to shed light on currency futures, features of currency futures contracts and the impact of investing in foreign market futures.

What are currency futures?

Currency futures, as the name suggests, are future contracts with underlying assets as currencies.

Currency futures are derivative contracts entered by two parties to exchange currencies on a future date at predetermined exchange rates. The execution of these future contracts takes place on regulated stock exchanges, similar to all other futures contracts.

You may also like: The world of currency fluctuations: How does it impact your investments?

Components of a currency future contract

- Futures contract – It is a derivative contract to settle the trade on a future date at a predetermined rate or price. Traders enter into future contracts to hedge themselves from the risk of price/rate fluctuations due to market uncertainties.

- Derivative contract – A derivative contract is a financial agreement whose value depends on an underlying asset.

- Underlying asset – In the case of currency futures, the currency is the underlying asset based on which the contract’s price stands.

Features of currency futures

- Currency futures contracts involve two parties to trade, dealing in two different currencies.

- The settlement or the expiration date is a significant feature of a futures contract. It is the date on which the futures contract gets executed, i.e., the date on which the two currencies are exchanged.

- The spot rate is the current exchange rate of currencies in the forex market.

- The future rate is the predetermined rate at which the futures contract will be executed on the settlement date.

- Currency futures, like other future contracts, require traders to maintain margin accounts. Margins are deposits by futures traders to keep the futures contract open and running.

- The lot size of currency futures contracts is usually fixed.

The functioning of currency future contracts

Exchange rates of currencies are subject to high degrees of fluctuations. Currency futures are a risk hedging and speculation tool used by investors who deal with currencies.

An investor who wants to buy foreign currencies on a future date may enter a futures contract today if the exchange rate seems more suitable. Similarly, an investor who speculates an increase in exchange rates on a future date can enter a currency futures contract to benefit from the difference.

Currency futures can follow two modes of settlement:

Cash settlement or physical delivery.

Marked-to-market is an important concept, especially for cash settlement of currency futures. It is where the margin accounts of traders are adjusted on a daily basis with debits and credits, based on the market movement of exchange rates. The final balance is settled in cash on or before the expiry date, as decided by the traders.

Cash settlements are more common in currency futures. However, those who prefer physical delivery of securities, hold the contract till expiry and physically exchange currencies on the settlement date.

Also Read: Hedging 101: Protect your investments from market surprises

Currency futures in India

Currency futures contracts were introduced in August 2008 in India on the National Stock Exchange. Today, currency futures are traded on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and Multi Commodity Exchange (MCX).

The rules of trading in currency futures in India are as follows:

- The currency pairs available for trading in India are USD-INR, EUR-INR, GBP-INR and JPY-INR.

- The lot size for contracts with currencies USD, EUR and GBP are 1,000, and the lot size for JPY contracts is 1,00,000.

- Currency futures contracts in India must mature within 12 months.

- The Reserve Bank of India (RBI) has a crucial role in determining rates for the exchange of currencies in India.

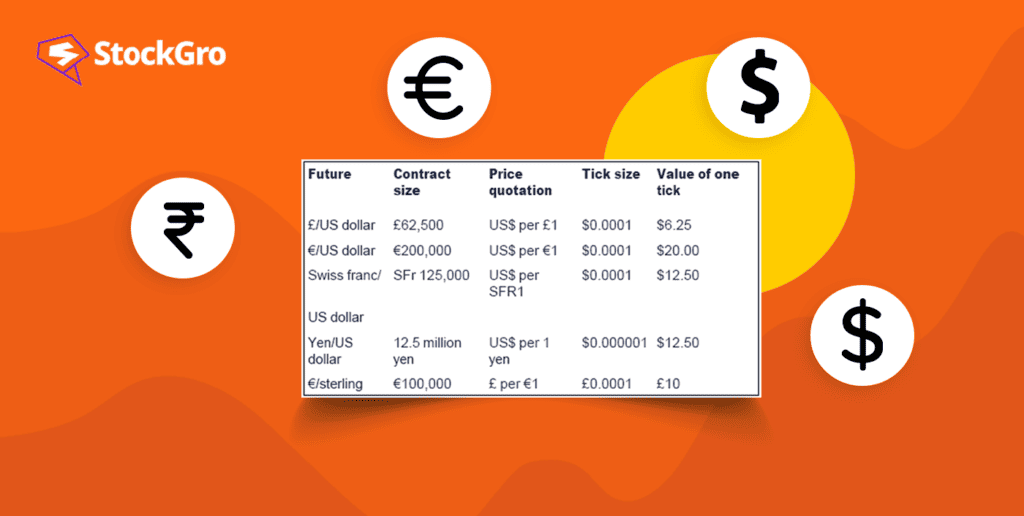

The stock market also allows cross-currency futures contracts in India. It is where traders deal with two international currencies without involving INR (Indian Rupees). Cross-currency pairs available in India are EUR-USD, GBP-USD and USD-JPY.

Pros and cons of investing in currency futures

Benefits of trading in currency futures:

- Investing in currency futures is one of the ways of holding a diverse portfolio. It gives investors access to global markets.

- Currency futures hedge the risk of exchange rate fluctuations, which can save investors from losses.

- Speculations based on currency futures can result in heavy profits for investors.

- The forex market is highly active, making these securities liquid. Buying and selling currencies is easy in the secondary market.

- Since these trades take place on the exchange, the environment is thoroughly under regulation at all times. It reduces the risk of defaults and fraud.

The major disadvantages of trading in currency futures are a lack of flexibility and high price fluctuations.

Since these transactions take place on the exchange, with the exchange itself being the counterparty at times, the rules are standardised. The room for customisation in trade is rare, making these contracts rigid.

Another limitation is the volatility of these securities. Though future contracts are a hedging tool, the rate fluctuations are so high that they can still lead to loss at times.

Also read: Why is the US dollar the ‘currency of the world’?

Example

An Indian trader wants to buy USD after 3 months. The current exchange rate of USD to INR is ₹ 83.25. He believes that the exchange rate will go up to ₹ 90 in 3 months. So, he enters into a futures contract to exchange currencies after 3 months at ₹ 84.

After 3 months, the exchange rate is at ₹ 88, so he executes the futures contract and earns a profit of ₹ 4 per unit.

Lot size: 1,000

Contract rate: ₹ 84

Contract value: 84*1000 = ₹ 84,000

Without the futures contract, he would have to spend ₹ 88,000.

Bottomline

Currency futures and options are derivative contracts that help traders hedge the risk of exchange rate fluctuations.

These securities help traders maintain a diverse portfolio and get access to global markets. They also offer attractive returns, given the rate fluctuations. Hence, currency futures are suitable for those investors looking to trade in a market that is highly liquid, volatile and regulated.