Investments come in various shapes and sizes, each with its own risk-reward profile and settlement procedures. Whether you are looking for immediate gains or long-term growth, the mechanics of settling these trades can be complex. That’s where the concept of ‘settlement’ becomes crucial in the financial market.

In this intricate ecosystem, the buyer, the seller, and the custodian are the key players. The custodian acts as a sort of middleman, responsible for receiving securities from the buyer, sending them to the seller, and managing fund distribution. This process ensures that everyone gets what they are due, making it a cornerstone in the world of trading.

Different types of settlements, like traditional and net settlements, offer their own advantages and drawbacks. But among these options, there’s one that provides an extra layer of security and efficiency: Delivery versus Payment (DvP).

What is DvP?

Settlement usually follows a “T+X” format, where T is the trading day, and X is the number of days until settlement. The timeline can be as short as the same day (T+0) or can extend up to two days (T+2). For government securities, the standard is typically T+1. Interestingly, if one party is a Foreign Portfolio Investor, the settlement of government securities can also go up to T+2.

When it comes to government securities, the Reserve Bank of India (RBI) holds a prominent position. The trades are reported through the Negotiated Dealing System (NDS) to the RBI-SGL (Subsidiary General Ledger). These settlements are assured by the Clearing Corporation of India Limited (CCIL). The whole process uses the Delivery versus Payment especially DvP-III system to settle both the securities and the funds on a net basis.

Non-government securities take a more direct route. Settlements are on a gross basis, with the Delivery versus Payment approach frequently employed.

The DvP full form stands for Delivery versus Payment. According to the RBI, it is a settlement mechanism that ensures securities and funds are exchanged simultaneously. The process is geared towards mitigating settlement risk, making sure that securities aren’t transferred until funds are available, and vice versa.

DvP has three variants, namely DvP I, DvP II, and DvP III:

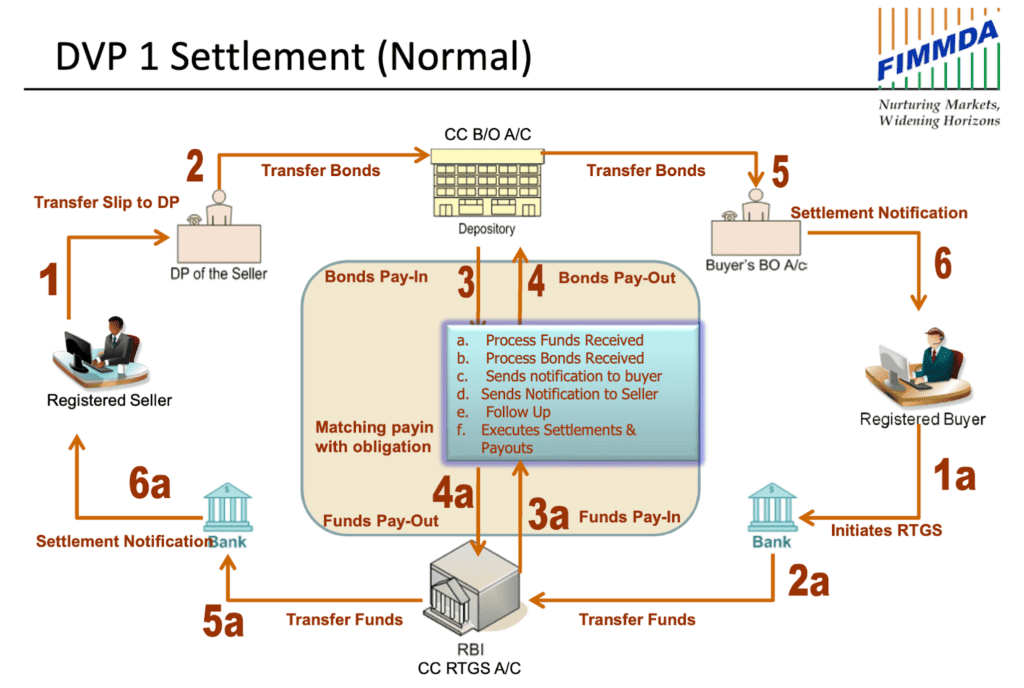

- DvP I: Here, both securities and funds are settled on a transaction-by-transaction or gross basis. Essentially, each transaction is settled independently without offsetting payables and receivables.

Source: FIMMDA

- DvP II: Under this approach, the funds are netted even though the securities are settled on a gross basis. In simple terms, a party’s total financial transactions are added up to determine the total amount that is payable or receivable.

- DvP III: Under this, both securities and funds are netted, meaning the final net position of all transactions is what gets settled.

You may also like: All you need to know about the basics of forex trading in India

How does DvP work?

Delivery versus Payment is a mechanism in securities trading that eliminates certain risks, especially the principal risk, which is the danger of one party failing to fulfil their end of the bargain. Essentially, securities are only delivered if the payment for those securities is also made.

The process is pretty straightforward. When a trade occurs, both the buyer and the seller have their respective assets at stake. The selling party holds the security, while the buying party holds the payment. In a Delivery versus Payment setup, the actual exchange happens almost simultaneously to ensure both parties fulfil their obligations.

The securities typically get delivered to the buyer’s bank. At the same moment, the payment for those securities is released. This is generally done through a bank transfer, a cheque, or direct credit to an account. So, both assets—money and securities—cross paths almost at the same instant, safeguarding the interests of both buyer and seller.

By doing this, Delivery versus Payment reduces not just the principal risk but also limits liquidity risks. During volatile times in the market, this setup ensures that neither deliveries nor payments get stuck or withheld.

Also Read: How does intraday trading work?

Origin of DvP

The Delivery versus Payment method came about after the stock market crash in 1987. The Group of Ten (G-10) countries’ central banks recognised the need for a safer method of trading assets.

They introduced Delivery versus Payment to cut down risks. In 1990, a special committee even formed a study group to explore DvP more deeply. The group’s report helped set new bank policies aimed at making financial markets more stable. In short, DvP was born out of a need for security and has since become a key part of how trading happens today.

Purpose of DvP

The purpose of DvP is to mitigate various types of risks in securities trading. Here’s a breakdown:

- Credit risk: Delivery versus Payment guarantees that the purchaser can fulfil their financial commitments. The risk of non-payment to the seller is decreased because no transfer of securities happens without payment.

- Replacement cost risk: Delivery versus Payment eliminates this risk by making sure the trade is executed at the agreed-upon price. There’s no room for market price fluctuations affecting the deal.

- Principal risk: The system is designed so that payment against delivery happens simultaneously. This eradicates the risk for both the buyer not receiving the securities and the seller not receiving the payment.

- Liquidity risk: By requiring payment at the time of delivery, Delivery versus Payment minimises the chance of an obligation being unsettled, addressing liquidity concerns.

- Systemic risk: Delivery versus Payment reduces the domino effect one defaulting party could have on others in the system.

By addressing these risks, DvP creates a safer, more reliable trading environment.

Also read: Risk management in stock market

In a nutshell

In trading, whether government securities or equity delivery, settling transactions securely and efficiently is vital. Delivery versus Payment shines as a proven method that safeguards both the buyer and the seller, significantly reducing multiple types of trading risks.

Whether you are a casual investor or a seasoned trader, understanding the benefits and mechanisms of DvP can give you an added layer of confidence and security in your investment journey.