When you’re trying to understand market trends, indicators can be a bit tricky. Some react too slowly, while others jump around too much and create confusion. But among all the indicators, moving averages are one of the most useful tools. Moving averages help traders understand price trends. The Arnaud Legoux Moving Average, or ALMA, is one of the newest tools traders use to reduce noise and see smoother signals. It gives more accurate signals than many older averages, like the SMA or EMA. Let’s understand what ALMA is, how it compares to other moving averages, and how to use it in real-world trading.

What is the Arnaud Legoux Moving Average (ALMA)?

ALMA is a moving average that clears price data while still maintaining its responsiveness. It reduces lag more effectively than most other moving averages. ALMA does this by using a Gaussian filter and shifting data toward recent prices. That makes it useful for traders who want fast signals that don’t get triggered by noise.

For example, if a stock is moving up but making small pullbacks, ALMA shows the general uptrend without reacting to every small dip.

Who Developed the ALMA?

The ALMA indicator was created by Arnaud Legoux in collaboration with Dimitrios Kouzis-Loukas. Both of them work in quantitative finance and trading. They wanted to solve the common problem where moving averages either lag too much or are too sensitive to small price moves. ALMA became popular in algorithmic trading and is now used by many retail traders as well.

How Does the Arnaud Legoux Moving Average Work?

ALMA uses three parts: a window size, a sigma (smoothing factor), and an offset. The sigma controls how smooth the curve is. The offset shifts the average to focus more on recent or past prices. It uses a Gaussian distribution to give more weight to the middle of the data window. This keeps the average smooth but still fast enough to catch price changes.

ALMA Formula: ALMA(i) = Σ (Price[i – n] * Weight[n]) / Σ Weight

ALMA vs Other Moving Averages

This ALMA works differently from other moving averages because it focuses more on the recent prices. Let’s compare ALMA with other popular types of moving averages.

ALMA vs Simple Moving Average (SMA)

The Simple Moving Average (SMA) takes the average of prices from the last X time periods, giving each price equal importance. While it’s straightforward and widely used, this equal weighting causes slow responses to price changes and makes it trail behind fast markets.

- Limitation: Equal treatment of all prices makes it slow to spot recent changes.

- ALMA Advantage: ALMA puts more emphasis on data from the middle range using a bell-shaped curve. This reduces delays and improves timing, particularly during trend shifts.

ALMA vs Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) also focuses on recent prices and reacts faster than the SMA. But this speed has a downside. It can react too much to market noise, like sudden jumps or crashes.

- Limitation: EMAs are quick to respond and may create false signals during rough market conditions.

- ALMA Advantage: ALMA finds the right mix between quick reactions and steady movement. It avoids overreacting to brief price swings while still moving fast with genuine trends.

ALMA vs Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) places growing emphasis on newer prices in a linear fashion, meaning today’s price has the greatest effect on the average.

- Limitation: WMAs often overreact to recent price action, particularly when false breakouts occur or news triggers volatile moves.

- ALMA Advantage: Instead of linear weighting, ALMA applies a Gaussian weighting window. This smooth distribution results in less noise sensitivity and cleaner trend signals.

ALMA vs Hull Moving Average (HMA)

The Hull Moving Average (HMA) is designed for maximum smoothness and speed. It uses a combination of WMAs and square roots of periods to reduce lag dramatically.

- Limitation: HMA tends to be too fast, frequently overshooting price levels or creating fake reversal alerts in flat or rough markets.

- ALMA Advantage: ALMA responds more cautiously but keeps its signals easy to read. It avoids the whipsaws that HMA might produce and offers better reliability in range-bound environments.

ALMA vs Jurik Moving Average (JMA)

The Jurik Moving Average (JMA) is a proprietary indicator known for its exceptional smoothness and speed. It adapts dynamically to market conditions and is often used by institutional traders.

- Limitation: JMA is not freely available, and its code is not open-source. It can only be used on certain platforms and typically requires payment.

- ALMA Advantage: ALMA offers similar performance benefits of smooth and responsive curves while being completely open-source and available for free on platforms like TradingView, MetaTrader, and Python.

How to Use the Arnaud Legoux Moving Average in Trading

ALMA can be used in several trading scenarios. Its flexibility makes it suitable for trend trading, scalping, and even as a filter in multi-indicator systems. This is best used to spot trends, confirm momentum, or act as support/resistance. It’s good for swing trading, day trading, or scalping. If the price is above the ALMA and ALMA is sloping up, the trend is strong.

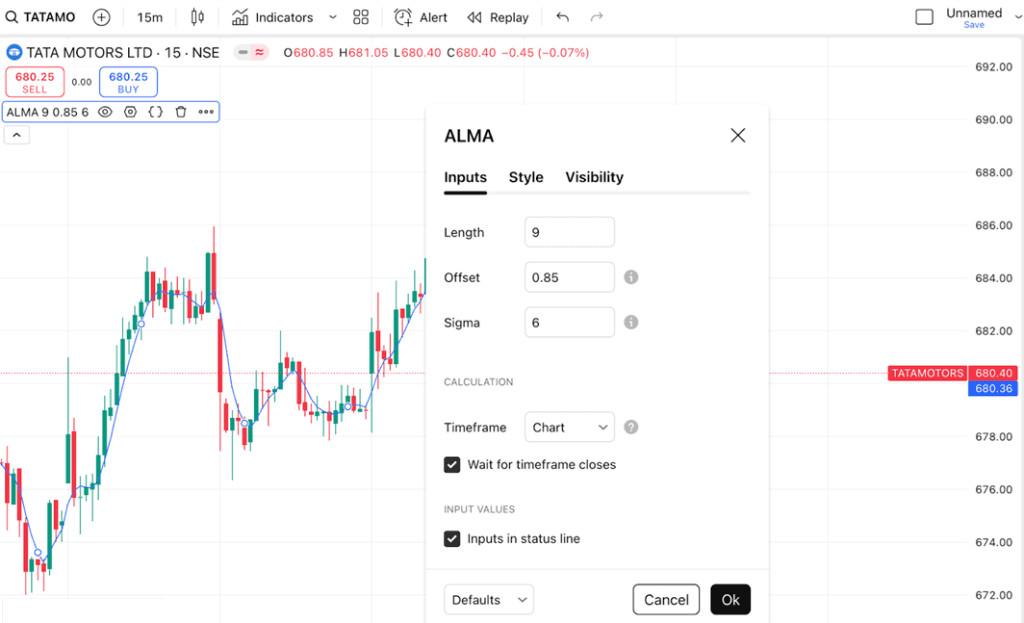

ALMA Settings and Parameters

The three key settings are:

- Length: Common values are 9, 20, 50

- Offset: Usually set between 0.85 to 0.95 (shifts the window forward)

- Sigma: Controls smoothness, typically set at 6

Best Timeframes for ALMA

You can use ALMA on any timeframe, but here are some best practices:

- Scalping: Use ALMA(9) on 1-min or 5-min charts

- Swing Trading: Use ALMA(20) on 1-hour or 4-hour charts

- Long-Term: Use ALMA (50) or ALMA(100) on daily or weekly charts

Combining ALMA with Other Indicators

ALMA works better when paired with confirmation tools:

- RSI: Use RSI to confirm trend strength. A reading above 50 with price above a rising ALMA suggests a strong uptrend. Below 50 with price under a falling ALMA confirms bearish conditions. Helps avoid weak trend entries.

- MACD: Use MACD to spot changes in momentum. When MACD crosses up while ALMA is also rising, it confirms strong upward momentum. Bearish crossovers below a falling ALMA signal indicate downside pressure. Ideal for validating ALMA-based trend or reversal setups.

Arnaud Legoux Moving Average Trading Strategies

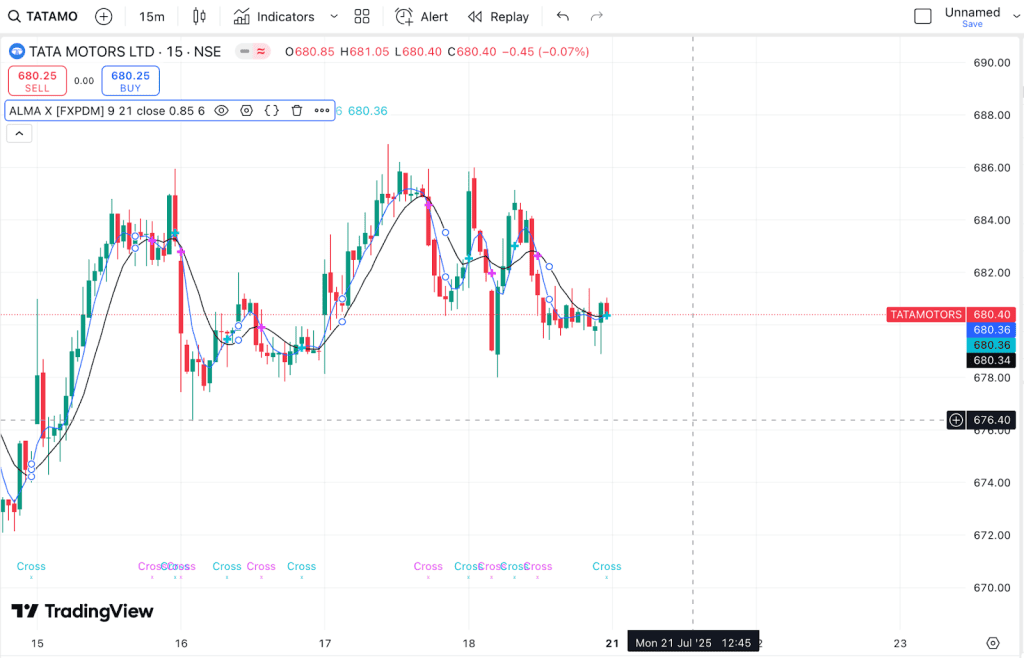

ALMA Crossover Strategy

The crossover strategy uses two ALMAs, one short and one long. Trade based on crossover.

- Buy Signal: ALMA(9) crosses above ALMA(21)

- This signals the start of a bullish trend. When the short-term ALMA(9) moves above the longer-term ALMA(21), it shows growing buying pressure. Traders often buy here expecting upward momentum. Ideal for trend entries on 15-minute or 1-hour charts.

- Sell Signal: ALMA(9) crosses below ALMA(21)

- This signals potential bearish momentum. When ALMA(9) falls below ALMA(21), it suggests weakening price strength and a possible downtrend. Traders may sell or short here, especially in a previously upward market. Works well for exit points or short trades.

ALMA as a Trend Filter

Use ALMA as a trend filter with other indicators or price action.

- If price stays above ALMA(50): Look for long setups

- When the price remains above ALMA(50), it indicates a strong uptrend. Traders should focus on long (buy) entries, especially during pullbacks or consolidations, to ride the trend and avoid countertrend trades.

- If price stays below ALMA(50): Look for shorts

- If the price stays below ALMA(50), it signals a downtrend. In this case, traders should look for short (sell) setups, ideally after minor rallies, to align with the overall bearish momentum and reduce risk.

How to Use ALMA for Scalping

Scalping is a quick trading method where you make small profits from fast price changes. Scalpers usually trade using 1-minute or 5-minute charts, so they need tools that are both speedy and right on target. The Arnaud Legoux Moving Average (ALMA) works great for this because it provides clean signals without delays or false moves.

Here’s how you can use ALMA effectively:

1. Use ALMA(9) on a 1-minute chart

- ALMA(9) is short and reacts quickly to price.

- It helps you track the very short-term trend.

- Works well with highly liquid instruments like Nifty, Bank Nifty, SPY, BTC, ETH, etc.

2. Combine with RSI or VWAP

- RSI (Relative Strength Index): Indicates if the price is stretched too high or too low.

- VWAP (Volume Weighted Average Price): Shows the average price weighted by trading volume. Useful for spotting when big institutions are trading.

Combining ALMA with RSI or VWAP helps confirm your trades. It filters out fake signals that might occur if you’re only looking at price.

3. Look for Bounce or Break Signals

You can trade ALMA in two ways:

- Bounce Strategy: When the price comes down and touches ALMA(9), but then bounces back up.

- Break Strategy: When the price breaks above or below ALMA(9) with strong momentum and volume.

Advantages of the Arnaud Legoux Moving Average

Some advantages that make ALMA stand out from other moving averages are:

- Minimal Lag: Faster than SMA, more stable than EMA

- Flexible: You can adjust offset and sigma settings for your approach

- Better Signals: Fewer false signals in volatile markets

- Flexible: Works on all timeframes and assets

Limitations of the Arnaud Legoux Moving Average

Although ALMA is considered one of the most advanced moving averages, it still has many loopholes.

- Not Built Into Every Platform: Some systems need you to add custom code

- Over-Tweaking Risk: Changing too many settings can hurt your results

- Newer Tool: Less backtesting data than traditional averages

- Complex for Beginners: The Gaussian logic and parameters may be intimidating at first.

How to Add ALMA to Your Trading Platform

Here’s how you can add the Arnaud Legoux Moving Average (ALMA) to different trading platforms:

- On TradingView, simply search for “ALMA” in the indicators menu. It’s available in the public library and is often included in custom scripts like the one by LazyBear.

- For MetaTrader 4 or 5, you must download a custom ALMA tool from the MQL5 marketplace or discussion boards, then install it in your Indicators folder.

- For automated trading with Python, you can build ALMA yourself using tools like pandas or ta-lib. This helps you test strategies or run them automatically with ALMA.

The Arnaud Legoux Moving Average is an effective tool that provides a steadier and more dependable trend following than most standard indicators. It’s perfect for traders who need fast signals while cutting down on false moves. Whether you trade short-term or long-term, ALMA can be an excellent addition to your toolkit.

FAQs

The best ALMA setting depends on your trading style. For short-term trading or scalping, ALMA(9) or ALMA(14) works well. For swing or trend trading, ALMA(50) or ALMA(100) provides better filtering. The offset (commonly 0.85) and sigma (6) are standard values but can be adjusted to make ALMA more responsive or smoother based on your needs.

Yes, ALMA works effectively for both crypto and forex trading. Its smooth, low-lag curve helps filter out market noise, making it useful in highly volatile environments like Bitcoin, Ethereum, or major forex pairs. ALMA can be applied on different timeframes for scalping, swing trading, or long-term trend following, depending on the asset’s behavior and your strategy.

ALMA is often considered better than EMA in choppy markets because it reduces noise while maintaining responsiveness. Unlike EMA, which can be overly sensitive to price spikes, ALMA smooths the price curve using a Gaussian distribution. However, EMA is simpler and widely available, so the choice depends on your trading style and need for clarity in signals.

The ALMA formula uses a weighted moving average with a Gaussian distribution curve. It applies more weight to recent prices but shifts the curve using an offset parameter. The formula involves adjusting the window with a midpoint offset and a smoothing sigma to produce a line that’s smooth yet highly responsive. It’s more complex than SMA or EMA but more accurate in some cases.

Yes, ALMA is well-suited for day trading, especially when you need clean signals and minimal lag. Many traders use shorter settings like ALMA(9) or ALMA(20) on 5-minute or 15-minute charts. It helps confirm entries, exits, and trend direction, especially when combined with indicators like RSI, MACD, or VWAP for more precise intraday setups.