Every day, we hear people lamenting the rising cost of living, complaining about “mehngai badh gayi hai” (prices have gone up). But let’s take a step back and dive into the data to understand what’s really happening behind the scenes.

Today, we’re taking a trip into the world of the Consumer Price Index (CPI) to uncover how it affects your everyday finances.

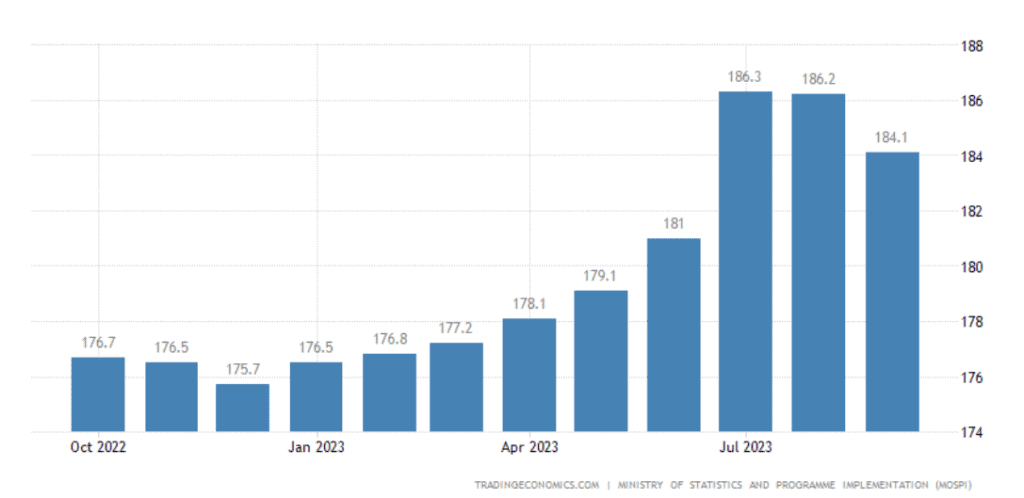

Source: tradingeconomics

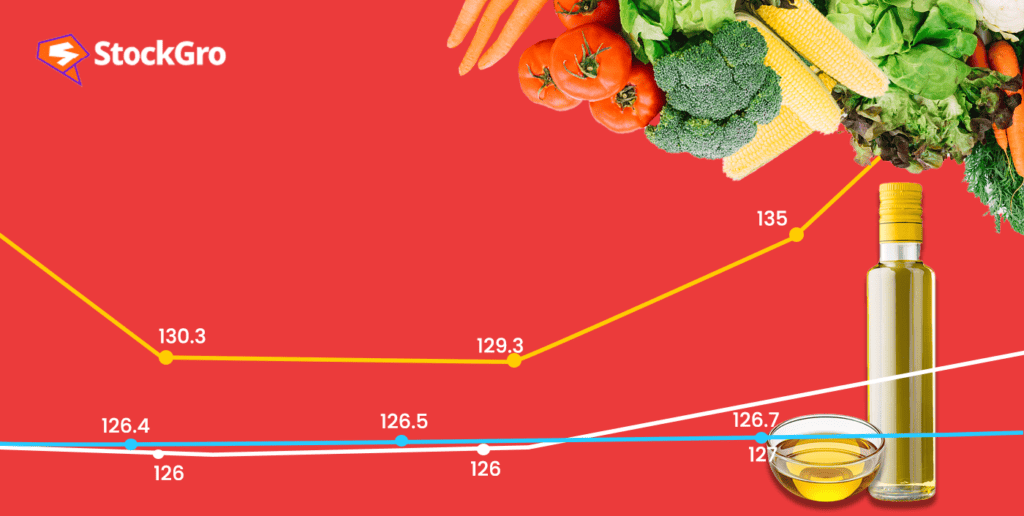

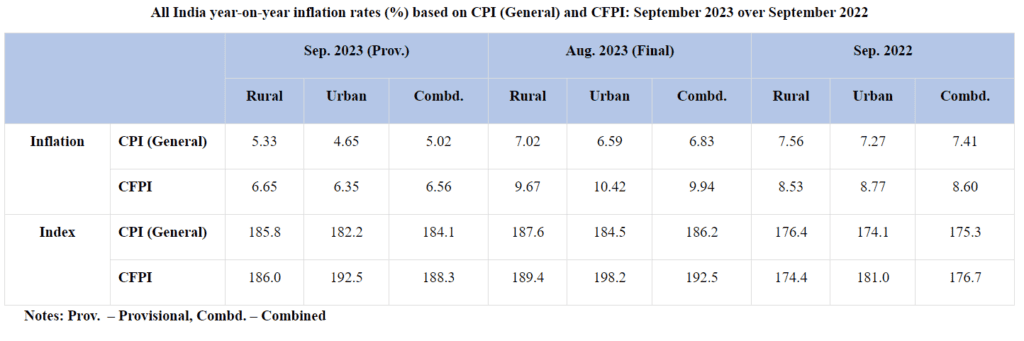

September 2023: CPI and CFPI inflation rates

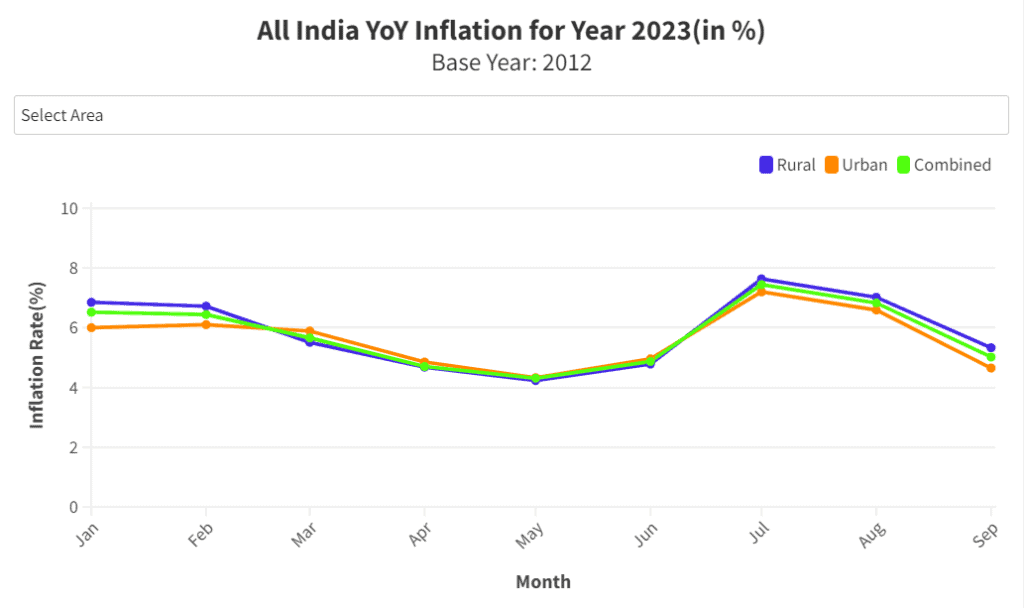

- CPI (General): In September 2023, the year-on-year inflation rate stood at 5.33% for rural areas, 4.65% for urban areas, and 5.02% for the combined index. This means that, compared to September 2022, prices had increased at these rates.

Source: MoSPI

- CFPI (Consumer Food Price Index): For the same period, the CFPI registered an inflation rate of 6.65% for rural areas, 6.35% for urban areas, and 6.56% for the combined index. These numbers reflect price changes in food items, providing crucial insights into food inflation.

Let’s delve deeper into what these numbers mean.

What is CPI?

The Consumer Price Index (CPI) tracks how the prices of goods and services in a typical consumer’s shopping basket change over time. It specifically tracks what urban consumers pay for a typical basket of consumer goods and services.

It’s like that trusty pizza price index you’d use to compare the cost of your favorite slice over several years. But, instead of just pizza, it covers all the goods and services you use in your day-to-day life.

You may also like: Germany falls into recession as inflation hits the economy; Here’s why

What’s in the CPI basket?

The “market basket” in the CPI contains a wide range of items that represent the typical expenses of an urban consumer. These include essentials like food, clothing, housing, transportation, and healthcare.

The CPI keeps tabs on over 200 such items, creating a comprehensive picture of the average consumer’s spending patterns.

How is CPI calculated?

The calculation of CPI involves multiple steps, and it’s all about comparing today’s prices with those from a reference period. In India’s case, the base year, managed by the Central Statistics Office (CSO) under the Ministry of Statistics and Programme Implementation (MoSPI), is periodically updated for relevance.

The latest shift occurred in January 2015, when the base year was moved from 2010 to 2012. Here’s a breakdown of the process:

- Data Collection: A team of diligent price collectors roam the urban landscape, noting the prices of items in the CPI basket.

- Data Compilation: Once the price data is gathered, it is meticulously compiled and categorised. This stage involves sorting, organising, and creating a structured dataset, making it ready for the analytical phase.

- Calculating the Index: This index is expressed as a percentage, reflecting how prices in a particular time compare to a selected base year.

The formula for calculating CPI index is:

The CPI value is calculated by dividing the cost of a standard basket of goods and services in a given year by the cost of the same basket during the base year, then multiplied by 100 to obtain the final CPI figure.

Why should you care about CPI?

The CPI isn’t just a bunch of numbers on a chart. It’s a crucial financial tool that affects your life in various ways. Let’s explore why it’s so important:

- Inflation indicator

The CPI is one of the most reliable indicators of inflation. When the CPI rises over time, it signals that the cost of living is increasing. This is a critical piece of information for policymakers, economists, and individuals alike.

High inflation can erode your purchasing power, affecting your ability to afford the same goods and services.

- Impact on financial planning

Whether you’re managing a household budget or planning your investments, the CPI matters. A rising CPI implies that the money you saved a year ago might not have the same purchasing power today.

To stay financially secure, it’s crucial to account for these changes in your financial planning.

- Wage adjustments

Employers often use the CPI as a reference point when determining salary adjustments. If the CPI is rising, it indicates that the cost of living has gone up.

To maintain employees’ purchasing power, employers may increase wages. Understanding the CPI can help you negotiate for fair compensation or evaluate your salary increases over time.

Also Read: Everything you need to know about deflation

- Investment insights

For investors, the CPI is a valuable tool. It plays a role in shaping central bank policies, which can influence interest rates. When interest rates change, it impacts the cost of borrowing and investment returns.

Staying informed about the CPI allows investors to make informed decisions and adapt their portfolios accordingly.

The CPI and government policies

Now, let’s take a closer look at how the Consumer Price Index (CPI) directly impacts government policies and how this vital financial instrument is meticulously crafted.

Data Collection

The National Statistical Office (NSO), part of the Ministry of Statistics and Programme Implementation (MoSPI), takes on the crucial role of collecting and compiling price data.

- Data Sources: The price data are sourced from 1114 urban markets and 1181 villages spanning all states and union territories. This comprehensive approach ensures that the CPI reflects the spending patterns of both urban and rural consumers.

- Field staff dedication: Trained field staff from the Field Operations Division of NSO personally visit these locations on a weekly basis to gather price data. This hands-on approach is essential to capture the nuances of price fluctuations.

- Coverage: During September 2023, NSO’s data collection efforts were extensive, encompassing nearly 99.8% of villages and 98.3% of urban markets. These figures illustrate the dedication to accuracy.

- Market-wise Reporting: The market-wise prices reported stood at 88.7% for rural areas and 92.0% for urban areas. This thoroughness ensures that the CPI calculations are as representative as possible.

Source: PIB Delhi

Inflation rates: A crucial indicator

Inflation rates, measured on a point-to-point basis, reveal the changes in the cost of living from one year to the next. These rates are a barometer of economic health, and they directly impact government decisions and policies.

Tailoring government policies

Government policies often use the CPI as a pivotal reference point. It plays a key role in influencing various aspects of governance, from financial assistance to tax policies.

- Tax adjustments: Governments use CPI data to adjust tax brackets. As the cost of living increases, tax brackets may shift to prevent citizens from moving into higher tax brackets merely due to inflation. This protects the purchasing power of individuals.

- Social security benefits: Social security benefits, including pensions and welfare programs, may be linked to the CPI. When the CPI rises, these benefits may also increase to keep pace with the rising cost of living.

- Financial assistance: Various forms of financial assistance, including subsidies and grants, may be indexed to the CPI. When the CPI indicates an increase in living costs, this indexing ensures that the assistance provided remains relevant and effective.

Also Read: Cost inflation index – What, why and how?

The comprehensive approach taken by NSO and MoSPI in data collection ensures that the CPI accurately reflects the real-life experiences of consumers across India. This, in turn, guides government policies to protect citizens’ financial well-being in an ever-evolving economic landscape.

CPI limitations

While the CPI is an essential tool, it’s not without its limitations. It doesn’t account for the fact that consumers can substitute one item for another when prices change. Additionally, it might not fully capture quality improvements in goods and services over time.

Conclusion

The Consumer Price Index isn’t just an obscure financial statistic; it’s a practical tool that helps you navigate the financial landscape.

Understanding the CPI empowers you to make informed financial decisions, whether you’re budgeting for your family, planning for retirement, or investing for the future.

So, the next time you encounter discussions about the CPI, you’ll be equipped with the knowledge to grasp its significance and impact.

Stay curious, stay informed, and keep those financial goals in sight!