In FY23, the Indian automobile industry manufactured an impressive 2.7 crore vehicles, valued at approximately $108 billion (₹8.7 lakh crore). The passenger vehicle segment alone contributed 57% to the total value, amounting to ₹5 lakh crore.

With a 7.1% GDP contribution, it’s a titanic struggle ground where Tata Motors and Eicher Motors are two of the biggest players.

Delving into the Eicher Motors vs Tata Motors saga, this article explores how these industry giants navigate the twists and turns of this dynamic sector.

Also read:Automobile industry in India

Company profiles

Tata Motors

Tata Motors Group is a renowned global automobile manufacturer that provides a diverse selection of commercial, passenger, and electric vehicles.

The company strengthened its presence among customers with the launch of 40+ new products and 150+ variants in FY 2022-23. It houses well-known brands such as Jaguar and Land Rover (JLR). These various brands serve a diverse range of customers and market segments, providing a wide variety of products within the Tata Motors umbrella.

Tata Motors Limited (TML) is a major player in the Indian automobile manufacturing industry, offering a wide range of integrated, smart, and e-mobility solutions.

If we check the Tata Motors share price history, it has provided a return of 369% in the past 5 years as of 11th April 2024.

Tata Motors share news: As of April 11, 2024, the Tata Motors share price is ₹1,014.00. The recent analysis by Goldman Sachs has led to an increased Tata Motors share price target, maintaining a ‘buy’ rating for the fiscal year 2024.

For companies like Tata Motors, DVR share stands for shares with Differential Voting Rights. Shares with DVR are similar to ordinary shares, with the exception that they provide different voting rights. The Tata Motors DVR share price is around ₹670.95.

Eicher Motors

Eicher Motors Limited, established in 1982, is a publicly traded company of the Eicher Group in India. It is a prominent player in the Indian automobile industry and holds the global leadership position in middleweight motorcycles.

Eicher Motors has a diverse product portfolio, including motorcycles like the Bullet, Classic, Meteor, Interceptor, Continental GT, and Himalayan under the Royal Enfield brand. Through its joint venture with Volvo, VE Commercial Vehicles (VECV), produces a range of commercial vehicles, from light to heavy-duty trucks and buses, catering to evolving customer preferences.

If we check the Eicher Motors’ share price history, it has provided a return of 101.19% in the past 5 years.

This chart represents the Eicher Motors historical share price. The Eicher Motors share rate has seen a steady increase, reflecting the company’s robust performance in the competitive Indian automotive market.

Eicher Motors share news: As of April 11, 2024, the Eicher Motors share value is ₹4,297.60.

In the domestic market of India, Eicher Motors’ market share in premium is as follows:

Financial profiles

Here is a list of Tata Motors’ financial ratios based on Tata Motors’ financial statements, compared with Eicher Motors’ financial analysis:

| Tata Motors financial report in 2023 | Eicher Motors’ financial report in 2023 | |

| EPS (₹) | 6.29 | 95.91 |

| Net Profit/Share (₹) | 6.14 | 95.89 |

| PBIT Margin (%) | 3.37 | 25.03 |

| Net Profit Margin (%) | 0.68 | 18.64 |

| Return on Capital Employed (%) | 6.45 | 25.46 |

| Return on Assets (%) | 0.71 | 15.54 |

| Current Ratio (X) | 0.98 | 1.15 |

| Inventory Turnover Ratio (X) | 2.21 | 8.64 |

These ratios paint a picture of the financial year 2023.

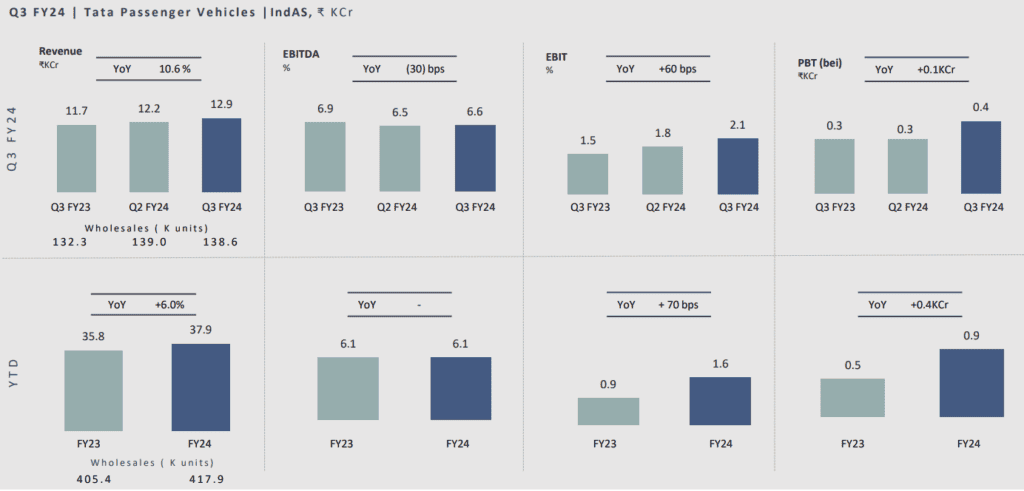

In the third quarter of FY2024, Tata Motors released the following results.

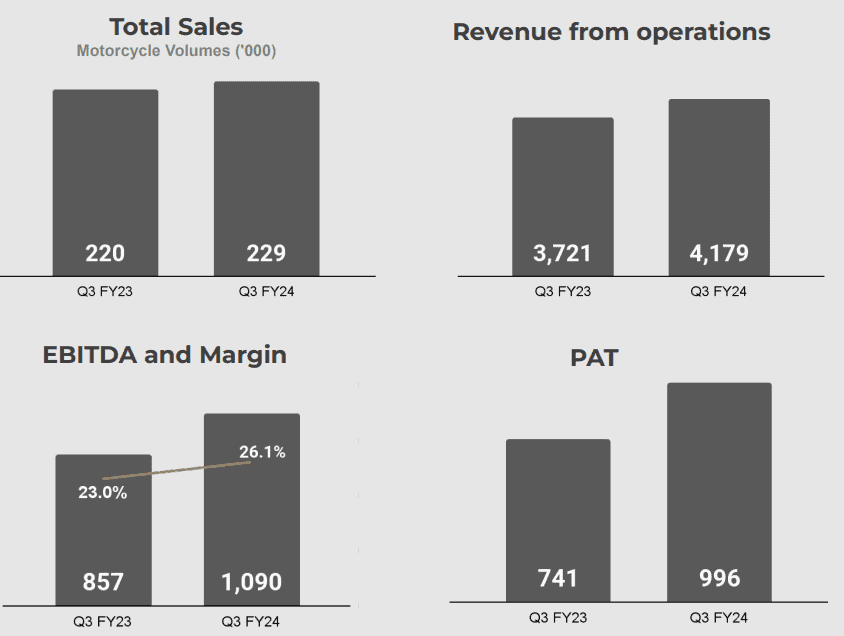

Moreover, for Eicher Motors, in the latest quarterly results for FY2024, the following findings have been disclosed.

Reasons for growth

Tata Motors

- New models like Punch.ev, Intra V70 pickup, and Ace HT+ boosting sales.

- Strategic investments in facilities and technology, including the establishment of a new facility in Sanand.

- Impressive financial performance is characterised by a rise in revenue and profitability, a notable improvement in EBIT margin, and a decrease in net auto debt.

- Expanding the market in the commercial and passenger vehicles sectors, with a strong emphasis on electric vehicles (EVs) and the establishment of a specialised EV showroom network.

- Customer satisfaction and a strong emphasis on quality. The company is poised to meet its deleveraging targets and is dedicated to maintaining a steady, competitive, and cash-generating growth trajectory.

Eicher motors

- Eicher Motors has expanded its range of motorcycles with the introduction of the Himalayan 450 and Shotgun 650. This has significantly contributed to the company’s growth.

- The company’s products are sold in more than 60 countries. This has significantly expanded its customer base and facilitated substantial growth.

- The company has made strategic investments in research to maintain a competitive edge in the market. In addition, they are actively involved in the development of electric vehicles.

- Strong leadership and a clear plan have helped Eicher Motors compete and grow in the car industry. Their focus on sustainability, community, and stakeholder management also helps their growth.

Company strategies

Tata Motors

Tata Motors, a prominent player in the automotive industry, has been strategically balancing its presence in both the Internal Combustion Engine (ICE) vehicles and Electric Vehicle (EV) market segments. It involves the establishment of charging infrastructure through partnerships with charge point operators and oil marketing companies.

The company acknowledges the promising growth potential of Compressed Natural Gas (CNG) and EVs, which are seen as positive developments in the industry. Nevertheless, it recognises the obstacles in the sector, with only modest growth expected in FY 2024 and FY 2025. Despite these challenges, Tata Motors has set a bold target to achieve a 10% EBIT margin by 2026.

Tata Motors is actively involved in the EV bus segment and has implemented a payment security mechanism to ensure seamless transactions. In addition, the company believes that there is little risk of one model cannibalising the sales of the other, as the Nexon EV and Punch EV cater to different price points and customer segments. It indicates a carefully planned product strategy.

Eicher Motors

Eicher Motors Limited focuses on fostering innovation and offering a wide range of products to meet the diverse needs of consumers. With a keen eye for market trends and customer demands, the company is strategically developing new products to stay ahead of the competition.

In addition, Eicher Motors is making strides in global expansion, strengthening its brand presence and retail network, all while prioritising customer satisfaction. At the same time, it is making strides in sustainability initiatives to reduce its carbon footprint and encourage environmentally friendly practices, demonstrating its dedication to environmental responsibility.

These strategies are designed to sustain growth, enhance the brand’s global footprint, and ensure long-term success.

Future outlook

Tata Motors is poised for a robust growth trajectory, anticipated to persist in its upward trend through the introduction of innovative models and strategic global expansion efforts. The company is adapting to market demands with a strong emphasis on electric vehicles, aligning with global environmental standards and consumer preferences for sustainable transportation solutions.

Eicher Motors has been experiencing steady growth in market share, especially with its Royal Enfield motorcycles, which have become a significant player in the industry. The company is also expanding its product range and venturing into new markets, aiming to strengthen its position and cater to a broader consumer base. Product expansion and market penetration are key strategies driving Eicher Motors’ success.

Further reading: https://www.stockgro.club/blogs/trending/automotive-finance/

Bottomline

Tata Motors and Eicher Motors are leading the charge in India’s burgeoning automotive industry. With Tata Motors expanding its EV and CNG offerings and Eicher Motors strengthening its motorcycle range, both companies are poised for significant growth.

Their strategic investments and focus on innovation and customer satisfaction are key drivers of their success in a competitive market. As they continue to navigate the dynamic landscape of the automotive sector, their financial and market performance will be crucial indicators of their future trajectory.