The residential real estate industry is currently booming in India. The March quarter (Q4FY24) pre-sales of significant real estate companies indicate solid progress, presumably backed by several new project launches and current inventories.

For example, new launches in Mumbai helped Macrotech Developers Ltd. achieve pre-sales of ₹4,230 crore, which is a 40% increase year-on-year. Additionally, the pre-sales for DLF’s financial year 2024 might surpass ₹20,000 crore, according to a recent report published by Morgan Stanley.

There’s no denying that public real estate companies are benefiting from the faster growth rate in the sector. That said, let’s take a closer look at how the two real estate giants: DLF and Macrotech, are differentiating themselves in terms of strategic approaches and growth factors.

Also read: Is real estate growth in India sustainable? Opportunities vs Challenges!

Company overview

DLF

Chaudhary Raghvendra Singh established DLF in 1946 by establishing 22 urban colonies in Delhi. In 1985, the business ventured into the unexplored landscape of Gurugram, providing first-rate housing and office facilities.

With holdings in fifteen states and twenty-four cities, DLF has grown into India’s biggest publicly traded real estate corporation.

In 2007, the company had the largest initial public offering (IPO) in India, raising $2 billion. The business is involved in every facet of real estate development, from finding and purchasing property to developing plans, building, and selling the finished product.

Selling and renting out the company’s projects are the main sources of income. It is also involved in the transmission and production of electricity.

DLF share price

According to the DLF share price history, the stock has returned 401.18% over the last five years.

As of April 12, 2024, the value of the DLF share rate is ₹911.40, which is around 47% up in the last 30 days.

Also read: What is REIT

Macrotech Developers

Macrotech Developers is a prominent player in India’s real estate market. It has focused on developing properties exceeding 85 msf (million square feet), primarily in the Mumbai Metropolitan Region (MMR), since its establishment in the 1980s. Among India’s leading real estate developers, it has established itself in the MMR and the Pune markets.

MDL has been concentrating on MMR, Pune, and Bangalore, as of now. Macrotech Developers’ market share is over 10% as of FY23, making them unquestionably the dominant player in the MMR area.

Macrotech Developers share price

Based on the MDL share price information, the business has returned 359.88% in the last five years.

As of April 12, 2024, the value of Macrotech Developers shares is ₹1220.30, which is 8.86% up in the last 30 days.

Financial profiles

Next, let’s look at some of the most crucial financial statistics for these companies.

| Value | DLF (March 2023) | Macrotech (March 2023) |

| EPS (Rs.) | 9.34 | 6.34 |

| Net Profit/Share (Rs.) | 9.34 | 6.34 |

| PBIT Margin (%) | 76.89 | 22.54 |

| Net Profit Margin (%) | 58.07 | 3.49 |

| Return on Capital Employed (%) | 9.91 | 13.45 |

| Total Debt/Equity (X) | 0.11 | 0.81 |

| Asset Turnover Ratio (%) | 0.11 | 0.22 |

| Current Ratio (X) | 2.01 | 1.41 |

| Earnings Yield | 0.03 | 0.01 |

Strategic differences

DLF’s strategy:

- Strong demand momentum

DLF has continuously prioritised Goa, Pune, Chennai, Mumbai, and Delhi-NCR. By strategically concentrating on areas with high demand, DLF can guarantee that its projects will find a ready market and continue to build strong sales momentum.

This approach goes after the high-end market and makes the brand more visible in significant cities.

- Affordable land banks in known locations

DLF has a history of acquiring property at relatively low prices; for example, it invested ₹825 crore to acquire a 29-acre plot of land in Gurgaon. This strategy helped DLF expand its strong land bank to profit from a rising real estate market.

- Enhanced organisational capabilities:

Through several initiatives, DLF has engaged in strengthening its organisational capabilities. DLF has created a portfolio that includes businesses, residential, and retail sectors.

Macrotech Developers’ strategy:

- Profiting from the market’s high demand:

Macrotech Developers (LODHA Group) has singled out the Mumbai Metropolitan Region (MMR), Pune, and Bangalore as excellent locations with enough room for expansion. These areas are expected to see a solid trajectory for development, with the business projecting a compound annual growth rate of about 10%.

- The ‘20:20’ Action Plan

With a strict financial strategy that limits net debt to 0.5x debt-to-equity (D/E) and 1x debt-to-operating cash flow (D/OCF), Macrotech Developers’ strategic ’20:20′ Action Plan seeks to achieve a 20% CAGR in pre-sales and a 20% RoE.

This strategy highlights the group’s dedication to significant growth, creating value for shareholders, and maintaining a mindful financial position.

Also read: The Nifty Realty Index 2023: India’s real estate powerhouse

These ratios paint a picture of the financial year 2023.

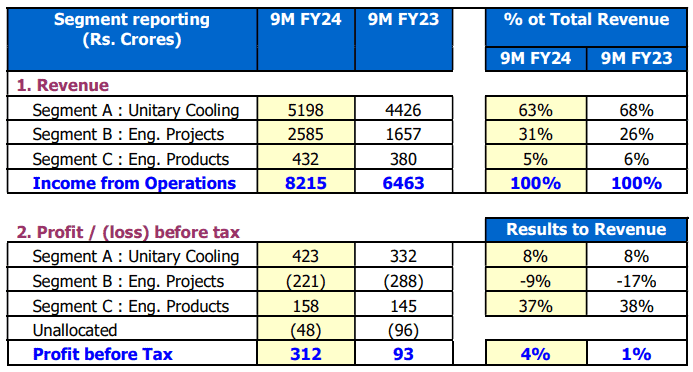

In the third quarter of FY2024, Voltas released the following results.

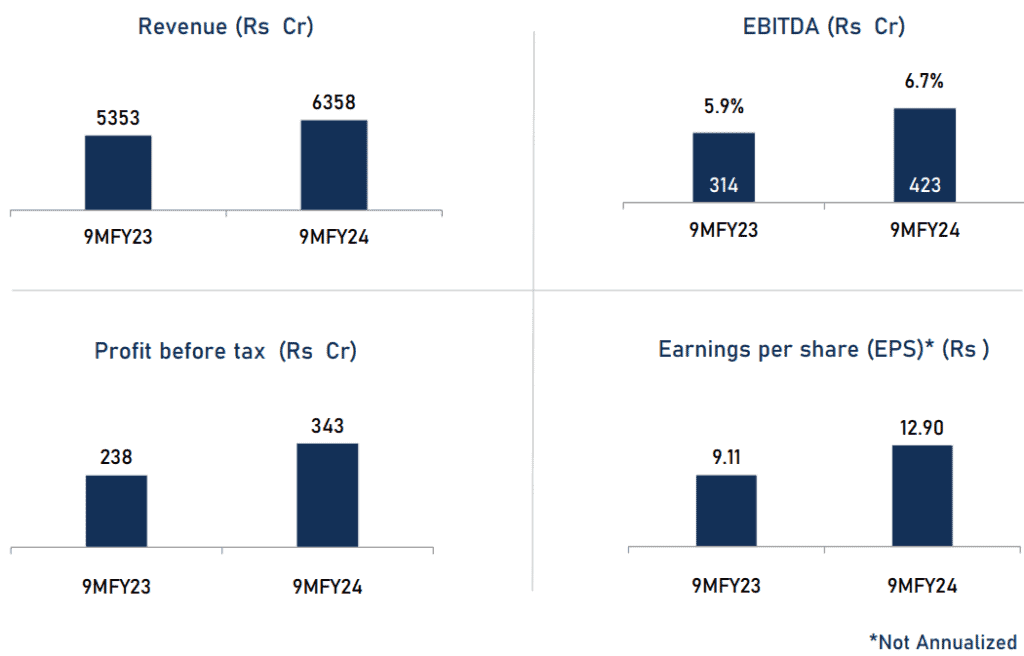

Additionally, in the third quarter of FY2024, Blue Star released the following results.

Reasons for growth

DLF

- Strong pre-launch sales and their impact:

DLF’s financial stability is a direct outcome of the significant sales pipeline generated via aggressive pre-launch strategies. Throughout the first nine months of the fiscal year, the company achieved more than its pre-sales (bookings) estimate of ₹13,000 crore. The company has set a modest 15% pre-sales growth target for FY25.

- Being successful in the retail sector:

A factor in DLF’s expansion has been the steady stream of rental money, which has been made possible by exceptionally high occupancy rates in the retail divisions.

Macrotech Developers

- Influence in the real estate industry:

The varied portfolio and emphasis on the MMR area have allowed Macrotech to capture a significant portion of the organised real estate market, fueling its expansion.

- Strategic growth of the company:

The company is well-positioned for sustained long-term development due to its expansion into new regions and industries and its debt reduction strategy. With the support of internal accruals and equity fundraising, Macrotech Developers has cut its net debt in the latest fiscal quarter by 55%, bringing it down to ₹3,010 crore.

Conclusion

India’s prominent real estate businesses, like DLF and Macrotech Developers, have benefitted from the strong recovery in the residential segment.

Although both firms stand to gain from India’s increasing urbanisation and economic expansion, DLF might be in a better financial position. On the other hand, the ability to convert Macrotech’s strong brand into long-term success depends on the projects and cost control efficiency.