India’s real estate industry is one of the most vibrant worldwide. Even though the industry has grown quickly recently, unforeseen challenges created by the pandemic between 2020 and 2022 significantly impacted the industry.

However, the Indian real estate industry made a stunning recovery in 2022, breaking previous annual sales records by 68% despite a two-year downturn. Following COVID’s two-year impact, Tier 2 and Tier 3 cities have emerged as new, significant real estate trends.

The market size of real estate in India was valued at USD 256.8 billion in 2022. Real estate sales in India will climb to $1 trillion by 2030, which will contribute thirteen percent of India’s GDP by 2025.

In today’s article, we will dive into India’s high potential industry and focus on its evolution, the current market scenario and what the future looks like for the sector.

Understanding the real estate sector in India

The land and any permanent buildings, such as houses or constructions affixed to the property, are considered real estate. The market involves the categories of residential, office, commercial, and retail real estate, depending on the function of the building. In many cases, real estate and housing are even used interchangeably.

One of the most prominent industries worldwide is real estate. The middle class in India is expanding quickly, with more and more individuals earning enough money to own real estate. The demand for housing is growing, especially for low- and moderate-priced properties.

Housing is in high demand in India since the country’s population is relatively young and urbanisation is still growing. A robust IT sector also helps the office sector, and one of India’s top sectors for drawing in foreign direct investment is the housing sector.

It was additionally expected that, over time, this industry would see a rise in non-resident Indian (NRI) investment.

In addition to its significance for the Indian market, the real estate industry is the second largest employer in the country, just after agriculture. The market is constantly growing, which is one thing that is guaranteed about the industry.

Also read: All you need to know about India’s first Retail REIT – Nexus Select IPO

How did the real estate market in India start?

In ancient India, land was regarded as one of the most precious assets and belonged to the governing class and affluent landowners. This is when the real estate sector in India began to develop. The real estate market saw substantial change that helped form the industry after India’s independence in 1947.

Government-sponsored public housing initiatives were introduced in the 1950s and 1960s to provide low-income families access to inexpensive homes. The primary goals of these programmes were to enhance living conditions and lessen the scarcity of housing in metropolitan areas.

The government also invested significantly in ports, highways, bridges, and other infrastructure projects to boost economic growth while improving connectivity.

The real estate market changed from public to private housing in the 1980s and 1990s due to the entry of private developers. New real estate markets, such as luxury homes and commercial real estate, were created due to the rise of private developers.

With the Pradhan Mantri Awas Yojana (PMAY), which offers low-income households incentives to purchase or construct their own houses, the Indian government has also started to support affordable housing.

Also read: The economics behind the fun Indian toy industry

Market today: Real estate growth in India

In India, during the initial nine months of FY22, approximately 1,700 acres of land were sold in the country’s top eight cities. Nearly 558,000 houses will be completed by Indian real estate developers in the nation’s biggest cities by 2023, marking a significant milestone.

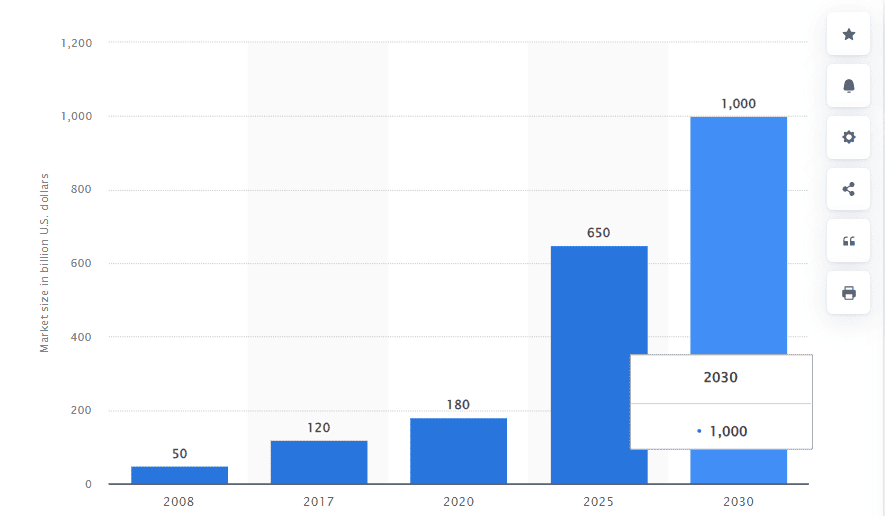

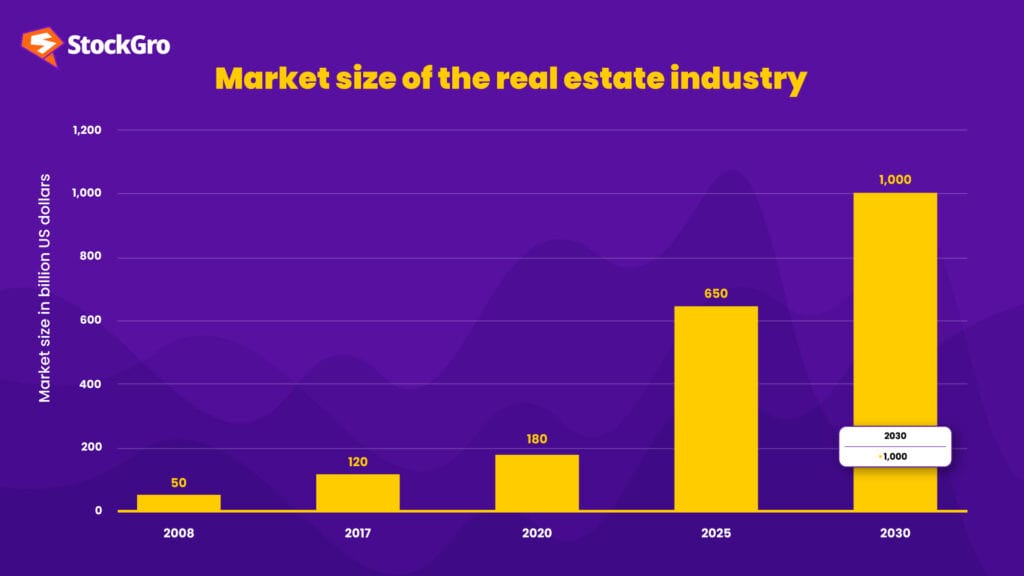

In 2021, the market size of the real estate industry was US$ 200 billion and it is estimated to grow to US$ 1 trillion by 2030.

Source: Statista

In 2023, private equity investments in the Indian real estate market were valued at US$4.2 billion. By 2047, it is expected to grow to $54.3 billion.

Moreover, with the introduction of online real estate sites and property listing platforms, the Indian real estate market has seen an extensive digital transformation in recent years.

Nowadays, finding and dealing with properties online has been comparatively simpler for buyers, sellers, and renters, who often end up with better offers.

The potential of the real estate market in India

By 2047, the real estate industry in India is predicted to grow to $5.8 trillion, accounting for 15.5% of the country’s GDP, up from its current 7.3% contribution.

The Real Estate Investment Trust (REIT) platform has received permission from the Securities and Exchange Board of India (SEBI), enabling many investors to take part in the real estate market in India. It will open up access to the Indian market in the next few years for ₹1.25 trillion (US$ 19.65 billion).

With the national government’s ambitious Pradhan Mantri Awas Yojana (PMAY) programme intending to build 20 million cost-effective houses in metropolitan areas nationwide, the housing industry was expected to expand dramatically.

It is clear that the real estate industry is seen as one of the fundamental forces behind India’s economic development in the coming years.

Top real estate stocks to consider

The real estate sector has proved to be a reliable inflation hedge. Real estate values often grow in line with increasing inflation, providing investors with an opportunity for financial gains.

Retail investors have also been showing interest in real estate investment trusts (REITs) recently, among other investment classes.

With that being said, here are a few top stocks with their market capitalisation and net profit (as of December 14, 2023)

Also read: The Nifty Realty Index 2023: India’s real estate powerhouse

Conclusion

India’s real estate market is set for rapid expansion. The future seems bright for real estate investors, especially those who are prone to diversifying their investments. Investors with the know-how to add value and seize chances in both economic and tough times are hopeful about the current market and the industry’s prospects.