It is raining IPOs in India. Just as we are getting over the allotment of shares from DOMS, Muthoot Microfin is all set to open its IPO.

If you are an investor looking for an opportunity in the BFSI sector, this is your chance. But is this a good addition to your portfolio? Let’s find out!

This article will take you through Muthoot Microfin’s company details, such as the background financials and terms of the IPO.

Who is Muthoot Mircrofin?

Let’s begin with understanding what microfinance means.

Microfinance is a service in the financial sector that provides loans to individuals and businesses with low income. It is specially meant for entities not qualifying for any other type of loan.

Muthoot Microfin is the microfinance wing of the Muthoot Group. Its primary objective is to provide micro-loans to women entrepreneurs in rural areas.

Also read: The best banks in India: Leading the way in finance

History

In 2011, the parent company, Muthoot Pappachan Group, acquired an NBFC (Non-Banking Financial Company) and rebranded it as Muthoot Microfin Limited (MML).

MML got its licence from the Reserve Bank of India to run as a microfinance institution in 2015.

Objective and vision

The NBFC’s objective is to develop entrepreneurship among women and enable them to explore new opportunities to earn a better income for their livelihood. They mainly focus on providing quick, affordable, and hassle-free loans to such unprivileged groups in rural areas.

Muthoot Microfin today

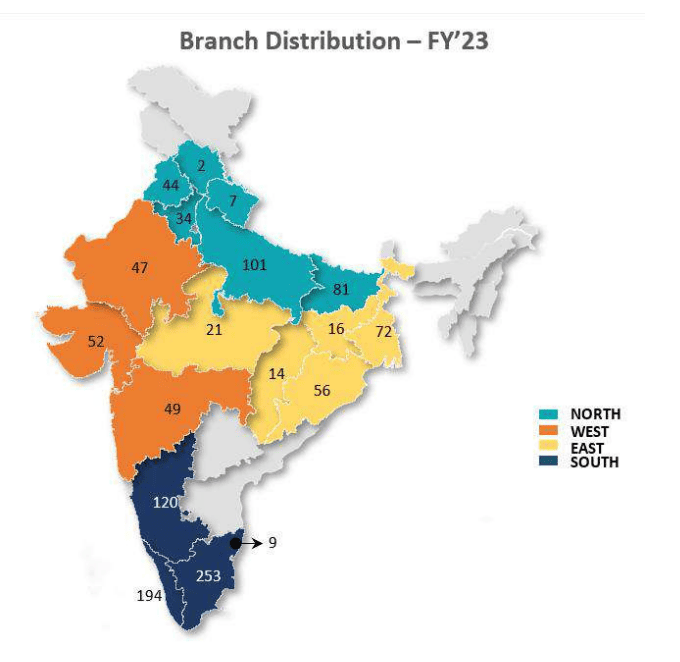

Muthoot Microfin is a popular name among those looking for microloans today. The firm has a presence in 18 states across the country, with 1,172 branches and more than ₹10,000 employees.

Source: Muthoot Microfin – DRHP

As of 31 March 2023, the firm managed a portfolio of ₹9,200 crore with a borrower base of more than 2.7 million women entrepreneurs.

Muthoot Microfin’s financials

| Particulars | FY 2023 (In ₹ million) | FY 2022 (In ₹ million) | FY 2021 (In ₹ million) |

| Revenue from operations | 14,287.64 | 8,325.06 | 6,841.67 |

| Expenses | 12,334.74 | 7,782.20 | 6,872.26 |

| Profit before tax | 1,638.89 | 473.98 | 70.54 |

| Earnings per share (Basic) | 14.19 | 4.15 | 0.62 |

| Gross loan portfolio | 92,082.96 | 62,549.42 | 49,867.11 |

| Capital adequacy ratio | 21.87% | 28.75% | 22.55% |

Also read: IREDA touches 200% returns after IPO: Should you book profits?

Muthoot Microfin’s IPO details

| Muthoot Microfin’s IPO date | 18 December 2023 |

| Muthoot Microfin’s IPO closing date | 20 December 2023 |

| Anchor bidding date | 15 December 2023 |

| Muthoot Microfin share price/ price band | ₹277 – ₹291 |

| Issue size | ₹960 crores |

| Fresh issue | ₹760 crores |

| Offer for sale | ₹200 crores |

| Minimum bids | 51 shares and multiples of that |

IPO reservation | Anchor investors – 30% Qualified Institutional Buyers (QIB) – 20% Non-Institutional Investors (NII) – 15% Retail investors – 35% |

Shareholding pattern before IPO

| Shareholder | Percentage of equity share capital |

| Muthoot Fincorp Limited | 72.36% |

| Creation Investments India, LLC | 11.13% |

| Thomas Muthoot | 3.04% |

| Thomas John Muthoot | 3.03% |

| Thomas George Muthoot | 3.03% |

| Subha Joseph | 2.97% |

| Nina George | 1.30% |

| Preethi John Muthoot | 1.30% |

| Remmy Thomas | 1.29% |

| Greater Pacific Capital WIV Ltd | Negligible |

Fund utilisation plan

- The funds raised through the offer for sale will be fully credited to the selling shareholders after deducting the expenses of the public offer.

- The company aims to handle its existing activities using the proceeds that it will receive from the fresh issue.

- One of the significant uses of the fund is to increase the capital adequacy ratio. As an organisation in the loan lending sector, Muthoot must maintain the minimum capital adequacy ratio as suggested by RBI. Since the company is growing its loan portfolio, it will need additional funds to grow its capital proportionately.

Is Muthoot Microfin’s IPO for you?

The numbers for the last three years, both in terms of revenue and assets, show a steady increase, indicating a positive growth for Muthoot. But, like every other stock, investing in Muthoot Microfin can be beneficial and risky, too. Here are some factors to support your investment decision:

Why should you add this to your portfolio?

- Muthoot Microfin is one of the top companies in its sector and has a pan-India presence. With 2.77 million active customers as of March 2023, Muthoot Microfin is the fourth-largest microfinance NBFC in India and the third-largest in South India.

- Their focus on helping women in rural areas is not restricted to loans but also extends to meeting customers’ healthcare needs. The NBFC has set up various e-clinics across different states and provided medical consultations to 198,826 customers.

- Muthoot Microfin is part of the Muthoot Pappachan Group, which has significant brand value and goodwill in the financial industry. Being the second largest company under the group, Muthoot Microfin aligns fully with Muthoot Pappachan’s values.

- Muthoot Microfin understands the importance of technology in today’s world. As of 31 March 2023, the company had 87 employees in its IT team to work exclusively on improving its exposure to technology. The company now has the facility to onboard customers digitally and also has an app called Mahila Mitra that helps reduce cash transactions through digital payments on the app.

- On 19 January 2023, the firm received an A+/Stable rating from CRISIL, indicating a high credit rating and brand equity.

| Peer comparison | ||||

Name | Total income (₹ in million) | EPS (Basic) (₹) | Return on Net Worth (RoNW) | Net Asset Value per equity share (₹) |

| Muthoot Microfin Limited | ₹14,463.44 | ₹14.19 | 10.08% | ₹139.15 |

| Equitas Small Finance Bank | ₹48,314.64 | ₹4.71 | 11.12% | ₹46.44 |

| Ujjivan Small Finance Bank | ₹47,541.90 | ₹5.88 | 27.79% | ₹20.25 |

| Credit Access Grameen Limited | ₹35,507.90 | ₹52.04 | 16.18% | ₹326.89 |

| Spandana Sphoorty Financial Limited | ₹14,770.32 | ₹1.74 | 0.40% | ₹436.58 |

| Bandhan Bank Limited | ₹183,732.50 | ₹13.62 | 11.21% | ₹121.58 |

| Suryoday Small Finance Bank Limited | ₹12,811.00 | ₹7.32 | 4.90% | ₹149.28 |

| Fusion Micro Finance Limited | ₹17,999.70 | ₹43.29 | 16.67% | ₹230.74 |

What should you watch out for?

- The customer base of microfinance companies includes people from rural areas who may not have sufficient resources to repay loans. So, the risk of non-performing assets increasing is high. This will automatically affect the revenue and the firm’s balance sheet.

- The company is exposed to interest rate risks. It is highly impacted by the economic policies and the decisions made by the Reserve Bank of India. As of 2023, the firm had an interest income of ₹12,906.45 million, forming 90% of its revenue. Since interest on loans is the main source of income, any change in interest policies in the country can impact the firm’s revenue.

- Any non-compliance to RBI’s norms can hurt the firm, affecting its brand value and goodwill.

- The company is currently a part of more than 300 legal proceedings, of which over 20 are against the firm. The company’s financial status, as well as the brand name, may be affected based on the judgements of these cases.

- The company holds large quantities of data, including the personal information of all its customers. Since the firm is digitally active, it is exposed to the risk of hacking and other unethical cyber crimes.

Also read: ISF IPO open till 15th December: Should you apply?

Bottomline

Given the growth of Muthoot Microfin, the stock may seem like a good fit in your portfolio. However, the BFSI sector is constantly exposed to various risks – like credit risk, operational risk, interest rate risk and more. Hence, analysing your risk appetite is the first step to consider in this direction.