Did you know that India is set to be home to the third-largest domestic banking sector by 2050? Yes, that’s right! India is home to some of the world’s top banking firms. One merger between HDFC Bank Ltd and Housing Development Finance Corp. has given birth to a financial behemoth.

This mega-bank, with a market capitalisation of around $172 billion, has secured its place as the fourth-largest global player, trailing behind financial giants like JPMorgan Chase & Co., Industrial and Commercial Bank of China Ltd., and Bank of America Corp.

Despite global chaos, India’s banking industry has stood tall as one of the most stable systems worldwide. Thanks to high savings rates and the growth of disposable income,

Indian banks have a solid foundation to build upon. And here’s a staggering number to prove it: there are approximately 123,000 bank branches across the country! The cherry on top? The total deposits in Indian banks amount to a whopping $2 trillion!

Let’s dive into the fascinating world of Indian banks, where numbers and facts intertwine with resilience and innovation.

A banking ecosystem like no other

The Indian banking wonderland, where the numbers are as diverse as the flavours in a spice market. Here’s a snapshot of the banking ecosystem in India:

- Public sector banks: 12 in total, known for their reliability and strength.

- Private sector banks: 22 mighty players who have carved a niche for themselves with top-notch services and profitability.

- Foreign banks: 46 international powerhouses adding their unique touch to India’s financial landscape.

- Regional rural banks: 56 strong pillars supporting the growth of rural areas.

- Cooperative banks: A whopping 96,000 cooperative banks and 1,485 urban cooperative banks lend a helping hand to their communities.

You may also like: SGX Nifty to GIFT Nifty brings new opportunities

Fintech revolution and India’s digital future

In recent years, India has become a hotbed of fintech innovation and microfinancing.

- Digital lending: In FY18, India’s digital lending stood at a staggering $75 billion. But it doesn’t stop there. By FY23, it is estimated to soar to $1 trillion. That’s a five-fold increase!

- Fintech funding: India’s fintech market is a force to be reckoned with, attracting $29 billion in funding across 2,084 deals from January 2017 to July 2022. Impressive, right? It ranks second globally in deal volume, accounting for 14% of total global funding.

- Future forecast: By 2025, India’s fintech market is projected to reach a staggering Rs. 6.2 trillion ($83.48 billion).

The best bank in India: What makes the cut?

What defines the best bank in India? It is financial performance, customer satisfaction, technological innovation, comprehensive services, and robust risk management.

The top banks in India consistently demonstrate outstanding revenue growth, sustainable net income, and a strong market position. They also prioritise customer-centric approaches, embrace digital transformation, offer a wide range of products, and manage risks effectively.

In the ever-evolving landscape of Indian banking, a few institutions stand out as true financial titans. Let’s dive into the top banks in India and discover what makes them shine in the realm of finance.

Also Read: The world of currency fluctuations: How does it impact your investments?

1. HDFC Bank:

HDFC Bank, the torchbearer of the private banking sector, has taken the industry by storm since its establishment in 1994. With its relentless focus on technology and innovation, HDFC Bank has revolutionised the way banking is done. From its robust financial performance to its comprehensive range of services, HDFC Bank has cemented its place as a leader in the industry.

- Market capitalisation (post-merger): Rs 14,12,055.5 crore

- Revenue: Rs.1,70,750 cr

- Net Income: Rs.2,04,666 cr

- Branches: 7,821

- ATMs: 19,727

- Net Interest Margin (NIM): 3.67%

- Gross Non-Performing Assets (NPA): 1.12%

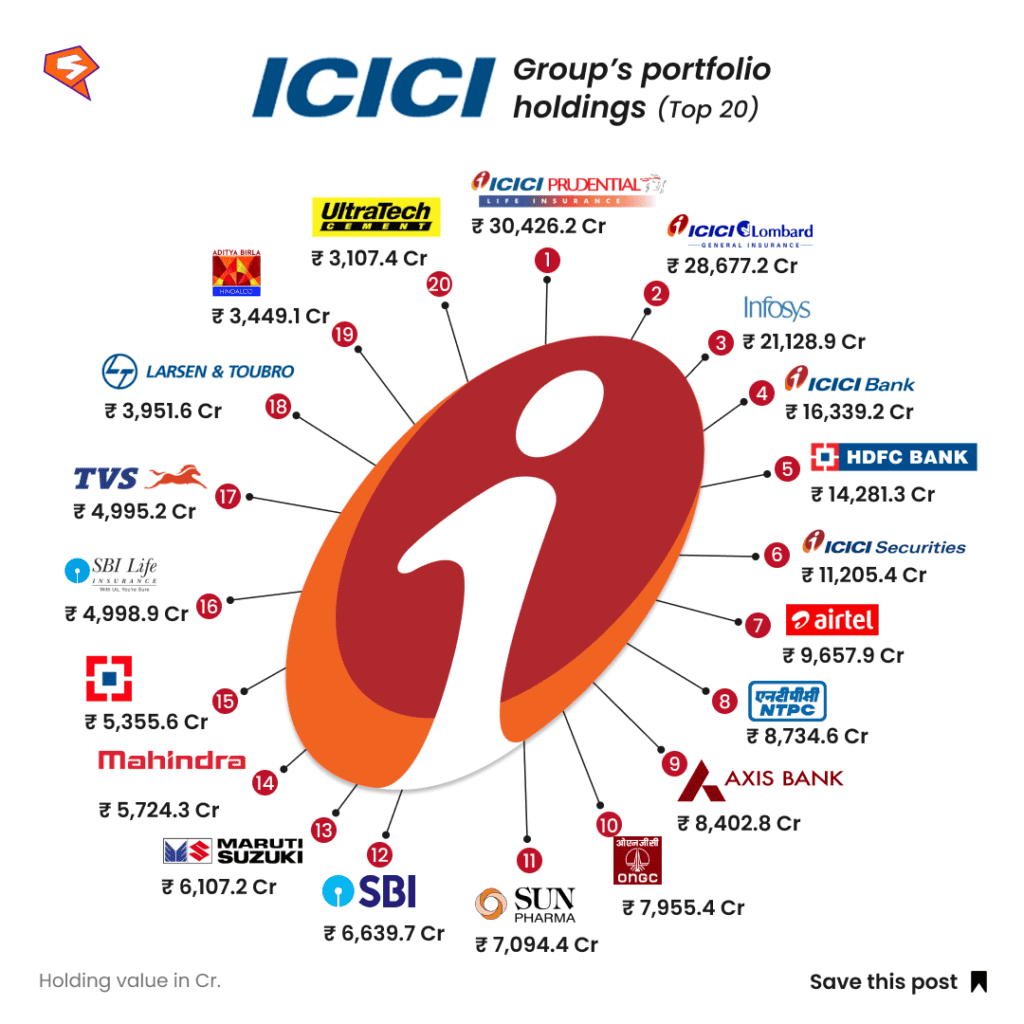

2. ICICI Bank:

ICICI Bank, the second-largest private sector bank in India, has captured the imagination of millions with its diverse range of financial products and services. With a strong presence in India and overseas, ICICI Bank has earned the trust of customers far and wide.

- Market capitalization: ₹ 670,000 cr

- Revenue: Rs.121,066 cr

- Branches: 6,612

- ATMs: 15,158

- Net Income: Rs.186,178 cr

- Net Interest Margin (NIM): 3.60%

- Gross Non-Performing Assets (NPA): 2.81%

3. State Bank of India (SBI):

State Bank of India reigns supreme as the largest public sector bank in the country. With a history dating back to 1955, SBI has become synonymous with reliability and trust. Boasting a staggering 20% share in the country’s banking sector. Offering diverse financial products, SBI caters to the banking needs of individuals, businesses, and the government.

- Market capitalisation as of July 2023: ₹5,25,838 Cr ($64.85 Billion)

- Revenue: Rs.350,844 cr

- Net Income: Rs. 473,378 cr

- Branches: 22,405

- ATMs: 62,617

- Net Interest Margin (NIM): 2.70%

- Gross Non-Performing Assets (NPA): 2.78%

4. Punjab National Bank (PNB):

In the realm of public sector banks, Punjab National Bank (PNB) stands tall as a prominent player committed to promoting financial inclusion. With over 10,076 branches and 3,766 ATMs spread across the country, PNB ensures that banking services are accessible even in the most remote corners of India.

- Asset under management (AUM) as of March 31, 2023: ₹1,493,648.94 crore (US$190 billion)

- Market capitalization as of July 5th, 2023: ₹3.2 trillion

- Revenue: Rs.86,845 cr

- Net Income: Rs.28,132 cr

- Branches: 10,076

- Net Interest Margin (NIM): 2.34%

- Gross Non-Performing Assets (NPA): 9%

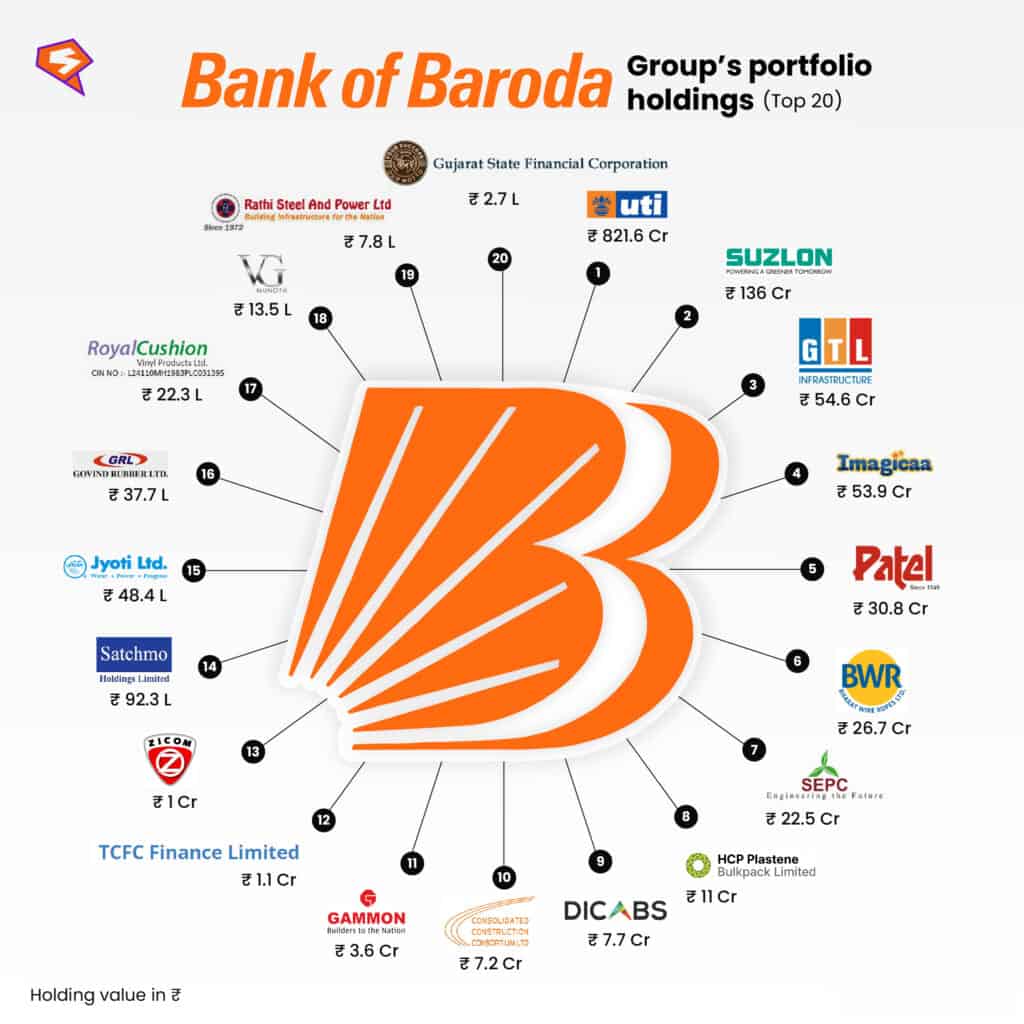

5. Bank of Baroda (BoB):

Established in 1908, this public sector bank has been delivering a wide range of financial products and services to its customers for over a century.

Let’s dive into the numbers that make Bank of Baroda shine:

- Market capitalization: ₹281.34 billion (US$3.5 billion)

- Asset under management: ₹1,319,458.90 crore (US$165 billion)

- Revenue: ₹94,138 crore

- Net Income: ₹32,528 crore

- Branches: 8,200

- Net Interest Margin (NIM): 2.89%

- Gross Non-Performing Assets (NPA): 3.79%

6. Axis Bank:

In the realm of private sector banking, Axis Bank takes the spotlight. Established in 1994, this leading bank has earned a reputation for excellence in services.

Let’s explore the financials of Axis Bank:

- Market capitalization: ₹1.7 trillion (US$21 billion)

- Asset under management: ₹5.5 trillion (US$70 billion)

- Revenue: ₹87,448 crore

- Net Income: ₹1,06,154 crore

- Net Interest Margin (NIM): 3.27%

- Gross Non-Performing Assets (NPA): 2.02%

7. Canara Bank:

Founded in 1906 by the visionary Subba Rao Pai, Canara Bank is ranked 10th in the world by market capitalisation. It caters to both retail and corporate banking needs and has made significant strides in the mutual fund and insurance sectors.

- Market capitalization: ₹58.35 billion (US$740 million)

- Asset under management: ₹11.7 trillion (US$145 billion)

- Revenue: ₹85,884 crore

- Net Income: ₹1,11,209 crore

- Branches: 9,706

- Net Interest Margin (NIM): 2.38%

- Gross Non-Performing Assets (NPA): 5.35%

With the HDFC-HDFC Bank merger making waves globally and public sector banks tripling their net profits, the future of Indian banking looks promising. As the country embraces technology and witnesses the rise of fintech, the possibilities are endless.

Are you planning to invest in any of these banking stocks? Why not take this as a sign and give it a go?