The ever-changing paint industry in India is responsible for the vibrant colours that decorate our environment, the coatings that protect our infrastructure, and the creative solutions that improve our living spaces.

This industry, which is pivotal to India’s economy, has been growing at a rapid pace recently. As a result of factors such as expanding urban areas, higher disposable incomes, and a desire for eco-friendly paints, the paint market in India is a vibrant tapestry of substantial opportunities.

We will paint a complete picture of the present and future of this industry by delving into its many aspects, such as market trends and key players. A market as varied and lively as the paints it sells, the Indian paint industry is the focus of this article.

Market analysis

Over the years, the paint industry market size in India has grown into a dynamic and rapidly expanding landscape. By the end of 2024, the market is projected to be worth $14.61 billion. Several factors have contributed to this expansion, including more urbanisation, higher disposable incomes, and a greater need for eco-friendly paints.

The industry’s predicted compound annual growth rate (CAGR) from 2024 to 2028 is 1.85%. This robust growth forecast indicates that the Indian paint industry is ripe with opportunity.

Also read: What is CAGR and how to calculate? [ Explained]

A favourable development for the paints and coatings industry occurred in fiscal year 2022–23 when the prices of raw materials dipped from their previous highs. The input costs of the industry saw an improvement in margins due to price corrections in crude and other essential components, which account for 55% to 60% of the total.

Segmentation

Many different kinds of paint are sold in India’s varied paint industry. The technology, resin type, and end-user industry can all be used as criteria for segmentation.

Technology-based segmentation

The paint industry makes extensive use of a broad range of technologies. Because of their low flammability and low toxicity, water-borne coatings are popular. A lot of people also use coatings that are solvent-borne because of how long they last and how shiny they are.

The popularity of powder coatings has skyrocketed due to their low production costs and low impact on the environment. Finally, this class also contains radiation-cured coatings, which are well-known for having very short drying periods.

Resin type segmentation

Resins with varying characteristics are used in the industry. The exceptional colour retention and general durability of acrylic and alkyd make them popular choices. Epoxy and polyurethane have excellent chemical and abrasion resistance. There are many uses for polyester and other resin types.

End-user industry segmentation

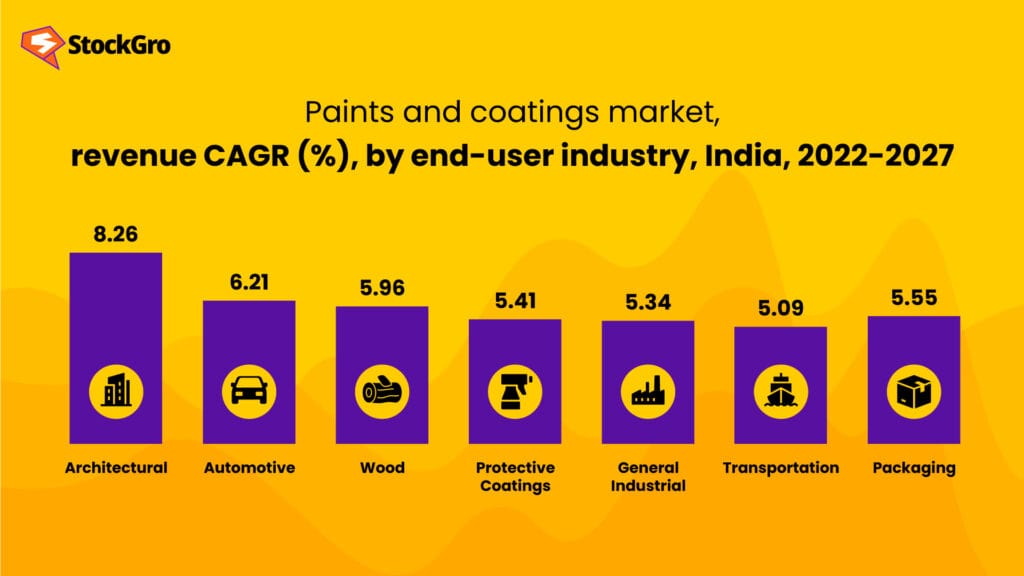

Many different types of end-user industries are served by the paint industry. Paints are used extensively in the architectural and automotive industries. Paints are in high demand across a variety of industries, including those dealing with wood, protective coatings, general industrial, transportation, and packaging.

Key market trends

The usage of nanotechnology and the increasing influence of the architectural industry are two major trends influencing the future of India’s paint industry.

Role of the architectural industry

When it comes to the paint market, the architectural industry is crucial. The report by Mordor Intelligence states that architectural paints and coatings constitute the largest segment within the paints and coatings industry, accounting for approximately 75% of the market share.

According to the report, the revenue CAGR of the architectural industry is the highest among other end-user industries.

Coatings like these serve to both preserve and adorn the exteriors of houses and other structures. They have a wide range of commercial and residential uses, from office and warehouse buildings to convenience stores, shopping malls, and residential complexes.

Infrastructural projects like roads, bridges, and airports, as well as residential, commercial, and industrial building projects, are inextricably linked to the demand for paints and coatings. The architectural paints industry has grown thanks to the thriving construction sector.

Use of nanotechnology

When it comes to paints and coatings, nanotechnology is making all the difference. Adding nanoparticles to coatings improves their performance in many ways and allows for the creation of multipurpose coatings at a relatively low cost.

Nanoparticles, which can vary in size from 1 to 100 nm, have the potential to alter the physical properties of conventional coatings. This could make coating systems more smart and responsive to environmental stimuli, or they could act as separate coatings with distinct qualities that aren’t present in less advanced barrier coatings.

There will likely be several chances for market growth in the paints and coatings industry due to the utilisation of nanotechnology throughout the forecast period.

Not only are these trends impacting the paint industry in India right now, but they will also likely shape its future.

Major players in the industry

A small number of paint companies in India control a disproportionately large portion of the Indian paint industry market share. Listed below are some of India’s most prominent paint manufacturers:

Also read: Fundamentally analysing Kansai Nerolac Paints Ltd. for investment

Challenges, opportunities and future outlook

Challenges:

- For many years, this sector has relied on volatile organic compounds (VOCs), which pose serious health and environmental risks.

- A major obstacle is the ever-increasing environmental regulations.

- The financing costs and research and development centres are more favourable to large companies.

- Unlike the MSME sector, large companies have the resources to purchase raw materials in bulk.

Opportunities:

- In light of the challenges faced by the Indian paint industry, multiple initiatives have been initiated by the government.

- Over the next three years, the industry is projected to add 2.5 million kilolitres of capacity.

Future outlook:

- Within the next five years, the paints and coatings sector in India is anticipated to surpass ₹1 lakh crore.

- There will likely be several chances for market growth in the paints and coatings industry due to the utilisation of nanotechnology.

- The market has great potential for expansion due to improving consumer sentiment and a robust economy.

- The traditional whitewash is giving way to high-quality paints.

- Paint sales in India have been on the rise recently, thanks to several factors such as rising middle-class disposable income, more spending on education, more urbanisation, the expansion of the rural market, and the introduction of numerous innovative products (such as eco-friendly, odour-free, and dust-and water-resistant paints).

Further reading: Automobile industry in India

Bottomline

The Indian paint industry, a vibrant blend of colours and opportunities, is poised for a future as bright as the hues it offers. Through its innovative, resilient, and growth-oriented canvas, it goes beyond simply painting walls—it paints a future filled with promise.

This sector is all set to leave a lasting impression, colouring the future with its compelling narrative.