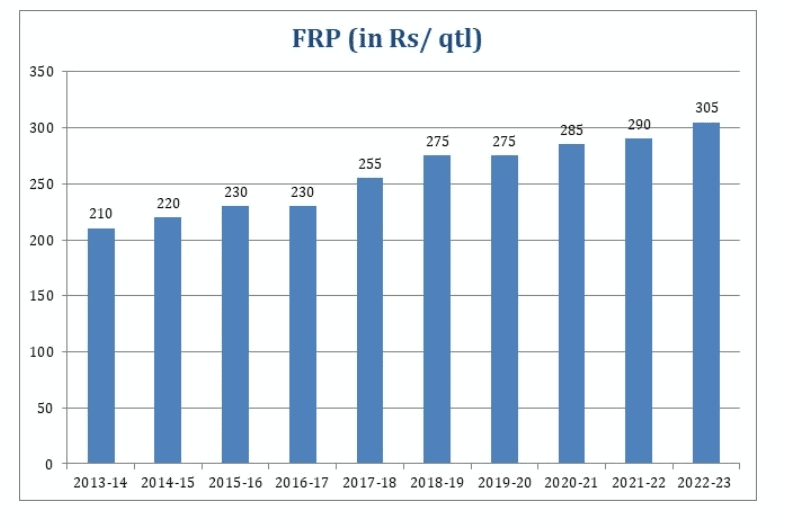

Sugar stocks in India faced a significant downturn on February 22nd, 2024, amid announcements of a hike in the Fair and Remunerative Price (FRP) for sugarcane by the government.

Let’s delve into the reasons behind the nosedive of sugar stocks, analysing the impact of the FRP increase and market dynamics.

Market reaction to FRP hike

The Cabinet Committee on Economic Affairs, chaired by Prime Minister Narendra Modi, approved the FRP of sugarcane for the 2024-25 season at ₹340/quintal, representing an 8% increase from the previous season.

This decision sent shockwaves through the sugar industry, leading to a flurry of selling activities in morning trading sessions.

You may also like: Mumbai High: ONGC’s legacy and future in India’s energy sector

Immediate impact on sugar stocks

Sugar stocks, including major players like Balrampur Chini Mills and Shree Renuka Sugars, experienced substantial declines. Balrampur Chini share price opened at ₹375 apiece and dip to an intraday low of ₹372, marking a 2.50% decrease.

Similarly, Shree Renuka Sugars witnessed a 3% dip, with its share price plummeting from ₹50 to ₹47.85 per share. The sell-off extended beyond the major players, affecting stocks like Dwarikesh Sugar, Rana Sugars, Dalmia Bharat, and others.

Sector-wide sell-off and investor sentiment

The recent sell-off has highlighted the concerns of investors about the future profitability of the sugar industry. The market buzz surrounding the potential escalation of input costs contributed to the bearish sentiment among investors.

Analysts raised concerns about the financial health of sugar companies due to the increase in FRP. Such uncertainties increased selling pressure, driving down stock prices across the sector.

Also Read: Mitsubishi’s game-changing venture into India with TVS Mobility

FRP mechanism and government support

The FRP hike is a critical factor influencing sugar stocks, directly impacting the input costs for sugar manufacturers. The government’s decision reflects its commitment to supporting sugarcane farmers, aiming to ensure their prosperity while balancing the interests of sugar companies.

The increase in FRP is expected to benefit over 5 crore sugarcane farmers and numerous individuals associated with the sugar sector. Despite concerns from industry stakeholders about rising input costs, the government emphasises the importance of fair compensation for farmers.

Long-term industry outlook

While the immediate market reaction was negative, the long-term outlook for the sugar industry remains influenced by various factors. Weather patterns, such as lower rainfall impacting sugarcane plantations, significantly determine production levels.

Additionally, government policies and international market dynamics shape the industry’s trajectory. As the industry navigates through these challenges, a nuanced understanding of market dynamics and supportive policies will be crucial for its long-term sustainability and growth.

Also Read: Sugar export ban – Too sweet to digest?

Conclusion

The recent hike in the Fair and Remunerative Price of sugarcane has sent shockwaves through the Indian sugar industry, triggering a widespread sell-off in sugar stocks.

While the government’s decision reflects its commitment to farmers’ welfare, concerns regarding rising input costs have weighed heavily on investor sentiment.

As the sugar market navigates these challenges, one can’t help but wonder: Will sweet returns prevail amidst the bitterness of current uncertainties?