By FY31, the Indian software products market is expected to have grown substantially, reaching a value of $42.62 billion. Given the diversity of software products available in the market, analysts predict a robust compound annual growth rate (CAGR) of 14.12% for the projected period from FY2024 to FY2031.

Rising consumer demand, improved IT infrastructure, and several government programs have all contributed to the software product industry’s recent evolution in India.

The main drivers of the software product industry’s expansion are the cloud’s adoption, MSMEs’ digitalization, and a thriving startup scene. To top it all off, India has no shortage of qualified IT experts, such as programmers, engineers, and data analysts, fuelling the expansion of the market.

In such a scenario, two of the well-known titans are LTIMindtree Ltd. and Tech Mahindra Ltd. Today, we will analyse their financials, latest results, strategies, and reasons behind their growth to compare the two companies. Let’s begin!

Company overview

LTIMindtree Ltd.

As a division of Larsen & Toubro, the business was established in December 1996 under the name L&T Information Technology Ltd. Originally known as L&T Information Technology Ltd, the brand was renamed to L&T Infotech Ltd.

L&T Technology Services, a newly formed subsidiary of parent company Larsen & Toubro, bought the engineering services section of L&T Infotech. L&T Infotech raised ₹1,243 crore (US$184.98 million) in July 2016 via an IPO, making it public for the first time.

Recently, Larsen & Toubro successfully acquired Mindtree, a company situated in Bengaluru. The merger of Mindtree with LTI, a former IT services division of Larsen & Toubro, was announced in May 2022. The newly formed company was officially named LTIMindtree.

Today, LTIMindtree serves 700 clients spanning 30 countries around the world.

Also read: The IT & BPM sector in India: A powerhouse of growth and transformation

LTIMindtree news:

Based on the most recent trading session on May 6, 2024, LTIMindtree’s share price is now trading at ₹4689.0.

LTIMindtree results:

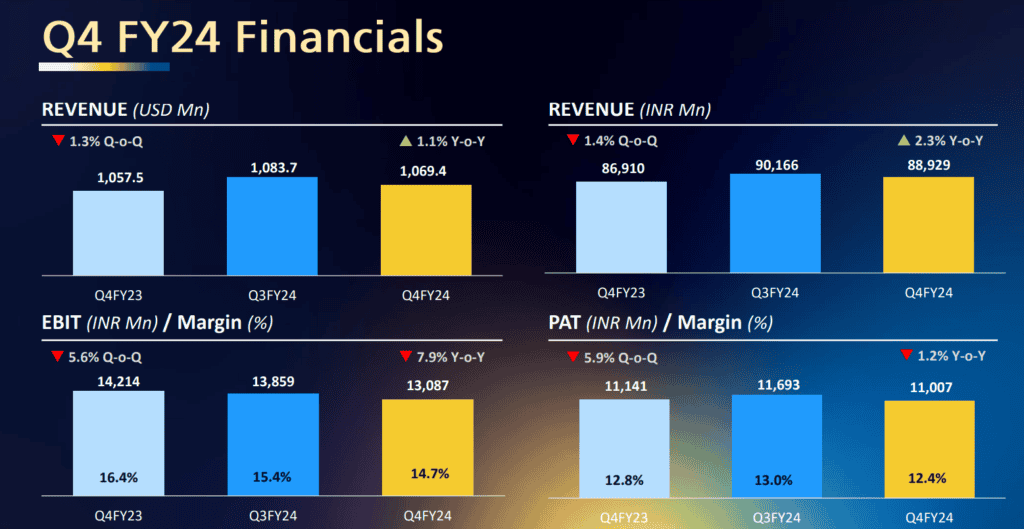

As per LTIMindtree quarterly results, ending March 31, 2024, the revenue of the company was ₹88,929 crore. The revenue in USD shows a decrease of 1.3% quarter-over-quarter (Q-o-Q) but an increase of 1.1% year-over-year (Y-o-Y). In contrast, the revenue in INR reflects an increase of 1.4% Q-o-Q and 2.3% Y-o-Y.

However, in FY24, LTIMindtree achieved a whopping 7.0% increase in revenue to ₹3,77,170. Earnings Before Interest and Taxes in FY24 grew 3.4% year-over-year to ₹55,685 and PAT to ₹45,846, a 4.0% Y-o-Y increase.

Tech Mahindra Ltd

Tech Mahindra is a global IT consulting and services firm headquartered in India. The Pune-based firm has corporate headquarters in Mumbai and is a member of the Mahindra Group.

As an information technology (IT) service provider, Tech Mahindra Ltd. serves a diverse clientele across many different sectors. Its offerings include IT-enabled services, consulting, enterprise business solutions, software development and maintenance, and more.

Tech Mahindra and Mahindra Satyam announced their merger on June 25, 2013. Tech Mahindra has worked with more than 1100 clients worldwide, spanning 70 countries.

Also read: Mahindra Logistics Ltd.

Tech Mahindra news:

On May 6, 2024, Tech Mahindra’s share price closed at ₹1262. According to Tech Mahindra’s share price history, the stock gained 20.96% in the last 12 months.

Tech Mahindra’s results:

In the last quarter (Q4 FY24), the company’s revenue stood at ₹12,871 crores, marking a decrease of 1.8% compared to the previous quarter and a 6.2% decline from the same period last year. EBITDA was reported at ₹1,408 crore, which is a significant increase of 22.8% quarter-over-quarter, although it reflects a 30.3% decrease year-over-year.

The consolidated PAT amounted to ₹661 crore, showing a robust growth of 29.5% over the last quarter, but a substantial decrease of 40.9% compared to last year.

Financial profiles (as of May 6, 2024)

| Value | LTIMindtree Ltd. | Tech Mahindra Ltd |

| EPS (Rs.) | 155 | 24.1 |

| Net Profit last quarter (Rs. crore) | 1,101 | 664 |

| Return on Capital Employed (%) | 32.1 | 11.9 |

| ROE (%) | 25.0 | 8.64 |

| Book value (₹) | 676 | 273 |

| Dividend Yield (%) | 1.28 | 2.54 |

Reasons for growth

LTIMindtree

- Maintaining a manageable operating scale

After merging with Mindtree, LTIM jumped to number six among India’s IT businesses. With a presence across end-user sectors, countries, and customers, the merged business has a larger size, varied technical skills, and a wide range of products.

As a result of its efficient operations and strong market position in important end-user sectors, the business is doing well. Of its total income, 37% came from BFSI, 24% from IT, media, and entertainment, and 18% from manufacturing and resources, to mention a few.

- Strategic relevance to L&T:

Over the last several years, the L&T group’s IT services business has grown in importance. Having previously prioritised infrastructure and capital-intensive divisions, the company is now shifting its attention to the services industry, which encompasses financial and information technology services.

In addition to the infrastructure business’s less-than-expected performance, the asset-light services business’s excellent growth potential and high ROCE have contributed to the strategy modification.

Tech Mahindra Ltd

- A diverse set of clientele and strong business vertical diversity

Technology, Media and Entertainment (CME), Production, Finance, Financial Services, and Insurance (BFSI), and many more sectors are all well-served by Tech Mahindra’s extensive product and service offerings. A diverse customer base has been and will continue to be, an advantage to the company.

- Dedicated promoters and a qualified management team

In its more than 30 years of operation, Tech Mahindra has expanded, attracting customers from a wide range of industries and regions. Because the promoter firms get substantial financial incentives in the form of dividends, the company’s strategic relevance to the Mahindra group is rather significant.

Also read: India’s port dominance: Adani Ports vs. JSW Infra analysis

Conclusion

The software product landscape in India is evolving rapidly, driven by factors such as digitalization, cloud adoption, and a thriving startup ecosystem. In this ever-changing environment, LTIMindtree and Tech Mahindra have emerged as formidable forces, each with its own unique strengths and strategies.

As the industry continues to evolve, their ability to stay ahead of the curve will be the key determinant of their success in this highly competitive market.