India’s food processing industry is a major driver of the nation’s economic growth. With a predicted output of $535 billion by 2025–26, this industry is highly significant for meeting the wide range of culinary preferences of India’s huge population.

Despite the abundance of competitors, two of the most prominent names in the Indian food industry—Nestle India Ltd. and Britannia Industries Ltd.—stand out as household names thanks to the extensive product lines they provide.

In this article, we will examine the two most prominent players in the industry and contrast their past results and future potential as investors.

Company overview

Nestle India Ltd

In India, the international corporation Nestle operates under the name Nestle India Limited, with headquarters in Delhi, India. In 1912, under the name The NESTLE Anglo-Swiss Condensed Milk Company (Export) Limited, NESTLE started importing and marketing completed goods in the Indian market, marking the beginning of its association with India.

As a wholly owned subsidiary of Nestle S.A. (62% ownership), Nestle India mainly operates in the food industry, which encompasses categories such as dairy and nutrition, ready-to-eat foods and cooking ingredients, powdered and liquid drinks, and confectionery.

In several of its product categories, such as milk and nutrition, drinks, ready-to-eat foods and kitchen tools, and sweets and chocolate, it ranks in the top two. A total of 5.2 million outlets and 10,000 distributors make it possible.

Also read: India’s food retail revolution: Growth, trends, and insights

Nestle India share news

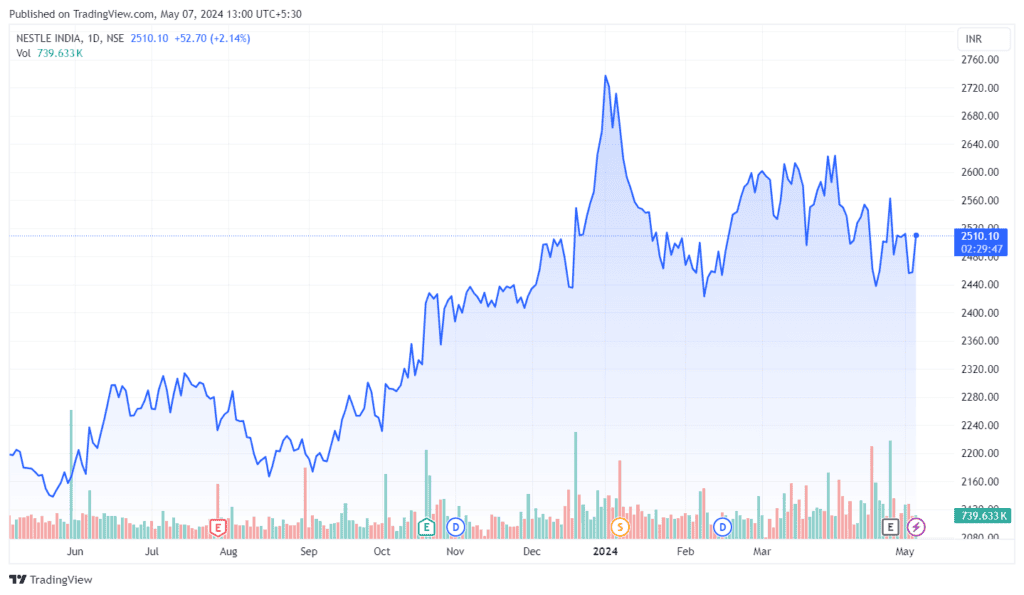

At the time of writing, the Nestle India share price is ₹2510.10. According to Nestle India’s share price history, investors have received an attractive return of 47.16% from the stock throughout the last three years and 145.59% gains in the past 5 years.

Nestle India results:

For the extended fifteen-month financial year that concluded on March 31, 2024, the company has reported robust financial results. The total sales reached a remarkable figure of ₹24,275.5 crore, reflecting the company’s strong market presence and sales strategies.

The profit from operations was notably efficient, standing at 22.0% of sales, which underscores the company’s operational excellence and cost management. The net profit for the period was an impressive ₹3,932.8 crore, indicating healthy profitability and financial stewardship. The operations of the company were highly cash-generative, with a substantial ₹4,174.8 crore cash inflow, which signifies a solid operational cash flow position.

Lastly, the earnings per share (EPS) were calculated at ₹40.79, suggesting a rewarding return for the shareholders. Overall, these financial highlights depict a company that is not only growing in terms of sales but also managing its operations effectively to ensure profitability and shareholder value.

Britannia Industries Ltd

One of India’s most well-known and prominent food product businesses, Britannia has been around since 1892, when it was founded in Kolkata.

With over ₹9000 crore in yearly sales, Britannia Industries has been around for 100 years and is one of the most prominent food firms in India. Good Day, NutriChoice, and Marie Gold are well-known brands in India, while Britannia is one of the most dependable food brands in the country.

With the public offering of its shares in 1978, Britannia solidified its position as an Indian corporation, with 62% of the shares held by Indians. Over half of India’s households have access to the company’s goods, and the company’s presence is widespread throughout the country, with over 5 million retail outlets selling them.

Britannia share news

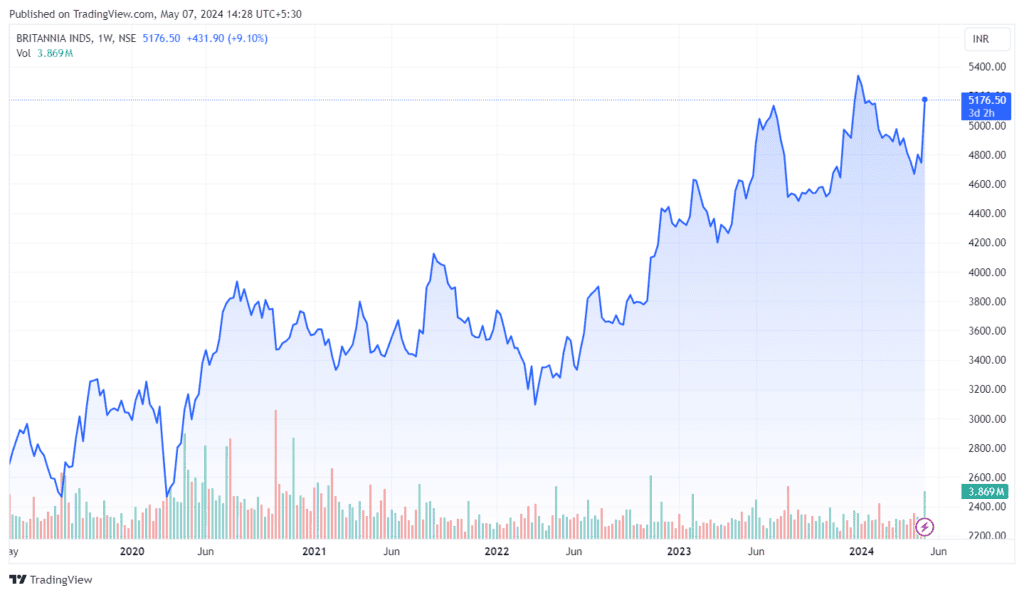

Britannia’s share price has risen 2.33% today (May 07, 2024) to ₹5176.50. According to the Britannia share price history, the stock price increased 6.49% in the last six months and 92.90% in the last 5 years.

Britannia Industries results

With an increase of 3.1% year-over-year, Britannia’s consolidated sales for the quarter ending March 31, 2024, were ₹4,014 crores, while the operating profit was ₹708 crore. Operating profit for the year ending March 31, 2024, was ₹2,869 crores, a growth of 10.1% from the previous year, while consolidated revenue was ₹16,546 crores, a 4.5% increase.

Also read: Varun Beverages Ltd.

Financial profiles (as of May 7, 2024)

| Value | Nestle India | Britannia Industries |

| Market cap (Rs. crore) | 2,42,259 | 1,25,060 |

| EPS (Rs.) | 40.79 | 88.8 |

| Net Profit last quarter (Rs. crore) | 934 | 537 |

| Return on Capital Employed (%) | 153 | 48.9 |

| ROE (%) | 122 | 57.2 |

| Book value (₹) | 34.6 | 164 |

| Dividend Yield (%) | 0.68 | 1.38 |

Reasons for growth

Nestle India Ltd

- Strong market position:

With strong footholds in the majority of the product categories in which it participates, Nestle India dominates the Indian fast-moving consumer goods (FMCG) sector. Nestle leverages its intellectual property rights to strengthen its brands and guide brand excellence and quality standards. It focuses on global brands and premiumisation through 2000+ brands worldwide.

- Technical assistance:

Brands sold in India by Nestle are mostly associated with the parent company’s products sold across the world. The company’s robust R&D skills and access to its parent’s patented technologies are major advantages. The biggest participant in the food and beverage industry on a global scale, Nestle SA of Switzerland, owns 62.76% of Nestle India.

Nestle offers advanced consumer and marketing insights, digital best practices, factory design approaches, digital consumer engagement, and tools for sustainable pricing.

- Financially sound profile:

A healthy capital structure and stable operational cash flow provide a solid foundation for an acceptable financial risk profile. Until 2025, Nestle India plans to spend ₹5,000 crore on capital expenditures (capex) to build new factories, acquire pertinent companies, and expand its product line.

They anticipate that a combination of external borrowings and cash accruals will cover the costs of this. At a cost of ₹800-900 crore, the company is presently setting up its initial production facility in East India.

Also read: Fast-Moving Consumer Goods (FMCG) Sector- A Safe Haven in Bear Markets?

Britannia Industries Ltd

- Reliable distribution network

Britannia Industries’ market share has been steadily increasing over the last several years, thanks to its direct involvement with over 2.73 million retail outlets as of December 31, 2023, compared to around 0.73 million outlets at the end of the fiscal year 2014. In the future, BIL plans to increase its exposure across other states and broaden its distribution reach, particularly in rural India.

- Market share in domestic FMCG

Britannia Industries is the undisputed leader in the Indian biscuit sector, and its influence extends beyond different product categories. Although overseas business made up around 5.5% of BIL’s sales in FY2023, the company is now concentrating on increasing that share by making the most of its manufacturing base and engaging in certain partnerships.

In addition to its strong foothold in the Nepali market, Britannia Industries is well-positioned to expand internationally by targeting significant markets in the Americas, West Asia, and Africa.

- Shifting emphasis to diversification

At the moment, almost 80% of the company’s revenue comes from biscuits, with the other 20% coming from other markets. Thanks to its commitment to innovation and diversification, Britannia Industries has maintained and grown its market position in the biscuits segment and is making waves in other product categories as well.

Conclusion

As India’s food processing sector continues to flourish, Nestle India shares and Britannia shares stand out as compelling investment opportunities for investors seeking exposure to this industry. However, it is always the best practice to do thorough research, which this article aims to provide.