Titan Company, known for its jewellery and watches, recently announced its Q4 results. The company reported a year-on-year increase of 7%, with profits rising to ₹786 crore for the March quarter, up from ₹734 crore in the previous year. In this blog, we will explore the key factors contributing to Titan’s profitability, analysing the essential components of its financial performance.

Also read: India’s gems and jewellery industry: A treasure trove of opportunities

About Titan Company

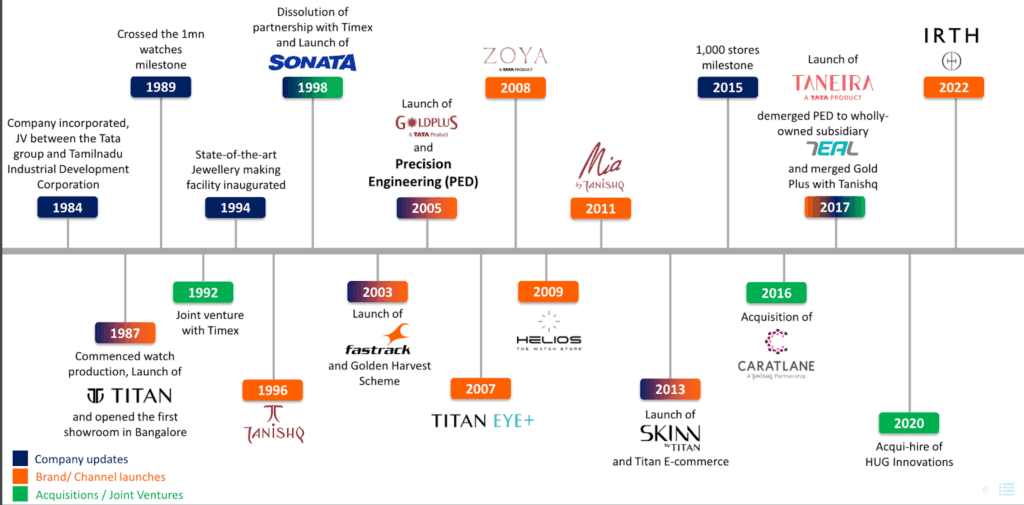

Titan Company Limited, established in 1984, is a partnership between the Tata Group and the Tamil Nadu Industrial Development Corporation (TIDCO). It has grown to become a leading lifestyle company in India.

Titan is particularly renowned for its strong presence in the jewellery and watches market, featuring well-known brands like Tanishq, Zoya, Mia, and CaratLane for jewellery, and Titan, Fastrack, Sonata, and Xylys for watches.

In terms of revenue mix, the jewellery segment dominates, contributing 88% to the total revenue, followed by watches and wearables at 9%, eyecare at 2%, and emerging businesses making up 1%.

Titan Company operates across a wide network, with 3,035 stores spread over 4.14 million square feet of retail space in 428 towns. Additionally, the company maintains 10 manufacturing and assembly facilities, supporting its extensive product range and distribution capabilities. This setup allows Titan to effectively meet customer demand and maintain its presence in the market.

As of May 4, 2024, the Tata Group holds a 25.02% stake in Titan, while TIDCO owns 27.88%, with the remainder shared among institutional investors and the public.

Source: Titan Company Investor Presentation Q4FY24

You may also like: Tata Group stocks surge ahead of anticipated Tata Sons IPO

Titan Q4 results performance

Titan Company reported a growth in its standalone net profit for the March quarter, reaching ₹786 crore, a 7% increase from the previous year’s ₹734 crore. This was slightly below the analyst expectation of a 10.5% rise.

The company’s revenue for the quarter stood strong at ₹10,047 crore, a 17% increase year-over-year from ₹8,553 crore, closely aligning with analyst expectations of a 16% rise due to a strong wedding season and solid performances in new growth areas like Taneira and Caratlane.

Operational performance was marked by a growth in EBITDA to ₹1,109 crore, up by 6.2% from the previous year, although EBITDA margins slightly contracted by 90 basis points(bps) to 9.9%. This quarter’s results reflect Titan’s sustained focus on expanding its core segments and exploring new business avenues.

| Period | Q4 FY24 | Q4 FY23 | Y-o-Y growth |

| Operating revenue (₹ crore) | 11313 | 9305 | 21.60% |

| Total income (₹ crore) | 11472 | 9419 | 21.80% |

| PBT (%) | 8.6% | 10.50% | (185) bps |

| PAT (%) | 6.70% | 7.80% | (109) bps |

Source: Titan Company Investor Presentation Q4FY24

The company also announced a dividend of ₹11 per equity share with a face value of ₹1. When we look at Titan’s share dividend history, FY23, the company distributed ₹888 crores in dividends, which represented 27% of its net income.

You may also like: A guide to stock dividend

Titan Company share price performance

Ahead of the release of the Q4 results on May 3, Titan’s share price exhibited some fluctuations. It initially opened higher at ₹3,598.90, up by 0.82% from the previous close of ₹3,569.50 on the BSE. However, the Titan share value relinquished its early gains and subsequently dropped by 0.76% to a day’s low of ₹3,542.20.

As of May 3, 2024, Titan shares have delivered a significant return of 31.62% over the last year.

Looking at a longer timeline, Titan shares have delivered a robust return of 206.95% over the past five years.

Investing pros and cons

Pros:

- Titan operates across several segments—jewellery, watches and wearables, eyecare, and fashion accessories, providing robust diversification. Notably, jewellery accounts for about 88% of Titan’s consolidated operating income. The company’s extensive retail presence includes over 3,000 stores globally, enhancing its market reach.

- Titan has a strong financial risk profile with consistent earnings leading to a conservative capital structure. The company’s financial metrics show an interest cover of more than eight times and a Debt Service Coverage Ratio (DSCR) above four times, indicating sound debt protection.

- The shift from unorganised to organised jewellery retailers is accelerated by regulatory changes aimed at enhancing transparency. This shift is likely to benefit structured players like Titan, which has a market share of around 7%.

Cons:

- The jewellery business is highly susceptible to regulatory changes and seasonal demand fluctuations. For example, the introduction of GST and PAN card disclosure requirements has historically affected market dynamics.

- As a significant player in the jewellery sector, Titan’s operations are vulnerable to the volatility of gold prices, which can substantially affect its operational costs and margins.

Bottomline

Titan’s quarterly results reflect a stable financial performance with consistent growth. The company’s strategic diversification and market presence suggest resilience in a fluctuating economic landscape.

However, investors should remain cautious and consider the potential risks associated with regulatory changes, seasonal demand fluctuations, and gold price volatility that could impact the company’s operational costs and profit margins.