Does a nation ever run out of money? The simple answer is ‘yes’. And as kids may wonder, ‘no’, you cannot just print more money. Instead, you borrow and invariably, increase the nation’s overall debt. But what if the nation is unable to repay the debt? They borrow more money, and thus, the cycle continues. This is precisely what’s brewing in the US debt crisis.

It may be difficult to believe, but the world’s most powerful, USD 26 trillion economy runs a major risk of defaulting on debt repayment. It will run out of money as soon as June 01, 2023. Unless it figures out a way to thwart this debt ceiling.

No wonder US President Joe Biden cancelled his upcoming Australia visit, postponing the Quad leaders’ level summit. All because of the US debt ceiling looming large on the leader’s head.

What is the US debt ceiling

Many wonder – how did the US reach this situation? It is a well-known fact that the country has been looming in debt for quite some time. In fact, it managed to mount a debt of USD 31.40 trillion in 2023 from a mere USD 408 billion a century ago.

But the nation always came around. Sadly, the situation is a bit more complex, this time around.

US debt crisis: Janet Yellen’s letter to congress

The United States’ worry about defaulting on debt began after treasury secretary Janet Yellen sent a letter to Congress, informing that the country might just run out of money on June 01, 2023. The US is already breaching its debt ceiling, and the situation only worsens by the minute.

As you may know, the US government comprises two political parties – the Republicans and the Democrats. With Joe Biden, a Democrat candidate being the current US president, the Republicans form the opposition.

With the debt crisis date approaching soon, the bipartisan congress needs to reach a consensus on one crucial question – whether or not to allow the US to borrow money for raising the debt ceiling. And all this before the next month approaches.

This is precisely why Biden met the Republican House speaker Kevin McCarthy and thereafter, resumed talks on the US debt ceiling.

You may also like: Why is each share of MRF worth ONE LAKH rupees?

What is a debt ceiling?

Before getting into the US debt crisis, let’s understand how a ‘debt ceiling’ works. Put simply, the debt ceiling is the upper limit that the country imposes while borrowing money to pay its expenses.

Typically, a country’s government earns money from levying taxes on its citizens. In India, for instance, there are direct taxes through income and indirect taxes levied on products via GST, etc.

The money, thus, collected is used to develop the country’s infrastructure, support the marginalised groups, provide facilities to the citizenry, manage welfare schemes, etc.

In the context of the USA, the money from taxes is used to provide social security protection to as many as 51 million Americans. This isn’t a random claim but a fact corroborated by the country’s financial watchdog, the Securities and Exchange Commission (SEC).

Collecting taxes from 334 million citizens seems like a lot of money. But to run a country as powerful as the United States, this money is not enough. Plus, there are limitations on how much tax you can impose.

Thus, to cover this difference between the total expenditure and the taxes collected, the USA borrows money.

Understandably, the country’s expenditure increases faster than the taxes collected for obvious reasons. And so, the USA has to borrow more money, invariably increasing its debt. And with inflation skyrocketing in 2022, no wonder the country is facing a USD 31-trillion debt crisis.

Don’t forget the interest rate levied on the debt!

Read Also: Why is the US dollar the ‘currency of the world’?

When was the last time the US government raised the debt ceiling?

Based on the data released by the US treasury department, the current US debt ceiling or debt limit is USD 31.381 trillion and has been so since December 2021.

Prior to that, the US ceiling existed at USD 28.401 trillion. What this means is that raising the debt ceiling is not a foreign concept to the No.1 economy. In fact, in the face of a recession or debt crisis, the US government did resort to many such measures.

When exactly did the US hit its USD 31 trillion debt ceiling?

Below is the table summarising the comparison between the US debt ceiling and the actual debt reported:

| Month | Debt Limit | Total US debt | December 2022 | $31.381 trillion | $31.36 trillion |

| January 2023 | $31.381 trillion | $31.35 trillion |

| February 2023 | $31.381 trillion | $31.45 trillion |

| March 2023 | $31.381 trillion | $31.46 trillion |

| April 2023 | $31.381 trillion | $31.46 trillion |

| May 2023 | $31.381 trillion | Likely to exceed |

Although the US debt crisis is garnering attention right now, the country had already surpassed the limit in February 2023. What worries the country now is whether the debt reported in May 2023 would far exceed the limit, making the country run out of funds to continue.

Unless it increases its debt ceiling to borrow further and repay a part of its USD 31.40 trillion figure.

Who owns the most US debt?

Here’s something to ponder – which entity makes up the USD 31.4 billion debt? Is it just the government and the public, or do even investors have a fair bit of money to repay?

Fortunately for us, the US government releases a document called Quarterly Treasury Bulletin which summarises the debt bifurcation for each month, quarter and year.

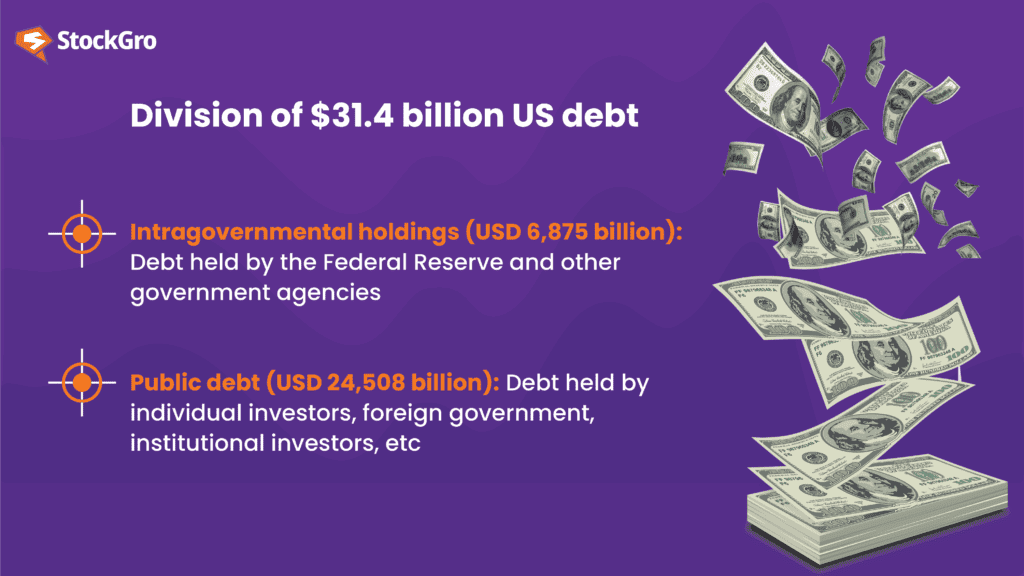

According to the bulletin, the USD 31.4 billion debt is divided into two basic segments:

Now this bifurcation is further divided into various agencies. Thus, to understand from where exactly this mountain of debt is originating, take a look at the table of sources given below, for the year 2022:

| Source | Debt Amount |

| Total | $30.948 trillion |

| Federal Reserve and government accounts | $12.26 trillion |

| Foreign and international investors | $7.43 trillion |

| Mutual Funds | $2.84 billion |

| Depository institutions | $1.81 trillion |

| State and local governments | $1.55 trillion |

| Pension funds | $1.15 trillion |

| Insurance companies | $368 billion |

| Others | $2.86 trillion |

Whether to suspend or raise the US debt ceiling

The last raise in the debt ceiling was announced in December 2021, which has remained intact to this day. And taking inspiration from past crises, the most obvious solution would be to raise the limit. But that would again, have serious negative consequences.

We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States

Janet Yellen

US Treasury Secretary

In a nutshell, an increase in the debt limit would hinder investments – both foreign and domestic – deeming the country “unreliable”. And well, that’s not a good reputation if you want to maintain the No.1 position. Especially with a powerful competitor like China slowly making headway.

US planning to borrow more

In addition to raising the US debt ceiling, the country also plans to increase their borrowings to the USD 726 billion during the present quarter. Why? Because of –

- Low cash balance at the beginning of quarter

- Expected lower income tax earnings

- Expected higher expenditure.

Here’s a look at the past five US quarterly borrowings:

| Quarter – Year | Total borrowing |

| Q3 – 2023 | $726 billion (66% increase from previous quarter) |

| Q2 – 2023 | $435.5 billion |

| Q1 – 2023 | $234.2 billion |

| Q4 – 2022 | $337 billion |

| Q3 – 2022 | -$23 billion |

| Q2 – 2022 | $667 billion |

Although the US government is yet to take a final call, chances are the debt ceiling would be increased to propel more borrowing.

It would then be interesting to see whether or not the US Federal Reserve will pause its rate hikes, seeing that the country is suffering from an astounding amount of debt.

Silver lining alert – pausing rate hikes might result in a bullish market for Indian traders!