In India, where formal lending structures may not always be accessible to everyone, promissory notes serve as a crucial tool between individuals and businesses.

In this article, we’re going to explore the key aspects of promissory notes, focusing on their purpose, types, legal requirements, and differentiation from alternatives like IOUs.

What is a promissory note?

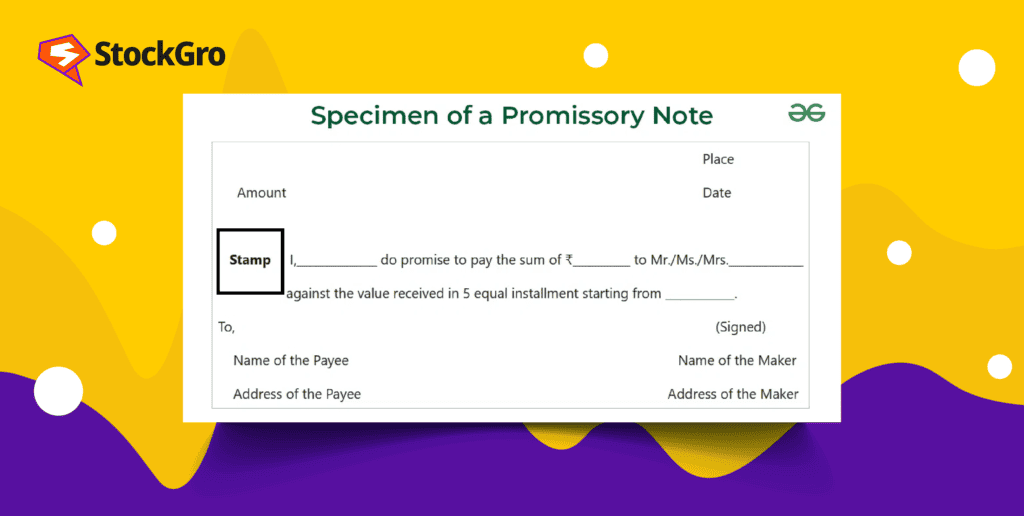

A promissory note, governed by the Negotiable Instruments Act, 1881, is a written instrument where one party (maker) promises to unconditionally pay a specific sum of money to another party (payee) at a fixed or ascertainable date. This promissory note acts as a legal record of the debt and serves as evidence in case of non-payment.

You may also like: Debt instruments in India: Understanding your investment options

Essential elements of a promissory note in India

Here are a few typical components of promissory notes in India:

- Date and place of issue: Specifies the location and time of note creation.

- Parties involved: Clearly identifies the maker (borrower) and payee (lender).

- Amount: States the exact sum borrowed both in numerals and words.

- Payment terms: Defines the due date or instalment schedule for repayment.

- Interest rate (Optional): Specifies the interest rate if applicable.

- Witness signature: Requires signature of one or more witnesses for legal validity in some states.

- Revenue stamp: Affixation of appropriate stamp duty as per the Indian Stamp Act.

- Signatures: Both maker and witnesses must sign the note.

Applications of promissory notes

Here are some situations in which promissory notes like these could be useful:

- When getting a personal loan – You could use promissory notes for getting or lending money as friends, family, or acquaintances if you prefer to have a record of the debt in writing.

- Business transactions – Business transactions can also sometimes happen with promissory notes, especially when the amount of money involved is small or the loans are short-term.

- Investments – Fixed income returns could be put on paper using promissory notes also, often with clear information about the kind of debt, the coupon payment, interest rates, and payment cycles.

- Land deals – Real estate transactions concerning property also use promissory notes to record payments of advances that are made before the final settlement of funds.

Also Read: Is real estate growth in India sustainable? Opportunities vs Challenges!

Difference between secured and unsecured promissory notes

Depending on whether you’re using collateral in the debt, promissory notes can either be secured or unsecured. Secured promissory notes are backed by collateral like property, vehicles, or investments. Failure to repay authorises the payee to claim the collateral to recover the debt from the payer.

However, unsecured promissory notes solely rely on the payer’s personal guarantee that they will pay their debts as laid out in the note. In this case, there is no additional security that the money will be returned, which means that the creditor takes a higher risk (and hence may demand a higher rate of interest).

Difference between promissory notes and IOUs

It is often easy to confuse IOUs and promissory notes since they usually do the same thing. However, there are some key differences you must understand before using either one of them:

- Formality: Promissory notes are formal documents with specific legal requirements, while IOUs are informal acknowledgments, which can often be handwritten.

- Enforceability: Promissory notes are legally enforceable contracts, whereas IOUs may not hold strong legal weight in court.

- Interest: Notes can specify interest rates, while IOUs typically don’t.

- Specificity: Promissory notes define the exact amount, payment date, and parties involved, while IOUs may lack these details.

Other considerations

- Stamp duty: Stamp duty in India varies depending on the loan amount and must be paid as per state regulations.

- Registration of the promissory note: While not strictly required, it does make the note more enforceable in case it is presented to the court or other authorities.

- Legal advice: Make sure that you consult a lawyer before drafting and using a promissory note. This is especially recommended if you’re engaging in complex transactions.

Also Read: Want to be debt-free soon? Here are some strategies to manage your debts!

Conclusion

Promissory notes offer a valuable tool for informal lending in India. Understanding the note’s legal implications, the difference between a note and a IOUs, and making sure that you’re drafting the note well is very important. We encourage you to seek special legal advice when entering into a debt contract so that your note is more enforceable.