When you’re getting a personal loan for yourself from any bank in India, there are some common steps you need to follow in terms of documentation, approval, and verifications. However, as soon as the bank issues you a loan sanction letter, you can rest assured that your loan is approved.

In this article, we’re going to learn a bit more about a loan sanction letter, why it’s so important, and you should know about it.

What is a personal loan sanction letter?

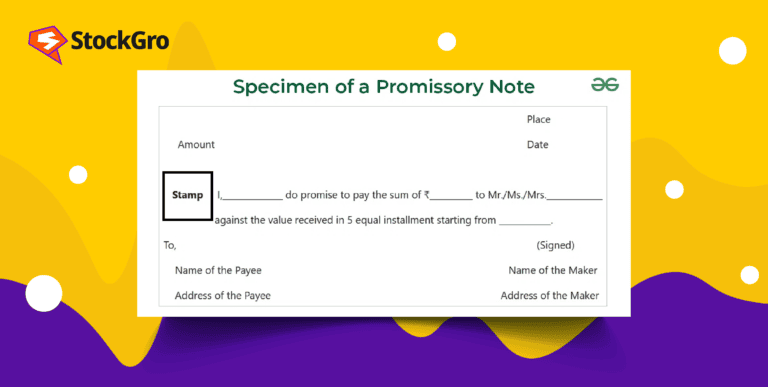

Imagine receiving a document confirming your personal loan application’s approval – that’s a personal loan sanction letter. It’s a formal notice issued by the lender, outlining the approved loan amount, interest rate, repayment terms, and other crucial details.

You may also like: Mastering the maze: Your pathway out of student loan debt

Note: While a sanction letter is not the final loan agreement, it is certainly an important document that signifies your eligibility and acts as a stepping stone towards receiving the funds.

A sanction letter is different from a disbursement letter. The sanction letter is sent from the lender to the borrower once the loan application has been approved. A Disbursement Letter, on the other hand, is issued when the loan amount has been released by the lender.

Why does this letter matter?

- Clarity: The letter eliminates ambiguity for you by clearly stating the approved loan amount, interest rate, processing fees, and repayment tenure. This clarity can help you make informed financial decisions and budget effectively for your monthly payments.

- Security and assurance: The sanction letter is also a legal document which outlines the agreed-upon terms and conditions between you and the lender. This formal confirmation provides a sense of security and strengthens the trust between both parties.

- Planning and budgeting: Knowing the specific amount and repayment details allows you to accurately plan your finances and allocate funds for monthly instalments. This proactive approach promotes responsible credit management.

- Negotiation power: While not always applicable, the sanction letter sometimes offers a window for negotiation on specific terms, like the interest rate or processing fees, before finalising the loan agreement.

- Proof of loan approval: In various financial situations, such as applying for a visa or renting an apartment, the sanction letter acts as proof of your financial capability and loan approval, potentially aiding in securing other opportunities.

Components of a sanction letter

Each letter may vary slightly depending on the lender’s format, but key elements remain consistent:

- Your information: Name, address, contact details, and loan application reference number.

- Loan details: Approved loan amount, interest rate (fixed or floating), processing fees, and any applicable charges.

- Repayment terms: Loan tenure, monthly instalment amount (EMI), payment due date, and any prepayment options.

- Special conditions: Any specific terms or conditions attached to the loan, such as collateral requirements or restrictions on usage.

- Validity period: Timeframe within which the sanction letter is valid and the loan must be accepted.

- Contact information: Details for contacting the lender for further clarification or queries.

Also Read: The role of compound interest to reach your financial goals

Requirements for a sanction letter

Here are some documents you might need to present to your bank before they issue a loan sanction letter to you for your loan:

- Proof of identity: Aadhaar card, PAN card, Passport, Voter ID card.

- Proof of address: Latest utility bills, rental agreement, bank statements.

- Income documents: Salary slips, income tax returns, bank statements reflecting salary credits.

- Employment details: Employer contact information, designation, work experience.

- Other documents: Depending on the lender and your profile, documents like bank account statements, guarantor details, or asset ownership proofs might be required.

Other features to note for a personal loan sanction letter

Here are some other distinguishing features you might notice with an Indian sanction letter from another one abroad:

- CIBIL score importance: Your CIBIL score, which is your credit score, reflects your creditworthiness and significantly impacts your loan eligibility and interest rate. Maintaining a good score is crucial for favourable terms.

- Employer verification: Indian lenders often verify your employment details directly with your employer to authenticate income and stability.

- Processing time: Depending on the lender and your documents’ completeness, processing timelines can vary from a few days to a week or more.

- Stamp Duty: In India, a stamp duty might be applicable on the loan amount, payable with the final loan disbursement.

Also Read: Credit history: What is it and why it matters?

Conclusion

Remember – your sanction letter is not confirmation of your loan disbursement. While this is certainly a very big milestone in getting your loan, it is not the final step. You must make sure that the details mentioned in the sanction letter are agreed upon, and any additional requirements are fulfilled by you before a certain date.

Carefully review the details mentioned in the letter, seek clarification if needed, and make sure you consult your relationship manager at the bank if you have any important questions. Good luck!