Stock overview

| Ticker | Bajaj Finserv |

| Sector | Finance |

| Market Cap | ₹ 3,14,500 Cr |

| CMP (Current Market Price) | ₹ 1,968 |

| 52-Week High/Low | ₹ 2,135/1,523 |

| Beta | 1.1 (Moderate volatility) |

About Bajaj Finserv India Ltd.

Bajaj Finserv is one of India’s most diversified and valuable financial conglomerates, spanning consumer lending, life and general insurance, and wealth advisory services. It holds major stakes in Bajaj Finance, Bajaj Allianz Life, and Bajaj Allianz General Insurance.

Primary growth factors for Bajaj Finserv India Ltd

- Diversified Business Model: Exposure to multiple high-growth segments in financial services reduces dependency on a single vertical.

- Strong Lending Momentum: Through Bajaj Finance, it dominates consumer durable financing and unsecured personal loans.

- InsurTech Focus: Heavy digital investments in insurance to boost customer acquisition and claims efficiency.

- Rural Penetration: Deepening presence in Tier-2, Tier-3 towns via affordable loan products and micro-insurance schemes.

- Digital Transformation: Over 70% of new customer sourcing is digital-first, improving cost ratios and scalability.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Revenue | ₹ 36,594 cr | 20% | 14% |

| Operating Expense | ₹ 24.206 cr | 13% | 21% |

| Operating Income | ₹ 12,388 cr | 35% | 3% |

| PAT | ₹ 2,416 cr | 14% | 8% |

Bajaj Finserv has delivered great results in Q4 FY 25 with both revenue and profit growth at a YoY and a QoQ level.

Detailed competition analysis for Bajaj Finserv India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Bajaj Finserv | ₹ 3,14,500 cr | ₹ 36,594 cr | 35 x | 11% |

| Bajaj Holdings | ₹ 1,50,000 cr | ₹ 145 cr | 23 x | 10% |

| Choice Intl | ₹ 13,700 cr | ₹ 253 cr | 87 x | 21% |

| JM Financial | ₹ 13,200 cr | ₹ 1,003 cr | 17 x | 9% |

Bajaj Finserv is uniquely positioned with a mix of NBFC and insurance exposure. While ROE trails HDFC, it compensates with broader financial sector play and scalability.

Company valuation insights: Bajaj Finserv India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Bajaj Finserv shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹2200 per share

- Upside Potential: 12%

- WACC: 10.1%

- Terminal Growth Rate: 2.7%

Major risk factors affecting Bajaj Finserv India

- Regulatory Overhang: Tightening NBFC norms and IRDAI insurance guidelines.

- Credit Cycle Risks: Rising retail delinquencies could impact Bajaj Finance.

- Valuation Stretch: Premium valuation leaves little room for disappointment.

- Insurance Margin Pressure: High competition could squeeze underwriting profits.

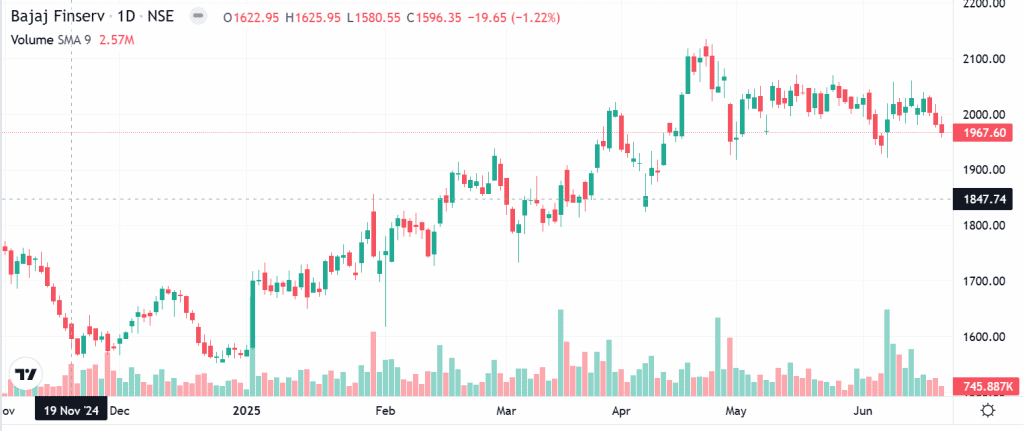

Technical analysis of Bajaj Finserv India

- Resistance: ₹1995

- Support: ₹ 1900

- Momentum: Neutral

- RSI (Relative Strength Index): 44 (Neutral)

- 50-Day Moving Average: ₹1929

- 200-Day Moving Average: ₹1892

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹2000

Bajaj Finserv India stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹2050 (6-month horizon); ₹2200 (12-month horizon);

Investment Horizon: 2–4 years for stable returns

Rationale

Recommend a Buy on Dips / Accumulate approach for Bajaj Finserv.

Recommendation

Accumulate / Buy on Dips

Bajaj Finserv’s integrated presence across lending and insurance is rare.

Scalable digital platforms, rural growth, and solid asset quality make it a stable compounder.

High-quality management and conservative risk culture add comfort.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Bajaj Finserv remains a compelling long-term play in India’s financial services space. Its well-diversified business model, digital advantage, and consistently improving financials make it a BUY with a 12-month target of ₹2,200, implying an upside of 15% from current levels.