India’s push towards infrastructure modernisation, industrial automation, and electrification creates a strong runway for engineering and capital goods companies. Among the key beneficiaries of this transformation is CG Power, a turnaround success story backed by a strong parent (Murugappa Group), aggressive restructuring, and a pipeline of opportunities in both domestic and global markets.

Once mired in corporate governance issues, CG Power has reinvented itself and is now emerging as a leading electrical equipment manufacturer, riding India’s next big capex cycle.

But does CG Power offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | CGPOWER |

| Industry/Sector | Capital Goods (Electric Equipment) |

| Market Cap (₹ Cr.) | 1,01,954 |

| Free Float (% of Market Cap) | 41.80% |

| 52 W High/Low | 874.70 / 517.70 |

| P/E | 105.57 (Vs Industry P/E of 62.67) |

| EPS (TTM) | 6.37 |

About CG Power

CG Power and Industrial Solutions Ltd. (formerly Crompton Greaves) is a leading Indian company in power transmission, distribution, and industrial equipment.

Acquired and turned around by the Murugappa Group in 2020, CG Power has since re-established its position in the electrical equipment space, offering a wide range of products and systems to utilities, industries, and infrastructure developers.

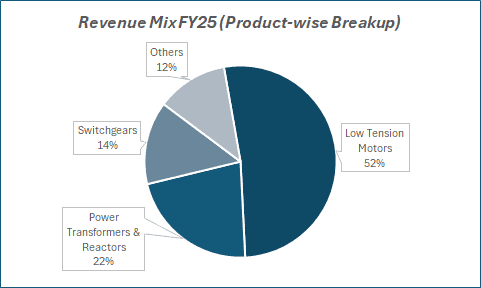

Key business segments

CG Power operates primarily in the following key business segments:

- Industrial Systems: Offers motors, drives, and automation solutions for core industries.

- Power Systems: Focuses on transformers and switchgear for power transmission and distribution.

- Railway & E-Mobility: Engaged in traction equipment for railways and emerging electric mobility solutions.

Primary growth factors for CG Power

CG Power key growth drivers:

- Govt capex boost: Benefiting from power infra upgrades and railway electrification.

- Industrial revival: Rising demand from the steel, cement, and chemicals sectors.

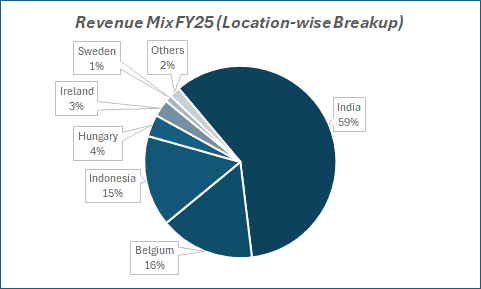

- Export growth: Strong overseas demand for transformers and motors.

- Metro & Rail projects: Traction systems are benefiting from urban transport expansion.

- Murugappa group: Operational excellence and financial discipline under reputed backing.

Detailed competition analysis for CG Power

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE (%) | ROCE (%) | P/E (TTM) |

| CG Power | 9908.66 | 13.17% | 9.82% | 36.44% | 48.88% | 105.57 |

| ABB India | 12267.51 | 18.93% | 15.40% | 28.80% | 38.86% | 64.40 |

| SIEMENS | 19510.80 | 12.80% | 11.22% | 19.11% | 26.29% | 41.13 |

| HAVELLS | 21778.06 | 9.78% | 6.75% | 18.07% | 25.46% | 67.83 |

Key insights on CG Power

- Revenue CAGR of 22% over the last 3 years, indicating robust top-line growth backed by strong execution across business segments.

- EBITDA margins have remained consistently between 13–14%, reflecting operational stability and efficient cost management.

- Profit CAGR of 12% over 3 years, showcasing sustained earnings growth despite a challenging macro environment.

- 3-year average ROE of 45.3%, underscoring excellent capital efficiency and strong return generation.

- Debt-free status positions the company for financial flexibility and resilience during economic cycles.

- Healthy dividend payout ratio of 19.4% reflects a stable approach to rewarding shareholders while retaining capital for growth.

- Strong balance sheet with surplus cash enhances CG Power’s ability to pursue organic expansion and strategic acquisitions.

- Capex plans of ₹600–700 crore over the next 2–3 years demonstrate a focused long-term strategy to enhance capacity, automation, and export potential.

Recent financial performance of CG Power for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2191.72 | 2515.68 | 2752.77 | 9.42% | 25.60% |

| EBITDA (₹ Cr.) | 283.83 | 331.04 | 346.82 | 4.77% | 22.19% |

| EBITDA Margin (%) | 12.95% | 13.16% | 12.60% | -56 bps | -35 bps |

| PAT (₹. Cr.) | 233.81 | 237.85 | 274.26 | 15.31% | 17.30% |

| PAT Margin (%) | 10.67% | 9.45% | 9.96% | 51 bps | -71 bps |

| Adjusted EPS (₹) | 1.53 | 1.57 | 1.78 | 13.38% | 16.34% |

CG Power financial update (Q4 FY25)

Financial performance

- Consolidated revenue for Q4 FY25 grew 26% YoY to ₹2,750 crore.

- EBITDA increased 22% YoY to ₹347 crore, while PAT rose 17% YoY to ₹274 crore.

- Power Systems margin expanded by 250 bps YoY and 340 bps QoQ to 21%, driven by better price realisation and operating leverage.

- Industrial Systems profitability was impacted by higher copper prices and early-stage losses in new business initiatives. However, strong Power Systems performance supported overall EBITDA margins.

Business highlights

- The company reported a healthy order book of ₹10,600 crore, reflecting a 66% YoY increase.

- Ongoing capex of ~₹700 crore across segments is well-aligned with sector tailwinds and long-term growth prospects.

- Continued product launches and strategic go-to-market efforts are strengthening CG Power’s presence in the Industrial Motors space.

Outlook

- CG Power expects to gain market share in the Industrial Motors segment through innovation and channel expansion.

- Global trends in energy transition and efficiency are driving a cyclical upturn, supporting demand across its business lines.

- The company’s ₹700 Cr capex plan over FY24–27E is aimed at enhancing capacity, automation, and export capabilities, unlocking a multi-year growth opportunity.

Company valuation insights – CG Power

CG Power trades at a TTM P/E of 105.6, well above the industry average of 62.7, with a 1-year return of 11.65%, in line with the Nifty 50.

Ongoing capex, strong order book (₹10,600 crore), and tailwinds from energy transition and automation offer solid multi-year growth visibility.

Margins are expected to stay strong, and entry into OSAT provides a strategic edge in India’s semiconductor push. Healthy return ratios, with ROE/ROCE forecast at 34%/44% by FY27E, support premium valuations.

At 75x FY27E EPS of ₹11, we assign a 12-month target price of ₹825, implying a 19% upside. Our 3-month target price is ₹770, indicating an 11% potential upside from current levels.

Major risk factors affecting CG Power

- Execution risk: Scaling up high-voltage transformer and traction projects may bring execution challenges.

- Raw material price volatility: Steel, copper, and aluminium prices affect margins in the short term.

- Slowdown in Government capex: Any delay or underperformance in infra or power T&D investments can impact revenue growth.

- Global headwinds: Export orders depend on global demand conditions, especially in Africa, Middle East, and SE Asia.

Technical analysis of CG Power Share

CG Power recently broke out of a descending channel it had been trading in since October, rallying over 12% and confirming bullish momentum.

The stock is trading above its 50-, 100-, and 200-day EMAs, indicating strong underlying strength. MACD is positive at 11.20, with a bullish crossover already in place, reinforcing momentum.

RSI at 64.24 suggests strong buying interest, while Relative RSI remains positive over both 21-day and 55-day periods (0.08 and 0.07), indicating outperformance versus the benchmark. ADX at 27.28 confirms the presence of a strengthening trend.

A breakout above ₹770 could open the path to ₹825, while ₹640 serves as a strong support level.

- RSI: 64.24 (Bullish)

- ADX: 27.28 (Trending)

- MACD: 11.20 (Positive)

- Resistance: ₹770

- Support: ₹640

CG Power stock recommendation

Current Stance: Buy with a target price of ₹770 over a 3-month horizon and ₹825 over a 12-month horizon. CG Power’s strong positioning in industrial and power systems, healthy order book, and early entry into semiconductors offer compelling growth visibility amid India’s manufacturing and infrastructure push.

Why buy now?

Robust growth drivers: Benefiting from capex-led industrial recovery, energy transition, and export opportunities.

Strong execution: Healthy revenue/EBITDA growth and margins supported by price realisation and operating leverage.

Strategic expansion: Order book at ₹10,600 crore; capex of ₹6.9bn underway; recent OSAT foray provides optionality in semiconductors.

Financial strength: Near debt-free with strong return ratios; FY27E ROE/ROCE estimated at 34%/44%.

Portfolio fit

CG Power aligns well with portfolios focused on India’s industrial resurgence, infrastructure build-out, and electronics manufacturing. Its capital-efficient model, improving margins, and early semiconductor play make it suitable for investors looking for long-term compounders in core sectors with policy and cyclical tailwinds.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCG Power: Budget 2025-26 opportunities

- Make in India & PLI: Benefits from policy push in capital goods and electronics manufacturing.

- Energy transition: Boosts demand for transformers, switchgear, and automation solutions.

- Infra capex: Higher spend on rail, power, and urban infra expands CG’s core markets.

- Semiconductor focus: OSAT entry aligns with India’s chip ecosystem build-out.

- Export & MSME support: Aids the industrial segment and global expansion.

Final thoughts

CG Power is not just a capital goods company – it’s a comeback story with strong structural levers. From powering metros to electrifying factories, it is quietly enabling India’s growth from behind the scenes. For investors seeking exposure to the industrial revival, capex cycle, and electrification theme, CG Power presents a compelling narrative of transformation, resilience, and future-ready potential.