As India accelerates its push toward self-reliance in defence, railways, and critical infrastructure, niche engineering companies with deep technological capabilities are gaining strategic importance. HBL Power Systems Ltd (often referred to as HBL Power) is one such under-the-radar player, quietly building scale across batteries, defence electronics, and railway safety systems. With rising indigenisation and long-gestation government orders, HBL is increasingly positioned as a structural beneficiary rather than a cyclical bet.

But does HBL Engineering Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | HBLENGINE |

| Industry/Sector | Automobile Ancillaries |

| CMP | 784.5 |

| Market Cap (₹ Cr.) | 21,746 |

| P/E | 33.30 (Vs Industry P/E of 34.96) |

| 52 W High/Low | 1122.00 / 405.00 |

| EPS (TTM) | 23.09 |

| Dividend Yield | 0.13% |

About HBL Engineering Ltd.

HBL Power Systems Ltd is an Indian engineering company focused on specialty batteries, power electronics, and defence-oriented systems. Over the years, the company has evolved from being a battery manufacturer to a strategic supplier to defence forces, railways, and critical infrastructure projects. Its strengths lie in in-house R&D, high entry barriers, and long-standing relationships with government and PSU clients.

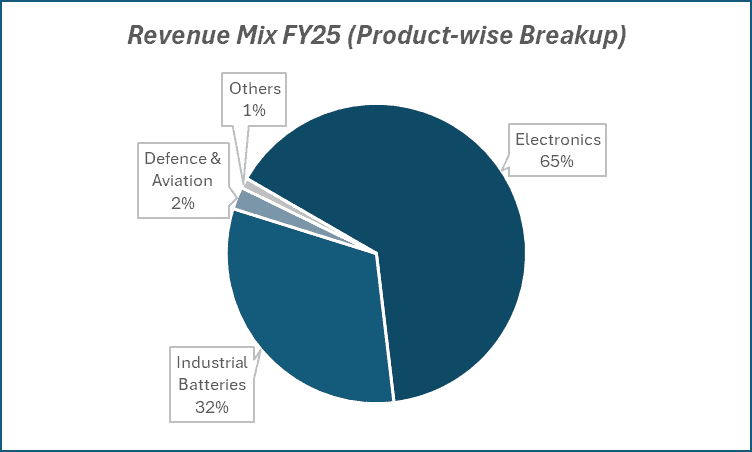

Key business segments

HBL Engineering Ltd. operates primarily in the following key business segments:

- Industrial & Defence Batteries: Lead-acid and nickel-based batteries for defence, railways, telecom, and UPS applications.

- Defence Electronics: Electronic fuzes, battery packs, and systems supplied to Indian armed forces.

- Railway Systems: Train collision avoidance systems (TCAS / Kavach), signalling batteries, and onboard electronics.

- Power Electronics & Services: Chargers, inverters, and maintenance services for mission-critical applications.

Primary growth factors for HBL Engineering Ltd.

HBL Engineering Ltd. key growth drivers:

- Defence Indigenisation: Rising domestic procurement under “Make in India” and Atmanirbhar Bharat.

- Railway Safety Push: Nationwide rollout of Kavach and modernization of signalling infrastructure.

- Energy Storage Demand: Growing need for reliable battery solutions in critical infrastructure.

- High Entry Barriers: Long qualification cycles limit competition and support pricing power.

- Strong Order Book: Multi-year visibility from government and PSU contracts.

Detailed competition analysis for HBL Engineering Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| HBL Engineering Ltd. | 2750.80 | 908.96 | 33.04% | 639.23 | 23.24% | 33.30 |

| Exide Industries Ltd. | 17595.64 | 1809.88 | 10.29% | 829.79 | 4.72% | 34.29 |

| Amara Raja Mobility Ltd. | 13200.64 | 1484.47 | 11.25% | 901.23 | 6.83% | 16.86 |

| Eveready India Ltd. | 1393.46 | 157.61 | 11.31% | 45.84 | 3.29% | 52.35 |

| CLN Energy Ltd. | 219.18 | 24.73 | 11.28% | 12.92 | 5.90% | 29.82 |

Key insights on HBL Engineering Ltd.

- Strategic Supplier: Deep engineering expertise with high-value products for defence, railways, and critical infrastructure.

- Long Horizon Orders: Multi-year contracts and qualification cycles create thick revenue visibility.

- Technology Moat: In-house R&D and product qualification barriers limit competition.

- Balanced Portfolio: Batteries provide cash flow stability; defence electronics and railway systems offer higher margins.

- Government Preference: Being part of strategic supply chains positions HBL well for public sector awards.

Recent financial performance of HBL Engineering Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 520.96 | 601.77 | 1222.90 | 103.22% | 134.74% |

| EBITDA (₹ Cr.) | 108.54 | 191.87 | 544.05 | 183.55% | 401.24% |

| EBITDA Margin (%) | 20.83% | 31.88% | 44.49% | 1261 bps | 2366 bps |

| PAT (₹ Cr.) | 76.01 | 141.23 | 387.29 | 174.23% | 409.53% |

| PAT Margin (%) | 14.59% | 23.47% | 31.67% | 820 bps | 1708 bps |

| Adjusted EPS(₹) | 3.15 | 5.17 | 13.97 | 170.21% | 343.49% |

HBL Engineering Ltd. financial update (Q2 FY26)

Financial performance

- Revenue grew 135% YoY to ₹1223 crore (consolidated), driven by strong execution in defence orders, healthy traction in industrial batteries, and improving contribution from export-led segments.

- Gross margin expanded meaningfully YoY, supported by a favourable product mix (higher defence and specialised battery share), operating efficiencies, and better absorption of fixed costs.

- EBITDA rose 401% YoY to ₹544 crore, with EBITDA margin improving to 44.5%, reflecting operating leverage from scale-up and disciplined cost control.

- PAT increased 410% YoY to ₹387 crore, underscoring a strong earnings rebound on the back of execution-led growth and margin expansion.

Business highlights

- The defence segment remained the key growth driver, supported by strong order execution in submarine batteries, avionics batteries, and strategic programmes aligned with defence indigenisation.

- Industrial and traction batteries saw steady demand from railways, telecom, and infrastructure-linked applications, aiding diversification of revenue streams.

- The order book remained robust, providing multi-quarter revenue visibility, with defence orders accounting for a significant share and improving margin profile.

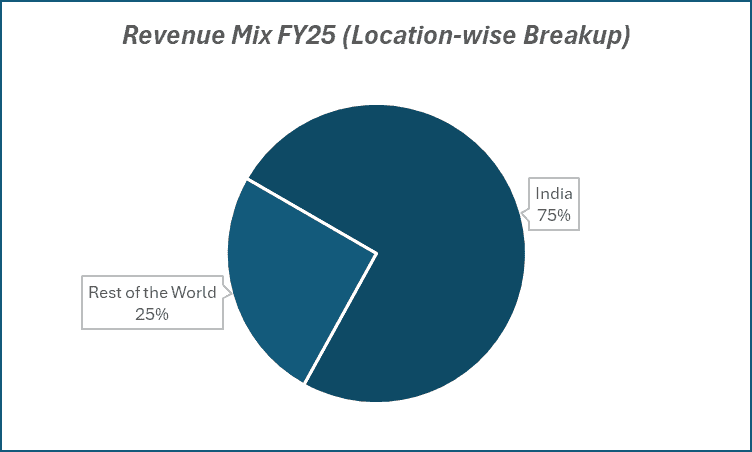

- Exports showed gradual improvement, aided by selective international orders, though management continues to prioritise high-margin and strategic contracts.

- Working capital discipline improved sequentially, supported by better collections and milestone-based defence billing.

Outlook

- Management remains optimistic on sustained growth, backed by a healthy defence order pipeline, increasing indigenisation, and rising capital allocation towards strategic sectors.

- Margins are expected to remain firm, supported by a favourable mix, operating leverage, and controlled raw material costs.

- Capex remains calibrated, focused on capacity expansion for defence and specialised batteries without straining the balance sheet.

- Strong cash generation, low leverage, and improving return ratios position HBL Power Systems well for a sustained earnings upcycle and long-term value creation over FY26-27.

Recent Updates on HBL Engineering Ltd.

- Qualification of New Products: Successful testing or qualification of next-gen battery systems and defence electronics.

- Railway Safety Wins: Awards or progress updates on train collision avoidance systems (e.g., Kavach).

- Export Interest: Expressions of interest or MOU conversations with overseas defence/rail buyers.

- Capacity & Capability Enhancements: Commissioning of new production lines or lab accreditation upgrades.

- ESG & Sustainability Initiatives: Steps to enhance energy efficiency or waste reduction in production lines.

Company valuation insights – HBL Engineering Ltd.

HBL Power Systems is trading at a TTM P/E of 33.3x, broadly in line with the industry average of 34.9x. Over the last one year, the stock has delivered a 31.4% return, significantly outperforming the NIFTY 50’s 7.7% gain. The rerating has been driven primarily by improving earnings visibility and execution strength, rather than aggressive multiple expansion, reflecting growing confidence in HBL’s defence-led growth profile.

The investment case is anchored in a structural improvement in HBL’s business mix and profitability. Increasing contribution from defence batteries and specialised electronics, supported by a robust order book and strong execution, has led to higher margins and better cash flow visibility. Operating leverage from scale-up, disciplined working capital management, and calibrated capex have further strengthened earnings quality. As highlighted in management commentary, rising defence indigenisation, multi-year order visibility, and selective focus on high-margin contracts position the company well for a sustained earnings upcycle, while a low-leverage balance sheet provides financial flexibility.

From a valuation perspective, applying a 33x multiple to FY27E EPS of ₹29.5, we arrive at a 12-month target price of ₹974, implying an upside of 24% from current levels. On a shorter-term basis, we assign a 3-month target price of ₹830, offering a 6% upside, supported by steady order execution, margin stability, and continued momentum in defence-led revenues.

Major risk factors affecting HBL Engineering Ltd.

- Execution Delays: Government/PSU order execution timelines can be long and volatile

- Client Concentration: Heavy dependence on defence and railway budgets may compress growth if allocations shift.

- Collateral Cyclicality: Industrial demand fluctuations could impact battery segment performance.

- Product Qualification Risk: Failure to secure or renew qualification for key products can delay revenues.

- Foreign Exchange Movements: Import costs (critical components) can pressure margins.

Technical analysis of HBL Engineering Ltd. share

HBL Power Systems has formed a head-and-shoulders pattern, but notably, instead of breaking below the neckline, the stock has bounced back strongly, indicating absorption of supply and the formation of a solid base. This failed breakdown often signals a shift in market behaviour and increases the probability of a new trend emerging on the upside.

The stock has just crossed above its 50-day EMA, while it continues to trade below the 100- and 200-day EMAs, suggesting that the short-term trend has turned positive and the medium- to long-term trend is in the process of building. Sustaining above the 50-day EMA should help improve sentiment and attract incremental buying, with further strength likely as higher moving averages are approached.

Momentum indicators are gradually improving. MACD at -38.46 remains negative and marginally below the signal line; a bullish crossover would act as a clear buy signal. RSI at 45.61 indicates improving buying momentum, comfortably away from overbought conditions, allowing room for further upside. ADX at 28.37 points to a strong developing trend, with directional strength steadily building.

A decisive move above ₹830 could open the path towards ₹974 (12-month target). On the downside, ₹720 remains a key support level; holding above this zone keeps the emerging bullish structure intact.

- RSI: 45.61 (Decent buying momentum)

- ADX: 28.37 (Strong trend strength)

- MACD: -38.46 (Negative; signal line crossover awaited)

- Resistance: ₹830

- Support: ₹720

HBL Engineering Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹830 (6% upside) and a 12-month target of ₹974 (24% upside), based on 33x FY27E EPS of ₹29.5.

Why buy now?

Earnings upcycle underway: Strong execution of defence orders, rising contribution from high-margin specialised batteries, and operating leverage are driving a sustained improvement in profitability.

Execution-led growth visibility: A robust order book, increasing defence indigenisation, and multi-year programme visibility provide confidence in revenue and earnings scalability.

Margin resilience: Favourable business mix, operating efficiencies, and disciplined cost management support margin stability despite input cost volatility.

Balance sheet strength: Low leverage, healthy cash generation, and calibrated capex provide financial flexibility to support growth without diluting returns.

Portfolio fit

HBL Power Systems offers differentiated exposure to India’s defence and strategic electronics theme, combining structural growth visibility with improving return ratios. With earnings momentum, balance sheet resilience, and long-duration order visibility, the stock fits well in portfolios seeking defence-led growth stories, industrial cyclicals with improving margins, and medium-term earnings compounders alongside core large-cap holdings.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHBL Engineering Ltd.: Budget 2025-26 opportunities

- Defence Modernisation: Increased capital allocation for defence procurements supports order growth.

- Railway Safety Programmes: Funding for Kavach and signalling modernisation provides a structural demand base.

- Indigenisation Push: Policy incentives under Atmanirbhar Bharat for domestic strategic manufacturers.

- Energy Infrastructure Support: Higher focus on grid resiliency and standalone power back-up systems.

- R&D & Technology Promotion: Incentives for advanced manufacturing and electronics quality testing infrastructure.

Final thoughts

HBL Power Systems is more than a battery manufacturer, it’s a strategic engineering partner for India’s defence and railway safety ecosystems. With products that are hard to qualify, long-term contracts with government agencies, and rising emphasis on indigenous capabilities, HBL bridges critical technology gaps. For long-term investors, this makes HBL a play not only on India’s infrastructure growth but also on policy-driven self-reliance, where sustained execution and quality delivery can translate into stable profitability and structural compounding over time.