Stock overview

| Ticker | IRFC |

| Sector | Public Sector Financing |

| Market Cap | ₹ 1,82,600 Cr |

| CMP (Current Market Price) | ₹ 140 |

| 52-Week High/Low | ₹ 229/108 |

| Beta | 0.85 (Low volatility) |

About IRFC Ltd.

Indian Railway Finance Corporation (IRFC), a Government of India-owned enterprise, is the dedicated financing arm of Indian Railways. Established in 1986, IRFC raises funds for the acquisition of rolling stock assets, project assets, and other railway infrastructure projects. Its strategic relevance to India’s largest transport network makes it a critical enabler of railway modernization and expansion.

Primary growth factors for IRFC Ltd

1. Strong Linkage with Indian Railways: Assured demand pipeline as Indian Railways continues to expand its rolling stock and infrastructure assets.

2. Sovereign Guarantees: Backing from the Government of India provides unmatched creditworthiness and lowers borrowing costs.

3. CapEx Push: The Union Budget 2025 allocated ₹2.5 lakh crore to railways — a large part of which translates into future IRFC financing opportunities.

4. Asset Expansion: Financing of new Vande Bharat trains, wagons, and electrification projects supports steady asset growth.

5. Low Credit Risk: With effectively zero NPAs due to government-linked repayments, IRFC retains robust balance sheet quality.

6. Attractive Yield Spreads: Competitive funding costs allow healthy interest spreads.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Total income | ₹ 6,723 cr | 4.1% | -0.6% |

| Operating Income | ₹ 6,677 cr | 4% | -0.7% |

| Net Income | ₹ 1,681 cr | -1% | 3.2% |

| EPS | 1.29 | -1% | 3% |

IRFC continues to deliver stable profits with near-zero asset risk thanks to sovereign-backed lending, maintaining its critical role in railway funding.

Detailed competition analysis for IRFC

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| IRFC | ₹ 1,82,600 cr | ₹ 6,723 cr | 28 x | 6% |

| PFC | ₹ 1,37,900 cr | ₹ 29,265 cr | 6 x | 10% |

| REC Ltd | ₹ 1,04,000 cr | ₹ 15,333 cr | 7 x | 10% |

| Indian Renewable | ₹ 47,100 cr | ₹ 1,904 cr | 28 x | 9% |

While IRFC’s valuation is modest compared to PFC and REC, its clean book with zero NPAs and sovereign backing makes it uniquely low-risk.

Company valuation insights: IRFC

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of IRFC shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹165 per share

- Upside Potential: 20%

- WACC: 10.1%

- Terminal Growth Rate: 3.2%

Major risk factors affecting IRFC

- Policy Dependence: Any shift in railway CapEx priorities could alter funding demand.

- Interest Rate Risk: Sharp spikes in funding costs could narrow spreads.

- Concentration Risk: Overdependence on Indian Railways as a single client.

- Regulatory Oversight: Being a PSU, decisions may sometimes be driven by policy more than pure commercial interest.

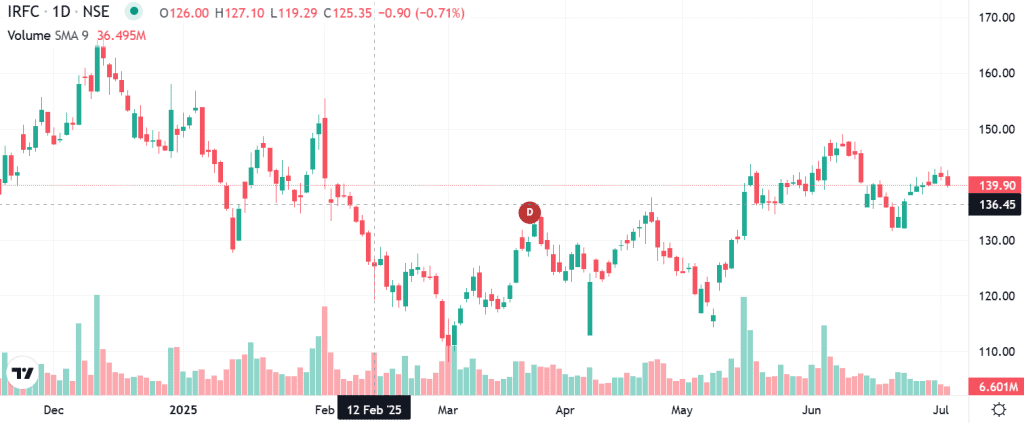

Technical analysis of IRFC

- Resistance: ₹150

- Support: ₹ 135

- Momentum: Neutral to Bullish

- RSI (Relative Strength Index): 44 (Neutral)

- 50-Day Moving Average: ₹145

- 200-Day Moving Average: ₹139

- MACD: Positive crossover; bullish divergence

Technically bullish with potential for breakout above ₹150

IRFC stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹150 (6-month horizon); ₹165 (12-month horizon);

Investment Horizon: 2–4 years for stable returns

Rationale

Recommend a Buy on Dips / Accumulate approach for IRFC.

Recommendation

Accumulate / Buy on Dips

Near-zero credit risk and sovereign backing provide excellent business predictability.

Ongoing railway modernization and the government’s CapEx commitment strengthen growth prospects.

Reasonable valuations with healthy yield make it a compelling steady compounder in the PSU financing basket.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

IRFC may not deliver eye-popping growth like private NBFCs, but its predictable, low-risk model backed by Indian Railways gives it a dependable place in any long-term portfolio. It combines stability, consistent cash flows, and reasonable upside with a strong dividend yield – a rare package in today’s volatile markets.