As India accelerates its push toward defence indigenisation, aerospace self-reliance, and strategic manufacturing, the importance of advanced materials has never been higher. At the heart of this transformation lies Mishra Dhatu Nigam Ltd (MIDHANI), a niche PSU that plays a critical role in supplying specialty alloys and superalloys essential for India’s defence, space, and nuclear programs. Often operating behind the scenes, MIDHANI is a silent enabler of India’s strategic ambitions.

But does Mishra Dhatu Nigam Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | MIDHANI |

| Industry/Sector | Iron & Steel |

| CMP | 358 |

| Market Cap (₹ Cr.) | 6,708 |

| P/E | 60.98 (Vs Industry P/E of 47.93) |

| 52 W High/Low | 469.00 / 226.93 |

| EPS (TTM) | 5.75 |

| Dividend Yield | 0.43% |

About Mishra Dhatu Nigam Ltd.

Mishra Dhatu Nigam Ltd is a Government of India enterprise under the Ministry of Defence, specializing in the manufacture of high-grade special steels, superalloys, titanium alloys, and strategic materials. Its products are used in fighter aircraft, missiles, submarines, space launch vehicles, nuclear reactors, and critical industrial applications. With deep in-house R&D, metallurgical expertise, and long-standing relationships with DRDO, ISRO, and defence PSUs, MIDHANI occupies a unique, high-entry-barrier position in India’s industrial ecosystem.

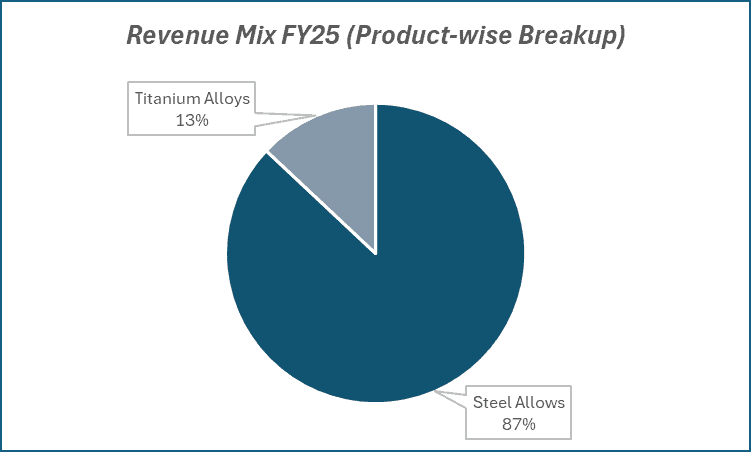

Key business segments

Mishra Dhatu Nigam Ltd. operates primarily in the following key business segments:

- Special Steels & Alloys: High-strength steels for defence, aerospace, and nuclear applications.

- Superalloys & Titanium Alloys: Used in aero-engines, rockets, and space systems.

- Strategic Materials: Nickel-based, cobalt-based, and high-temperature alloys for missiles and submarines.

- Industrial Alloys: Supplies to power, oil & gas, and advanced engineering industries.

Primary growth factors for Mishra Dhatu Nigam Ltd.

Mishra Dhatu Nigam Ltd. key growth drivers:

- Defence Indigenisation: Rising domestic sourcing under Make in India and Atmanirbhar Bharat.

- Aerospace & Space Programs: Increasing demand from ISRO, HAL, and private space players.

- Import Substitution: Replacement of critical alloy imports with indigenous production.

- Capacity Expansion: New alloy grades and melting facilities improving addressable market.

- Private Defence Participation: Growing opportunities as private OEMs enter defence manufacturing.

Detailed competition analysis for Mishra Dhatu Nigam Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Mishra Dhatu Nigam Ltd. | 1028.75 | 212.71 | 20.68% | 106.98 | 10.40% | 60.98 |

| NMDC Steel Ltd. | 26689.39 | 8894.94 | 33.33% | 7030.81 | 26.34% | – |

| Jindal Saw Ltd. | 18636.17 | 2796.81 | 15.01% | 1086.26 | 5.83% | 9.13 |

| Kirloskar Ferrous Ltd. | 6797.95 | 806.35 | 11.86% | 328.05 | 4.83% | 22.74 |

| Usha Martin Ltd. | 3551.37 | 599.86 | 16.89% | 402.71 | 11.34% | 32.77 |

Key insights on Mishra Dhatu Nigam Ltd.

- High Entry Barriers: Complex metallurgy and certifications limit competition.

- Order Book Visibility: Long-cycle defence and space orders provide revenue stability.

- R&D-Led Model: Strong in-house development enables customized, mission-critical materials.

- Strategic PSU Status: Preferred supplier status to defence and space agencies.

- Margin Sensitivity: Profitability linked to operating leverage and product mix.

Recent financial performance of Mishra Dhatu Nigam Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 262.12 | 170.50 | 209.73 | 23.01% | -19.99% |

| EBITDA (₹ Cr.) | 48.96 | 34.17 | 32.75 | -4.16% | -33.11% |

| EBITDA Margin (%) | 18.68% | 20.04% | 15.62% | -442 bps | -306 bps |

| PAT (₹ Cr.) | 23.55 | 12.80 | 12.77 | -0.23% | -45.77% |

| PAT Margin (%) | 8.98% | 7.51% | 6.09% | -142 bps | -289 bps |

| Adjusted EPS (₹) | 1.27 | 0.69 | 0.69 | 0.00% | -45.67% |

Mishra Dhatu Nigam Ltd. financial update (Q2 FY26)

Financial performance

- Revenue declined 20% YoY to ₹209.7 crore, though it recovered 23% QoQ, impacted by delays in order execution and inventory build-up due to longer superalloy processing cycles.

- EBITDA fell 33.1% YoY to ₹32.8 crore, with EBITDA margin contracting 306 bps YoY to 15.6%, primarily due to higher other costs and operating deleverage.

- PAT declined 45.8% YoY to ₹13 crore, remaining largely flat QoQ, reflecting lower execution rather than structural margin pressure.

- For H1 FY26, revenue was down 10.7% YoY to ₹380.2 crore, while EBITDA margin improved sequentially to 18%, indicating margin resilience despite volume softness.

Business highlights

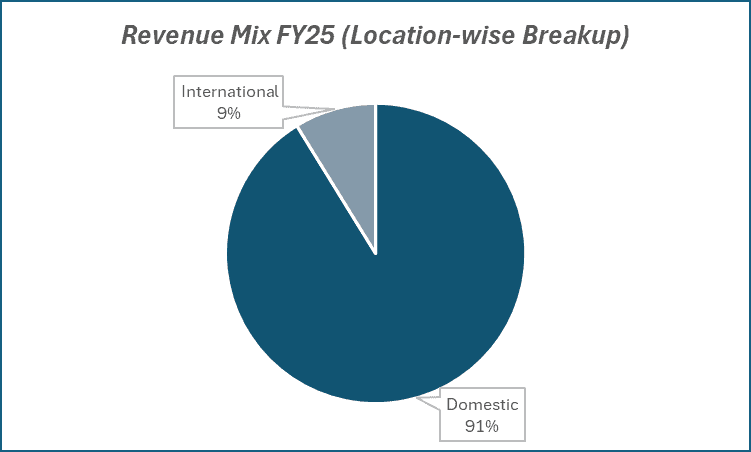

- Order book remained strong at ₹2,220 crore (1.8x TTM revenue), with ~70% exposure to defence and the balance from space, energy, exports, and others.

- Execution was impacted by inventory build-up due to long superalloy processing cycles, pushing revenue recognition to H2 FY26.

- Management reiterated FY26 revenue guidance of ~₹1,300 crore and EBITDA margin target of ~23%, implying a sharp pickup in H2 execution.

- Growth visibility supported by large titanium (~₹600 crore) and superalloy (~₹450 crore) orders, alongside rising defence and space contributions.

Outlook

- Management expects execution momentum to accelerate in H2 FY26, supported by strong order backlog and short execution cycle (1–1.5 years).

- Order inflow of ~₹500 crore expected in H2 FY26, taking YTD FY26 order intake close to ₹1,500 crore.

- EBITDA margins expected to normalize towards 23%, aided by improved plant utilisation, recycling of scrap, and benefits from recent capex.

- Medium-term vision targets 10–20% annual revenue growth, supported by forging and downstream capacity upgrades, metal bank initiative, and powder metallurgy expansion.

- Strong balance sheet, strategic defence positioning, and rising indigenisation create a favourable setup for earnings recovery and margin expansion over FY26–28.

Recent Updates on Mishra Dhatu Nigam Ltd.

- New Alloy Development: Ongoing work on advanced titanium and superalloy grades.

- Capacity Augmentation: Expansion of melting, forging, and finishing capabilities.

- Defence Ecosystem Integration: Deeper engagement with DRDO, HAL, and private defence firms.

- Technology Upgradation: Investments in modern furnaces and metallurgical processes.

Company valuation insights – Mishra Dhatu Nigam Ltd.

Mishra Dhatu Nigam is currently trading at a TTM P/E of ~61x, above the industry average of ~48x, and has delivered a muted 1-year return of 4.4%, underperforming the NIFTY 50’s ~10% over the same period. This underperformance is largely attributable to near-term execution delays, inventory build-up from long superalloy processing cycles, and softer H1 FY26 revenues, rather than any deterioration in the company’s long-term growth prospects or competitive positioning.

The investment case for Mishra Dhatu Nigam is anchored in its strong order book visibility (~₹2,220 crore, ~1.8x TTM revenues), strategic importance in India’s defence and aerospace indigenisation, and an expected sharp pickup in execution during H2 FY26. The company remains a critical supplier of high-value titanium alloys, superalloys, and special steels across defence, space, and energy platforms, supported by a robust pipeline and management’s reiterated FY26 revenue guidance of ~₹1,300 crore with EBITDA margins of ~23%. Ongoing capacity additions, recycling-led utilisation improvement, and new product development (including additive manufacturing powders and advanced defence applications) are expected to structurally improve margins and return ratios over the medium term.

From a valuation perspective, applying a 43x multiple to FY27E EPS of ₹10, we arrive at a 12-month target price of ₹430, implying an upside of ~20% from current levels. On a shorter-term basis, we assign a 3-month target price of ₹380, offering ~6% upside, supported by improving execution momentum, strong order inflows, and normalization of margins as H2 FY26 deliveries ramp up.

Major risk factors affecting Mishra Dhatu Nigam Ltd.

- Execution Delays: Long project cycles can defer revenue recognition.

- Client Concentration: Heavy dependence on government and defence agencies.

- Cost Pressures: Volatility in raw material and energy costs.

- Capacity Utilisation: Underutilisation can weigh on margins in slow order phases.

Technical analysis of Mishra Dhatu Nigam Ltd. share

Mishra Dhatu Nigam has formed a rounding bottom pattern, with prices currently hovering near the neckline. A sustained breakout above this zone could signal the beginning of fresh upside momentum, indicating a transition from prolonged base formation to an emerging uptrend.

The stock is comfortably trading above its 50-, 100-, and 200-day EMAs, reinforcing strong medium- to long-term trend strength and highlighting consistent buying support across timeframes.

Momentum indicators remain constructive. MACD at 7.21 is positive, with the MACD line placed above the signal line, indicating strengthening bullish momentum. RSI at 60.20 reflects healthy buying interest, while Relative RSI (0.21 over 21 days) suggests continued outperformance versus the broader market. ADX at 34.97 points to a strong and well-established trend with improving directional conviction.

A decisive move above ₹380 could open the path towards ₹430 (12-month target). On the downside, ₹320 remains a key support level; holding above this keeps the bullish structure intact.

- RSI: 60.20 (Healthy Buying Momentum)

- ADX: 34.97 (Strong Trend Strength)

- MACD: 7.21 (Positive)

- Resistance: ₹380

- Support: ₹320

Mishra Dhatu Nigam Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹380 (6% upside) and a 12-month target of ₹430 (20% upside), based on 43x FY27E EPS of ₹10.

Why buy now?

Execution inflection ahead: H1 FY26 was impacted by timing delays; a sharp pickup in execution is expected in H2 FY26, supported by a strong order book and short execution cycle.

Strong order visibility: Order backlog of ~₹2,220 crore (~1.8x TTM revenues) provides clear revenue visibility over the next 12–18 months.

Defence & aerospace indigenisation play: Midhani remains a strategic supplier of critical alloys (titanium, superalloys, special steels) across defence, space, and energy platforms, benefiting from sustained government capex.

Margin normalization lever: EBITDA margins are expected to revert towards ~23%, aided by higher utilisation, scrap recycling, and benefits from capex undertaken over the last 3–4 years.

Optionality from new products: Additive manufacturing powders, advanced defence applications, and export opportunities (post certifications) offer medium-term growth optionality.

Portfolio fit

Mishra Dhatu Nigam offers high-quality exposure to India’s defence, aerospace, and strategic manufacturing ecosystem, backed by strong entry barriers, long-term order visibility, and improving execution momentum. It fits well in portfolios seeking structural defence-led growth, earnings recovery plays, and operating leverage, complementing core industrials and PSU allocations with medium-term re-rating potential.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebMishra Dhatu Nigam Ltd.: Budget 2025-26 opportunities

- Defence indigenisation: Higher defence capex supports sustained demand for critical alloys.

- Space & aerospace growth: Expanding ISRO and private space programs boost alloy consumption.

- Energy infrastructure: Nuclear and ultra-supercritical projects drive advanced material demand.

- Import substitution: Policy focus strengthens domestic sourcing of strategic metals.

- Export enablement: Supportive framework improves long-term defence export opportunities.

Final thoughts

Mishra Dhatu Nigam is not a conventional metals play, it is a strategic materials champion tightly linked to India’s defence and aerospace future. With rising indigenisation, expanding defence budgets, and increasing complexity of platforms, MIDHANI stands to benefit from long-term structural demand. For investors seeking exposure to India’s strategic manufacturing and defence supply chain, MIDHANI offers a rare, high-entry-barrier opportunity with multi-year relevance rather than short-term cycles.