The Indian stock market is one of the world’s most dynamic and diverse markets. One of the ways to participate in the market is through derivatives trading, in which investing in option contracts is the popular one.

Options trading can be done in various ways, such as buying or selling a single option contract or combining multiple options contracts to create a more complex strategy. One of the option trading strategies that can be used in the Indian market is the call ratio spread.

With this technique, the underlying asset fluctuates barely or not at all, and there should be a decrease in fluctuation and time decay. A bullish trading strategy in the options market that includes trading call options is known as call ratio backspread.

In this article, let’s look into the concept of call ratio backspread in detail.

You may also like: How to trade in options and maximise your profit?

What is the call ratio backspread?

The concurrent buying and selling of call options is the basis of the call ratio backspread option approach. The trade’s ratio and structure are where its name came from. The strategy aims to make the most money possible shortly from a sizable increase in the underlying stock’s price. It can reduce risk and preserve infinite profit potential by combining purchased and sold options.

With this approach, you buy two call options that are OTM and sell one that is ITM and has the same expiry and underlying security. This approach is used by investors who are enthusiastic about the security’s price and anticipate higher volatility to profit from a spike in the asset’s value.

Here’s how the call ratio back spread approach is put into practice:

- You write down (sell) one call option with a strike price lower than the others.

- You purchase two options with comparatively greater strike prices.

When anticipating a significant increase in the underlying securities, bullish investors employ this method to limit losses. Using this method, a significant amount of call options are purchased, and a smaller number of calls with identical expiry dates but differing strikes are sold.

What makes the call ratio backspread approach up?

Let’s examine this strategy’s main components to grasp it completely :

- Ratio: There are two long call options and one short call option in the 2:1 ratio used in this approach.

- Same expiry date: To give you enough time to profit from the position, all of the call options in the approach need to have one expiration date.

- Strike selection: For long positions, you can usually pick an OTM call option; for short positions, you can often choose an ITM call option.

- Bullish view: Investors with a bullish perspective and expect a large price gain in the underlying securities will use this technique.

Also read: Mastering the bull spread strategies

How to set up a call backspread?

There must be a ratio in the number of contracts wherein more long calls are bought than short calls are sold. In call ratio backspread, a 2:1 ratio of long and short call options are used for longer-term or next-month options.

One short call option would necessitate two long call choices. When a trade is launched for credit, the most significant loss can be incurred if the long call option’s strike price is reached at expiry. This happens because the long calls would expire without any worth, and the short calls would be in-the-money. Beyond the long call options, the possibility to make a profit is limitless.

The amount debited or credited at the point of entry is contingent upon the relative distance between the short-term call option’s and the long-term call option’s from the underlying stock value.

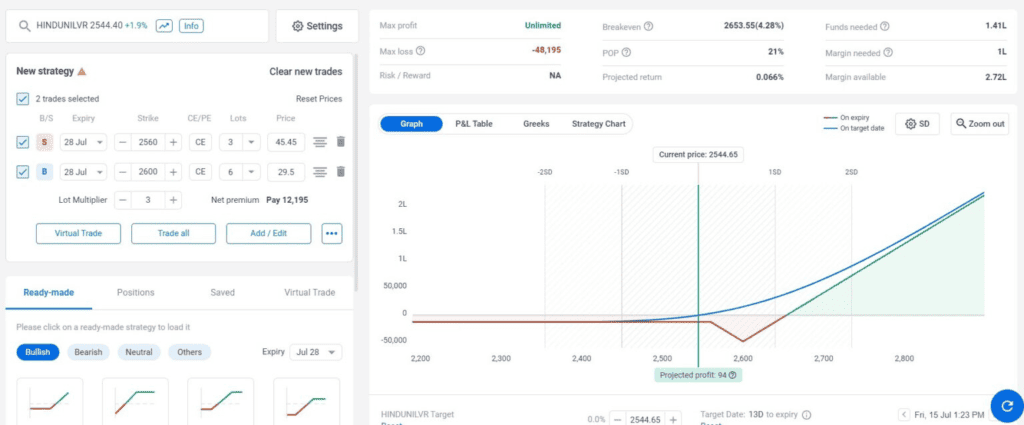

Below is a call ratio backspread example where the strategy is used in HINDUNILVR.

Call ratio backspread vs. put ratio backspread

A put ratio backspread is a strategy for bearish options traders who want to profit from the underlying stock’s volatility. With a predetermined ratio, the trader sells one put option and purchases other put options at a reduced strike price. The name of the strategy comes from the ratio of the puts and the fact that it benefits from a fall in the stock price.

The put ratio spread is like the call ratio spread but with puts instead of calls. Selling a single put option allows you to purchase two or more at a lower strike price by using the premium you receive. If the stock price drops significantly, you make money from the two puts and lose less from the one you sold.

Here is a quick summary of the difference between call ratio backspread and put ratio backspread.

| Call ratio backspread | Put ratio backspread |

| This bullish strategy uses longer-term or next-month options and buys a 2:1 ratio of call options to sell. | In this bearish technique wherein the trader sells one put option and purchases additional put options at a lower strike price in a predetermined ratio. |

| When the contract’s strike price plus the premium paid are equal to the underlying stock price at expiration, the maximum loss happens. | When the price of the underlying stock at expiration exceeds the short put’s strike price less the premium paid, the maximum loss happens. |

| The maximum profit is limitless and arises from a substantial increase in the price of the stock that is being traded. | The capped maximum profit happens when there is a substantial decline in the price of the stock being traded. |

| The break-even point is calculated by adding the net debit to the strike price of the long call. | The break-even point is calculated by subtracting the net credit from the strike price of the short put. |

Also read: Your ultimate guide to investing in a bear market

Conclusion

Only a sharp shift in price brought on by an increase in implied volatility would make the call ratio backspread option strategy profitable. Traders use versions of this method to maximise profitability while boosting trading odds.

The ratio is frequently changed from the standard 2:1 to the more intricate and highly leveraged 3:2 and 3:1 combination. However, before using this method, evaluating your risk tolerance and experience with options trading is a good idea.