Growth investing emerges as a captivating strategy in the stock market that combines income generation and capital appreciation. It involves targeting stocks with notably higher return rates than the overall market average. You might think that isn’t the essence of stock investing.

Growth investing stands apart from general investing as it primarily targets companies and industries experiencing a rapid rise.

Investors with the vision to think beyond traditional investment strategies and do not want to settle for modest returns can explore stocks with high growth potential, even though growth stocks might be more volatile and take time to reach their total value.

Imagine the thrill of holding Hindustan Aeronautics which has experienced staggering growth – up 50% in 2023 so far. Their stockholders who believed in their growth are enjoying above-average returns.

Growth investing demonstrates the potential for robust earnings and revenue over time. However, it can not be assumed that growth stock investing is meant to always offer high returns.

Economic and monetary headwinds can slow additional returns. In this comprehensive guide, you can explore the key aspects of growth stock investing in India and understand how to invest in growth stocks.

Let us start with understanding growth stocks quickly.

You may also like: The butterfly effect: Understanding the power of small changes

Detecting growth stocks

The first step to understanding how to invest in growth stocks is to know what is a growth stock and identify them. Here are the key characteristics of growth stocks:

Younger enterprises and industry disruptors:

Growth companies are often smaller, newer companies and industry disruptors poised to expand and usually offer unique services and products and frequently work with the latest technologies to stay ahead of their competitors in the industry.

However, these are not always pioneers of the idea. For example, Amazon was not the first business engaged in online selling. The best growth stocks can work on an existing concept and devise strategies to scale it. Another example is Zoom Video Communications, which emerged as an industry disruptor during the COVID pandemic.

Growth over dividend offerings:

Growth companies commonly opt for reinvestment over dividend declarations, or else there will be minimal dividend offerings. The rationale behind this strategy is their inclination to direct surplus funds back into the business in an effort to fuel future success.

With this strategy, they provide superior returns to shareholders via amplified share prices.

Premium valuations:

Growth stocks typically command higher valuations than their peers. Key valuation metrics that can help investors are the price-to-earning (P/E) ratio, EBITDA (Earnings before interest, taxes, depreciation, and amortisation), price-to-book (P/B) ratio and others.

Long-term potential for stabilisation:

The allure of growth stocks in India lies in their capacity to deliver superior returns over long periods. Growth stocks are generally volatile and take time to realise their complete potential. Over 10-15 years, they establish a market hold and accumulate market share swiftly.

Hence, growth stocks are the stocks from businesses or industries anticipated to expand faster. Their remarkable performance often captures the attention of most investors. However, they carry high risk, especially when a downturn is near. Therefore, it is necessary to follow strategies to make disciplined investment decisions.

Also Read: Hedging 101: Protect your investments from market surprises

Growth stock investing strategies

Growth investing can be an enticing but challenging journey for any investor. Here are the strategies that can help you to invest in growth stocks:

Evaluate company’s financials and growth prospects

Earnings stand as a key driver of market returns in the long term. Growth investors look for companies demonstrating robust growth in earnings and revenue over recent years. Positive cash flow indicates the financial well-being of the company. Several financial ratios are utilised to determine a company’s historical performance and growth potential, including the following:

- Return on equity (ROE): A high ROE indicates a company’s profitability in relation to generating returns on the funds invested by its shareholders. Ideally, the RoE value should be 15% or higher.

- Return on assets (ROA): ROA ratio indicates a company’s efficiency in relation to its total assets. Investors can compare the ROA of growth companies to analyse if the company is more adept at making profits from its assets compared to its industry counterparts.

- Price-to-earning (P/E): Investors can get insights into a company’s stock valuation relative to its earnings by considering the P/E ratio. Companies with the potential for significant growth often exhibit a higher P/E ratio, ideally equal to or higher than 1.

- Price-to-Earnings to Growth (PEG) Ratio: Since the P/E ratio overlooks the annual growth of a company’s total earnings per share, investors use the PEG ratio. A high PEG ratio, ideally 1, indicates a balance between price and growth.

The Nifty Next 50 price index helps investors to invest in future leaders of the Indian economy and capitalise on their growth potential. The next set of companies on the verge of entering the Nifty 50 is often in a phase of expansion and growth.

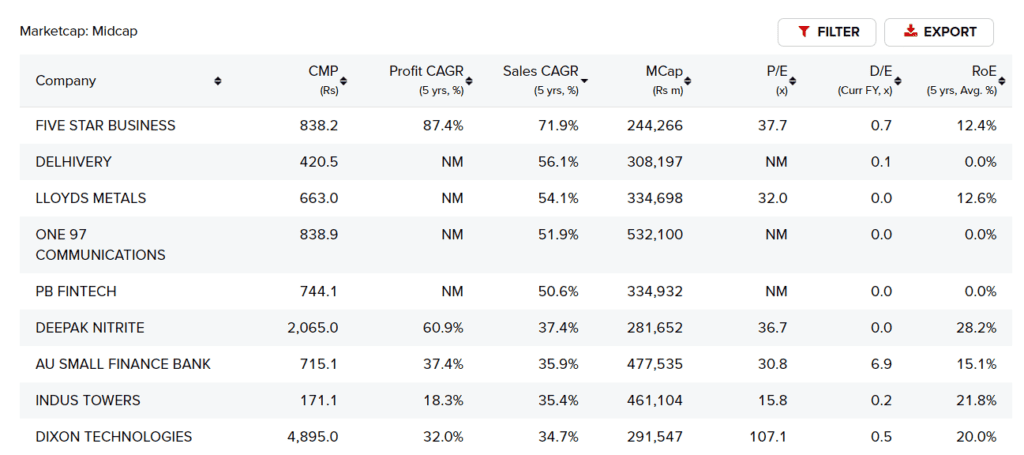

Screeners can also help you to compare the performance of different growth stocks.

In the above screener, you can see top growth stocks in India under the category of midcap market capitalisation.

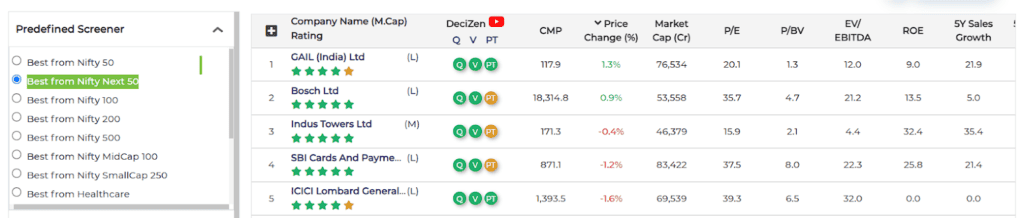

Here is another stock screener showing the best from Nifty Next 50.

Prioritise companies with competitive advantages

Look for companies in the sectors driven by innovation and at the forefront of technological advancements, as they have high growth potential.

It can be e-commerce, renewable energy, biotechnology, artificial intelligence, etc., that often have the potential to reshape industries and gain competitive advantage for rapid expansion.

Track stocks against 52-week high

Stocks trading near their 52-week highs are often at leading positions in their respective sectors. This strategy can help growth investors with valuable insights into its performance, potential momentum, and investor sentiment.

Also, if the stock is consistently reaching 52-week highs, it indicates the intact growth trajectory of the company with increasing revenues, expanding market share, or innovative offerings. Investors can use screening tools to track stock performance.

Also Read: The ABCs of stock market: Consolidation and Breakouts

Volume spikes

Volume analysis is among the commonly used tools by stock traders to gain insights into the supply and demand dynamics and investor sentiment for a stock.

If there is a spike (sudden and significant surge in trading volumes accompanied by significant price movements) in buying volume on the chart within a short period, it indicates strong buying pressure.

Volume spikes can confirm the strength of an existing trend. Suppose a growth stock on an upward trend is experiencing a volume spike due to a price increase. It signals investors’ confidence in the stock and the potential continuation of the upward price movement.

Crucial insights for investing in growth stocks

Here are the key considerations to understand how to invest in growth stocks:

- Check the cause of growth: If the company’s growth potential does not justify the stock valuation, it can lead to future volatility.

- Risk management: Acknowledging the volatility of growth stocks, consider risks associated with the industry to understand the potential impact of economic downturns.

- Research and due diligence: You can evaluate the company’s management quality, analyse financial stability, and use key metrics like revenue growth and profitability ratios to understand its performance.

- Time horizon: Growth stocks demand patience and are relevant to include in long-term portfolios.

Conclusion

Growth-oriented companies prioritise rapid expansion, whether it is about increasing revenue, designing new products, or extending market share into untapped regions.

Therefore, they are expected to grow at a higher pace than the industry’s average growth rate. Investing in high-growth stocks in India can offer exciting opportunities to individuals seeking high returns.

Leave a Comment