Imagine that you have a lot of funds to invest and want the best possible returns. You could buy some stocks or bonds, but the market is unpredictable. You could also invest in some startups or small businesses, but you know they are also risky. So what’s the way out here? The answer is PE investment.

Private equity, or PE for short, is a form of financing where your funds are invested in private companies that are not listed publicly. So, how do we invest in private equity and make a profit? Let’s find out!

You may also like: How to Invest in US Stocks from India?

What is private equity and how does it function?

Private equity is an alternate way of investing in shares of companies that are not listed on the stock exchanges. This means that you can’t buy or sell their shares and their financial information is not open to the public. In addition to venture capital, real estate, and more, PE is also an alternative asset class. Alternative asset classes are, as their name suggests, different from traditional equity investments.

These asset classes are not as easily accessible as other traditional equity investments, like stocks. Since these companies are not listed, they make investing decisions exclusive.

So, how exactly can you invest in one? The answer is PE firms. The whole private equity structure relies on PE firms or private equity firms. They raise money from investors to create private equity funds and use that to manage private companies.

So, what is a PE fund? PE firms create PE funds by raising pools of funds and seeking out highly potential companies that need capital to grow. Depending on the strategy, PE firms can buy a stake in a particular company after hitting their fundraising goal.

Some common types of PE investments are leveraged buyouts (LBOs), venture capital (VC), and growth equity. In the next section, we will go over each of them in greater clarity.

Private equity firms make money by charging fees that are a percentage of the fund size and the profits generated from them. The profit comes from selling portfolio companies to another company. Then they are shared between the investors and the PE firms that have agreed to a pre-approved ratio.

Private equity example:

One example of a private equity firm is Blackstone Group (BX), which invests in real estate, healthcare, and technology, among other sectors.

Different types of private equity funds

As mentioned above, private equity investments are typically categorised into three major segments. The categorization is made based on two aspects: the growth phase of a company and the size of the investment.

Venture capital: Venture capital is a collection of resources that are generally invested in start-ups and early-stage companies. These companies typically show great potential for growth but have little access to conventional lending sources.

Since they don’t have access to huge quantities of debt, venture capital funds are crucial for small start-ups with innovative ideas and value propositions to gather capital. Venture capital funds can offer exceptional returns for investors, even if they entail risks associated with funding developing companies.

Leveraged Buyout (LBO): Leveraged buyout funds, in contrast to venture capital firms, typically acquire a controlling stake in more established companies. As its name suggests, leverage is heavily used by LBO funds in order to increase their rate of return. Compared to VC funds, buyouts are often much larger in scale.

Growth equity: Through growth equity, businesses raise money to support their expansion. Similar to venture capital but less risky, growth equity is sometimes referred to as expansion equity or growth capital. Here, the firms will ensure that the businesses getting the investment are already financially viable, have a better valuation, and have barely any debt.

Also read: Power your investment portfolio with growth stocks

How do private equity firms work?

Private equity firms are in charge of various investment responsibilities. These include gathering funds, helping the companies grow, and assisting them with reselling. While particular responsibilities may vary from one PE firm to another, here are some of the common ones that most firms carry out:

Gathering capital

The first step in any private equity investment is raising capital to invest in certain companies. Here, investors may get capital commitments from LPs or other financial institutions. Limited partners, or LPs, often offer a majority stake to invest in, and most firms seek that as well.

Sourcing the funds

After creating a fund with sufficient capital, the firms then analyse the potential of the given companies before investing in them. Some non-negotiable factors that they consider for their selection are:

- What the business sells, such as its goods or services

- Which industry is the business in?

- How well the business has done financially recently

- Who makes up the top management team of the company?

- How much is the company worth?

- Which exit scenarios could the corporation face?

Finalising agreements

The firm offers the company a deal once the necessary research has been conducted. After that, the final terms of the contract are negotiated by solicitors from the firm and the company. Once decided upon, the transaction can move forward, exchanging equity and releasing funds for both parties.

Enhancing the company’s efficiency

The company’s condition can be improved with the aid of private equity firms. They frequently offer suggestions to aid in enhancing administration, reducing expenses, and improving operations. Depending on their ownership position in the business, the firm’s obligations may differ in scope.

The majority of private equity firms don’t get involved in the day-to-day management of the businesses in their portfolio. Companies that own larger shares in other companies could be more well-known or have greater leadership roles.

Making an exit

When a company in its portfolio is profitable and steady, the majority of private equity firms aim to sell their stake in it. This could guarantee that they make the most of their investment. The majority of businesses close within a maximum of seven years, though exact times may differ based on the business plan.

How can you invest in private equity?

If you are willing to invest in PE funds, there are two ways to do that: ETFs and direct investment.

Direct investments: If you want to make direct investments in PE, you are required to collaborate with a PE firm. For this, you have to conduct research to discover the most suitable firm for you, as each has different investment minimums, areas of speciality, fundraising schedules, and exit strategies.

ETF investments: Exchange-traded funds are specifically designed for private equity investing. ETFs allow you to participate in private equity without going through a regular business.

Also read: Who is a HNI trader in the stock market?

Conclusion

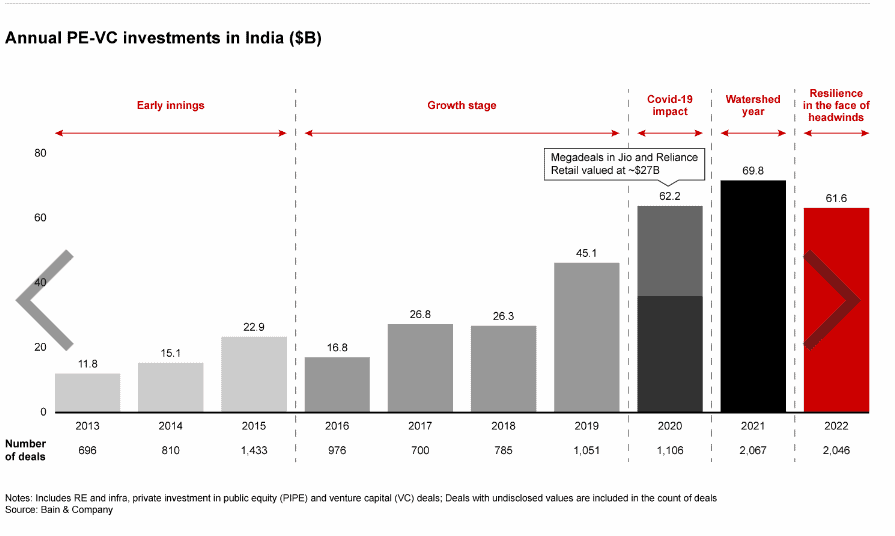

PE has become a crucial part of the Indian economy, attracting investors all over the world. However, private equity investors need to be aware of the risks and opportunities in this dynamic market to ensure growth. This alternative asset class is not just a source of capital but a catalyst for innovation and transformation.