India’s healthcare sector is a critical component of its economy, showing robust growth and significant potential for further expansion. Within this essential industry, two major entities stand out: Apollo Hospitals Enterprise Ltd. and Max Healthcare Institute Ltd.

Apollo Hospitals, part of the esteemed Apollo Group, is a pioneer in integrated healthcare services, offering a wide spectrum of healthcare across its extensive network of hospitals and clinics. Max Healthcare, on the other hand, brings a formidable presence in North India, particularly in the metropolitan hubs of Delhi-NCR and Mumbai.

In this blog, we will explore a detailed comparison between Apollo Hospitals and Max Healthcare, examining how each company shapes the landscape of healthcare services in India.

Healthcare industry in India

The healthcare industry in India is expansive and multifaceted, encompassing hospitals, medical devices, clinical trials, telemedicine, medical tourism, health insurance, and medical equipment. This sector is significant both for its economic impact and as a major employer.

India’s healthcare system includes both public and private components. The public sector mainly provides primary care in rural areas and some secondary and tertiary care in urban centres. Conversely, the private sector delivers a substantial share of the higher-level medical services, predominantly in urban areas.

The sector’s growth is propelled by increasing investments from both public and private sources. The government has increased healthcare funding post-pandemic and launched initiatives like the Ayushman Bharat health insurance.

Notably, the hospital sector alone is anticipated to reach ₹18,348.78 billion by FY 2027, growing at a CAGR of 18.24%. Furthermore, India is home to over 12,500 companies within the offline healthcare sector, having attracted investments exceeding $12 billion historically. However, the funding raised in 2023 has seen a decline compared to the previous years, influenced by an economic slowdown and higher interest rates.

With a large pool of medical professionals and cost-effective clinical services, India is a preferred destination for medical tourism. Patients from around the world are drawn to the country because it provides medical operations at a fraction of the cost of the US and Western Europe.

You may also like: The healthcare industry in India: An overview

Company overview

Apollo Hospitals

Apollo Hospitals Enterprise Ltd was established in 1983 as India’s first corporate hospital by Dr. Prathap C Reddy. It marked the beginning of the private healthcare revolution in India. Today, Apollo stands as a leading integrated healthcare services provider in Asia with a significant presence across various segments of the healthcare industry.

As of December 2023, Apollo operated 71 hospitals, managing a total capacity of 9,469 beds. This includes 44 owned hospitals and 22 daycare or cradle facilities with 634 beds. Beyond its extensive hospital network, Apollo also runs one of the largest pharmacy chains in India, with over 5,700 retail outlets.

Ownership remains largely within the founding family, with Dr. P C Reddy and his relatives holding approximately 29.33% of the company’s equity shares. Apollo HealthCo, a fully-owned subsidiary of Apollo Hospitals, has agreed to raise ₹24.75 billion from Advent International for a 16.8% stake.

Additionally, AHL plans to gradually integrate Keimed Pvt Ltd, a promoter group entity, to form a leading integrated pharmacy distribution business with a rapidly expanding omnichannel digital health operation.

Max Healthcare

Max Healthcare operates a comprehensive network of primary, multispecialty, and tertiary care facilities. As of now, the company manages 17 healthcare facilities, comprising a mixture of owned, leased, and operation and management (O&M) hospitals.

Currently, Max Healthcare has a capacity of approximately 3,550 beds, with a significant 82% of these beds located in metropolitan cities, emphasising its strong presence in urban centres. The organisation primarily serves the North India region, especially the Delhi-NCR and Mumbai areas, where it has established a substantial foothold.

The company’s facilities enjoy a high occupancy rate, approximately 75% as of the third quarter of FY24, indicating robust demand for its healthcare services. Max Healthcare continues to focus on expanding its reach and enhancing the quality of care provided across its network.

Also read: The pharmaceutical industry in India and its contribution to the world

Financial performance

Let’s compare Apollo Hospital’s quarterly results with Max Healthcare’s results for Q3 FY24.

| Apollo Hospitals | Max Healthcare | |

| Revenue (₹ crores) | 4,851 | 1,335 |

| Operating profit (₹ crores) | 614 | 386 |

| Profit before tax (₹ crores) | 363 | 360 |

| Net profit (₹ crores) | 254 | 289 |

| EPS (₹) | 17.06 | 2.98 |

Source: Screener as of 06.05.2024

Share price performance

Apollo Hospital share price

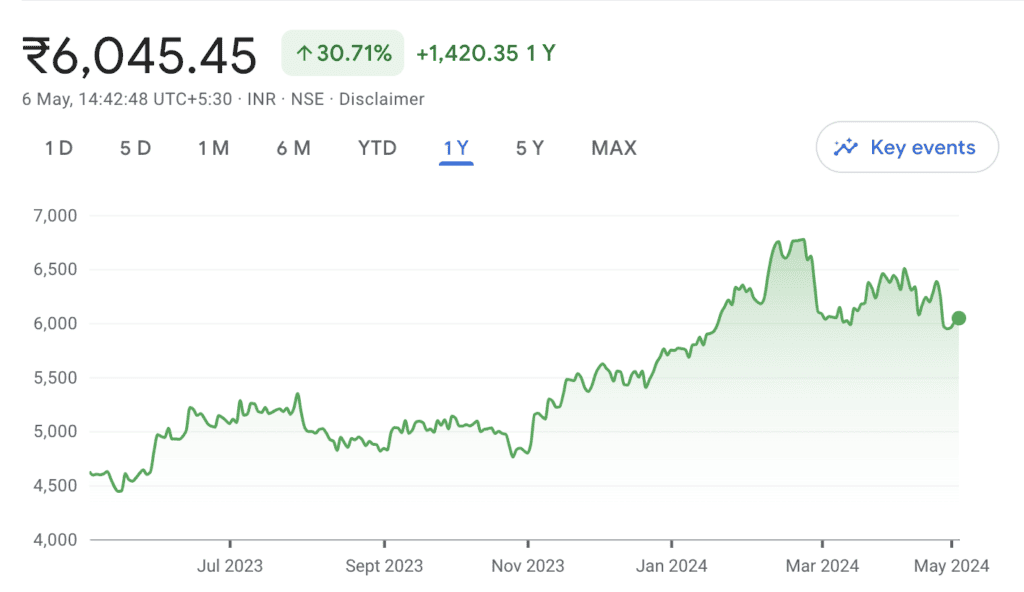

On May 6, 2024, Apollo Hospital’s share price was ₹6,045. Based on historical data, Apollo Hospital shares have yielded a return of 30.71% over the past year.

Source: Google Finance

Max Healthcare share price

On May 6, 2024, the share price of Max Healthcare was ₹832.6. During the previous year, the company’s share has returned 73.97%.

Source: Google Finance

Strength and weakness

Apollo Hospitals

Strengths:

- Market leadership: Apollo Hospitals is a leader in the private healthcare segment in India, operating the largest network of facilities with a current capacity of 9,469 beds. Its strong brand equity and quality of service contribute to its leadership.

- Integrated pharmacy distribution: Through its subsidiary Apollo HealthCo, Apollo Hospitals is strengthening its pharmacy distribution network. The integration with Keimed Pvt Ltd aims to create India’s leading integrated pharmacy distribution business, which is expected to significantly boost revenue and operational efficiencies.

- Financial stability: Apollo Hospitals plans significant capital expenditure of around ₹3,500 crore through FY 2027 for expansion and modernization, supported by strong annual net cash accruals of over ₹1,200 crore. Healthy debt protection metrics and solid financial flexibility ensure sustained growth and operational success.

Weakness:

- Dependency on technology investments: The high cost of ₹600 crore annually in fiscal years 2023 and 2024 for the Apollo 24*7 platform represents a substantial cash burn. While these investments are aimed at enhancing service delivery and market reach, they have yet to show sustained profitability.

- Impact on profitability: The investments in digital health have required substantial financial outlays without immediate returns, impacting overall profitability. However, a break-even was achieved at the operating level by Q3 of fiscal 2024, indicating a potential turnaround.

Max Healthcare

Strengths:

- Improved service realisation: Enhanced ARPOB (Average Revenue Per Occupied Bed), which stood at ₹75,000 in Q3 FY24, driven by specialisation in high-demand areas like Oncology.

- Operational efficiency: EBITDA per bed rose to ₹74 lakh in Q3 FY24, reflecting, due to higher bed occupancy and improved operational efficiency.

Weakness:

- Geographic concentration: A significant portion of Max’s operations is concentrated in metro cities like Delhi-NCR and Mumbai. While this strategy has advantages such as higher ARPOBs and access to medical tourists, it also exposes the company to localised socio-economic and regulatory changes which could impact performance.

- Regulatory and concentration risks: Max operates in a heavily regulated sector where past interventions, such as price capping on essential medical devices, have impacted margins. Future regulatory changes remain a key area of concern.

You may also like: All about health insurance schemes for a millennial investor

Bottomline

Both Apollo Hospitals and Max Healthcare are key players in India’s healthcare industry, each with its unique strengths and challenges. While Apollo focuses on expanding its network and integrating digital health platforms, Max Healthcare aims to enhance its urban presence and operational efficiency. Both companies face regulatory challenges and are striving to optimise their service models for better financial performance.