Technology is ruling the world today. It has gradually crept in and become a significant part of every sector of the economy. The beauty and personal care industry is no exception to this. With technology and an increase in sustainable products, the cosmetic industry is attracting more and more consumers towards it.

In today’s article, let’s go through how the cosmetic industry has shaped over time, its contribution to the economy and the future trends in beauty and personal care.

What is the cosmetic industry?

The cosmetic industry includes all entities that produce and sell cosmetic products. Cosmetic products generally refer to beauty and personal care products used on one’s body parts, like the skin, hair, nails, etc., to enhance beauty and health.

You may also like: Fast-Moving Consumer Goods (FMCG) Sector- A Safe Haven in Bear Markets?

History of the cosmetic industry in India

An article in the Indian Journal of Plastic Surgery spoke about the existence of cosmetic products back in the Indus Valley civilisation. Industry analysts have also noticed references to natural cosmetic products like butter and oil in ancient Hindu scriptures like the Ramayan and Mahabharat.

Further, during the British rule in the 1900s, several chemical-based products were introduced in India. However, the introduction of Lakme in 1952 by Hindustan Unilever marked the beginning of actual cosmetic products in the organised sector in India. With time, more manufacturers entered the industry, and globalisation in 1991 paved the way for international brands to enter the Indian cosmetic market.

Current and future economics of the cosmetic industry

The current market size of the cosmetic industry in India is valued at $15.05 billion and is expected to reach $17.34 billion by 2026.

The increase in e-commerce websites and the disposable income of consumers are the primary reasons for the growth of India’s cosmetic industry.

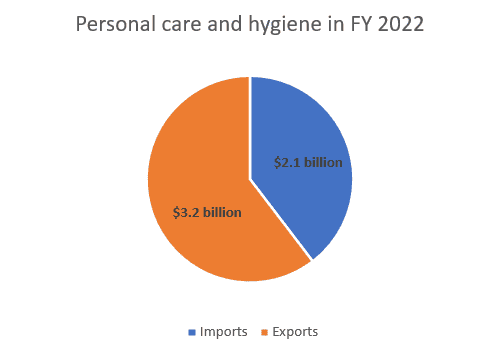

Below are some estimates across different products in the cosmetic sector:

| Product | Growth |

| Premium beauty and personal care products | CAGR (Compounded Annual Growth Rate) of 54% from FY21 to FY26. |

| Fragrances, makeup, and men’s grooming products | CAGR of 20-40% from FY21 to FY26. |

Oral care products | Revenue of $1.78bn in 2022, expected to reach $2.13bn in 2026, with a CAGR of 4.5%. |

Hair care products | Revenue of $3.34bn in 2022, expected to reach $3.62bn in 2026, with a CAGR of 2%. |

Fragrance products | Market size of $368mn in 2022, expected to reach $437mn by 2026, with a CAGR of 6.4%. |

- India’s recent free trade agreement with Australia will open wider doors for growth opportunities in cosmetics.

- A major portion of India’s cosmetic exports goes to the USA, UAE, China, Bangladesh and Nepal.

- The hair care market is the primary driver of the Indian cosmetic industry, with hair oil dominating all products.

Also read: The pharmaceutical industry in India and its contribution to the world

Trends in the cosmetic industry

Products in the cosmetic industry can be seen under two heads: Premium and mass products.

Mass products are those manufactured in large quantities and are available in supermarkets and departmental stores. Premium products, on the other hand, are products with high brand value and unique features.

The increase in disposable income has made mass and premium products more affordable to consumers, increasing the demand for cosmetics. This has given rise to new brands entering the market every day.

Influencer marketing is a popular trend for promoting cosmetics today. More and more brands partner with popular social media influencers on platforms like Instagram to review their products and attract the influencer’s followers.

Another popular trend in the beauty industry today is using technology to try cosmetics on online platforms virtually. Amazon, for example, allows its users to try products like lipsticks on the portal using their front cameras.

From the consumer’s perspective, there is an interesting shift in the mindset concerning beauty. Consumers rely more on products and brands that match their personal beliefs and principles. The demand for products offering mental and physical well-being is more than the demand for products that simply aim at enhancing one’s appearance.

There is also an inclination towards natural and herbal products over chemical products. A large section of customers choose products that are sustainable and environmentally friendly. This has led to an increase in preference for Ayurvedic and herbal products. According to recent research, the herbal cosmetics industry in India will reach $4.6 billion by 2026.

Cosmetic industry regulations

The Ministry of Health and Family Welfare regulates the cosmetic industry in India. The Central Drugs Standard Control Organisation (CDSCO) is specially created to supervise the activities in the medical and cosmetic field.

Since these products are directly applied to the skin, hair, teeth or other parts of the human body, manufacturers need to follow strict regulations during production.

Both CDSCO and ISO (International Organisation for Standardisation) recommend Good Manufacturing Practices (GMP) for cosmetic production, to ensure they are free of toxins and meet the required quality to avoid adverse effects on consumers’ health.

Also Read: Winter 2023: Navigating the effects on the stock market

The lipstick effect

The lipstick effect is an economic theory that aims to study the effect of economic crisis on consumer behaviour.

Analysts have noticed that consumers reduce spending on high-end luxury products and services during a recession, but their demand for less expensive luxury goods either rises or remains stable.

So, while they may not be able to buy high-end perfumes and bags, they will still buy smaller products like lipsticks. Similarly, they may not be able to afford a vacation, but they will still spend on movies in the theatre.

The psychology behind the lipstick effect is that consumers treat themselves with small luxuries to divert themselves from the pessimism of a down-trending economy.

Top stocks in the cosmetic sector

Below are the top 8 stocks on NSE and BSE as per the market capitalisation (As of 06 Dec 2023).

| Company | BSE Share price | BSE Market Cap (In ₹ crore) | NSE Share price | NSE Market Cap (In ₹ crore) |

| Hindustan Unilever | ₹2,575 | ₹605,019.75 | ₹2,567.65 | ₹603,292.80 |

| Godrej Consumer | ₹1,039.35 | ₹105,631.77 | ₹1,038.70 | ₹106,240.35 |

| Dabur India | ₹550.10 | ₹97,479.75 | ₹550.05 | ₹97,470.89 |

| Marico | ₹538.90 | ₹70,177.22 | ₹539.50 | ₹69,795.57 |

| Colgate | ₹2,337 | ₹63,563.04 | ₹2,331.05 | ₹63,401.21 |

| Procter & Gamble | ₹17,345 | ₹56,303.15 | ₹17,444.35 | ₹56,625.64 |

| Emami | ₹500.10 | ₹21,879.56 | ₹500.50 | ₹21,846.83 |

| Gillette India | ₹6,252.80 | ₹20,374.88 | ₹6,263.95 | ₹20,411.22 |

Bottomline

The cosmetic industry in India has seen steady growth since globalisation. Lately, the industry has been going through various changes owing to progress in technology and consumer mindsets. The growth rate and prospects of the industry seem optimistic in providing consumers with more beauty and personal care products in the days to come.