India stands as the largest sourcing destination in the world, backed by its vast pool of technically skilled graduates. This vibrant talent ecosystem makes the IT sector the largest employer within India’s private sector. Globally, enterprise software and IT services have recently surpassed the ₹2 trillion mark, underscoring the sector’s expansive scale and impact.

Happiest Minds Technologies, a key player in this growing field, specialises in digital transformation solutions. The latest quarterly results for Happiest Minds Technologies are now available. This blog will provide a detailed analysis of these results, offering insights into their significance in the broader context of the industry.

Also read: Decoding IT giants Q1FY24 earnings

Happiest Minds profile

Happiest Minds Technologies Ltd., headquartered in Bengaluru, India, was founded on March 3, 2011, by Ashok Soota. The company’s primary focus is on offering a variety of IT services that help businesses and technology providers with their digital transformation.

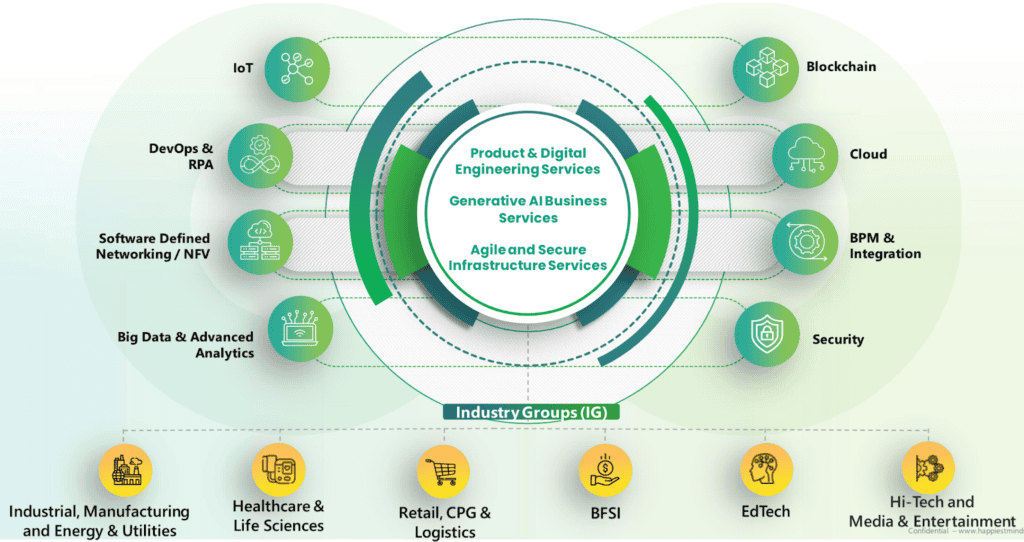

It offers a wide range of services, including Infrastructure Management & Security, Generative AI Business Services, and Product & Digital Engineering. Happiest Minds is recognised for its agile and digital-first approach, catering to diverse sectors such as automotive, BFSI, healthcare, and more.

To provide specialised solutions that address certain business demands, the organisation collaborates with leading worldwide IT companies. The United States, the United Kingdom, Canada, Australia, and the Middle East are among the nations in which the corporation conducts business.

As of FY24, Happiest Minds has a robust clientele with 250 active clients, including 61 Fortune 2000 and Forbes Global 2000 companies. The firm also has a high rate of repeat business, with 90% of its projects coming from existing customers.

Happiest Minds’ mission statement, “Happiest People, Happiest Customers,” is driven by its core SMILES values. With 5,168 employees in seven countries and a 27.7% gender diversity rate, it’s recognised as a “Great place to work” and ranks in India’s Top 50 best workplaces across multiple categories for 2023.

Source: Happiest Minds Technologies Investor Presentation Q4FY24

Also read: Paytm pre-Q4 analysis: COO exit and share price turmoil

Happiest Minds Technologies Q4 results

Happiest Minds Technologies reported its Q4 results for the fiscal year ending March 2024, marking significant financial growth. The company achieved a net profit of ₹71.98 crore, an increase of 24.8% year-over-year from ₹57.66 crore. This growth was accompanied by a 20.7% increase from the previous quarter’s ₹59.62 crore.

According to Happiest Minds Technologies financial report, the company’s revenue for the quarter stood at ₹417.29 crore, up 10.4% year-on-year from ₹378 crore, and a 1.8% increase quarter-on-quarter from ₹409.88 crore. This growth reflects ongoing operational improvements and the integration of strategic initiatives, including the formation of a Gen AI business unit and the successful acquisition of two companies.

Looking ahead, management is optimistic, expecting a revenue growth of 35%-40% in FY25. They aim to maintain operating margins between 20%-22% while pursuing long-term goals. These targets are part of Happiest Minds’ strategic vision to achieve $1 billion in revenues by FY31.

| (₹ crore) | Q4 FY24 | Q3 FY24 | Q-o-Q growth | Q4 FY23 | Y-o-Y growth |

| Operating revenue | 417.29 | 409.88 | 1.8% | 377.98 | 10.4% |

| EBITDA | 108.22 | 105.19 | 2.9% | 100.62 | 7.6% |

| PBT | 96.15 | 80.73 | 19.1% | 78.93 | 21.8% |

| PAT | 71.98 | 59.62 | 20.7% | 57.66 | 24.8% |

Source: Happiest Minds Technologies Investor Presentation Q4FY24

In addition to the financial performance, the Board of Directors has recommended a final dividend of ₹3.25 per equity share with a face value of ₹2 for the financial year 2023-24, subject to shareholder approval. This brings the total dividend for the year to ₹5.75 per share.

You may also like: Fundamental Analysis of Tata Consultancy Services Ltd.

Happiest Minds Technologies share price performance

Following the announcement of Q4 results for Happiest Minds Technologies, the share price has shown varied movements. Initially, on May 7, 2024, after the results were announced after market hours on May 6, the shares opened at ₹808 on the Bombay Stock Exchange (BSE).

However, a broader look at the company’s share price performance presents a more challenging view. As of May 9, 2024, Happiest Minds Technologies share price have declined by 5.36% over the past year.

Source: Google Finance

Looking at a longer timeline, the performance shifts significantly. Over the past five years, Happiest Minds Technologies’ shares have experienced a substantial positive return of 125.54%.

Source: Google Finance

Investing pros & cons

Pros:

- Diversified growth: Happiest Minds demonstrated growth in several verticals, with healthcare up by 9% QoQ, and retail and hospitality by 3% QoQ. Such broad-based growth highlights the company’s ability to effectively penetrate and perform in diverse markets.

- Strategic acquisitions: The recent acquisitions of PureSoftware Technologies for ₹779 crore and Macmillan Learning India for ₹4.5 crore strategically expand Happiest Minds’ service offerings and strengthen its presence in BFSI, healthcare, and education sectors.

- Strong deal pipeline: With a substantial deal pipeline, especially in digital engineering and transformation, Happiest Minds is well-positioned for sustained demand, backed by a free cash conversion of ₹107 crore in Q4FY24.

Cons:

- Geopolitical and economic risks: About 69% of the company’s revenue comes from North America, exposing it to regional economic fluctuations and political risks. Any downturn here could significantly affect overall revenue.

- Client concentration risk: Revenue dependence is high on top clients, with 57.5% coming from the top 10 clients and 11% from the top client alone, presenting substantial risk if any key client reduces spending or leaves.

Bottomline

Happiest Minds Technologies’ Q4 results for the fiscal year that ends in March 2024 showed significant growth and strategic planning. The company made smart acquisitions to expand its services and recorded notable growth in net profit and sales, all of which were in line with its aim of reaching $1 billion in revenue by FY31.

Investors should, however, take risks into account. Due to the company’s strong reliance on North American markets and sizable revenue from a small number of important clients, performance may be impacted in the event that the economy shifts or these clients decide to modify their spending plans.